We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

PPI Reclaiming discussion Part III

Comments

-

As most of you know, I am more of a technical specialist than financial expert, but I now feel I understand the PPI subject a little more.

I have devised various scenarios on these spreadsheets, and continually bounced them off my mate Billk, who has a far greater intuitive grasp of the interest principles and logic than I have, resulting in frequent enhancements and modifications. I usually have a custom one for complex cases, and include facilities for extra charges & refunds etc. However, everything is based on the principles of 2 separate loan accounts as detailed below.

I will summarise all that has gone before and explain everything in detail with a full audit trail, in an attempt to bring everybody to the same level of understanding on how these single premium PPI loans actually work in practice—rather than summarising it, and you merely accept what I say without actually understanding the audit trail.

Apologies to any financial purists if I use Laymens Terms rather than Financial Terms-but suggestions on appropiate terms welcomed.

I will use an old loan of Marshallka’s ---it is not necessary that we post up these illustrations for every future case, these are just so that you see where I am coming from.

It is possible to devise a simple calculation method to calculate a PPI refund for mis-sold single premium policies-when they are fixed interest rates, fixed payments, no missed payments, no penalty charges and the loan has run its full course.

However, this is not the real world , so we must work down at a more detailed level and try and replicate the situation as viewed on the Lender Accountant’s computer screens.

The Concept of 2 separate individual Loan Accounts

First of all we need to understand how these loans work in practice.

Although, the lender sends out a Statement Summary for the whole loan, in fact in accounting terms, they are considered as 2 separate loans-each with its own outstanding balance.

I have devised a model where I split the loan into its constituent parts and then amortize (produce the position throughout the course of the loan so on any given month in the next 7 years (in this case) we can see what the payments are, interest charged and the outstanding balance of the loan.

This is the basis for looking up the PPI position if mis-sold, but is also the basis for developing the model further to calculate settlement figures if we know the rules (I hope we can work on this later as I am not very familiar with settlement figures but I know there is experience on this forum)

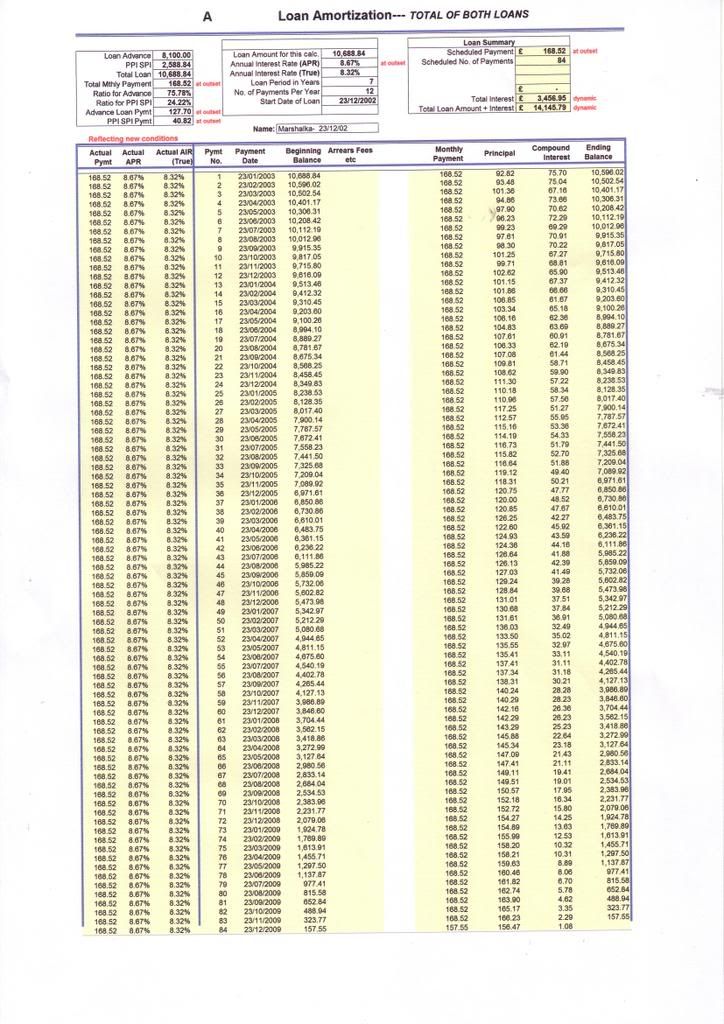

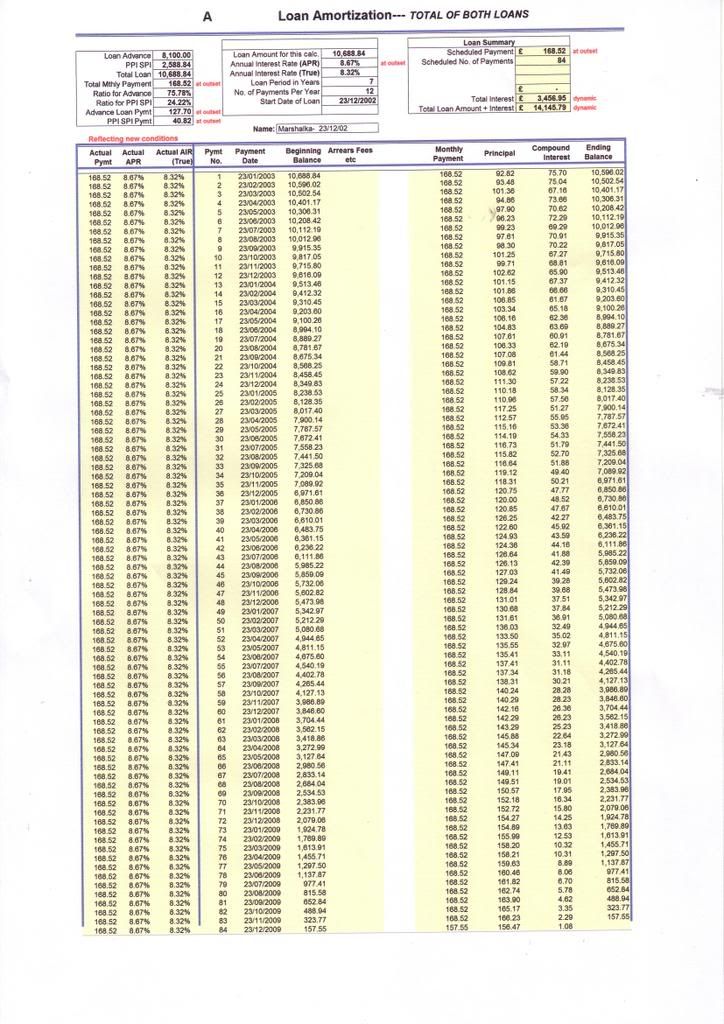

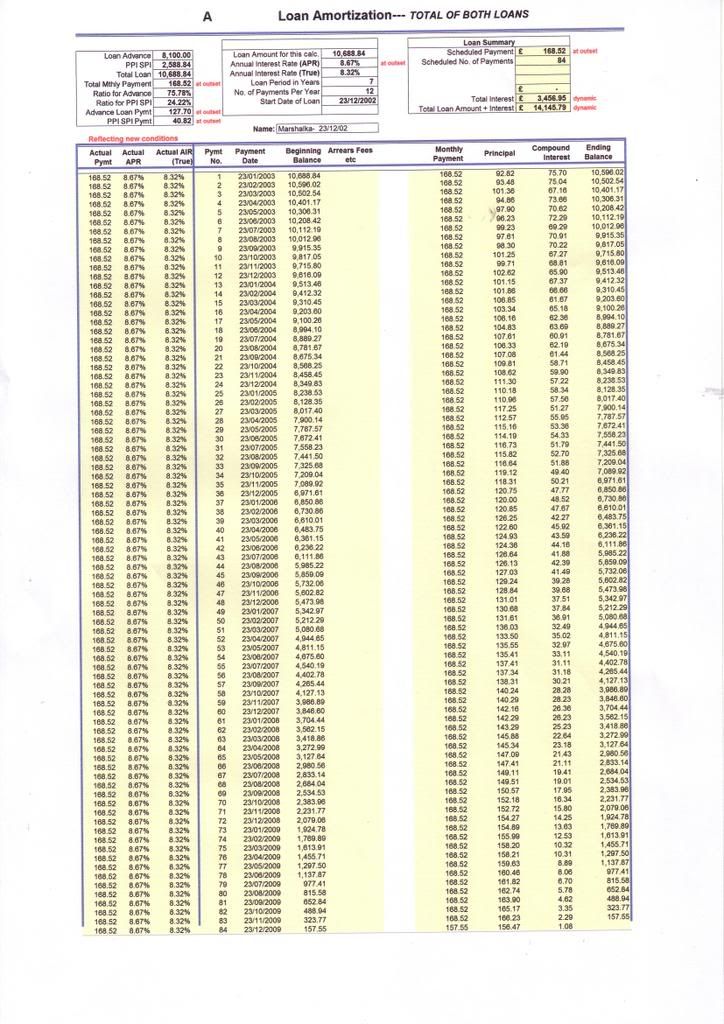

So, the summary statement including the total loan would look this—this is like your annual statement but with a lot more information added.

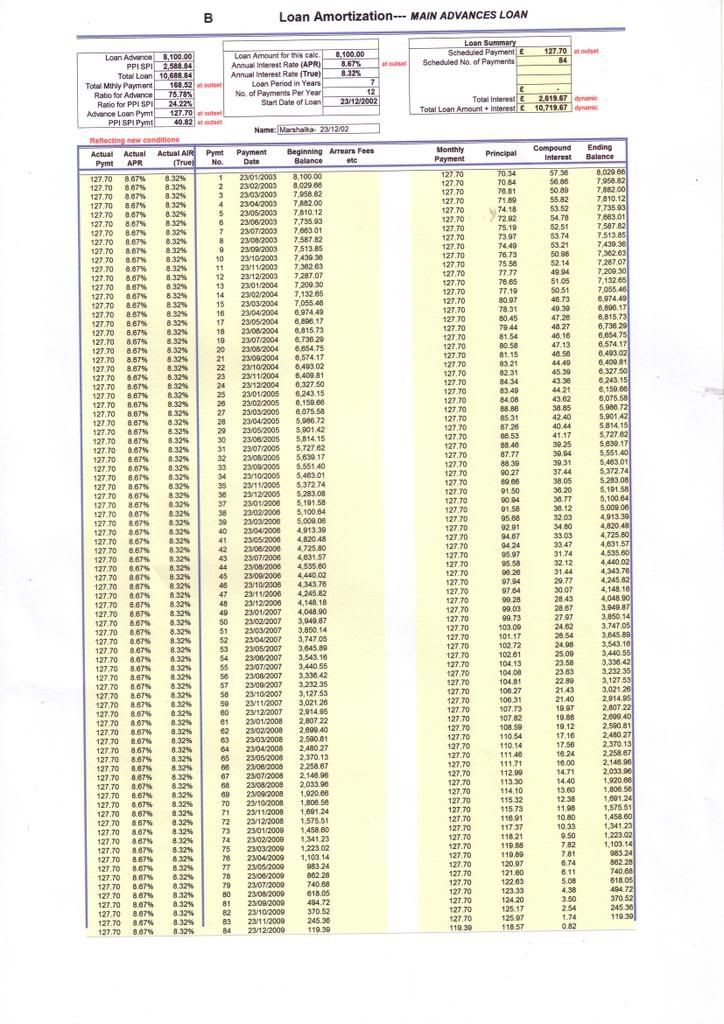

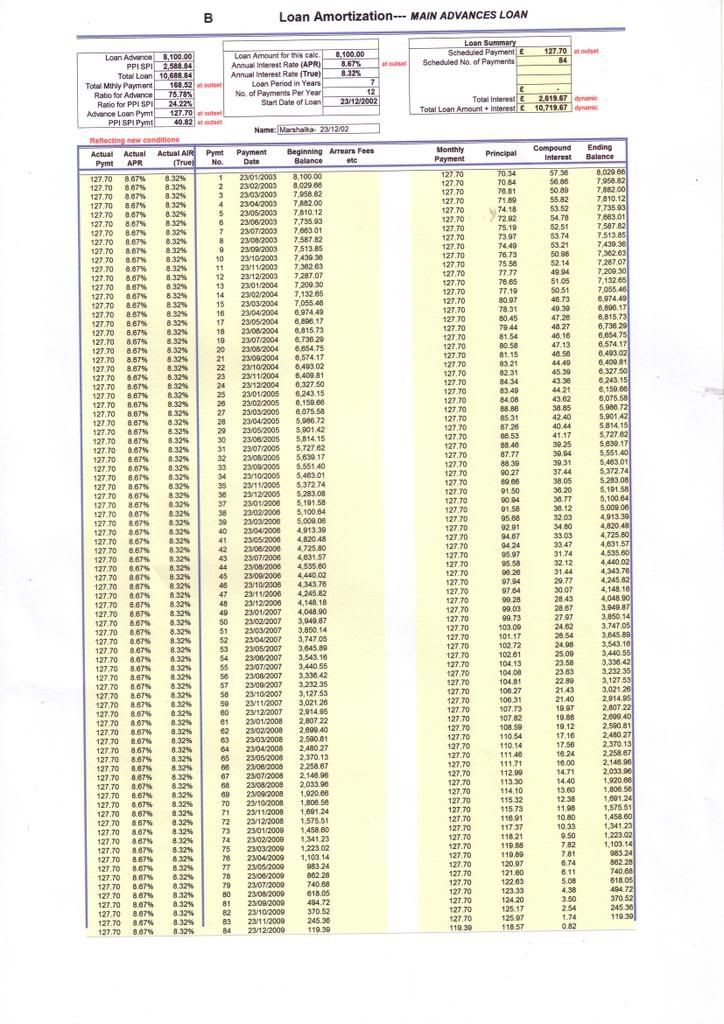

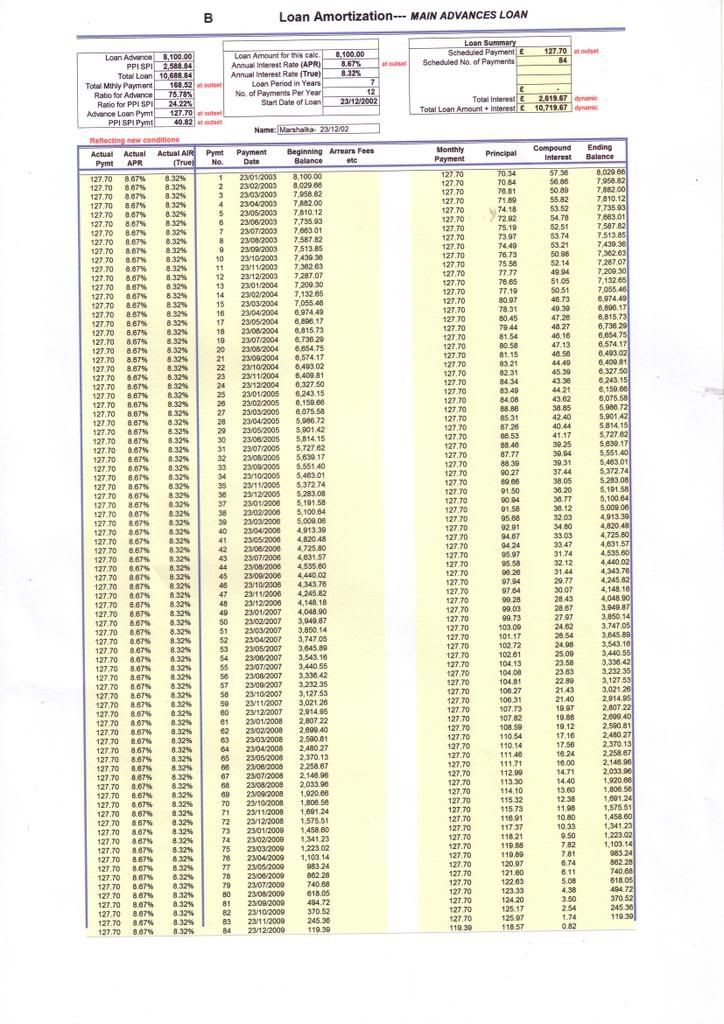

Similarly, the amortization of just the Advances Account below: Note that when succeeding in a mis-sold claim, all the outstanding balance in the PPI account would be written off and the resulting loan & monthy premium would be as on this statement.:

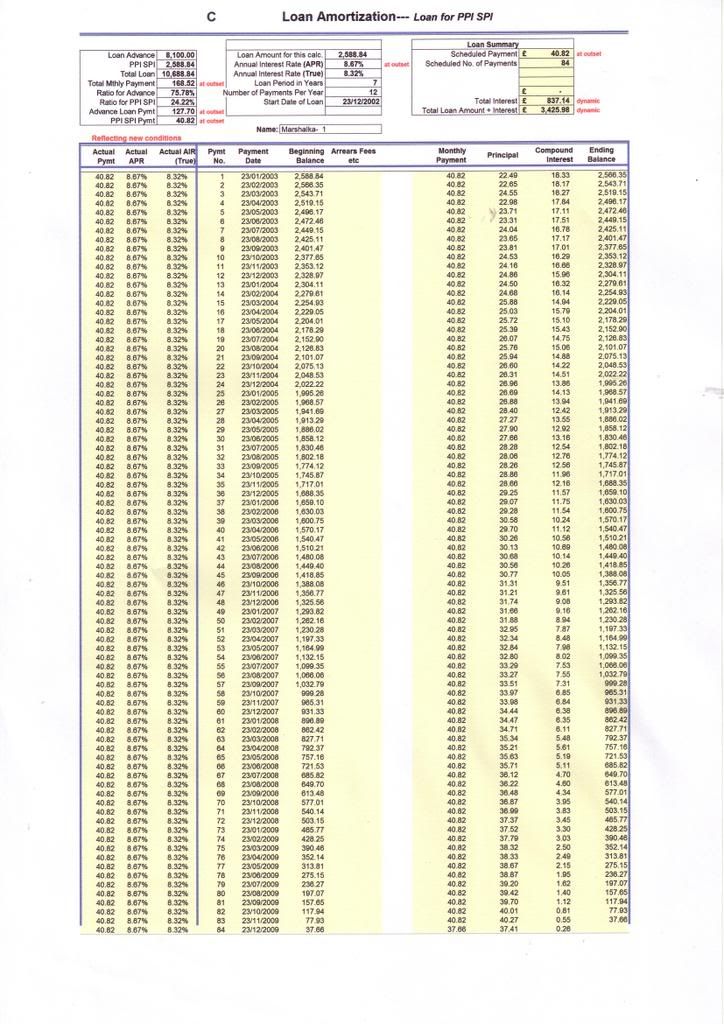

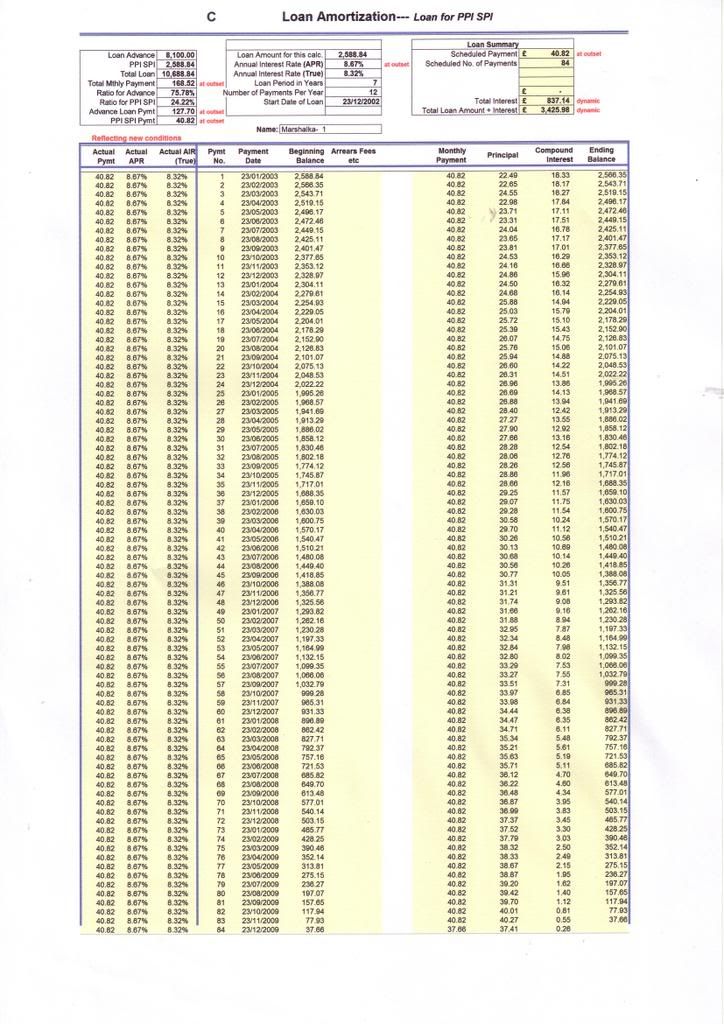

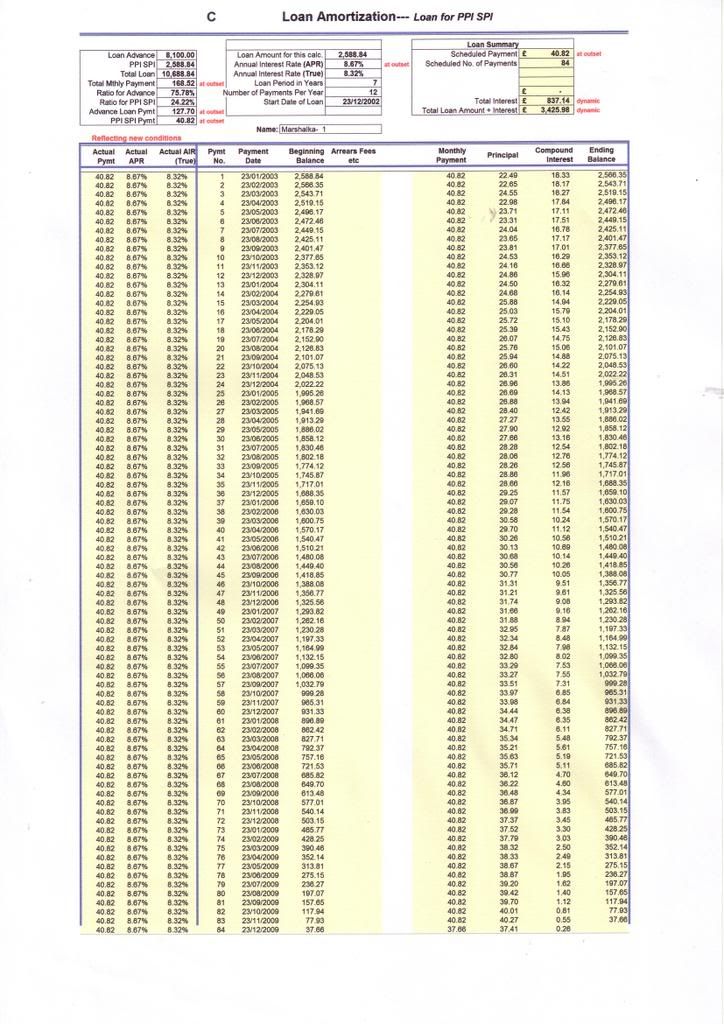

Similarly, the PPI SPI Loan Account statement as below:

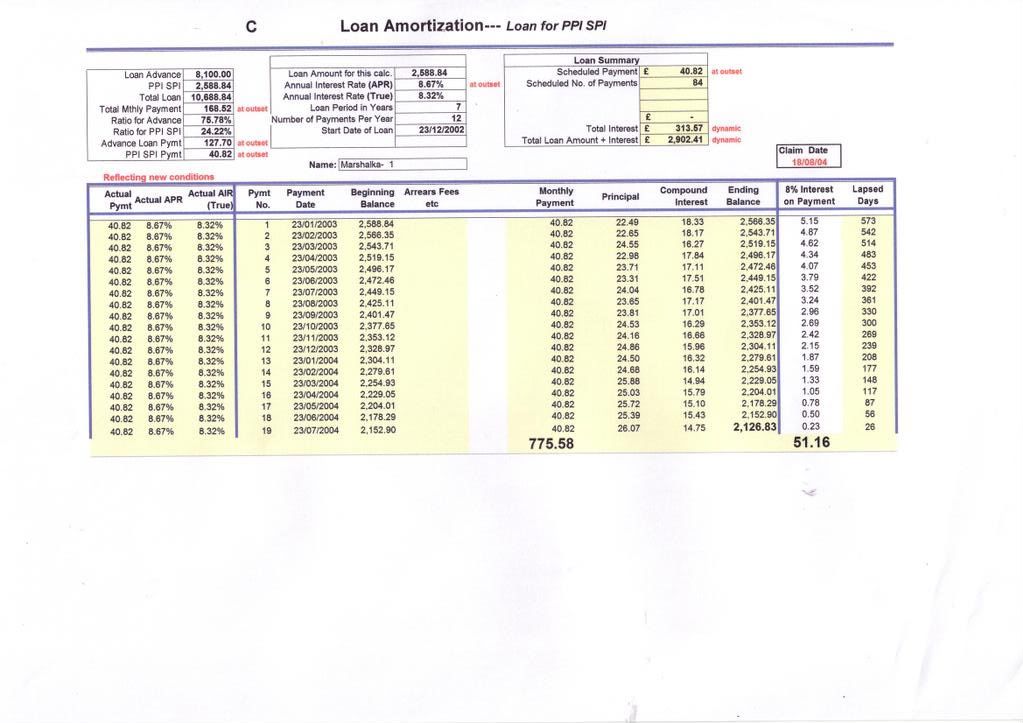

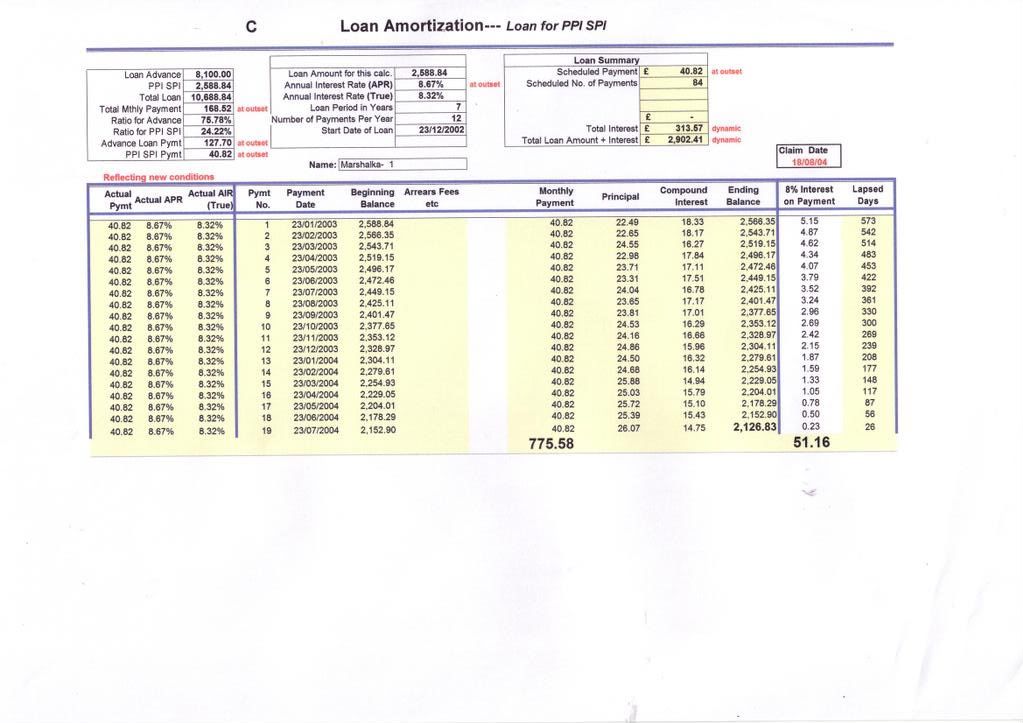

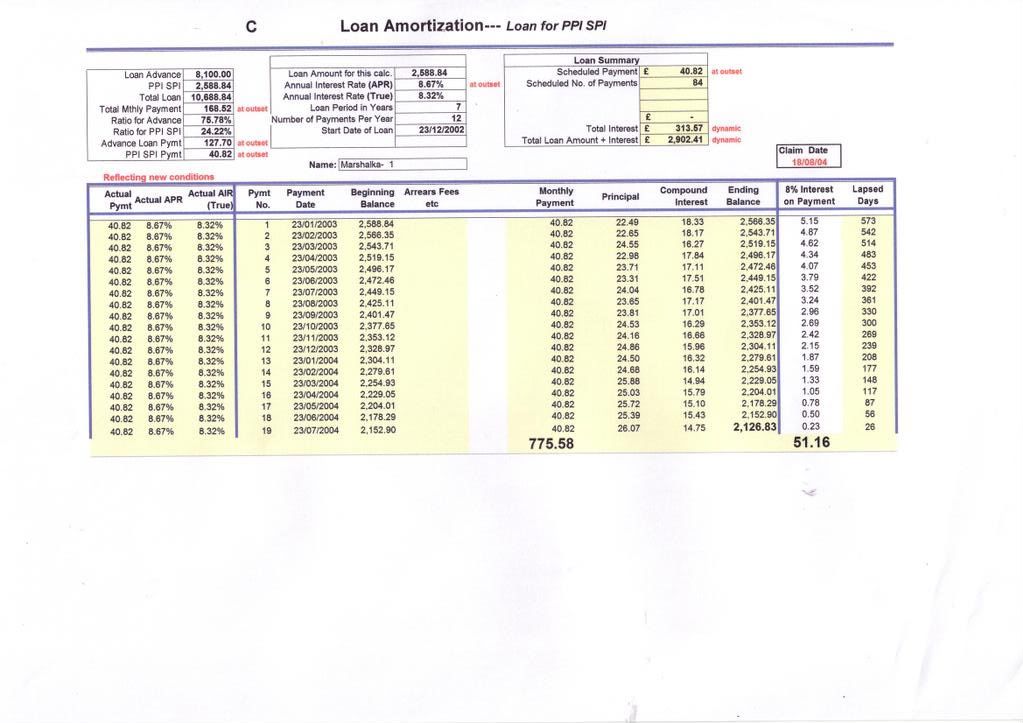

Right, as Marshallka succeded in mis-sold after 19 payments, we now examine the above statement at Line 19 and the illustration below is as above, but only showing the position up to 26/1/03.

Note the Payments of 775.58 would be refunded together with 8% interest of £51.16.

AND ADDITIONALLY, the outstandng balance of £2,126.83 would be written off.

In terminology by the way,Halifax refund the Principal part of the payment and the Interest part of the payment--which ,of course, IS the PPI payment.)

I hope that shows you how I am operating. I have a model on which to develop further.

Marshallka, I doubt that you can reconcile this as I believe you said you had a few interest rate changes, but I don’t have the details.

PLEASE NOTE: At this moment in time, I am only working on mis-sold PPI for CURRENT LOANS –AND NOT SETTLED (PAID OFF) LOANS.aka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0 -

:rolleyes:As most of you know, I am more of a technical specialist than financial expert, but I now feel I understand the PPI subject a little more.

I have devised various scenarios on these spreadsheets, and continually bounced them off my mate Billk, who has a far greater intuitive grasp of the interest principles and logic than I have, resulting in frequent enhancements and modifications. I usually have a custom one for complex cases, and include facilities for extra charges & refunds etc. However, everything is based on the principles of 2 separate loan accounts as detailed below.

I will summarise all that has gone before and explain everything in detail with a full audit trail, in an attempt to bring everybody to the same level of understanding on how these single premium PPI loans actually work in practice—rather than summarising it, and you merely accept what I say without actually understanding the audit trail.

Apologies to any financial purists if I use Laymens Terms rather than Financial Terms-but suggestions on appropiate terms welcomed.

I will use an old loan of Marshallka’s ---it is not necessary that we post up these illustrations for every future case, these are just so that you see where I am coming from.

It is possible to devise a simple calculation method to calculate a PPI refund for mis-sold single premium policies-when they are fixed interest rates, fixed payments, no missed payments, no penalty charges and the loan has run its full course.

However, this is not the real world , so we must work down at a more detailed level and try and replicate the situation as viewed on the Lender Accountant’s computer screens.

The Concept of 2 separate individual Loan Accounts

First of all we need to understand how these loans work in practice.

Although, the lender sends out a Statement Summary for the whole loan, in fact in accounting terms, they are considered as 2 separate loans-each with its own outstanding balance.

I have devised a model where I split the loan into its constituent parts and then amortize (produce the position throughout the course of the loan so on any given month in the next 7 years (in this case) we can see what the payments are, interest charged and the outstanding balance of the loan.

This is the basis for looking up the PPI position if mis-sold, but is also the basis for developing the model further to calculate settlement figures if we know the rules (I hope we can work on this later as I am not very familiar with settlement figures but I know there is experience on this forum)

So, the summary statement including the total loan would look this—this is like your annual statement but with a lot more information added.

Similarly, the amortization of just the Advances Account below: Note that when succeeding in a mis-sold claim, all the outstanding balance in the PPI account would be written off and the resulting loan & monthy premium would be as on this statement.:

Similarly, the PPI SPI Loan Account statement as below:

Right, as Marshallka succeded in mis-sold after 19 payments, we now examine the above statement at Line 19 and the illustration below is as above, but only showing the position up to 26/1/03.

Note the Payments of 775.58 would be refunded together with 8% interest of £51.16.

AND ADDITIONALLY, the outstandng balance of £2,126.83 would be written off.

In terminology by the way,Halifax refund the Principal part of the payment and the Interest part of the payment--which ,of course, IS the PPI payment.)

I hope that shows you how I am operating. I have a model on which to develop further.

Marshallka, I doubt that you can reconcile this as I believe you said you had a few interest rate changes, but I don’t have the details.

PLEASE NOTE: At this moment in time, I am only working on mis-sold PPI for CURRENT LOANS –AND NOT SETTLED (PAID OFF) LOANS.

Wow turboman that is really good, I find I may have to read it a few times to take it all in but it is really good what you have shown here.:T :A

Would the calcs for settled loans not be a similar calc?:wave:0 -

Right defo off to bed now.;)

Thanks to all on here

Marshallka

Dreamer

Maxdp

Boo

Natalie

Showergirl

Bathgatebuyer

Sarah

And again to anyone I missed, for being such good helpful mates, I will pop on from time to time, and thanks for your kind words as well, you've all been wonderful and I appreciate it and every one of you.:A

I can't thank you enough, and good luck with those claims.:D

Night night.

Di.

XXXXX

Di--get your butt back in here!!!aka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0 -

:rolleyes:

Wow turboman that is really good, I find I may have to read it a few times to take it all in but it is really good what you have shown here.:T :A

Would the calcs for settled loans not be a similar calc?

No--I've got to get my head round this later as there seems to be a few different ways of firms calculating the settlement figure---Some start off from the premise that you still owe the whole unpaid balance & then have calculations to produce a rebate. No doubt you all will educate me later when I'm ready cos I'm sure I can automate it if we have the rules.

I thik some others take the outstanding balance & then ADD a sum based on other type of calculations.

We'll discuss this in February (when I've done my Income Tax--lol)aka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0 -

Sorry what is the amount advance?

Monthly Premium?

7.4% variable

loan term is over 240 months

Doesnt quote the total interest

PPI LOAN IS 12,245.00

Monthly premium on the PPI where is do I find that out?

APR is the same

Interest isnt quoted

The loan is for 50,000 + 12,245 for PPI total 62,245,

Monthly payments 393.67 for the loan and 96.42 for the PPI totalling £490.09 but the repayments have been totalling £615 per month.

The loan was taken out Oct 05 and so have made 40 months worth of payments.

Not quite sure on the balance at the present time.

Sorry re the information if you can let me know what more you need that would be great.

Thanks Nick

I've got

a)4,736 refund for Pymts + 8% if fixed rate

b)4,906 refund if assumtions made on interest rates rising

c) + around £11,250-ish written off the overall loan

Will post up details tomorrowaka Calculator

My grandmother started walking five miles a day when she was 60. Now she's 97 years old and we don't know where the hell she is.0 -

marshallka wrote: »Oh Di, You are digging at me now...(anyway I do not want to get in the way of PPI posts lol!!!!!) perhaps its best I leave you all to it. I for one think that PPI and debts etc IS a serious subject and sorry if I have upset you and your friends on here. I really did not mean to do that. I can see now that the regulars mostly have your view here and you have now said you will leave with not even trying to understand where I am coming from and I have obviously wasted my time trying to get my view across. I was just trying to get some help again like we had before in people getting back their PPI when they cannot go to the FOS.

As regards that with credit crunched - you did things your way and that was appreciated but I was stating that I do things my way too and see no harm in that. I do speak out for things I believe in and people I also believe in too. Its just me, I cannot stand to see others picked on, even adults... I make a choice to do it... I am a big softie too, just like you, but we do things differently you and me. .... I don't harp on about my troubles too much on here as I could write a book just like everyone else. We all have troubles... some more than others... I was so shocked by two peoples posts last night and these people have come on here and never once mentioned their troubles and my HEART went out to them both. Others do seem to find comfort in mentioning about theirs and that is fine too. Some people find their money problems something to laugh about and others find them heart breaking in that they are at threat of losing their homes, their families breaking down, they kids having to give up pets to move into bed and breakfasts.... each are fine....

I do things my way and you do things yours... we are all different thats what makes us unique.

I like the officey side of things on here (its inbred!!) and you and some others prefer to chat, that is fine. I was only making a suggestion. Maybe I should have kept my mouth shut for once or I could see this as an apportunity...:rolleyes:

Marshallka, we need you. Your knowledge & advice is vital to this forum, OK you don't want to get involved with the chit chat but please continue to contribute. You & Di deserve a medal for all the advice you give & the time you spend on here.

If it wasn't for you all I would have given up trying to reclaim ages ago, but with your support I have kept going. I look forward to the quiet times at night or if my little one is at school on my days off so that I can join you all on here, sometimes just to read the posts or to ask questions & join in.

Please don't think that we don't support you. You are part of the team & I honestly think of you all as friends who do not judge but give support & advice whenever it is needed.0 -

Well what a nite you all had. All I can say is I agree with Maxdp last post and there is nothing wrong with a bit of chat and EVERYONE who comes on here has done posts that dont relate to PPI so I dont see why the big fuss about it. This thread has been running fine and theres no reason it shouldnt continue to do so.DS1 12/10/04

DS2 13/07/06

DD1 06/12/070 -

Turbo I got back £1462.00 without the 8% interest...:eek: :eek:As most of you know, I am more of a technical specialist than financial expert, but I now feel I understand the PPI subject a little more.

I have devised various scenarios on these spreadsheets, and continually bounced them off my mate Billk, who has a far greater intuitive grasp of the interest principles and logic than I have, resulting in frequent enhancements and modifications. I usually have a custom one for complex cases, and include facilities for extra charges & refunds etc. However, everything is based on the principles of 2 separate loan accounts as detailed below.

I will summarise all that has gone before and explain everything in detail with a full audit trail, in an attempt to bring everybody to the same level of understanding on how these single premium PPI loans actually work in practice—rather than summarising it, and you merely accept what I say without actually understanding the audit trail.

Apologies to any financial purists if I use Laymens Terms rather than Financial Terms-but suggestions on appropiate terms welcomed.

I will use an old loan of Marshallka’s ---it is not necessary that we post up these illustrations for every future case, these are just so that you see where I am coming from.

It is possible to devise a simple calculation method to calculate a PPI refund for mis-sold single premium policies-when they are fixed interest rates, fixed payments, no missed payments, no penalty charges and the loan has run its full course.

However, this is not the real world , so we must work down at a more detailed level and try and replicate the situation as viewed on the Lender Accountant’s computer screens.

The Concept of 2 separate individual Loan Accounts

First of all we need to understand how these loans work in practice.

Although, the lender sends out a Statement Summary for the whole loan, in fact in accounting terms, they are considered as 2 separate loans-each with its own outstanding balance.

I have devised a model where I split the loan into its constituent parts and then amortize (produce the position throughout the course of the loan so on any given month in the next 7 years (in this case) we can see what the payments are, interest charged and the outstanding balance of the loan.

This is the basis for looking up the PPI position if mis-sold, but is also the basis for developing the model further to calculate settlement figures if we know the rules (I hope we can work on this later as I am not very familiar with settlement figures but I know there is experience on this forum)

So, the summary statement including the total loan would look this—this is like your annual statement but with a lot more information added.

Similarly, the amortization of just the Advances Account below: Note that when succeeding in a mis-sold claim, all the outstanding balance in the PPI account would be written off and the resulting loan & monthy premium would be as on this statement.:

Similarly, the PPI SPI Loan Account statement as below:

Right, as Marshallka succeded in mis-sold after 19 payments, we now examine the above statement at Line 19 and the illustration below is as above, but only showing the position up to 26/1/03.

Note the Payments of 775.58 would be refunded together with 8% interest of £51.16.

AND ADDITIONALLY, the outstandng balance of £2,126.83 would be written off.

In terminology by the way,Halifax refund the Principal part of the payment and the Interest part of the payment--which ,of course, IS the PPI payment.)

I hope that shows you how I am operating. I have a model on which to develop further.

Marshallka, I doubt that you can reconcile this as I believe you said you had a few interest rate changes, but I don’t have the details.

PLEASE NOTE: At this moment in time, I am only working on mis-sold PPI for CURRENT LOANS –AND NOT SETTLED (PAID OFF) LOANS.

I will show you how this is worked if you are interested later on. I can show you the method used by FOS and the my bank;)

It may be of interest to you too.0 -

Pinknico, I have ALREADY said I do it too but I only suggested another way...Well what a nite you all had. All I can say is I agree with Maxdp last post and there is nothing wrong with a bit of chat and EVERYONE who comes on here has done posts that dont relate to PPI so I dont see why the big fuss about it. This thread has been running fine and theres no reason it shouldnt continue to do so.

It was just a suggestion

Brock posted this on another thread and it is something similar to what I was suggesting

Di - no offence, but you really seem to miss the point of what I was saying. I am actually on your side and if you look at my past posts you will see that I try and give good advice wherever I can.

However, you all bang on about how you are helping everyone, but the PPI thread is completely buried in a meaningless sludge of posts about complete & utter tosh. How anyone who is looking for useful help about reclaiming PPI can expect to wade through 500+ pages of people posting about what they had for dinner yesterday is beyond me. The PPI thread should be for useful stuff about PPI, not a replacement for MSN between a select few individuals whose presence appears to border on addiction.

When I posted my earlier comment about the PPI forum I had just popped over and read the following post.

"I have Sunday lunch to get on with as well, done the veg earlier, cooked the Chicken last night, its all wrapped up in foil.....:p .

My tummy is rumbling, I had some cereal bars for my brekkie this morning

".

".

And you know what - that post was thanked twice as being useful. Is that the purpose of a PPI forum?

Now is it just me or what? I am not trying to create waves - I'm just saying it as I see it.

(postscript): Whilst typing the above is seems that the PPI forum has already taken a few steps to realise what I am trying to point out above. I have decided to post this anyway to add an 'outsiders' viewpoint.

Once again, I will reitarate that I wish to give good advice to people as anyone else, so please don't treat me as the 'enemy'.

That is someone from the outside apparently....

Sorry if you have taken offence at me too.0 -

I have a claim against Picture and have had a similar reply from FSCS, they can't give me any time schedule when they will be able to look into my claim. My guess is that it could be months before Picture have being fully investigated and then the FSCS have to decide if the claim is valid under their criteria (whatever that is). My concern is that I am managing my debts now, but it is looking highly likely that my husband will be laid off, and with only me working, I will only be able to afford to pay the mortgage, but not Picture. Does anyone know what happens in this type of situation, as there is no available equity in the house? Also, as I will continue to pay my main mortgage lender - do Picture still have a right to repossess?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards