We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What to do with 25 year old stocks and shares ISA

Comments

-

That's telling you that your individual investments have increased by 112% and 79% respectively.

How much do you think has been invested in the ISA over the period you've held it? The figures are in the details you've provided above.

It's not clear why you think its made little return.

1 -

thank you and that makes good sense to me. I know I was paying in £100 per month since June, 1998 total value is £34,277 - global special situations £18,192, special situations £15,985. Worried that I should do something with it ?dunstonh said:

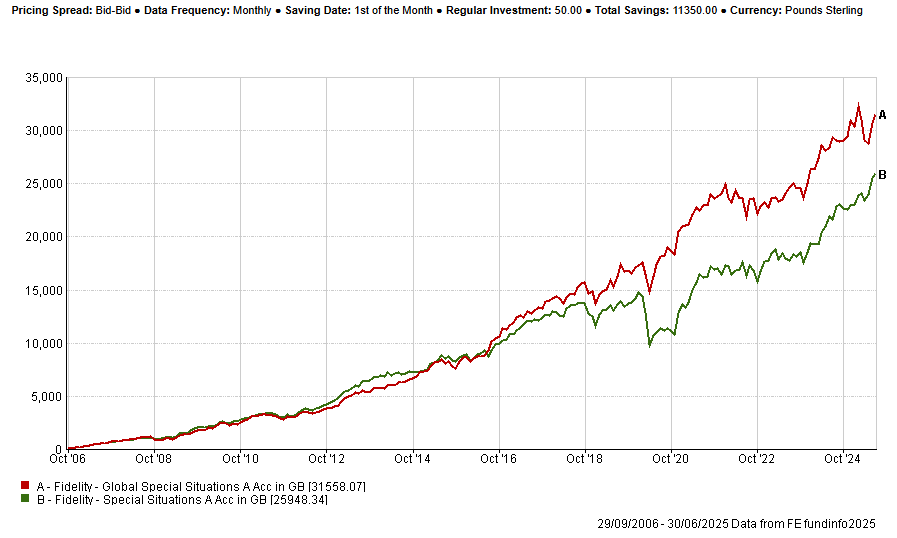

That is back to 2006. So, 2006 to date on £50pm into (£11,350 into each) would have grown to £31,558 and £25,948. Much higher than a savings account.0 -

Somethings not adding up in your figures. From your earlier post (assuming the formatting), you've paid in a little under £18.2K and have a current value of £35.6K. This align roughly with the increases across the two funds also mentioned there.sassy456 said:

thank you and that makes good sense to me. I know I was paying in £100 per month since June, 1998 total value is £34,277 - global special situations £18,192, special situations £15,985. Worried that I should do something with it ?dunstonh said:

That is back to 2006. So, 2006 to date on £50pm into (£11,350 into each) would have grown to £31,558 and £25,948. Much higher than a savings account.Value (£) Units Book Cost (£)

£19,020.55 262.86 £8,936.75Value (£) Units Book Cost (£)£16,629.72 280.86 £9,254.74

and that roughly matches, across the two fundsTotal Return Since Inception £10,365.35Total Return Since Inception £7,374.61

Why do you feel the need to change things. If you don't need the money, the investment seems to be doing ok.1 -

I find it significant that in you 24 July post you say you have received no payments or dividends since 1998.sassy456 said:

thank you and that makes good sense to me. I know I was paying in £100 per month since June, 1998 total value is £34,277 - global special situations £18,192, special situations £15,985. Worried that I should do something with it ?dunstonh said:

That is back to 2006. So, 2006 to date on £50pm into (£11,350 into each) would have grown to £31,558 and £25,948. Much higher than a savings account.

I also note you attempted to transfer your stocks and shares to Nationwide ( building society) where you would presumably begin to receive monthly or annual tax free interest payments, but for some reason your transfer failed.

If I interpret correctly the above, seems to me you may now require a tangible income stream paid to you, to reward your past 27 years of capital accumulation.

If you would like to see a regular income stream, then you do need to make changes.

Your current investment funds have done a good job of accumulating tax free capital gains over your 27 year monthly investments, but neither of them can be tweaked in order to generate income.

Your understanding of investment matters seems very rudimentary, so finding suitable investment funds that will in future generate income ( paid to you) whilst still potentially giving you continued access to the equity markets which grew your money to this point, might be a bit of a steep learning curve at this point.

I think dunstonh can provide some pointers with a bit more data from you such as your current age , which investment platform you are using , what kind of income yield you would now like and whether income should be paid monthly, quarterly , yearly etc. Some idea of you objectives at this stage of your investing life will provide context.1 -

From this, your total in investment cost was £8936.75 + £9254.74 = £18,191.49MeteredOut said:

Somethings not adding up in your figures. From your earlier post (assuming the formatting), you've paid in a little under £18.2K and have a current value of £35.6K. This align roughly with the increases across the two funds also mentioned there.sassy456 said:thank you and that makes good sense to me. I know I was paying in £100 per month since June, 1998 total value is £34,277 - global special situations £18,192, special situations £15,985. Worried that I should do something with it ?Value (£) Units Book Cost (£)

£19,020.55 262.86 £8,936.75Value (£) Units Book Cost (£)£16,629.72 280.86 £9,254.74

and that roughly matches, across the two fundsTotal Return Since Inception £10,365.35Total Return Since Inception £7,374.61

Why do you feel the need to change things. If you don't need the money, the investment seems to be doing ok.

Your investments are now worth £19020.55 + £16629.72 = £35,650.27

That's growth of 17,458.78 which seems ok to me considering you have made no deposits since then. Where are you getting your value of £34,277 in 1998.1 -

Even more confused following a conversation with Fidelity who said I have have had annual dividends of around £400 which don't show on any statements. Now being directed to an adviser so just wondered if anyone out there can help?0

-

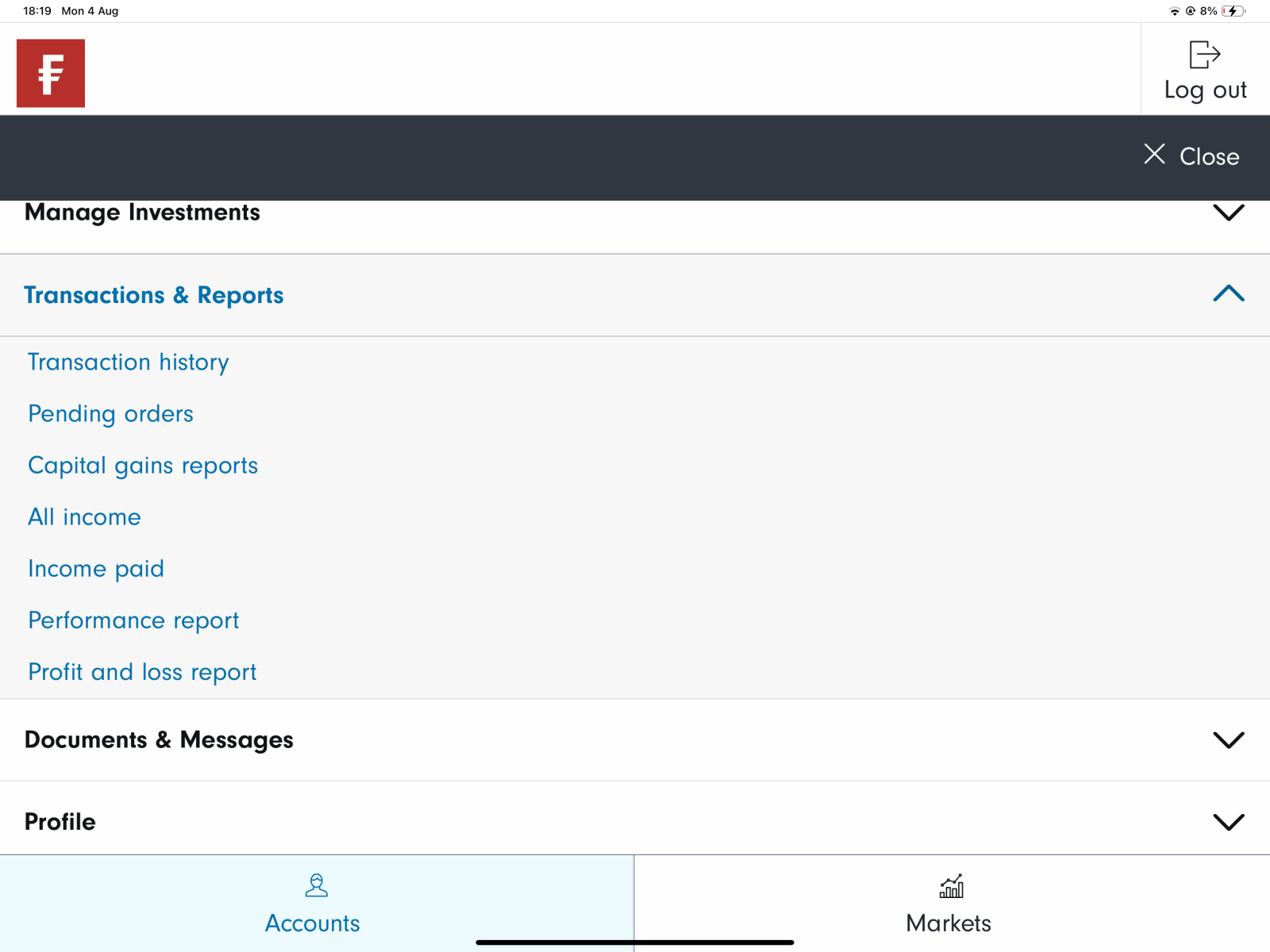

Do you have access to the app? Find the income report, select a date range and it'll spit it all out.sassy456 said:Even more confused following a conversation with Fidelity who said I have have had annual dividends of around £400 which don't show on any statements. Now being directed to an adviser so just wondered if anyone out there can help? 0

0 -

You have ACC units which means you still get the dividends. You just don't see the transactions as they are included in the unit price. Only INC units would show on the statement. ACC units would not.sassy456 said:Even more confused following a conversation with Fidelity who said I have have had annual dividends of around £400 which don't show on any statements. Now being directed to an adviser so just wondered if anyone out there can help?

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.4 -

Thank you for clarifying. My initial post was aimed at trying to make a reasonably sound decision re my 27 year old Stocks and shares ISA which according to my calculations has grown by £3K over the 27 years. I've stopped my monthly payment but really do not have a clue as to whether I should just leave it where it is with Fidelity or find a better place?0

-

Can you share those calculations? Because everything you have posted here has indicated your return has been significantly more than that.sassy456 said:Thank you for clarifying. My initial post was aimed at trying to make a reasonably sound decision re my 27 year old Stocks and shares ISA which according to my calculations has grown by £3K over the 27 years. I've stopped my monthly payment but really do not have a clue as to whether I should just leave it where it is with Fidelity or find a better place?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.7K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards