We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

If I recall correctly, some forumites attempted to withdraw but received a secure message back that their request couldn’t be carried out as the account didn’t allow withdrawals. They could only request closure via submitting a withdrawal request for the full balance.Reg_Smeeton said:Re: Monmouthshire Exclusive RS issue 2 ( the 4.9% one)

I thought this account had no withdrawals before maturity but I can see online that I have the option to withdraw or transfer to my other MBS accounts. Is this due to the interest rate recently dropping or was I mistaken in my assumption? Just assessing my options as mine still has six weeks to run and could do with freeing up some money to fund more competitive RS’s at the moment3 -

Agree, but it's likely the EA rate I used as an example would also fall in proportion to the RS rate. If the chart was adjusted accordingly, it would just show a reducing advantage but unlikely to show a negative one! Most forumites on here would know when to stop funding the RS before it got to that point!WillPS said:With regards to the discussion about delaying funding... worth noting that every day 'sat out waiting' is a day of 6% missed. It's silly to expect that 6% rate to last more than a few months; last year's MonBS "exclusive" issue has fallen with every base rate reduction and normally by more than the base rate has fallen.

I suspect we're safe for the one in a couple of weeks but I don't reckon I'll have much left in there by the end of the year.

The "sat out waiting" assumes you have the funds to go straight away! As mentioned above, I'm trying to show some what if's ... not all what if's!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

I suspect the biggest advantage in sitting out waiting is when you don’t have £500 now, but will in August. Risk free with Monmouthshire if you’ve already applied, unless it turns out accounts opened via app start on the day of application. If you wait, you can still hit the maximum balance. Though that being said they would allow a 13th payment taking the balance up to £6,000, you’d just have less interest than someone who had the full £6,000 earning interest for a month+ before the account matured.1

-

New to Monmouthshire BS. Went with opening via app - first an Instant Saver I4 (about 7-8 minutes waiting at the "processing" screen) and then subsequently applied for the Regular Saver I8. (this time processing took only about 3 minutes) Both now showing on the app. I will fund the RS early next week.Agree the 2x SMS codes is annoying. How come the e-mail code button works after 1x press?As per @10_66 post earlier on - I tried turning off bio-metric login (i.e. change to PIN) but that didn't help and still requires 2x button presses for SMS code = 2x OTPs. So it didn't work for me.Anybody knows if I will also be provided (via post?) with login details for their online portal?1

-

It's very situation dependent.Bobblehat said:

Agree, but it's likely the EA rate I used as an example would also fall in proportion to the RS rate. If the chart was adjusted accordingly, it would just show a reducing advantage but unlikely to show a negative one! Most forumites on here would know when to stop funding the RS before it got to that point!WillPS said:With regards to the discussion about delaying funding... worth noting that every day 'sat out waiting' is a day of 6% missed. It's silly to expect that 6% rate to last more than a few months; last year's MonBS "exclusive" issue has fallen with every base rate reduction and normally by more than the base rate has fallen.

I suspect we're safe for the one in a couple of weeks but I don't reckon I'll have much left in there by the end of the year.

The "sat out waiting" assumes you have the funds to go straight away! As mentioned above, I'm trying to show some what if's ... not all what if's!

One of the factors is the amount of money one has to invest. If you have enough that investing at 6% is only just worthwhile given the accounts you already have and are available, a rate drop is more likely to make the account not worthwhile for you compared to someone with enough money to fund every regular saver going if they chose to. This is obviously hugely variable person to person.

Another factor, since this is a variable rate, is how fast MonBS drop relative competitors. Last year's account most definitely outpaced both the market and the base rate in terms of how quickly it fell. So far, in fact, that it barely edges out easy access rates now!

I don't doubt there are some forumites for whom 4.9% is still the best that particular chunk of money could do but surely most have emptied their accounts by now? In which case the 'end of the month arbitrage' is negated by the amount of days they didn't get the best rate for.

MonBS could surprise us and leave the rate alone, and that'd be a pleasant surprise - but I think it's sensible to manage expectations such that we expect that it will fall.2 -

Mons BS app: Swipe the text box right when the 2fa sms appears and you get a submit box and avoids a 2nd 2fa text. (Android)3

-

The terms in the product literature I have for the Monmouthshire Exclusive RS issue 2 state:Reg_Smeeton said:Re: Monmouthshire Exclusive RS issue 2 ( the 4.9% one)

I thought this account had no withdrawals before maturity but I can see online that I have the option to withdraw or transfer to my other MBS accounts. Is this due to the interest rate recently dropping or was I mistaken in my assumption? Just assessing my options as mine still has six weeks to run and could do with freeing up some money to fund more competitive RS’s at the moment"No, you cannot withdraw money from this account for a 12 month term.You should not invest into this account if you think you will need access to your savings."

From the MonBS general savings terms:

"If we intend to lower the interest rate, we’ll let you know at least 30 days before the change happens, using letter, email, or text. If you’re not happy about the change, you can close your account or move the money to another one. If you do this within the 30 days, you won’t have to pay any charges or lose any interest. We’ll assume you accept the change unless you tell us otherwise."

1 -

Thanks for the reminder @ 35har1old - I couldn't remember how rapid Mon BS reduced their interest rates. At the moment I'm still waiting for my instant saver Issue 4 to register the £1 I sent hours ago which still hasn't been credited before I even think about sending money to the RS Issue 8. However, the app did say that there maybe some issues with funding until nominated accounts had been verified. The only way that can happen is to register for online banking through Mon BS website adding additional info i.e. NI number, password etc and then waiting 2-3 days for an activation code. I'll see how that goes, but not holding my breath after the experience of Dudley which I'm still waiting for them to return my money after they were finally able to sort out linking my nomintaed account:-( Far more hassle than it was worth :-(:-(35har1old said:

£215 maybe wishful thinking as issue 2 started at 6% and has dropped to 4.9% after 3 BOE rate drops each time they reduced it by more than 0.25%Bobblehat said:Mon BS RS Iss 8

As a new customer to Mon BS, and not overly keen on "Apps" (prefer big screens and full size keyboards!), I used the online process to apply. I am not expecting to fund the RS, if I'm successful, until as late as possible in August, so any delay with providing wet signatures etc. is not an issue for me. If it costs me a stamp for lack of pre-paid return envelope, so be it, it won't make much of a dent in ~£215 interest (funding late Aug and as early as possible in subsequent months).

The only snag I came across while applying was ... at the end of page 2, it went back to page 1 and I was expecting an error message (as if I might have missed a mandatory field out). No error flagged on page 1 and onto page 2 again, with no error flagged there either. Everything went on OK from that point, so just the mystery revisiting to page 1 and 2 threw me slightly! Confirmation of application email arrived within 1 minute of completing, so now I'll just wait and see what happens next

Ist 0.45% 2nd 0.35 and the third 0.3%

The website at present giving closed accounts rates hasn't been updated and still shows a rate of 5.2% more than a month after the last decrease# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £60+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)0 -

Please marry me xBobblehat said:

Firstly, let me say I totally agree with your last paragraphsnow62 said:

Ah, but my point is that funding initially at the end of the month instead of e.g. half-way through means that I would immediately be losing half a month at the higher rate. RS matures in a year's time in the middle of the month, so that can be used to fund new RS half a month earlier which will earn more interest than initially funding on the 1st of a month. Your b) just means you've missed out on a month of higher interest if you wait until the end of August; that's my take on it, anyway!Have you taken into account that the RS maturing near the end of a month may be used to.... a) fund other RS's a day or so later in the next month, which could/should pay more than any EA holding account ... b) or fund a new RS at the end of the next month on from when the maturing RS matured (e.g. RS matures at end of July funds 1st payment of new RS at end of August and 2nd at beginning of September)? .... c) a combination of a) and b)?

With 19 RS's, hopefully spread out over a decent period, I'm surprised that you are not already doing a) or b) or c)?

I'll admit that differences in timing will only create small advantages over figures quoted by the Banks/BS's expected interest figures, but those small advantages add up. After all, if you thought differently, why not leave the funds in an EA/FR/Notice Account rather than administer 19 RS's?

As for crystal ball gazing .... I work on the general principle that rising RS rates occur with rising EA rates, and falling EA rates occur when RS rates are falling! Once I've filled my ISA allowance for the year, I'm looking at which RS/EA/FR/Notice accounts have the highest interest rate and work my way down the list.

My 19 RSs aren't spread out evenly. RS rates rose sharply around September 3 (?) years ago, which meant opening several in a short period. That has followed on so I have 10 maturing Sept/Oct/Nov. I've been using flexible cash ISA to fund and will replenish that as the RSs mature as well as opening new ones if the rates are worth it.

It's all swings and roundabouts. What works for one person is not necessarily the same as what works for someone else. Each to their own method!

Each to their own method!

All I'm trying to show is that there are small advantages in doing the "fund at end of month strategy", and of course you might miss out if the RS is pulled before you bag it, as surreysaver points out. There's always another RS to open though if you miss one!

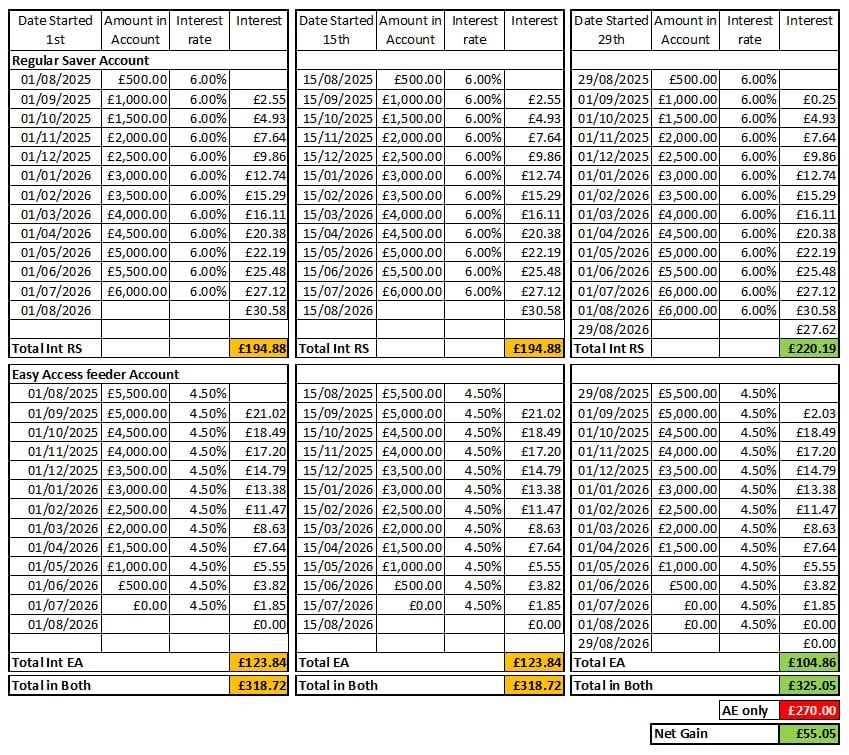

Have a look at this ... based on the MonBS RS and typical EA feeder account paying 4.5% .....

Provided I've done the calcs correctly, and ignoring that dates might fall at a weekend, irrespective of starting on the 1st or the 15th, you gain £6+ by funding on the 29th. Is it worth it ... that's up to you! If I were asked would you rather have £318.72 or £325.05, I know what I would answer!

You would gain a little more if you were allowed to fund a 13th payment (01/08), which some RS's allow. As I have mentioned in previous post, the 13th payment (not shown above) only provides a small gain to add on to the extra £6+ mentioned above, so is not a deal breaker for me, but I'll take it if offered.

What is fairly obvious is that there is a reasonably good gain over leaving the £6000 in the EA account.

For the curious, I did a second version of the chart altering it to move the payment dates on to the next working day if it fell at a weekend or Bank Holiday .... it lowered the advantage of starting on the 29th by 17p ... I won't bore everyone any further by attaching that chart!

If I've made any mistakes I'm sure there will be someone who will tell me 4

4 -

After much frustration, multiple installing, deleting, reinstalling, getting blocked for too many attempts I now have managed to login to the MBS app. And opened the RS too. I'd applied online so may well end up with two but will sort that when and if.The app really needs some severe deconstruction and a new build.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards