We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Santander free forever bank account changes

Comments

-

More likely the closure of 123 Lite accounts.2

-

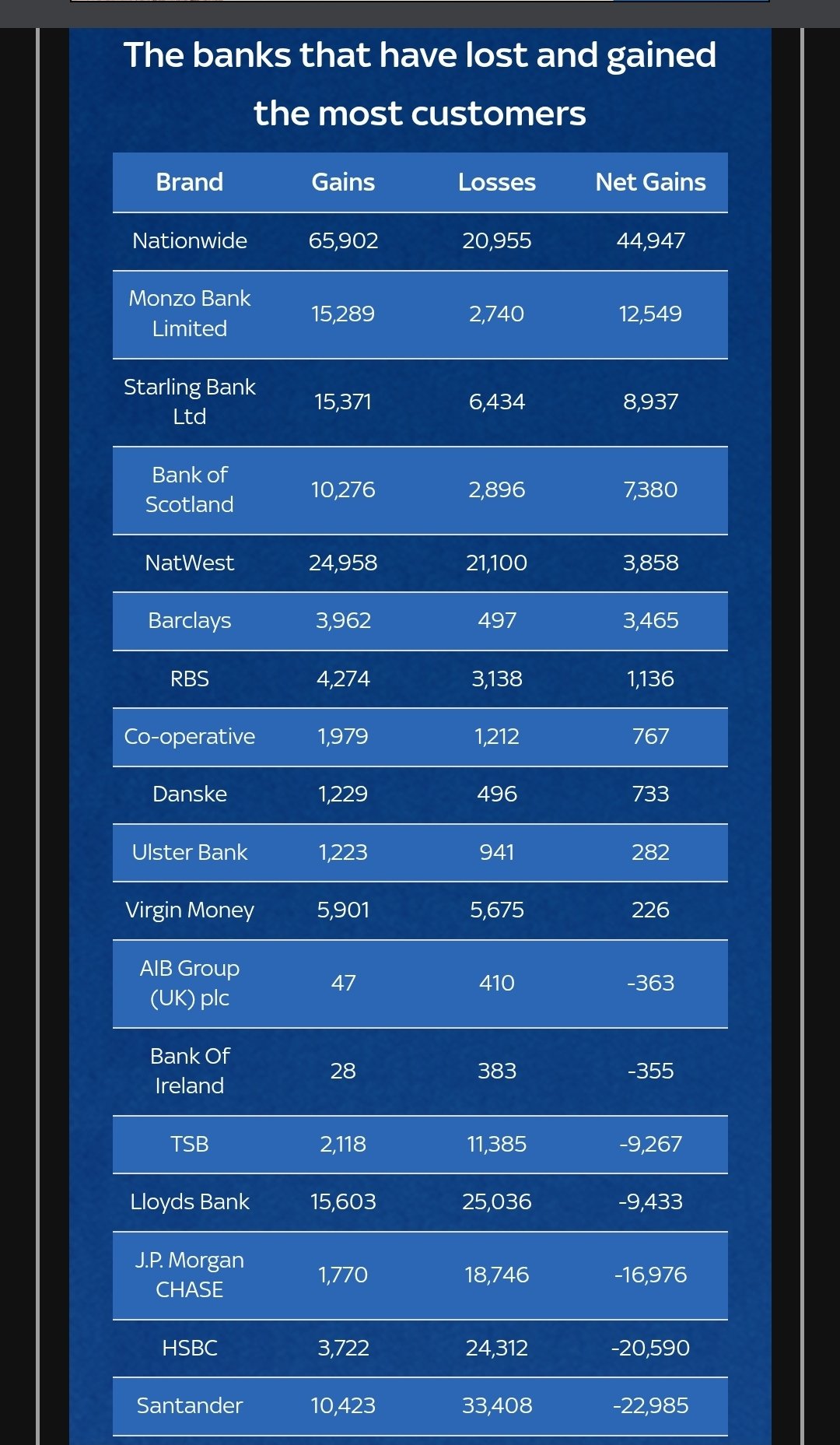

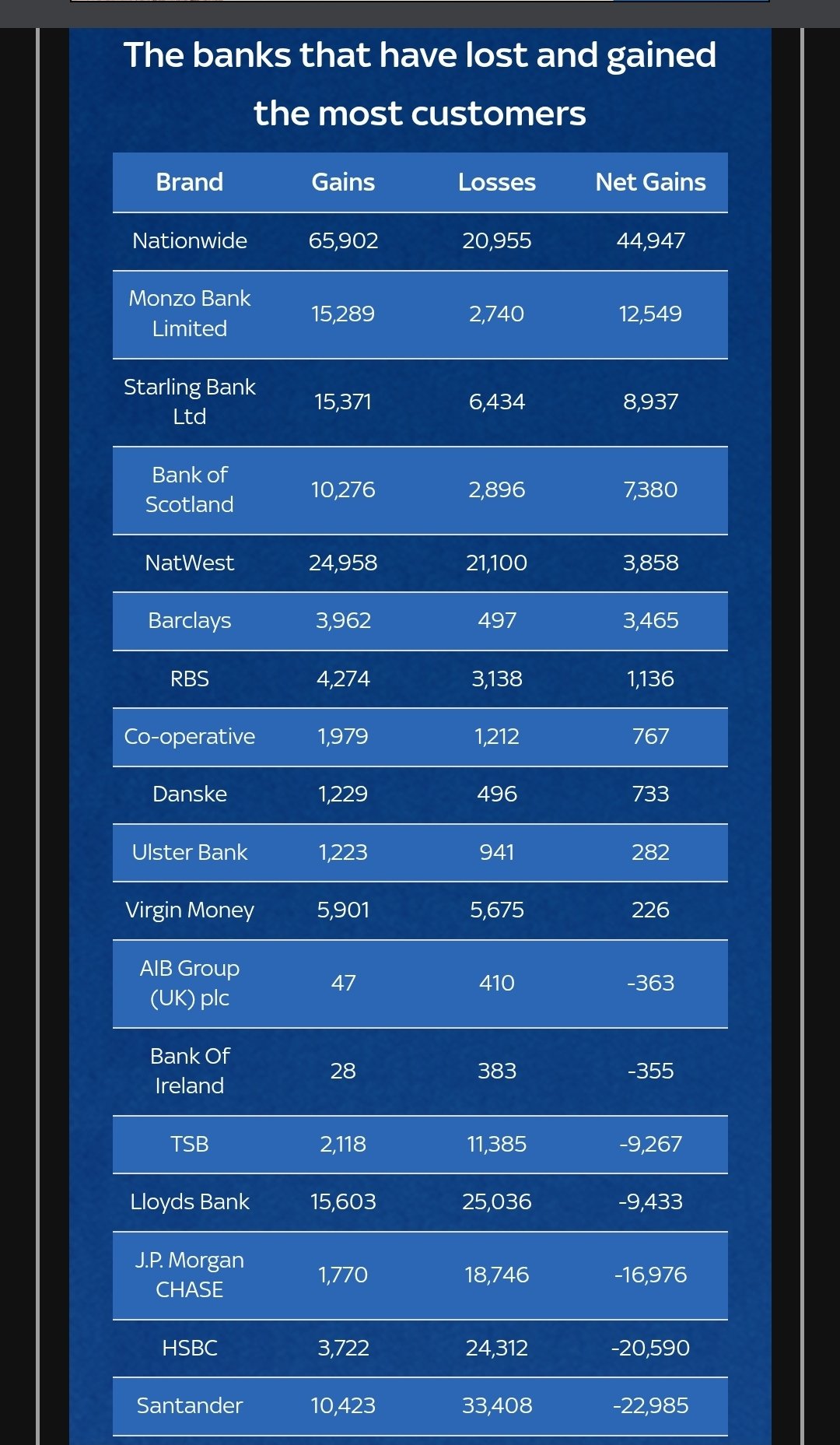

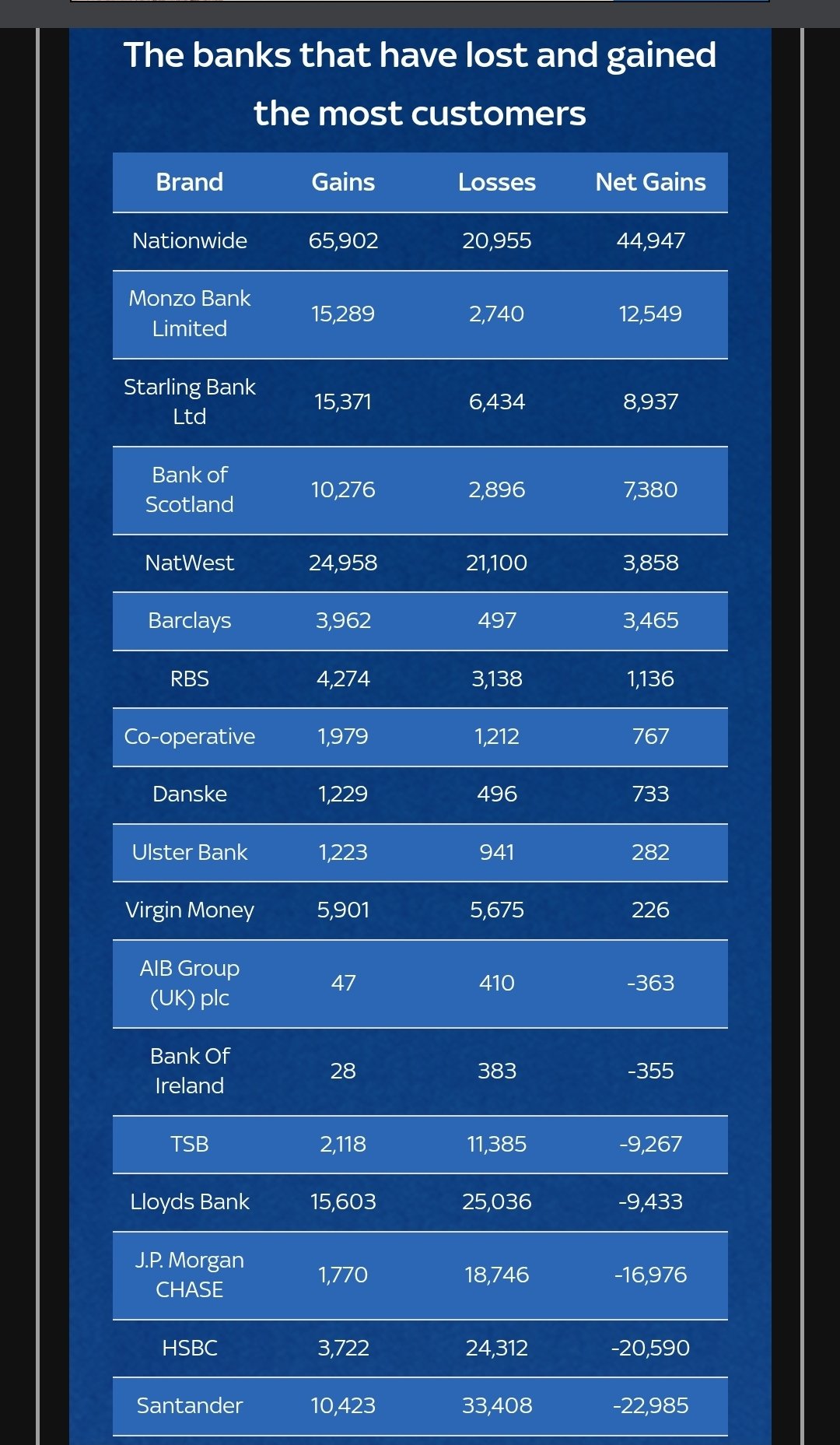

L999 said:From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !Very few probably. Here are results from January, before this thread started in July:Which banks are gaining and losing customers?Banks that gained customers in 2024

Nationwide Building Society: 22,622

Barclays: 18,053

TSB: 12,282

Lloyds Bank: 10,018

Monzo: 5,256

HSBC: 2,445

Co-operative: 1,100

Starling Bank: 801

Triodos Bank: 25

Banks that lost customers in 2024:

Danske: -193

Bank of Ireland: -350

AIB Group (UK): -431

Ulster Bank: -807

RBS: -5,352

Virgin Money: -4,832

JP Morgan Chase: -1,883

Bank of Scotland: – 1,606

Halifax: -14,898

NatWest: -18,322

Santander: -19,274

https://www.thesun.co.uk/money/33091489/bank-switch-millions-moved-accounts/Nationwide was top and Santander bottom then too, with Santander losing customers at nearly the same rate now as it did then. (The data is for a 3 month period, despite the titles. This is the Sun!)0 -

With those figures, it makes sense why they're trying to cut costs and remove accounts/customers which either don't make them any profit, or reduce their average revenue per customer.1

-

L999 said:

From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !Well they made significant changes everywhere like the retail 123 lite account and all other business accounts they had so it’s no surprise on the numbers. Bit like Chase who did same/top saving rate expiring and also lost a lot.0

From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !Well they made significant changes everywhere like the retail 123 lite account and all other business accounts they had so it’s no surprise on the numbers. Bit like Chase who did same/top saving rate expiring and also lost a lot.0 -

I don't know where Sky are getting their figures from but they don't match those officially published at https://www.currentaccountswitch.co.uk/media/iwlhfujt/cass-dashboard-q3-2025.pdfL999 said: From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !

From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !

Santander are still the biggest loser but the figures for some of the others appear totally wrong. Also the period covered is Q2 2025.1 -

Figures will depend in many ways on what bribes banks are offering & who people have a donor account with to cycle round.Life in the slow lane2

-

Q3 according to Sky:gt94sss2 said:

I don't know where Sky are getting their figures from but they don't match those officially published at https://www.currentaccountswitch.co.uk/media/iwlhfujt/cass-dashboard-q3-2025.pdfL999 said: From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !

From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !

Santander are still the biggest loser but the figures for some of the others appear totally wrong. Also the period covered is Q2 2025.

"More than 265,000 current account switches have been made in the third quarter of this year, and some banks have benefited a lot more than others, new data from the Current Account Switching Service (CASS) shows. "

https://news.sky.com/story/money-latest-personal-finance-consumer-sky-news-13040934?postid=10438159#liveblog-body0 -

I would go to the ombudsman first, as courts always prefer you to use arbitration etc first.L999 said:Does anyone have any thoughts on taking a claim to the County Court services "Money claims online"? .. for santander renaging on "Free forever" marketing claim for which we entered into when applying and the subsequent acceptance of our business and the opening of the account and then the 20+ years of our business ... and then the subsequent banks effective 'breach of contract" by imposing charges. With the amount being claimed as losses ... based on a (provable) day rate for the time involved in the matter and time to to switch to an alternative free business bank provider? ..

The county courts are pretty backed up, so it might take a year. Then you have the problem that the judge will be upset that you've wasted their time bringing a case where you've had a free product for 14 years that santander had already decided wasn't cost effective.

You can't force them into a contract where they have agreed to pay your day rate for switching to an alternative provider. So I'm not sure how you'd argue that they owe you that.

Any decent legal advice/representation will cost you considerably more than you'll recover.

I would talk nicely when complaining, and try to sell them the idea of giving me money to avoid going to the ombudsman.

0 -

They don't need legal advice/representation in the small claims court.phillw said:

Then you have the problem that the judge will be upset that you've wasted their time bringing a case where you've had a free product for 14 years that santander had already decided wasn't cost effective.L999 said:Does anyone have any thoughts on taking a claim to the County Court services "Money claims online"? .. for santander renaging on "Free forever" marketing claim for which we entered into when applying and the subsequent acceptance of our business and the opening of the account and then the 20+ years of our business ... and then the subsequent banks effective 'breach of contract" by imposing charges. With the amount being claimed as losses ... based on a (provable) day rate for the time involved in the matter and time to to switch to an alternative free business bank provider? ..

You can't force them into a contract where they have agreed to pay your day rate for switching to an alternative provider. So I'm not sure how you'd argue that they owe you that.

Any decent legal advice/representation will cost you considerably more than you'll recover.

Neither will a judge be upset that they've brought a case where they've had a free product for 14 years that Santander specifically said would be "free forever".

Note: Santander did not state it would be free for 14 years or 50 years or 500 years, they said 'forever'. You still don't seem to be able to get your head around that yet, for some reason.

Forcing Santander to carry on offering these accounts is a non-starter. Whereas suing them for the equivalent costs of £9.99 per month, plus fees, plus time wasted on all this, moving forward is most certainly not.

I suggested earlier in the thread suing for as many years ahead up to your state retirement date.3 -

L999 said:From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !GingerTim said:More likely the closure of 123 Lite accounts.GeoffTF said:L999 said:From Sky News. Santander has a nett loss of almost 23,000 customers. Wonder how many are due to their conduct related to 'Free Forever' accounts they've done a Uturn on !Very few probably.

The official CASS document is obviously likely to be more reliable than paraphrased and summarised versions elsewhere, but it does of course only relate to accounts that are being switched rather than opened/closed for other reasons.gt94sss2 said:I don't know where Sky are getting their figures from but they don't match those officially published at https://www.currentaccountswitch.co.uk/media/iwlhfujt/cass-dashboard-q3-2025.pdf

However, in terms of interpreting the figure of circa 23k, the CASS report does helpfully share figures relating specifically to small business and charity accounts, as well as the personal ones which form the vast majority, i.e. 95/96%:

so it can readily be seen that switching of such accounts did increase by about four thousand between Q2 and Q3, although the firm-specific data isn't broken down so it's purely speculation as to how much of that extra 4k relates to Santander.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards