We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

"Average Earnings Growth" and triple lock

Comments

-

The problem is your graphs have the Y-axis in cash value yet you are making comments based upon %, they are different measures and mixing and matching to always achieve the "best" % increase will out perform each individual cash based line over the term.hugheskevi said: Here are charts comparing the rate of Basic State Pension since 2001 and 2010 to what it would have been under different upratings, through to 2026 (assuming uprating of 4.8% in April 2026, which is subject to confirmation).How earnings have fared relative to inflation depends on whether the comparator is RPI or CPI. Earnings growth has closely matched RPI over the last 25 years, with both earnings and RPI being noticeably higher than CPI.A few interesting points:

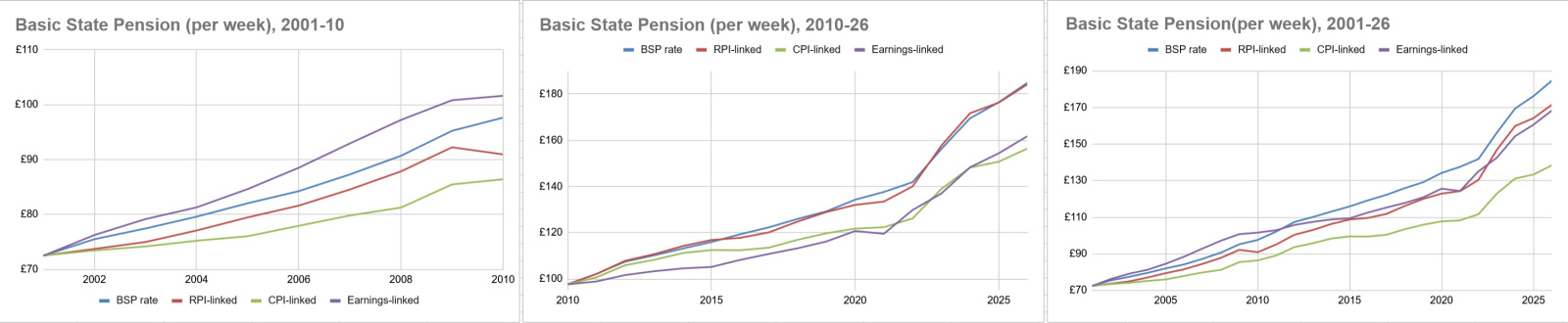

Here are charts comparing the rate of Basic State Pension since 2001 and 2010 to what it would have been under different upratings, through to 2026 (assuming uprating of 4.8% in April 2026, which is subject to confirmation).How earnings have fared relative to inflation depends on whether the comparator is RPI or CPI. Earnings growth has closely matched RPI over the last 25 years, with both earnings and RPI being noticeably higher than CPI.A few interesting points:- Since 2001, the State Pension is more than 33% higher than it would have been if uprated in line with CPI

- If Triple Lock had not been implemented, and State Pension has simply continued to be uprated by RPI (as it was before 2011, albeit with a lot of discretionary increases on top of RPI), the State Pension would now be almost the same as it actually is (it would be 0.4% lower now under RPI than it is under Triple Lock)

- Over the last 25 years, State Pension increases have been higher than any of RPI, earnings or CPI growth.

- Since 2010, State Pension is 14% higher now than if it had simply increased in line with earnings

- Over the last 25 years, State Pension increases have been higher than any of RPI, earnings or CPI growth.

Each year in of itself the increase is allotted to the highest so it cannot be higher than any, it matches the highest. Hence the cumulative effect of % increases might be higher than any single line.

But I get your general point and whilst there are differences between the three factors it will always be so. And this is the reality of the triple lock.

Perhaps a median of the 3 indices might work better, be more equitable for all.

0 -

Where do other pensions come in and should we do away with NI with a 2 fold benefit:Grumpy_chap said:

There would be a great simplicity if everything was linked to earnings.QrizB said:there's some logic in "benefits intended to mitigate poverty" tracking earnings rather than CPI.

Average earnings = £x per week / month / year

Personal allowance = a% of £x

Higher rate starts at b% of £x

Additional rate starts at c% of £x

NMW = d% of £x

State pension = e% of £x

UC = f% of £x

And so on.- People do not consider it a separate and discrete tax payment that only comes back to them via pension.

- Tax paid on pensions increases to accommodate reclassified NI and is therefore payable by all, increasing the net take.

1 -

You could use average income instead of average earnings as the basis.BikingBud said:

Where do other pensions come in and should we do away with NI with a 2 fold benefit:Grumpy_chap said:

There would be a great simplicity if everything was linked to earnings.QrizB said:there's some logic in "benefits intended to mitigate poverty" tracking earnings rather than CPI.

Average earnings = £x per week / month / year

Personal allowance = a% of £x

Higher rate starts at b% of £x

Additional rate starts at c% of £x

NMW = d% of £x

State pension = e% of £x

UC = f% of £x

And so on.- People do not consider it a separate and discrete tax payment that only comes back to them via pension.

- Tax paid on pensions increases to accommodate reclassified NI and is therefore payable by all, increasing the net take.

NI rates and thresholds would be just further alphabet percentages, which could be zero.

Transferring NI to income tax would work to some extent for personal taxation but the large employers contribution would need to be recovered somehow.0 -

Instead of uprating each individual year based on the highest figure, you could set 2025-6 as a baseline and guarantee that the pension will always match the higher of: cumulative inflation since 2025-6, or cumulative wage growth since 2025-6. That eliminates the ratchet effect but protects pensioners from inflation and from falling behind general wage increases.

You could even keep it as a triple lock by guaranteeing a rise of at least 2%. While that would add to costs in the year it was awarded, it wouldn't raise the baseline for future years like it does now, since future inflation/wage linked increases would be lower.

2 -

That's quite a good idea, they could still call it a Triple Lock.1

-

I have been tracking our actual expediture since the year 2000, and our actual personnal inflation over this time period has averaged out at just under 1% per year...."It's everybody's fault but mine...."0

-

Crikey have you bought a car recently? That's when inflation feels painfully real. They usually have to get a special tool from the dealership workshop to open my wallet and release my fingers from grasping it shut. Apparently they can still hear my screams and weaping far away many days later.Stubod said:I have been tracking our actual expediture since the year 2000, and our actual personnal inflation over this time period has averaged out at just under 1% per year..

1 -

There must be kids (who are no longer kids) involved, and/or mortgages, unless you don’t eat!Stubod said:I have been tracking our actual expediture since the year 2000, and our actual personnal inflation over this time period has averaged out at just under 1% per year..

I was spending £3k a month back then and now I spend around £1k.0 -

What on earth can you spend £3k a month on, every month?Cobbler_tone said:

I was spending £3k a month back then and now I spend around £1k.0 -

Mortgage, kids, two cars and holidays. TBF it’s a lot less than you need on average to be ‘comfortable’ in retirement apparently.Grumpy_chap said:

What on earth can you spend £3k a month on, every month?Cobbler_tone said:

I was spending £3k a month back then and now I spend around £1k.

Just to add, there are plenty of people paying £2k+ a month on a mortgage alone these days.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards