We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Mine and Mrs Bobblehat's matured last night and we had instructed the funds to go to our nominated accounts. I was surprised to see it sat there this morning in a "Maturity Everyday Saver" earning 1.60%. I inquired via online chat why it had not been sent to the nominated accounts and was told it will get processed today manually and be available in nominated accounts tomorrow!jaypers said:Re Furness, I’ve found them to be about the slowest institution to credit money out of any that I have used. My Christmas Reg Saver matures tomorrow so it will be interesting how quick they are the other way!

Like watching treacle flow! Compiler of the RS League Table.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum4 -

I paid £2 into Furness on Friday evening. It materialised yesterday, when I paid £1 back into my nominated account. It was there this morning. So it must depend on whether their computer wants to do it or pass it to a human?Bobblehat said:

Mine and Mrs Bobblehat's matured last night and we had instructed the funds to go to our nominated accounts. I was surprised to see it sat there this morning in a "Maturity Everyday Saver" earning 1.60%. I inquired via online chat why it had not been sent to the nominated accounts and was told it will get processed today manually and be available in nominated accounts tomorrow!jaypers said:Re Furness, I’ve found them to be about the slowest institution to credit money out of any that I have used. My Christmas Reg Saver matures tomorrow so it will be interesting how quick they are the other way!

Like watching treacle flow! I consider myself to be a male feminist. Is that allowed?0

I consider myself to be a male feminist. Is that allowed?0 -

Furness BS Christmas RS

Mine matures on 22 January. I don't have online access, so posted the maturity instruction form (with passbook) on Friday last week (second class stamp), instructing closure on maturity with funds to transfer to nominated account.

Pleasantly surprised to receive email today from Furness, acknowledging receipt of my instructions and confirming that they will be implemented on maturity.

Nice touch by Furness. When posting instructions into the hands of Royal Mail, you can't help but worry that they go astray.

22nd is a Thursday, so I may have to wait until the Monday for the funds to arrive in NA.

0 -

Mansfield BS Interest Rate Reductions 1/2/26:

Mansfield BS Bonus Regular Savings (Issue 8) ~~~ Reduction from 5.25% to 5.1% (both rates include a 1.85% bonus for 12 months).8 -

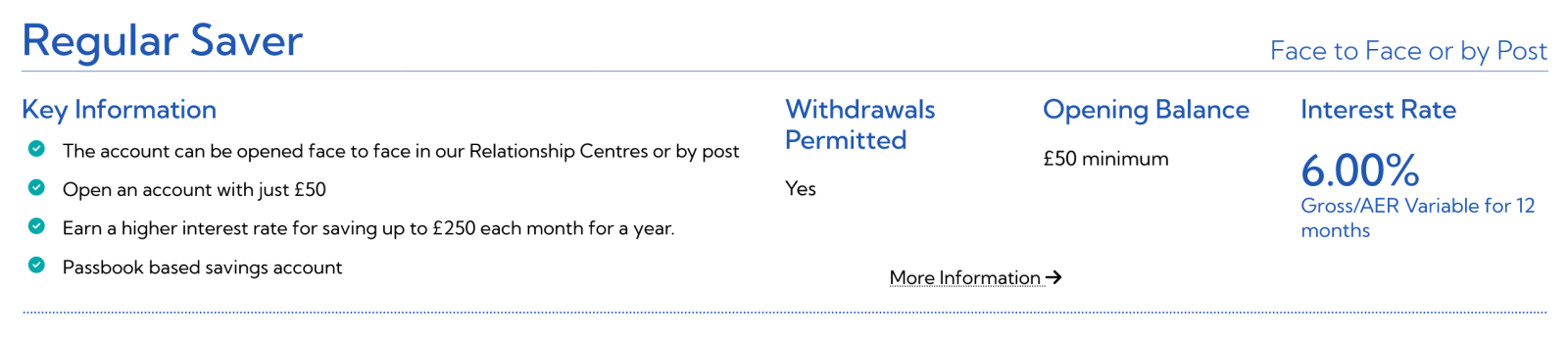

Scottish BS RS.The rate is already 6%. Apparently it reduced on 8/1/26.0

-

Is the 6% rate showing that in online banking yet? I'm afraid I don't currently have access to view my account online.lr1277 said:Scottish BS RS.The rate is already 6%. Apparently it reduced on 8/1/26.

I've had a skeg at their website and it seems there's contradictory info on there, one page says the 6% rate comes into effect 30/1/26:

https://www.scottishbs.co.uk/media/ydbf32f5/rate_page_web.pdf

Another page states the rate was effective 8/1/26:

https://www.scottishbs.co.uk/savings/savings-explained/savings-interest-rates/

I'm also yet to receive notification of any reduction to my regular saver rate. I don't know if their website contains a typo somewhere.

1 -

My MBSBRS(8) account`s 12 month1.85% bonus rate runs out at the end of this month. Is it possible to close the account withdrawing final balance to nominated account and then a few days later open a new one?Bridlington1 said:Mansfield BS Interest Rate Reductions 1/2/26:

Mansfield BS Bonus Regular Savings (Issue 8) ~~~ Reduction from 5.25% to 5.1% (both rates include a 1.85% bonus for 12 months).0 -

Bridlington1 said:

Is the 6% rate showing that in online banking yet? I'm afraid I don't currently have access to view my account online.lr1277 said:Scottish BS RS.The rate is already 6%. Apparently it reduced on 8/1/26.

I checked SBS Online and it still shows 6.50% for me.Some of the accounts under the page you linked say:

Interest rates effective from 8 January 2026 for accounts opened on or after that date.

For accounts opened before 7 January 2026, rates are effective from 30 January 2026.not the Regular Saver mind, but that seems to be the approach taken?

2 -

I received a letter from Scottish Building Society today confirming that the interest rate on my Regular Saver will reduce to 6% (from 6.5%) from the 30 January.

3 -

lr1277 said:Scottish BS RS.The rate is already 6%. Apparently it reduced on 8/1/26.Not for me. My online account still shows 6.5% and I've yet to receive a letter or any communication reguarding a reduction in interest rate, even though we all know it's going to happen.The Scottish BS website presently shows the RS @ 6% - Only one RS to be held in a single name at anytime.

# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £50+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £898.78 / £2026 (2)1

# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £50+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £898.78 / £2026 (2)1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards