We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Ulster Savings

Comments

-

I opened my account yesterday morning and this morning it was available on the app. I would try and reinstall the app.jaypers said:

I think it’s a case that they simply haven’t opened it yet. They haven’t come back to me since I got the login ID. The app authenticates fine, it’s just that there is no account. Ulster Bank not exactly filling me with much confidence.thevoid69 said:

Try and uninstall the app and reinstall and try againjaypers said:3 days now and account still not showing when I try to login to app. Hopeless.1 -

Not sure you'll get the higher interest as of yet if it's not on the app.Ayr_Rage said:

I can answer that, opened yesterday afternoon, downloaded app and registered for online banking, email received saying account open.thevoid69 said:Account is open and interest rate is 1%. When I add funds above £5000, will the interest rate update straight away on the app?

App and online were not able to display the account.

Even so I tried adding £1 yesterday but it bounced back with Chase advising "details do not match" although they were correct.

App showed the account this morning and added £25000 from Chase using the same details and it arrived instantly.

However, when selecting the interest rate it shows and states that the details are from the balance at the end of the last business day.

Hopefully I am getting the full amount but the app will not update the rate until Monday at midnight.0 -

I'll probably wait and transfer mine on Sunday evening just to be sure.Ayr_Rage said:

I can answer that, opened yesterday afternoon, downloaded app and registered for online banking, email received saying account open.thevoid69 said:Account is open and interest rate is 1%. When I add funds above £5000, will the interest rate update straight away on the app?

App and online were not able to display the account.

Even so I tried adding £1 yesterday but it bounced back with Chase advising "details do not match" although they were correct.

App showed the account this morning and added £25000 from Chase using the same details and it arrived instantly.

However, when selecting the interest rate it shows and states that the details are from the balance at the end of the last business day.

Hopefully I am getting the full amount but the app will not update the rate until Monday at midnight.0 -

35har1old said:

Have you registered for biometrics approval?thevoid69 said:Hi, I have opened an account with them as they offer 4.5%. I've just gone for a savings account and not a current account.

Since then, I've been reading a few horror stories online, such as being unable to close the account, interest not being paid, unable to transfer funds to a non Ulster account.

Does Ulster just work exactly like NatWest would with transfers, or is it going to get complicated without a current account with them?

Thanks

If not withdrawals restricted to £750 per dayML said one of the savings they would go for was with the Ulster Bank. I am 81, been with ML since inception and have always been grateful for his advice but have you ever tried to open an account with the Ulster Bank? As the advert goes "what a malarky".1st they would not accept joint accounts, so we tried for my wife first, they wanted pictures of her, her passport all of which their computer could not handle and we were told to start again. An hour later success. Then my turn, went through the same proceedure then "oops something went wrong please start again Twice!!. Half way through before I had been asked for a pin nor given a passcode I was told my application was successful and to login in a couple of days. I called them, waited twenty minutes and after explaining the problem was told to log on on Monday. They were completely deaf to my explanation that I could not so I said forget it we will go elsewhere which we have to First Save at 4.45% normal questions successful login quite quickly and login details arrived in 24 hours. Job done...

0 -

I opened with £1 on Friday morning. Added enough to make it up to £5000 in the afternoon. Their close of business seems to be end of working day, and not midnight. My interest rate changed to the higher rate.0

-

So adding £5k+ on Monday morning will change the rate to the higher rate Monday evening?0

-

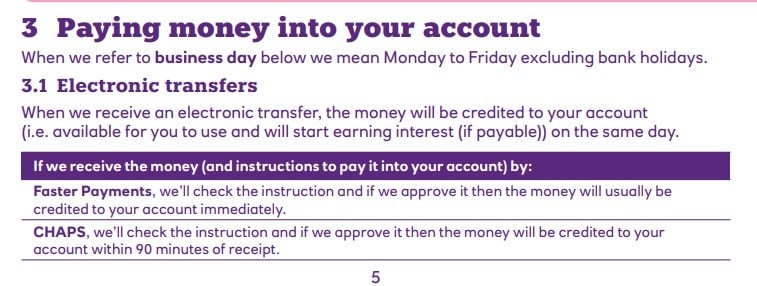

As the Ts and Cs DO NOT refer to Business Days for credits by Faster Payments then according to this interest should be payable the same day as the funds arrive.

The rate info in the app and online seems to have built in lag.

0 -

If I remember correctly from when I had an Ulster Bank account previously their daily withdrawal limit reset at 6pm each day so you could withdraw the daily maximum twice in one day but then couldn't withdraw againuntil6pm thenextday. I could be wrongly remembering so forgive me if I am not correct.topyam said:I opened with £1 on Friday morning. Added enough to make it up to £5000 in the afternoon. Their close of business seems to be end of working day, and not midnight. My interest rate changed to the higher rate.0 -

I've had an Ulster Bank Loyalty Saver for a couple of years which worked well to keep my quick-access cash "float" in the £5000 tier until the rate dropped to below alternative accounts. So when this new Limited Edition Saver appeared at 4.41% gross paid monthly on balances above £5000 I looked at the small print. It says:

"Interest is calculated daily and paid on the first business day of the month and at account closure. You’ll be able to see and access the interest in your account on the following day. During the 12 month term, if you have a balance of £5,000 and £3,000,000, you will earn the bonus interest rate in addition to the variable rate. If your balance drops below £5,000 at any time during the 12 month term, interest will be paid at the variable interest rate set out above."

I can't work out if that means "on every day the balance is £5000+, the bonus rate will be paid" or does it mean "once the balance drops below £5000, there'll be no more bonus rate even if the balance is later topped-up to over £5000". Has anyone had clarification from Ulster Bank on this specific issue?

The Loyalty Saver wording is no guide because it has a different structure without a bonus rate - the interest rate paid is simply different rates depending on which tier the balance sits.

I don't want to go to the trouble of setting up this new account, transferring funds and setting-up payees if, someday, I need to withdraw cash unexpectedly which temporarily takes me below a £5000 balance resulting in the account being pointless from then on - I might as well keep the funds in my Cahoot Simple Saver Iss11 at 4.3% gross paid monthly.

0 -

I had the same concerns so contacted them and got the following reply (posted on another post with other inputs on easy)pafpcg said:I've had an Ulster Bank Loyalty Saver for a couple of years which worked well to keep my quick-access cash "float" in the £5000 tier until the rate dropped to below alternative accounts. So when this new Limited Edition Saver appeared at 4.41% gross paid monthly on balances above £5000 I looked at the small print. It says:

"Interest is calculated daily and paid on the first business day of the month and at account closure. You’ll be able to see and access the interest in your account on the following day. During the 12 month term, if you have a balance of £5,000 and £3,000,000, you will earn the bonus interest rate in addition to the variable rate. If your balance drops below £5,000 at any time during the 12 month term, interest will be paid at the variable interest rate set out above."

I can't work out if that means "on every day the balance is £5000+, the bonus rate will be paid" or does it mean "once the balance drops below £5000, there'll be no more bonus rate even if the balance is later topped-up to over £5000". Has anyone had clarification from Ulster Bank on this specific issue?

The Loyalty Saver wording is no guide because it has a different structure without a bonus rate - the interest rate paid is simply different rates depending on which tier the balance sits.

I don't want to go to the trouble of setting up this new account, transferring funds and setting-up payees if, someday, I need to withdraw cash unexpectedly which temporarily takes me below a £5000 balance resulting in the account being pointless from then on - I might as well keep the funds in my Cahoot Simple Saver Iss11 at 4.3% gross paid monthly.

Ulster Bank Limited Saver Account interest. I have been talking to Cora. Had to ask the question 3 times to get someone to answer re bonus interest. This is their final reply:

"No, Malcom. You only lose the bonus interest rate for the days you are below the £5000 requirement, as interest is calculated daily."1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards