We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

Cynergy Bank have launched a new issue of their Online ISA (issue 36), paying 3.50%.

This ISA is available to open online. Minimum opening amount is £1.

Please call me 'Kazza'.7 -

Kazza242 said:Cynergy Bank have launched a new issue of their Online ISA (issue 36), paying 3.50%.

This ISA is available to open online. Minimum opening amount is £1.I opened and funded issue 35 of this account a week ago at 3.35%. Is there a way I can obtain the new rate without breaking the rules of subscribing to multiple isa's?Tia

0 -

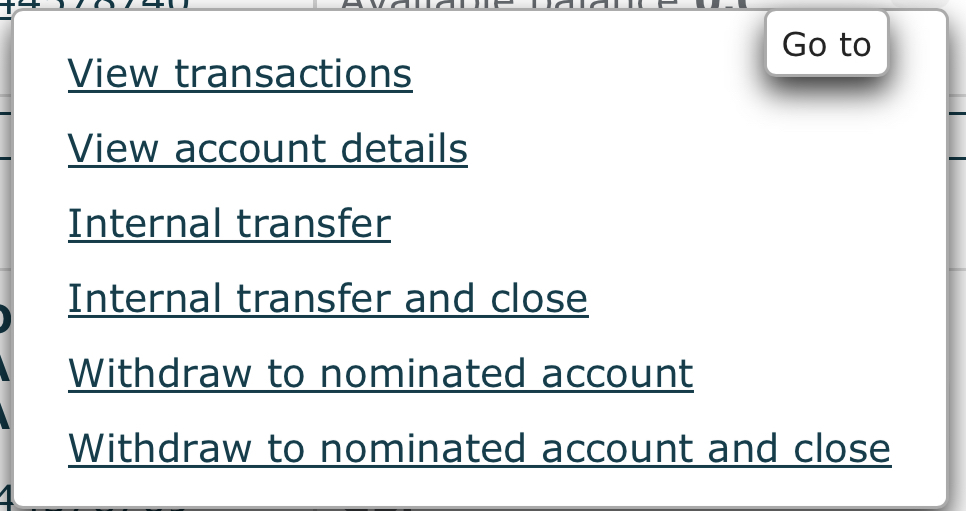

Log in and open a new ISA account first without paying anything in, then on the main accounts screen select Internal transfer and close from the drop-down menu, choosing your new higher rate ISA. As long as you are transferring it won’t be counted as new money being paid in, and you’ll probably also get a teeny tiny bit of interest to date added too.ConsistentlyLost said:Kazza242 said:Cynergy Bank have launched a new issue of their Online ISA (issue 36), paying 3.50%.

This ISA is available to open online. Minimum opening amount is £1.I opened and funded issue 35 of this account a week ago at 3.35%. Is there a way I can obtain the new rate without breaking the rules of subscribing to multiple isa's?Tia1 -

PloughmansLunch said:

Log in and open a new ISA account first without paying anything in, then on the main accounts screen select Internal transfer and close from the drop-down menu, choosing your new higher rate ISA. As long as you are transferring it won’t be counted as new money being paid in, and you’ll probably also get a teeny tiny bit of interest to date added too.ConsistentlyLost said:Kazza242 said:Cynergy Bank have launched a new issue of their Online ISA (issue 36), paying 3.50%.

This ISA is available to open online. Minimum opening amount is £1.I opened and funded issue 35 of this account a week ago at 3.35%. Is there a way I can obtain the new rate without breaking the rules of subscribing to multiple isa's?TiaOkay thanks. Will I then be able to fund the newly opened Isa with further deposits as I've only used £5500 of my isa allowance for this year?Tia0 -

Yes, you'll be able to add further funds to your cash ISA for 2023-24.ConsistentlyLost said:PloughmansLunch said:

Log in and open a new ISA account first without paying anything in, then on the main accounts screen select Internal transfer and close from the drop-down menu, choosing your new higher rate ISA. As long as you are transferring it won’t be counted as new money being paid in, and you’ll probably also get a teeny tiny bit of interest to date added too.ConsistentlyLost said:Kazza242 said:Cynergy Bank have launched a new issue of their Online ISA (issue 36), paying 3.50%.

This ISA is available to open online. Minimum opening amount is £1.I opened and funded issue 35 of this account a week ago at 3.35%. Is there a way I can obtain the new rate without breaking the rules of subscribing to multiple isa's?TiaOkay thanks. Will I then be able to fund the newly opened Isa with further deposits as I've only used £5500 of my isa allowance for this year?Tia

The ISA allowance is £20,000 per tax year, and as you have only used £5,500, you can pay in up to another £14,500 by the end of the tax year, which is 5th April 2024.Please call me 'Kazza'.2 -

BreakingGlass, our Paragon transfers took about 30 minutes as well. We did them yesterday.1

-

Keen to see if rates on flexible easy access ISAs go up post the expected BOE 25 bps hike tomorrow. Right now the best buy is Principality at 3.3% but my Skipton tracker ISA (tracks at BOE - 1.25%) too will get bumped to 3.25% if the boe hikes 25bps. Will leave current year subscription in the skipton to ensure I retain access to a proper tracker for next two years (skipton have now pulled their tracker isa product for new customers) but will move older money to the best paying flexible easy access isa if there is a product that pays significantly over 3.25%.0

-

Great news !!

YBS rate increases from 17/05

Loyalty 6 E-ISA and Loyalty 6 Branch ISA both increasing

Up to 20K 4.25% > 4.50%

Over £20K 3.75% > 4.00%

https://www.ybs.co.uk/documents/productdata/YBM1607RC.pdf

7 -

Posted this a few weeks ago . Updated daily

Best cash Isa savings rates: Easy access and fixed deals in our tables | This is Money

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards