We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Being nosey... How many Regular Saver accounts do you have?

Comments

-

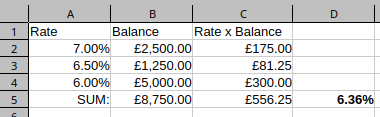

I'm one of the small number, but I think it is potentially a more useful metric as there is only one way of calculating it (unlike the annual return which is being calculated in different ways). Weighted average can only be the sum of (current balance x rate) all divided by total balance.

1 -

Using the method you described, I'm happy to see 6.21% as my current Weighted Average figure. So we have potentially 4 or 5 figures to populate the column 😀

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

My weighted average for the accounts I actually fund is 6.4%. A tad higher than what I expected, but thinking of it I've got quite a few at 7%, including £1000 per month at Monmouthshire, so this drags the average up a lot. I've got 3 or 4 accounts which I don't fund at the moment but should be able to in a couple of months, which will drag my average down a little.

1 -

I think it will be a good column to add. I remember people were mentioning this. not many as you say, but this made me interested in calculating my own. I've looked up how to calculate this, very tedious if I'm to use calculator. I think it's the same as calculation of finial university degree grades, but they were made out of only a small number of weighted grades, having 50+ RS's can turn into a task I would be reluctant to do😔 I've searched for spreadsheet templates, they didn't work. Found step by step instructions how to do it on google sheets, no luck - I'm rubbish at spreadsheets😥

0 -

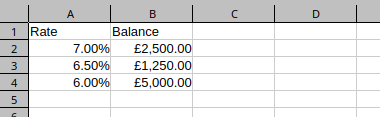

Say you have a table of Rate (col A) and Balance (col B), then you'd follow these steps

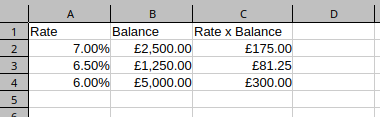

- Add a new column for Rate x Balance with formula =A2*B2 in C2 and drag down the column

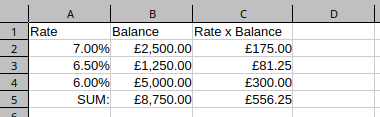

- Add a row at the bottom for the sum of the B and C columns, e.g. in col B =SUM(B2:B4) in this example, then drag along for col C

- Finally add a formula to another cell, e.g. D5 =C5/B5

0 - Add a new column for Rate x Balance with formula =A2*B2 in C2 and drag down the column

-

I took a similar approach, but used "rate x monthly maximum" instead of "rate x deposit"

0 -

If what you are calculating is the weighted average rate you are earning at a specific point in time, then it would depend on the account balance. It's the tangent of the curve of accrued interest over time relative to the capital that is being used to generate it. If you refresh a high paying account in your portfolio then you'd expect that to have a detrimental effect on your weighted average rate, because a greater proportion of your pot will be in lower paying accounts. If you have £5k in a 5.5% account that you are not adding to, then that should feature in the weighted average.

To illustrate with an extreme example, it is like holding £95k in a S&P500 index fund and £5k in a FTSE100 index fund, deciding that you want more UK equities, so changing your monthly funding to pay £900 per month into the FTSE100 and £100 into the S&P500, then claiming your weighted average rate of return should be calculated based on 90% FTSE100 and 10% S&P500 rather than 5% FTSE100 and 95% S&P500.

0 -

Ah, fair point. I was just looking at it from the angle of "what interest am I earning on this month's deposits".

Makes a very slight difference to my average. Using the monthly maximum, weighted average was 6.67% (I made a slight error in my earlier calculation), using total balance puts the weighted average up to 6.74%.

1 -

I have calculated my weighted average at 6.32% for now (though it'll be out of date tomorrow as NatWest interest goes in then and I'll hopefully be able to make my Monmouthshire transfer.) Could up it by opening the current account linked RS that I don't have, but would have to double my number of current accounts to get them all and am not inclined to do so at the present time.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards