We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

credit card clearance

Comments

-

Hi again NID, heres my latest update. I still havent received a CCA from CAP1. I keep getting calls and letter from collections and have kicked up a fuss about harassment and am considering sending the harassment template letter this week.

I spoke with their cust svcs dept and a manager there told me that they had sent a letter and CCA on 22 Sept. She actually read me out what she claimed was a copy of the letter, which blathered on about the "enclosed signed true copy"... yadda yadda... "therefore we have provided you the details requested and so dont deem the account to be in dispute" I still havent received this but i have had 3 collections letters all dated later than 22 September. It strikes me as a bit odd that the postal service is fast and reliable for collections letters and slow for CCA letters. :rolleyes:

I think theyre bullsh!tting me, and im not sure what to do now. Can you give me any ideas?

Send letters mate, asap! Do it recorded and then you have proof of receipt which stops them doing anything.....

Send the relevant letter from within here to stop the harassment: Dealing with Bailiffs Harassment

or stick to the templates here: Unenforceability & Template Letters

Good Luck matey

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Tks NID. Ive printed off the harassment letter and thats going rec.delivery today.

The last letter i sent them was the "account in dispute" letter but that was weeks ago. Shall i send the "Alternative Follow-Up Letter after failed CCA" letter too but amend the paragraph...

"As you have replied to me confirming you have no CCA then the account must remain in dispute which refers s.10 CCA (cease & desist processing data)"

to this...

"As you have not replied to my requests for a CCA then the account must remain in dispute which refers s.10 CCA (cease & desist processing data)"

Is that the one? Whats the next step after that?0 -

Oh also, in the "Alternative Follow-Up Letter after failed CCA" letter theres this paragraph that mentions default removal;

Whilst it is unenforceable, no interest can be added to the account and no action can be taken against me such as defaults or adverse data registered at any of the credit reference agencies. As you have already added a default against me, I hereby give you 30 days in which to remove the default or supply me with the Consumer Credit Agreement to enforce the default.

CAP1 havent yet, as far as i know, registered a default on my CR file, theyre just showing me as in arrears. Should i remove that section of the letter or amend it thus;

Whilst it is unenforceable, no interest can be added to the account and no action can be taken against me such as defaults or adverse data registered at any of the credit reference agencies. If you have already added a default against me, I hereby give you 30 days in which to remove the default or supply me with the Consumer Credit Agreement to enforce the default.

Apologies if im being overcautious and asking obvious questions but im sure youll understand theres a lot at stake. If i get anywhere on CAP1 the Barclaycard are in for some correspondence.:D0 -

Oh also, in the "Alternative Follow-Up Letter after failed CCA" letter theres this paragraph that mentions default removal;

Whilst it is unenforceable, no interest can be added to the account and no action can be taken against me such as defaults or adverse data registered at any of the credit reference agencies. As you have already added a default against me, I hereby give you 30 days in which to remove the default or supply me with the Consumer Credit Agreement to enforce the default.

CAP1 havent yet, as far as i know, registered a default on my CR file, theyre just showing me as in arrears. Should i remove that section of the letter or amend it thus;

Whilst it is unenforceable, no interest can be added to the account and no action can be taken against me such as defaults or adverse data registered at any of the credit reference agencies. If you have already added a default against me, I hereby give you 30 days in which to remove the default or supply me with the Consumer Credit Agreement to enforce the default.

Apologies if im being overcautious and asking obvious questions but im sure youll understand theres a lot at stake. If i get anywhere on CAP1 the Barclaycard are in for some correspondence.:D

Hiya mate - yes you're right with all the above, just amend as you quoted that's great! Remember the lender does ignore the default rule because they know you won't pursue it so bear in mind they will ignore this part regardless of what you tell them.....

Good Luck - am away til the end of the month by which time you should start to get replies. :cool: 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Tks NID. Have a great time away. Do you have a Blackberry you can take with you by the way?:rolleyes:

0

0 -

Bloody hell, I dont believe it! Got back tonight and theres a fat envelope from CAP1 on the mat. I missed a beat thinking it was the CCA, but when i opened it there was a hand written CAP1 comp slip with my address on it and the CCA reminder letter i sent 2 months ago that they say they never received. AND they had stuck the recorded deliver barcode to the top of the letter too, just to further prove that I hadnt sent it recorded delviery and they hadnt had it. T*ssers!.0

-

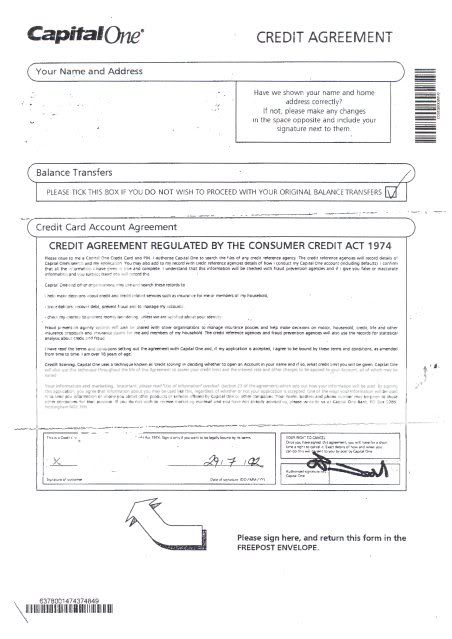

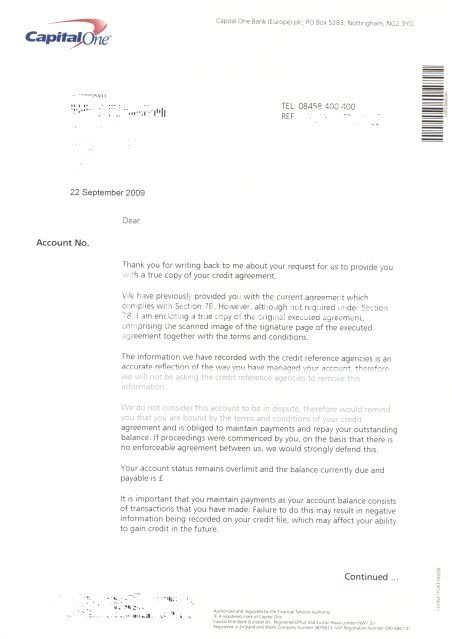

The letter they claimed they sent over a month ago finally arrived on 26 October, dated 22 September in a 2nd class envelope stamped 12 October. They also sent a copy of the CCA;

And a 2 page letter, page 1;

And page 2;

What does anyone make of it, does it look enforceable, and what should i do now?

thanks in advance. 0

0 -

That looks more like an application form than a compliant copy of the original executed consumer credit agreement.

I doubt that it contains all of the legally required terms, but would need to be able to see it a bit more clearly to be absolutely certain, but I doubt that it is enforceable.I am NOT, nor do I profess to be, a Qualified Debt Adviser. I have made MANY mistakes and have OFTEN been the unwitting victim of the the shamefull tactics of the Financial Industry.

If any of my experiences, or the knowledge that I have gained from those experiences, can help anyone who finds themselves in similar circumstances, then my experiences have not been in vain.

HMRC Bankruptcy Statistic - 26th October 2006 - 23rd April 2007 BCSC Member No. 7

DFW Nerd # 166 PROUD TO BE DEALING WITH MY DEBTS0 -

I agree with rog2 - from what I can see the prescribed terms are not on that form and they have certainly not complied (its their usual cut/paste job - Cap1 seem to be the experts at sending the same blanket letter!)...

I'd send the CCA dispute letter - basically arguing that the prescribed terms are not all intact. They already know this of course.

As for pursuing the 'debt' - let them - are we bothered? They have no legal entity to do so and they'll find out soon enough if they pursue it won't they... 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Tks for the replies fellas.

Ive already complained to the FOS and received an acknowledgement, so I will send this on with a covering letter explaining about the non compliance of the "CCA" theyve sent.

In order for them to pursue the debt i need to stop paying it, which is academic really since i stopped paying it when they cancelled my DD of their own volition a few months ago. The problem is that I will end up with a default that could be tricky to remove from my file.

What d'you both recommend i do next?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards