We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum's text editor will shortly be getting an update, adding a bunch of handy new features to use when creating new posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

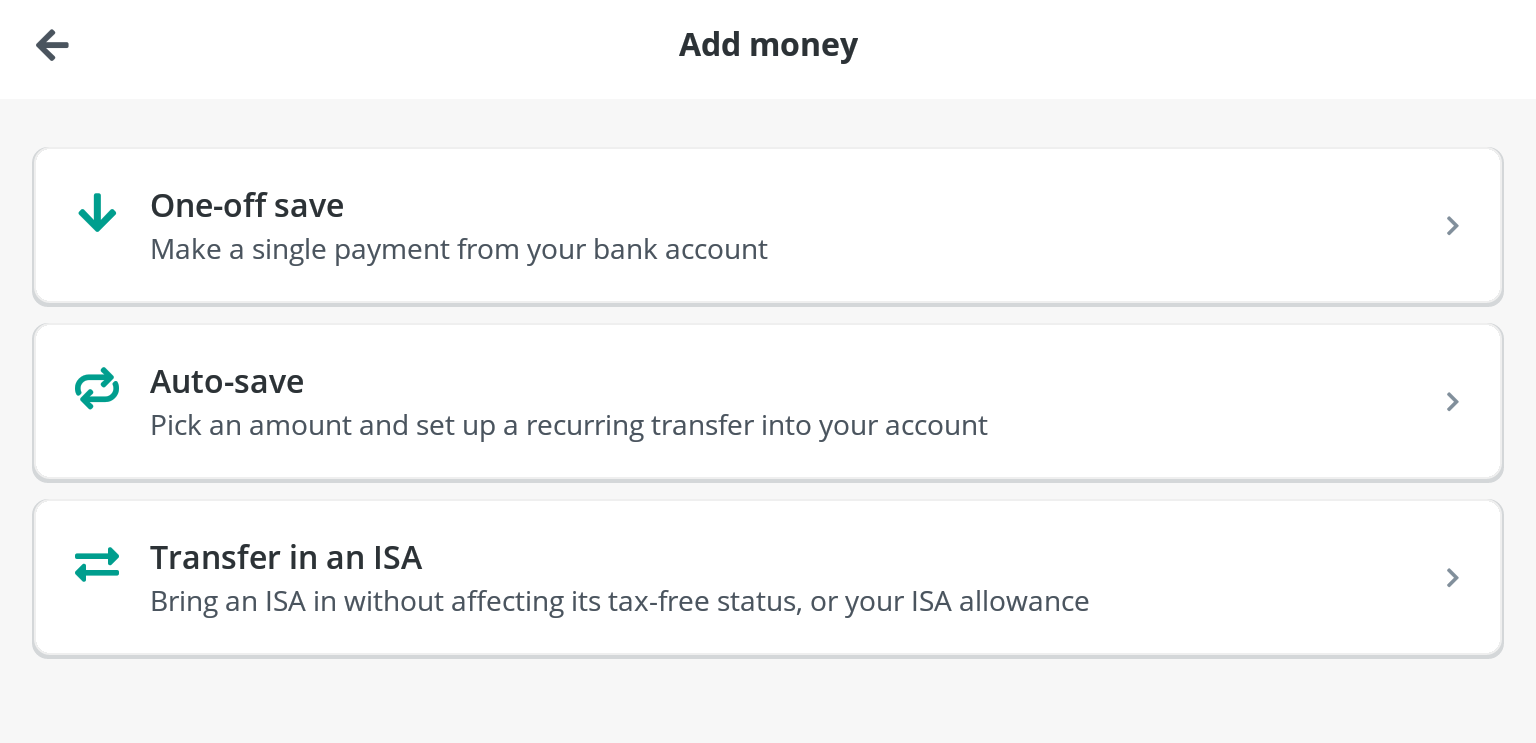

Zopa ISA transfer option is available in the app starting with the December 15 update.refluxer said:I've just received an email from Zopa stating that they now allow transfers-in from other cash ISAs, which means that their (easy access) Smart ISA @ 5.08% and associated Fixed Term ISA pots are no longer restricted to those who haven't yet made use of their 2023-24 ISA allowance.

Zopa app ..

1 -

Yeah there was no option to declare during, just a paper form to post or give into a branch afterwards.refluxer said:

If you declared the ISA will be funded with a transfer at the time you opened it, then the funding window shouldn't apply as that is for new subscriptions only. As they don't use the BACs ISA (electronic) transfer service and require paper forms and transfers via cheque (both via post), then it would be virtually impossible for such a transfer to happen within 5 days anyway.Navigaor31 said:Just opened (not paid into) the Principality Cash ISA (Online bonus one).

I was planning on transferring from my current Cash ISA - Which I have paid into already this year.

Looking at this the transfer can take up to 15 days once the form is received (via post). - However the initial deposit needs to be made within 5 days otherwise the account will be closed.

Didn't realise this until after sign up (I know always read!).

So I suppose a couple of questions:

1) Would paying £1 (the minimum amount for the ISA) into the principality ISA, be a bad thing at this stage? As I will be initiating the transfer process right away? - but i'd have technically paid into 2 ISA's at the same time within the same year?

2) If i take the form into a branch, will they initiate the Transfer quicker than posting? - I.e, they will mark my account with an incoming transfer thus postponing the account closure? Or is posting the form just as quick?

If there wasn't an opportunity to request the transfer at the time of application, then you just need to request one via whatever method they require ASAP. If you do have a branch locally, then this will almost-certainly speed the process up, compared with posting the transfer form off.

Essentially, the bottom line is that they need to be made aware that the ISA will be funded with a transfer only, so that the 5 day funding requirement doesn't automatically close the account.

It's been a few years since I last did this with the Principality, but I've funded a number of their cash ISAs with just a transfer over the years and never had any issues.

You mustn't pay into the new ISA as you've already funded the other ISA during this tax year and that breaks ISA rules.

I've dropped them a message and if I haven't heard i'll drive to a branch on Saturday to drop the form off I think.0 -

https://www.familybuildingsociety.co.uk/savings/isas/product-detail/market-tracker-cash-isa-(2)

Rate effective from 1 October 2023 £500+ 4.69% Rate effective from 1 January 2024 £500+ 5.00% - Interest is calculated daily and added to the account annually on 30 September

- The interest rate tracks our Market Tracker Saver (1) account interest rate, plus 0.05%

- The interest rate on the Market Tracker Saver is calculated using data from Moneyfacts® and pays an average interest rate of the 20 highest gross annual variable interest rates, for an investment of £10,000 from a reference group

1 -

My Virgin Money easy access exclusive flexi ISA2 annual interest was paid on 29/12/2023.5

-

Reasonably sure there was an account like that when rates used to be reasonablepecunianonolet said:Quite an interesting way to determine the rate imho. 0 -

Principality EA ISA 5.06% now NLA and replaced with slightly lower rate of 5.0%1

-

Have you had any update on your Virgin ISA transfer mess?soulsaver said:

Yep - they made the transfer yesterday...sparkiemalarkie said:

I've just had a look at my account and it all seems good...nothing has changed. Has something happened to yours?soulsaver said:@sparkiemalarkie Have you checked your VM account?

sx

.. and applied early closure penalty!

I'll be complaining... eventually.

sx0 -

sparkiemalarkie said:

Have you had any update on your Virgin ISA transfer mess?soulsaver said:

Yep - they made the transfer yesterday...sparkiemalarkie said:

I've just had a look at my account and it all seems good...nothing has changed. Has something happened to yours?soulsaver said:@sparkiemalarkie Have you checked your VM account?

sx

.. and applied early closure penalty!

I'll be complaining... eventually.

sx

On Tuesday their CS admitted they could see I'd asked for transfer at maturity (Jan 31). Good start.

They promised to phone back, latest next day and pointed out a possible solution - which would mean I was better off than if I waited for maturity date.

Ok, that's 'good' so far.

But they didn't phone back.

Nor Thursday.

And they haven't corrected the error or repaid the early closure fee.

So I phoned again Friday: 20 minutes on hold. CS said they'd ask the team. Another 10 minutes of hold music and they cut off the call.

Impressed? I didn't think so.

I subsequently submitted a complaint on line via the chat on Friday.

This is not my first brush with VMs (Post Office like) service, and it is the same sort of poor service I experienced in the past with queries:

They drag their feet for ever hoping you don't go formal and tire your resolve. They'll usually find an argument, that ends with a miserly offer and 'If you can show you incurred more costs then we'll look at it again...'

Ed

0 -

Virgin Money (still)

Just to be aware - If you've chosen to submit a complaint via the 'Chat' route (to avoid the call holding and the potential for a frustrating cut off) VM issue a complaint reference in the chat .

I asked if a transcript of the chat is emailed or saved.

They said it will be (only) in the letter acknowledging the complaint.

So best make a note of complaint reference, other wise when their letter possibly get's 'lost in the post' and/or 'we have no trace...' you'll not be starting the clock ticking all over again.

I took screen dumps (& photos) of the chat as it went along.

2 -

Gosh it's exhausting for you!soulsaver said:Virgin Money (still)

Just to be aware - If you've chosen to submit a complaint via the 'Chat' route (to avoid the call holding and the potential for a frustrating cut off) VM issue a complaint reference in the chat .

I asked if a transcript of the chat is emailed or saved.

They said it will be (only) in the letter acknowledging the complaint.

So best make a note of complaint reference, other wise when their letter possibly get's 'lost in the post' and/or 'we have no trace...' you'll not be starting the clock ticking all over again.

I took screen dumps (& photos) of the chat as it went along.

My money is still in the fixed rate ISA but I'm anticipating problems so wondering if I need a contingency plan.

I have an Exclusive Fixed ISA 9 open @ 5.5% but it's unfunded and probably past the funding window or do I open the Fixed ISA 10 @ 5.25% in case everything goes pear shaped ?......

sx0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards