We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

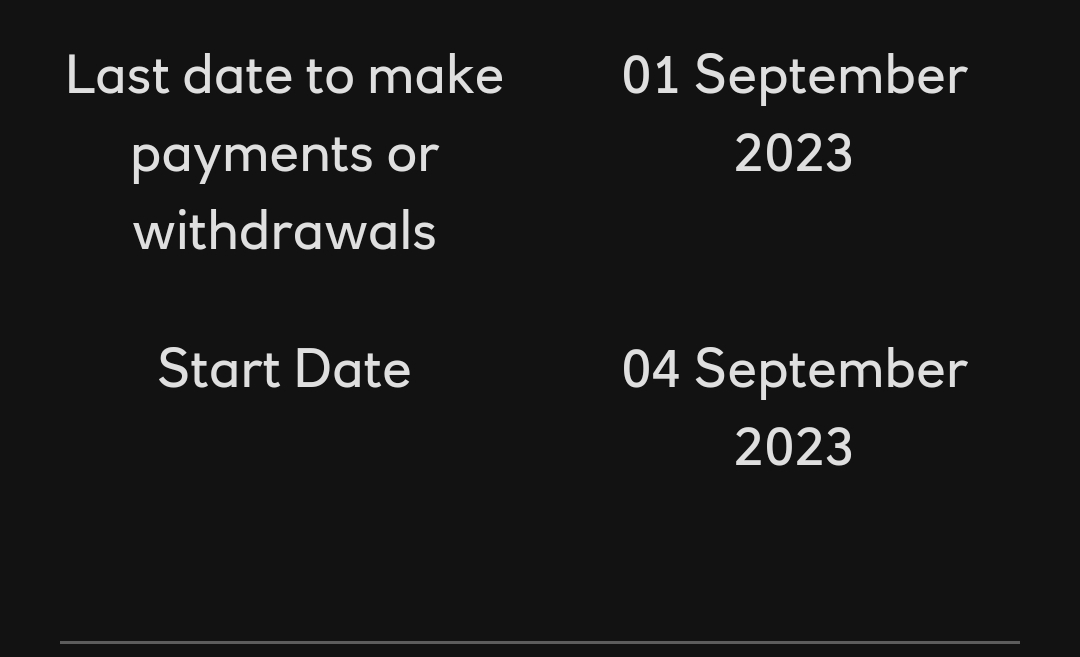

How can we interpret the difference between 01/09 and 04/09 in the above list?0

-

The 4th is the start date in their view but I agree, there is ambiguity about it all.intalex said:How can we interpret the difference between 01/09 and 04/09 in the above list?

Yeah, cheers but nah, I will stick with yes, thank you and no.

Thank you.0 -

So if 04/09 is not the start date for the interest to kick in, what exactly is it a start date for?

Has to have some specific significance, given that the deposit + cooling off windows are both 01/09.0 -

The 'overview' states "a set, tax-free interest rate for a defined period of one or two years when you deposit a minimum of £1,000."

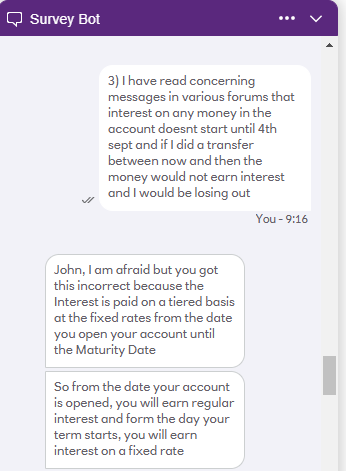

The t&c's refer you to the 'information sheet' regarding payment of interest, which is at odds with the above: "Interest is paid at these fixed rates from the date you open your account until the Maturity Date."

Since there was ambiguity, I asked in branch, and was told zero interest until the "start date" in September.

I could have been advised incorrectly, but that was what I was told.0 -

But under estimated balance at maturity it says “These are only examples and do not take into account your individual circumstances, or any interest earned prior to the Start Date.”happybagger said:The 'overview' states "a set, tax-free interest rate for a defined period of one or two years when you deposit a minimum of £1,000."

The t&c's refer you to the 'information sheet' regarding payment of interest, which is at odds with the above: "Interest is paid at these fixed rates from the date you open your account until the Maturity Date."

Since there was ambiguity, I asked in branch, and was told zero interest until the "start date" in September.

I could have been advised incorrectly, but that was what I was told.0 -

This is what I got from NatWest chat this morning

0

0 -

RBS/NatWest being RBS/NatWest I see. Knowing them, there'll be interest paid until the formal start date alright, but probably at some lower rate that's hidden away in the corner of a Ts&Cs webpage somewhere.

My advice would be to do yourself a favour and just use a bank that's fair and transparent, not that bunch of absolute chancers.1 -

And what is the “regular” interest rate?1

-

Have to agree.Eirambler said:RBS/NatWest being RBS/NatWest I see. Knowing them, there'll be interest paid until the formal start date alright, but probably at some lower rate that's hidden away in the corner of a Ts&Cs webpage somewhere.

My advice would be to do yourself a favour and just use a bank that's fair and transparent, not that bunch of absolute chancers.

Hoop jumping and too much hassle.

Very unclear when interest starts.

0 -

More general question on how ISAs work.

Am I correct in thinking if I've:- Opened a new cash ISA this tax year,

- Paid £16,000 of new ISA money into it (with £4k to a LISA),

- Transfer existing ISAs opened in previous tax years into this ISA,

- Open another new cash ISA this tax year and transfer the current cash ISA to that account?

The Gov UK ISA page seems to imply you can do unlimited transfers, but general guidance online says can only open one ISA of each type each year - but it isn't always clear if transfer to new accounts is the same thing as opening new accounts.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards