We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Why house prices may fall another 38%

Smitty

Posts: 341 Forumite

For all us bears - Dont get too down about the Halifax blip !

http://blogs.thisismoney.co.uk/this_is_money_blog/2009/02/why-house-prices-may-fall-another-38.html

http://blogs.thisismoney.co.uk/this_is_money_blog/2009/02/why-house-prices-may-fall-another-38.html

0

Comments

-

I love the first lines.

"The most basic measure of house price, which was sidelined in the boom, suggest they may fall a total of 50%.

It's not a prediction but an observation."

Loosely translates as "it is a prediction but don't hold me to it.":D0 -

I love the way this article dismisses the supply and demand principle - one of the fundamental tenets of economics - as "dubious".0

-

Thanks, OP - good post.0

-

the article is 2nd February and now out of date, it definitely needs to be re-written

"HBOS, the parent of mortgage lender Halifax, has reported a plunge in this measure in its monthly property market report"

5th February

"There was a 1.9% increase in average UK house prices in January"

http://www.hbosplc.com/economy/includes/05_02_09HousePriceIndexJanuary2009.pdf0 -

Degenerate wrote: »I love the way this article dismisses the supply and demand principle - one of the fundamental tenets of economics - as "dubious".

Of course supply and demand is important but more important is people's ability to pay.

The argument that a shortage of supply means that any price is justified (an argument we've all heard ad infinitum over the last 8 years to justify the ever sillier house prices) is nonsense.0 -

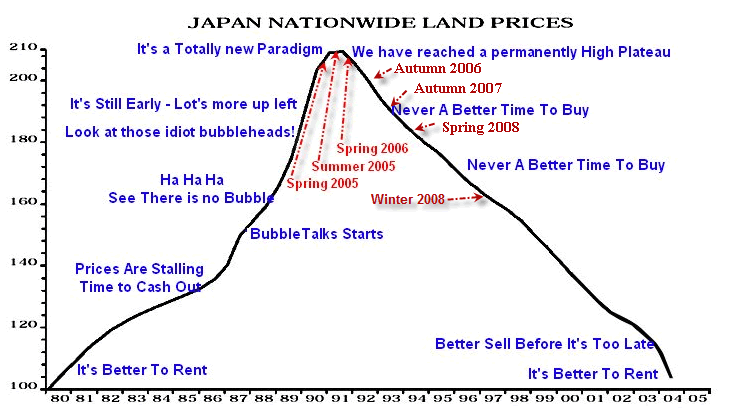

I found this graph here:

It looks like Japan has been here before and I would suggest that Japan has even greater pressure on land & supply than the UK does. 0

0 -

Of course supply and demand is important but more important is people's ability to pay.

.

I Agree, but in such a over populated island it is hard to know how many people earn over the average.

So even though houses may be unafordable on average wages there may be enough people earning over the average (7M+) to keep houses higher than the average wage.

I hope that makes sense as I find that hard to explain for some reason.0 -

Degenerate wrote: »I love the way this article dismisses the supply and demand principle - one of the fundamental tenets of economics - as "dubious".

Supply and demand is the primary school level of economics. Many markets simply do not follow this model. Houses, for example, are something of a Veblen good - when the price of them goes up, the demand increases rather than decreases, and now as prices drop like a stone, the demand is a fraction of what it was.

It's all tied up with so many other factors - availability of credit, perception of the future value (i.e. speculation), emotional reactions, the time delay in being able to actually execute a trade - all this and much more gives us a non-linear and frankly pretty complex system; the idea that the only two factors are how many houses there are on sale and how many people want to buy one becomes frankly untenable.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards