We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

bristolleedsfan said:

I re-applied for 5.61% 4 year fix this morning to split transfer in that arrived today with this years funding that I plan to make on Tuesdaydrphila said:Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to sticky, persistent inflation it's an extra £2500.Is it ever likely to reach that high, though, are future increases already baked in, and are we nearing that peak?

If you're an exsiting or previous customer of United Trust Bank, you could always consider a 4 yr lock-in at 5.61% as per @bristolleedsfan post on 31 July, if it is still available.

Yes I'm very tempted to go for that myself as a transfer-in for my 4.2% 5yr fix with Gatehouse in March (which itself was a part-transfer in from a United Trust 5yr ISA from several years back at 1.9% !!)

0 -

I paid United Trust Bank 365 days considerable value of interest a couple of weeks ago to get out of 5+ year fix I switched into 23 April@ 4.10%, lucky because at the time UTB had interest penalty that was off the planet, they recently changed T+C making loss of interest on early cashin "cheaper"drphila said:bristolleedsfan said:

I re-applied for 5.61% 4 year fix this morning to split transfer in that arrived today with this years funding that I plan to make on Tuesdaydrphila said:Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to sticky, persistent inflation it's an extra £2500.Is it ever likely to reach that high, though, are future increases already baked in, and are we nearing that peak?

If you're an exsiting or previous customer of United Trust Bank, you could always consider a 4 yr lock-in at 5.61% as per @bristolleedsfan post on 31 July, if it is still available.

Yes I'm very tempted to go for that myself as a transfer-in for my 4.2% 5yr fix with Gatehouse in March (which itself was a part-transfer in from a United Trust 5yr ISA from several years back at 1.9% !!) 0

0 -

Wouldn`t be surprised to see Charter jump to the top for a 1yr fix soon.

Virgin now sitting at 5.71% along with Shawbrook.0 -

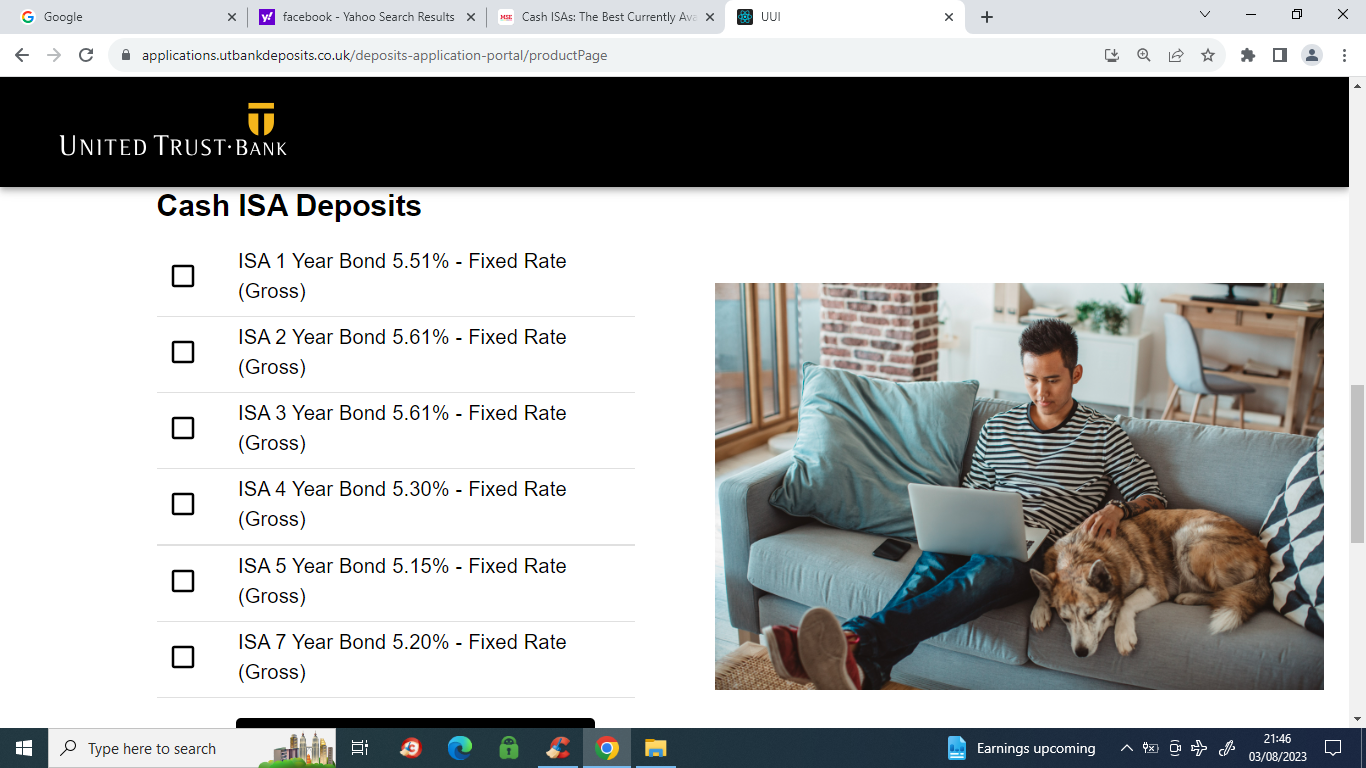

United Bank Trust 4 and 5 year rates reduced, rates for existing or previous customers shown in screenshot now only marginally higher than new customer rates.drphila said:Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to sticky, persistent inflation it's an extra £2500.Is it ever likely to reach that high, though, are future increases already baked in, and are we nearing that peak?

If you're an exsiting or previous customer of United Trust Bank, you could always consider a 4 yr lock-in at 5.61% as per @bristolleedsfan post on 31 July, if it is still available.

1 -

Alas it looks like my Virgin ISA shuffle is at an end.Only offering a 1 year ISA now.I just cant switch to a 1 year instead of 3 years of security.1

-

Next week I plan to switch to the 1-year fix (to buy more time) or to the defined access (to switch out elsewhere)... if both options disappear, then I will stay with the 2-year fix that I'm on, not optimal but not bad at all...Bigwheels1111 said:Alas it looks like my Virgin ISA shuffle is at an end.Only offering a 1 year ISA now.I just cant switch to a 1 year instead of 3 years of security.0 -

Can you shuffle between the fix and easy access ISA via online to buy time ?intalex said:

Next week I plan to switch to the 1-year fix (to buy more time) or to the defined access (to switch out elsewhere)... if both options disappear, then I will stay with the 2-year fix that I'm on, not optimal but not bad at all...Bigwheels1111 said:Alas it looks like my Virgin ISA shuffle is at an end.Only offering a 1 year ISA now.I just cant switch to a 1 year instead of 3 years of security.0 -

I saw the option of a defined access ISA in the drop-down, which I think had a 4.00% AER for up to 3 withdrawals, which is not a bad interim option. The pure easy access (at 4.25% AER) wasn't in the drop-down as I think it's part of the "other" side of Virgin Money and exclusive to their current account customers.DJSINGH said:

Can you shuffle between the fix and easy access ISA via online to buy time ?intalex said:

Next week I plan to switch to the 1-year fix (to buy more time) or to the defined access (to switch out elsewhere)... if both options disappear, then I will stay with the 2-year fix that I'm on, not optimal but not bad at all...Bigwheels1111 said:Alas it looks like my Virgin ISA shuffle is at an end.Only offering a 1 year ISA now.I just cant switch to a 1 year instead of 3 years of security.1 -

You never know, they might have had enough of the current game players and decided to improve the house odds. 😉Bigwheels1111 said:Alas it looks like my Virgin ISA shuffle is at an end.Only offering a 1 year ISA now.I just cant switch to a 1 year instead of 3 years of security.

Yeah, cheers but nah, I will stick with yes, thank you and no.

Thank you.2 -

Paragon Double Access ISA up .1% to 4.35%

https://www.paragonbank.co.uk/savings/cash-isas/double-access-cash-isa

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards