We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What to do with 25 year old stocks and shares ISA

SheeranJ

Posts: 5 Forumite

Completely confused and out of my depth re action to take with what appears to be a particularly underwhelmingly pointless stocks and shares ISA which I've had for over 20 years with a value of very little more than the monthly contributions made over the period. Initially attempted to make a simple transfer to a normal ISA with Nationwide but they've 'lost' my signature! so now rethinking if I should now put in another stocks and shares ISA? ISA value £34,000

0

Comments

-

Your ISA has failed to grow because of the particular stocks and shares in which it is invested. Most providers allow you to choose your own investments, so you should be able to switch into different investments within the same ISA.

When you say a "normal" ISA, do you mean a cash ISA? These offer security, but rarely grow at more than about the rate of inflation. If you want the value of your funds to increase, you need to invest them in the right shares.2 -

An ISA is just a tax wrapper. What matters is the investments contained within itWhat are you invested in?2

-

20 years with no uptick begs the question as to what you are actually invested in

The FTSE has a 20-year annual cumulative return 0f ~6.85% (if my research is correct)

Regards

Tet2 -

Something doesnt seem right with your figures unless you have really gone bonkers on the investment selection.

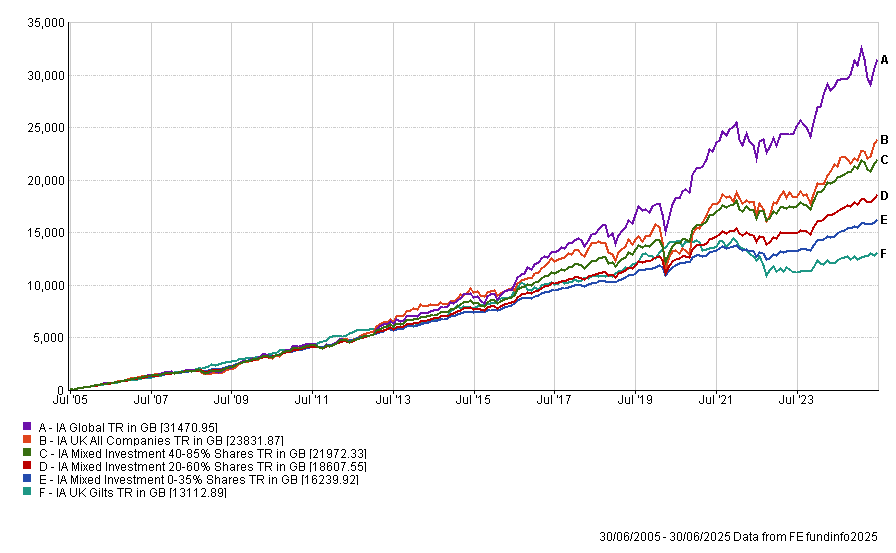

Here is 20 years of £50pm (total cost £12050):

The figures are sector average. I woudln't normally include gilts in such an example but its one of the only things would be close to the return mentioned. Although you wouldn't expect someone to invest monthly into gilts/bonds solely. That would be bad investing.

(so £12050 invested as £50pm with the value shown in brackets in tey)

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

So do you mean I should keep it as a stocks and shares ISA rather than swapping it? the breakdown is 50/50 Fidelity Global Special situations fund with accumulation and Fidelity Special Situations fund with accumulationVoyager2002 said:Your ISA has failed to grow because of the particular stocks and shares in which it is invested. Most providers allow you to choose your own investments, so you should be able to switch into different investments within the same ISA.

When you say a "normal" ISA, do you mean a cash ISA? These offer security, but rarely grow at more than about the rate of inflation. If you want the value of your funds to increase, you need to invest them in the right shares.0 -

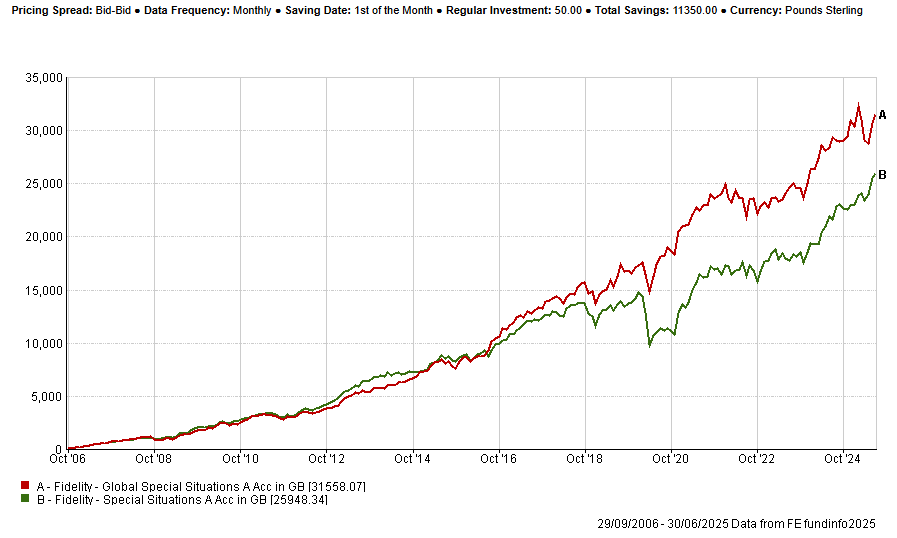

That is back to 2006. So, 2006 to date on £50pm into (£11,350 into each) would have grown to £31,558 and £25,948. Much higher than a savings account.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

Where did you get the info that it's not grown in 20 years? That's an investment I own and has done fairly well long term. Even the dividends are more than many bank accounts pay.SheeranJ said:

The breakdown is 50/50 Fidelity Global Special situations fund with accumulation and Fidelity Special Situations fund with accumulationColdIron said:An ISA is just a tax wrapper. What matters is the investments contained within itWhat are you invested in?Remember the saying: if it looks too good to be true it almost certainly is.2 -

I haven't had any payments/dividends since set up in 1998. I have the information below which means absolutely nothing to me!

Fidelity Global Special Situations Fund W-AccumulationFidelity FundCode ISIN SEDOLWGSA GB00B8HT7153 -Total Return Since Inception £10,365.35+112.83%Gain/loss since Inception (£ & £10,083.80%)Your Returns3 year 39.569.7957.7910 year 190.775 year1 yearPerformance (%)11.751 year11.263 year9.795 year 9.5510 yearAnnualised Return (%)5 year 23.814 year3 year6.282 year1 year10.27-6.0317.18Annual Return (%)Value (£) Units Book Cost (£)£19,020.55 262.86 £8,936.75Current Price (p)7236p £9,395.32 £740.12 £0.00Total AmountInvestedTotal Withdrawn Total Income(Incl income paid) Paid OutFidelity Special Situations Fund W-AccumulationFidelity FundCode ISIN SEDOLWSSA GB00B88V3X40 -Total Return Since Inception £7,374.61+79.68%Gain/loss since Inception (£ & £7,374.98%)Your Returns3 year 49.9714.9297.9910 year 105.935 year1 yearPerformance (%)14.461 year7.493 year14.925 year 14.6410 yearAnnualised Return (%)5 year 36.004 year3 year17.702 year1 year5.72-1.5119.08Annual Return (%)Value (£) Units Book Cost (£)£16,629.72 280.86 £9,254.74Current Price (p)5921p £9,255.11 £0.00 £0.00Total AmountInvestedTotal Withdrawn Total Income(Incl income paid) Paid Out0 -

sorry should have explained it was my previous thread under SheeranJ but couldn't use my previous sign in so new sign in.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.7K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards