We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

Hi, long time lurker, first time poster...

More importantly, I don't think this has been mentioned yet:

Paragon Bank have released a new issue (8) of their Triple Access Cash ISA, the rate is now 1.35% AER for up to three withdrawals (0.25% for 4 or more). A slight increase over the issue 7 which I believe was 1.2% (I believe it was 1.25% if you were an existing customer)

Hope that brings a little more happiness to your day.1 -

Yep - issue 7 of Paragon's Triple Access Cash ISA got a couple of increases which took it from 0.80 to 1.25% but it looks like that may be where it stays.CompulsiveSaver said:Paragon Bank have released a new issue (8) of their Triple Access Cash ISA, the rate is now 1.35% AER for up to three withdrawals (0.25% for 4 or more). A slight increase over the issue 7 which I believe was 1.2% (I believe it was 1.25% if you were an existing customer)

Oddly, issue 8 @ 1.35% now has the same rate as their 1 Year Fixed rate ISA. They're definitely lagging behind the competition with their fixed rate products.0 -

YBS have also released their increases for the 7th July (all accounts). (I am not allowed to post links yet :'( ... : It is a PDF download form www. YBS. co. uk / boe-rate-change / index (just remove the spaces, there is also a link on their home page)

Happy to see their Loyalty Six Access eISA/ISA Saver 2 will be increasing (as this was the lowest rate ISA I have)

£1+ 1.25%

£25K+ 1.3%

£50K+ 1.4% (So lets see what the competition have an offer before deciding if I need to transfer out).

0 -

Yes, I thought that was a little odd pricing too, especially as further base rate increases are expected, although I am not sure when that account was last increased and if there is a pending increase to the fixed accounts.refluxer said:Oddly, issue 8 @ 1.35% now has the same rate as their 1 Year Fixed rate ISA. They're definitely lagging behind the competition with their fixed rate products.

0 -

Oh how to keep up! Can you move existing Paragon to this new one? I'll have to investigate.CompulsiveSaver said:Hi, long time lurker, first time poster...

More importantly, I don't think this has been mentioned yet:

Paragon Bank have released a new issue (8) of their Triple Access Cash ISA, the rate is now 1.35% AER for up to three withdrawals (0.25% for 4 or more). A slight increase over the issue 7 which I believe was 1.2% (I believe it was 1.25% if you were an existing customer)

Hope that brings a little more happiness to your day.0 -

Yes you can.Chloe_G said:

Oh how to keep up! Can you move existing Paragon to this new one? I'll have to investigate.CompulsiveSaver said:Hi, long time lurker, first time poster...

More importantly, I don't think this has been mentioned yet:

Paragon Bank have released a new issue (8) of their Triple Access Cash ISA, the rate is now 1.35% AER for up to three withdrawals (0.25% for 4 or more). A slight increase over the issue 7 which I believe was 1.2% (I believe it was 1.25% if you were an existing customer)

Hope that brings a little more happiness to your day.1 -

The first post has been updated to include the new rates available on variable rate ISAs and the new fixed rate ISAs.

Please call me 'Kazza'.2 -

Is it me or is the Leeds BS 30 month fix just insanely good? Is there a catch - I've sent off for the forms to transfer (they want it done on paper not online). A 2.5 year fix which beats the best 5 year fix, and a relatively small (180 day) penalty for moving? The rate is nearly as high as the best 2 year fixes outside an ISA wrapper...The only downside I can see is that rates might peak before then and might be lower in Feb 2025 than now, so you might wish you had a 5-year fix if you really don't need the money for that long...0

-

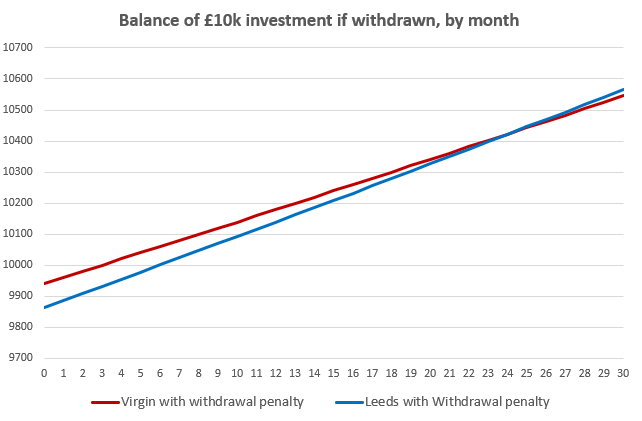

Johnjdc said:Is it me or is the Leeds BS 30 month fix just insanely good? Is there a catch - I've sent off for the forms to transfer (they want it done on paper not online). A 2.5 year fix which beats the best 5 year fix, and a relatively small (180 day) penalty for moving? The rate is nearly as high as the best 2 year fixes outside an ISA wrapper...The only downside I can see is that rates might peak before then and might be lower in Feb 2025 than now, so you might wish you had a 5-year fix if you really don't need the money for that long...Damn ! This is so tempting (for the higher rate immediately .... a bird in the hand and all that ......) but I think I'll stick with the Virgin 2 yr expecting retes to rise much further, so maybe needing to bail out early and benefit from the much lower interest penalty.hmmm.... I'll do some maths .....EDIT: ah and interest only annual - I prefer to take mine monthly .....0

-

I prefer accounts with penalties to keep the interest hidden for as long as possible so I don't feel like I'm losing it! Other accounts I prefer monthly so it's more consistent in my budget spreadsheet.As to Virgin vs Leeds it looks like you're right if you're going to take the money out at any point in the first two years although by the 18 month point the difference is down to about £20 per £10k invested.

For me this is one half of my cash ISA money, which in turn is about one third of my total money, so if interest rates go up significantly I'll call that a nice problem to have and take the win on my premium bonds and other cash...0

For me this is one half of my cash ISA money, which in turn is about one third of my total money, so if interest rates go up significantly I'll call that a nice problem to have and take the win on my premium bonds and other cash...0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards