We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

gele said:. The next 48hrs may give us a clue.

"Three more major mortgage lenders have announced they are slashing their rates.

NatWest, Halifax and Virgin Money will all be making cuts, effective from 2 August "

0 -

Lower paying 2 and 3 year E- Bond fixed rates have not been withdrawn (non Cash ISA)uk1 said:

I have just moved the 2 ISAs to the new 1 year.Mr_blibby said:

Think that's a good call - I swapped from their 3 year to 2 year product trying to be too smart and thinking I would switch back to the 3 year one within the 14 days, but after the confirmation of the BoE rate rise and maybe a higher rate.....wished I'd stuck at 3 year at 5.55%... Ah well, better problems to have than getting 0.5% !Bigwheels1111 said:Mr_blibby said:

Virgins 2 year option also now withdrawn - 1 year up to 5.71%... maybe waiting for Thursday BoE guidance about future rates...Decided to move couple of EA ISAs to 3year+ fixed whilst still have a few options - prefer the longer term certainty and as its tax free for me - decided not chase a small uplift for a 1 year product and potentially have a much lower rate down the lineBigwheels1111 said:Sticking with my 3 year Virgin ISA.

I have until next Friday to decide.

I like the rate and 3 years, also the 120 penalty is very good also.I have stuck with the 3y 5.55% isa.But I have until Friday I think as that will be day 14.£1759.11 will be a nice payout after 3 years, as 2 years ago I did not get that on 76K for 18 monthes.I think it was 0.5%.

I think you shouldn’t over-fret.

I think the removal of the longer options is only temporary until the base rate review and if you have enough of your 14 day grace period left then you might /should see them reappear in the next day or so.0 -

? Yes, because they are lower and represent no comparable exposure. I was referring to the ones that have been removed not those that remain.bristolleedsfan said:

Lower paying 2 and 3 year E- Bond fixed rates have not been withdrawn (non Cash ISA)uk1 said:

I have just moved the 2 ISAs to the new 1 year.Mr_blibby said:

Think that's a good call - I swapped from their 3 year to 2 year product trying to be too smart and thinking I would switch back to the 3 year one within the 14 days, but after the confirmation of the BoE rate rise and maybe a higher rate.....wished I'd stuck at 3 year at 5.55%... Ah well, better problems to have than getting 0.5% !Bigwheels1111 said:Mr_blibby said:

Virgins 2 year option also now withdrawn - 1 year up to 5.71%... maybe waiting for Thursday BoE guidance about future rates...Decided to move couple of EA ISAs to 3year+ fixed whilst still have a few options - prefer the longer term certainty and as its tax free for me - decided not chase a small uplift for a 1 year product and potentially have a much lower rate down the lineBigwheels1111 said:Sticking with my 3 year Virgin ISA.

I have until next Friday to decide.

I like the rate and 3 years, also the 120 penalty is very good also.I have stuck with the 3y 5.55% isa.But I have until Friday I think as that will be day 14.£1759.11 will be a nice payout after 3 years, as 2 years ago I did not get that on 76K for 18 monthes.I think it was 0.5%.

I think you shouldn’t over-fret.

I think the removal of the longer options is only temporary until the base rate review and if you have enough of your 14 day grace period left then you might /should see them reappear in the next day or so.0 -

Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to sticky, persistent inflation it's an extra £2500.Is it ever likely to reach that high, though, are future increases already baked in, and are we nearing that peak?0

-

You could open and fund if it has a cooling off period? Would perhaps only buy you a small window but better than nothing. At least it would allow you to monitor any short term movements after BOE meeting. Also, you need to factor in that if you wait for a better rate the waiting time is usually at a lower rate.Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to stick inflation it's an extra £2500.0 -

pecunianonolet said:

You could open and fund if it has a cooling off period? Would perhaps only buy you a small window but better than nothing. At least it would allow you to monitor any short term movements after BOE meeting. Also, you need to factor in that if you wait for a better rate the waiting time is usually at a lower rate.Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to stick inflation it's an extra £2500.

It's an interesting idea, but would the opening and then closing of the ISA within the cooling off period count towards my ability to open and fund one ISA within the year, prevening me from opening a different one?

0 -

No. Closing within the cooling off period means its regarded as if it never existed so you are free to open and subscribe to another one. Might just take a while to get your money back from the first one though depending on who the provider is.Desk said:pecunianonolet said:

You could open and fund if it has a cooling off period? Would perhaps only buy you a small window but better than nothing. At least it would allow you to monitor any short term movements after BOE meeting. Also, you need to factor in that if you wait for a better rate the waiting time is usually at a lower rate.Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to stick inflation it's an extra £2500.

It's an interesting idea, but would the opening and then closing of the ISA within the cooling off period count towards my ability to open and fund one ISA within the year, prevening me from opening a different one?0 -

Shedman said:

No. Closing within the cooling off period means its regarded as if it never existed so you are free to open and subscribe to another one. Might just take a while to get your money back from the first one though depending on who the provider is.Desk said:pecunianonolet said:

You could open and fund if it has a cooling off period? Would perhaps only buy you a small window but better than nothing. At least it would allow you to monitor any short term movements after BOE meeting. Also, you need to factor in that if you wait for a better rate the waiting time is usually at a lower rate.Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to stick inflation it's an extra £2500.

It's an interesting idea, but would the opening and then closing of the ISA within the cooling off period count towards my ability to open and fund one ISA within the year, prevening me from opening a different one?Works .even better if its within the same Provider.Virgin takes 2 minutes to switch between isa's.A pain as of today as they only have a 1 year isa.I have the 3 year isa and Friday is the end of my cooling off period.What to do.0 -

An alternative way of thinking through the better option for you might be this. The choice you have is whether to lock in your cash for a five year period today for the difference between what you can lock in now compared to what it may be outside your lock-in period which may not be that much more. It’s wrong to think of it as 5.35% compared to zero percent for example. And your figure may a 50/50 chance (perhaps) of being higher or lower. But the BOE rates in the short time are more likely to increase rather than decrease. Human nature is that “a bird in the had is worth two in the bush” but whether that is best is clearly something only you can decide.Desk said:Anybody hazard a guess about the likely direction of long-term fixed rate ISA returns?I've got an option which expires today for 5.35% on a five year deal, which is excellent. My concern, as always, is that you pass on that in the hope of something better which doesn't materialise.But then, I locked in money last year that I could be getting a better return on now.With £20k locked away for five years, though, a difference between 5% and 6% could mean an extra £1200, and if it's 7% in some months' time due to sticky, persistent inflation it's an extra £2500.Is it ever likely to reach that high, though, are future increases already baked in, and are we nearing that peak?

Good luck.0 -

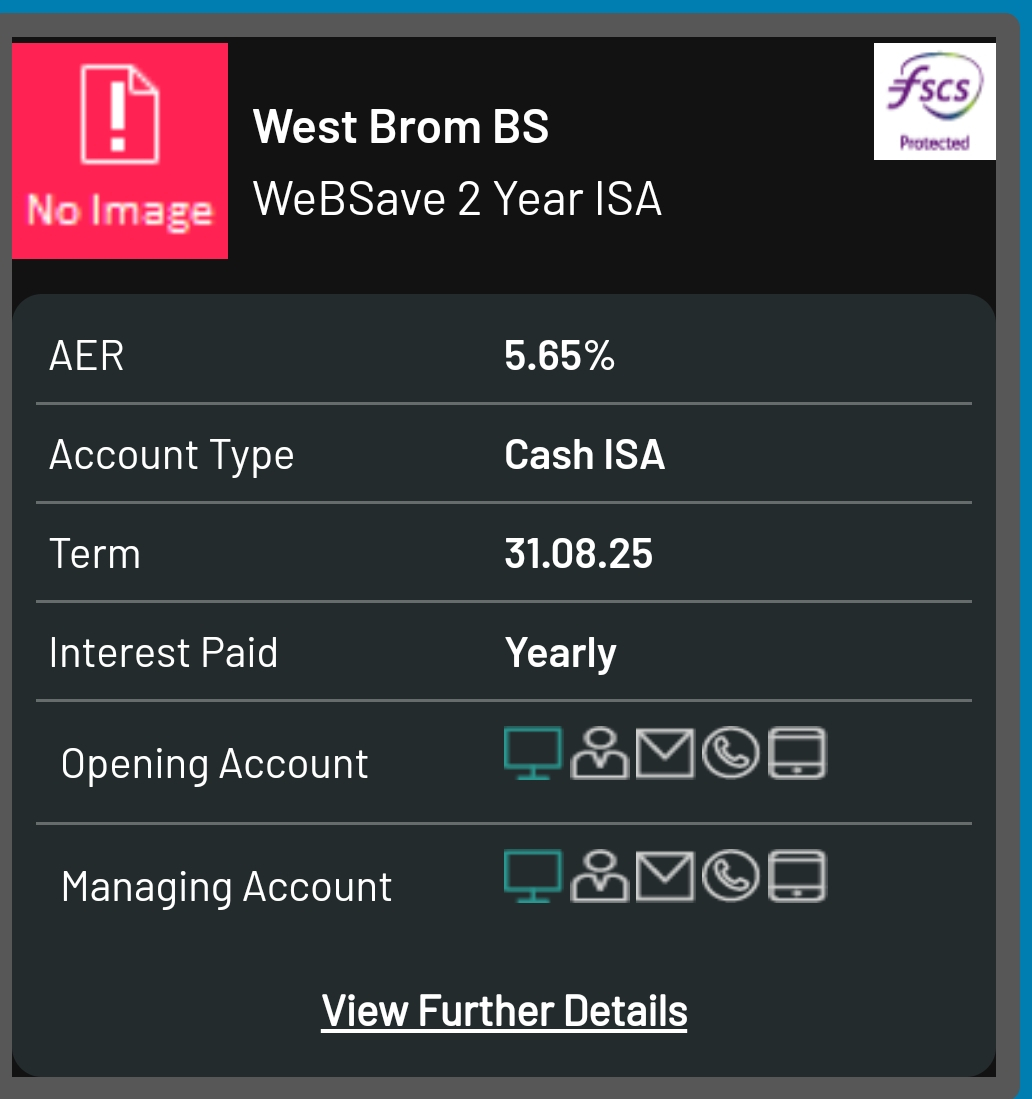

Moneyfacts showing Westbrom 2yr at 5.65, yet to be updated on the Westbrom site which is still at 5.35. See what happens.

Yeah, cheers but nah, I will stick with yes, thank you and no.

Thank you.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards