We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Being nosey... How many Regular Saver accounts do you have?

Comments

-

Nationwide difficultiesNot sure if I can post links here to other websites, but the experience of @Pickledonionlover is very similar to that described following, and this goes back 4 years I think :

Moral appears to be give them what they want, don't ask questions and hope you can move on as you were, maybe even benefit from it (Premier banking anyone ). Significant point is if the bank were very suspicious they would close down access and then maybe ask questions.

). Significant point is if the bank were very suspicious they would close down access and then maybe ask questions.

0 -

How surprisingly nice of them to give you premier though - did you actually qualify?dcs34 said:I had to politely explain to NatWest that I wasn't using my personal account for business purposes, and that if they actually looked at the 30+ payments going out on the 1st of each month they were to accounts in my name, not me running payroll or paying invoices etc.

Took a week for them to look into it and they were fine about it. Upgraded me to Premier to say sorry for the inconvenience.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

Not as far as I can see - but I think the monthly payments in/out to fund regular savers made them think I had a higher income salary than I do. Or they were a bit embarassed IDK.ForumUser7 said:

How surprisingly nice of them to give you premier though - did you actually qualify?dcs34 said:I had to politely explain to NatWest that I wasn't using my personal account for business purposes, and that if they actually looked at the 30+ payments going out on the 1st of each month they were to accounts in my name, not me running payroll or paying invoices etc.

Took a week for them to look into it and they were fine about it. Upgraded me to Premier to say sorry for the inconvenience.1 -

November update following some maturity in Oct, now on 23 Regular savers in my name, fully funded now £5850 per month, I also have rbs and NatWest sitting full that I just skim the interest off, but I’m not counting these as not really Regular Savers now.1

-

Sorry, I forgot to update - Personal RS - 51, OH's - 16 (which I am managing) - total 66. I am "basic" tax payer by virtue of pension contribution, she is additional tax payer, thus the lower RS count1

-

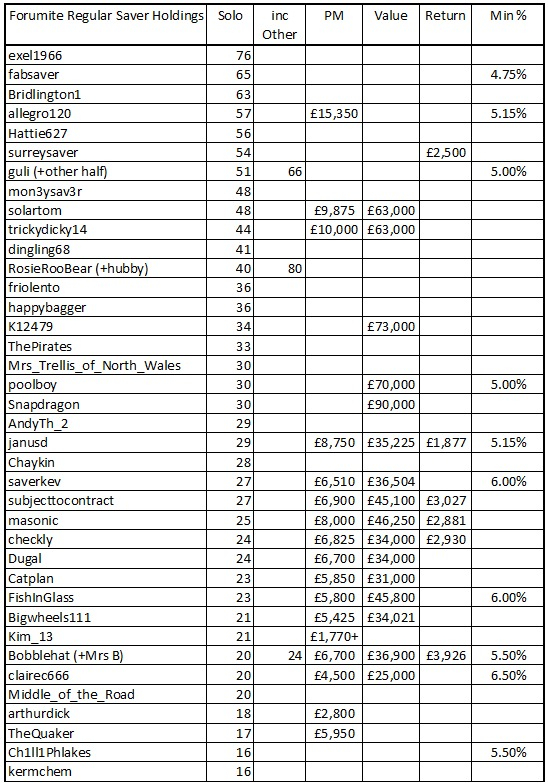

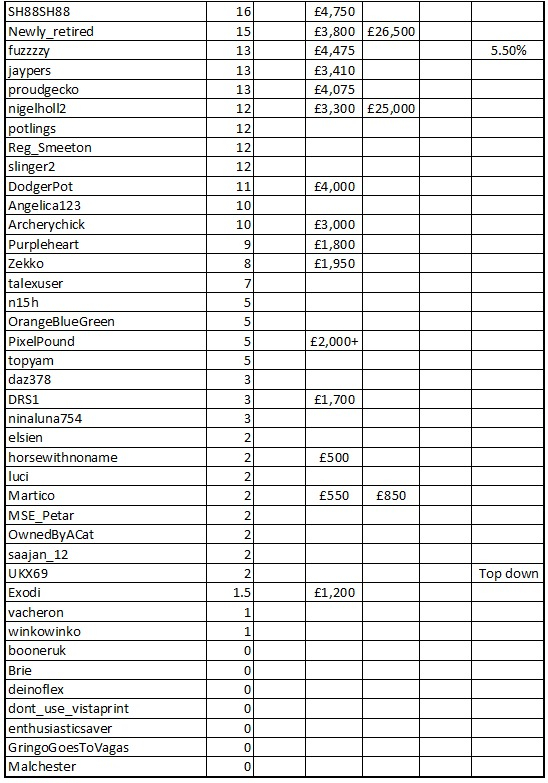

As mentioned on 29th October, I've rejigged the table to try to keep as many people as possible happy regarding counts of RS's held by individuals and by those held including "other half's". I've kept the change as simple as possible to try to preserve the "fun" element of the table and the table still shows the total holdings where people are administrating their own and significant other's RS's too.

I am now sorting by individual holding's only, so the "inc Other" column is now really just extra information which people are free to find interesting, or just ignore! Inevitably, those that were willing to split their figures have dropped down the table, so I'm grateful for those for being still willing to participate.

I'd be very happy to include figures from former participants who didn't like the sound of the changes, or figures from new readers of the thread. As always, I'm very happy to receive updates or corrections as and when participants feel happy to post to the thread, it takes little time for me to incorporate the figures.

Hope you like the change .......

.......

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum17 -

I understand the frustration with NatWest as it’s my bank as well. I’ve got around this little problem in the past - especially with Principality having a number of RS - by having an EA account. One transfer in from NW and distributed from there. 😏clairec666 said:

Depends whether it's the quantity of transactions that's attracting their attention, or the total amount of money involved.masonic said:

It does make me wonder whether it would be worthwhile to spread these payments out over a number of accounts. So for example, in my case with 25 RS accounts, instead of funding all from my main account, instead use this to send a larger sum out to 5 x sub-accounts, and from each of those fund 5 x RS. Or perhaps that would look even more like layering...Pickledonionlover said:Anyway, very recently the Account Evidence team from NW have been touch asking all sorts of questions on the source and destination of this money.

I use Nationwide to distribute some of my funds, because my main account with Natwest isn't helpful for accounts like Principality where you need to use different reference numbers. So thanks @Pickledonionlover for the heads up. Hopefully my regular saver exploits won't attract their attention, but if so I can produce my trusty spreadsheet and hopefully that will satisfy them.2 -

you joining in with the rest of them now Bobblehat? to remind you, I checked and rechecked the rules first before posting. Only after I posted, came the demand for changes from the sour grapes.Bobblehat said:

I'd be very happy to include figures from former participants who didn't like the sound of the changes,If you want to be rich, never, ever have kids 0

0 -

Just trying to keep as many people happy as possible and to cordially invite new or old contributors. I appreciate that the changes may not suit everyone, so no compulsion to either join in or re-join.nomorekids said:

you joining in with the rest of them now Bobblehat? to remind you, I checked and rechecked the rules first before posting. Only after I posted, came the demand for changes from the sour grapes.Bobblehat said:

I'd be very happy to include figures from former participants who didn't like the sound of the changes,

The mentioning of an advantage by including "other half's" figures occurred before you started posting on the thread (which would be easy for you to check), they were balanced by people expressing that they were happy with the status quo. I only reacted once the number of requests got proportionately higher for change, nothing personal to any contributor from my point of view.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum4 -

Bobblehat, I hope all your grapes are of the sweet variety. Thanks for all your efforts.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards