We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

PPI Reclaiming Discussion part 4

Comments

-

Hi,

I'm starting my claim against Halifax, Egg and RBS,. When i took out my Credit card with these lenders i had just finished university and started a temporary job which then went to permanent. Do i have more of a claim if i put down i had a temp job or a perm job when the card/insurance was taken out.

Any advice is a ppreciated.

Thanks in advance.

D0 -

Hi all,

Has anyone had any dealings with Park Financial services? I'm in an ongoing claim against them at the moment, Give me my money are acting as agents for me?

Thanks0 -

Hi thanks for the answer, it is hard work trying to explain someone elses claim, lol, but she has no internet at the moment. So it is classed as outstanding debt even though she got an amount required from them to pay it off to roxburghe. Am I right in thinking then that to work out what she would be left with if they do want to offset any compensation due is total original amount repayable, minus payments made. Then whatever the compensation amount may be taken off what is left as outstanding on the loan. Also did I see a calculator on a thread somewhere that can work out the amount due on the £1318 insurance premiumon a 7 year loan. Thanks in advance,

Hiya

Yes that sounds about right.;)

What you could do is post up the calculations, as there will be interest to add as well, and maybe Robbedofmymoney of Marshallka will take a look at them for you.:)The one and only "Dizzy Di" 0

0 -

Hi,

I'm starting my claim against Halifax, Egg and RBS,. When i took out my Credit card with these lenders i had just finished university and started a temporary job which then went to permanent. Do i have more of a claim if i put down i had a temp job or a perm job when the card/insurance was taken out.

Any advice is a ppreciated.

Thanks in advance.

D

Hi there

The policy could vary, but if you worked for less than 16 or 18 hours a week on a temp basis, then the policy would not have been suitable for you. I think they vary on the employment side of it as well, some will cover for temp and others not, so if you don't have the policy details, request for them, they will send them free of charge.

In regards of reclaiming, write down as much as possible that you believes applies to you.

And remember as well, you did not have to have the ppi, it should have been made optional, so if it rings the bell that this was added automatically make sure you mention this. Some think ppi is all part of the account because of not being told any different.

To make a reclaim, complete the reclaim questionnaire on step 3 below link, send to their head office or complaints dept if they have one, allow 8 weeks for a decision, and remember to keep copies of everything in case you need to go back to it again at some stage, good luck.

http://www.moneysavingexpert.com/reclaim/ppi-credit-card-insuranceThe one and only "Dizzy Di" 0

0 -

CardiffAntony wrote: »Hi all,

Has anyone had any dealings with Park Financial services? I'm in an ongoing claim against them at the moment, Give me my money are acting as agents for me?

Thanks

Hiya

I have not actually heard of them before but wishing you luck.

If your using a claims company keep on at them for updates, but if you have any further reclaims, please do have a go yourself if you can, they only do what we do and banks/businesses are also advising not to use claims companies now as well.

Hope you receive some good news soon, fingers crossed and please keep us posted, cheers.;)The one and only "Dizzy Di" 0

0 -

Hiya

Yes that sounds about right.;)

What you could do is post up the calculations, as there will be interest to add as well, and maybe Robbedofmymoney of Marshallka will take a look at them for you.:)

loan taken out 8/11/99,

origianal loan £5400 at 11.7% for 7 years/ 84 months,

insurance premium £1318.93,

interest £2978.87,

total repayable at £115.45 per month £9697.80, hopefully someone can tell me what the amount of ppi refund maybe on those figures, still need to work out the full amount paid back after the arrears occured when I talk to my friend , will that make a difference, 0

0 -

loan taken out 8/11/99,

origianal loan £5400 at 11.7% for 7 years/ 84 months,

insurance premium £1318.93,

interest £2978.87,

total repayable at £115.45 per month £9697.80, hopefully someone can tell me what the amount of ppi refund maybe on those figures, still need to work out the full amount paid back after the arrears occured when I talk to my friend , will that make a difference,

hi,

happy to help but need a bit more information.

from the posts it looks like you friend had defaulted on the loan, in order to come to some figures i need to know the following information.

how many monthly payments were made before the loan was passed on to a collection agency, and were they for the full amount.

how much were the total charges that were added for defaults.

and of course how much was the debt when it was passed on and has it now been settled.

i can then give a guide to how much would be due back.I'm proud to say that the banks no longer take money from me after becoming debt free0 -

any help please :-)

Submitted 2 claims to HSBC in August, both were put on hold due to judicial review. (held out rather than going to FOS)

Wrote again at end of March before the review was completed saying -

To date, I have not received an adequate response from you with regards this matter so I am writing again to request a full refund of the premiums, subsequent interest that I have paid on these premiums and the 8% statutory interest that a court would award. If I have not heard from you within 14 days I shall be taking my complaint to the Financial Ombudsman.

No response has been received to this letter, judicial review is now completed and banks not appealing.

What shall I do now? Wait two weeks to see if a letter arrives and if nothing then chase?

Maybe in 2 weeks send another letter with previous back up stating that now the judicial review has been completed please can you respond to my claim etc

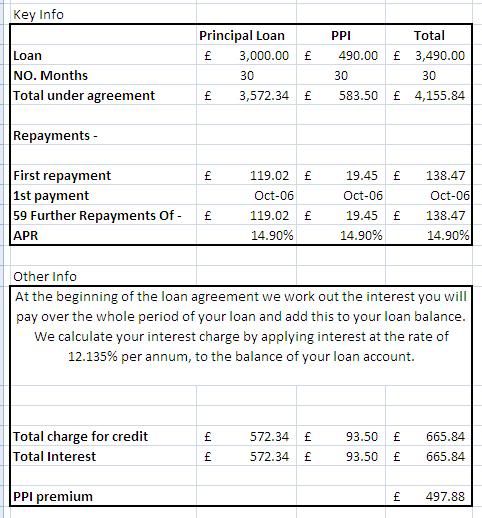

Also, if 100% successful how much might an offer be for? I’m not sure how the interest side works out on the PPI that’s been paid, breakdown of both loans is below.

Be very grateful if someone could take a look at the figures.

The PPI claims aren’t actually for me, I am helping a friend get out of debt which is now well on the way so this would be a massive bonus.

Loan1 - paid off early with loan 2, no sign of PPI being refunded.

http://i113.photobucket.com/albums/n215/DPS1984/spreadsheetjpeg.jpg

Loan 2 - still going with £5k left to pay

http://i113.photobucket.com/albums/n215/DPS1984/Pic.jpg

here goes

Loan 1 you would get back the premiums you paid

12 x 19.45 = £233.40 + 8% simple (£77) = £310.40

and the difference in settlement

583.50 - 233.40 = £250.10 + 8% simple (£73) = £323.10

total refund for loan 1 = £633.50

loan 2

43 x 60.15 = £2586.45 + 8% simple (£379) = £2965.45

your monthly repayments will then go down by £60.15 per month for the remainde rof the loan termI'm proud to say that the banks no longer take money from me after becoming debt free0 -

Have heard a firm of solicitors on the radio called Hindle Campbell, I rang them asking about a PPI refund and they said i can claim 100% of the compensation and they do all the work,

Is this correct or is it dodgey?

Has anyone heard of them?0 -

FROGMARCH8 wrote: »Have heard a firm of solicitors on the radio called Hindle Campbell, I rang them asking about a PPI refund and they said i can claim 100% of the compensation and they do all the work,

Is this correct or is it dodgey?

Has anyone heard of them?

Sure they will give you 100% of it, probably due to it being 'in a cheque. However they WILL charge you for something that would take a mere 10 minutes of your time.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards