We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

UC and if you go over 16k?

Comments

-

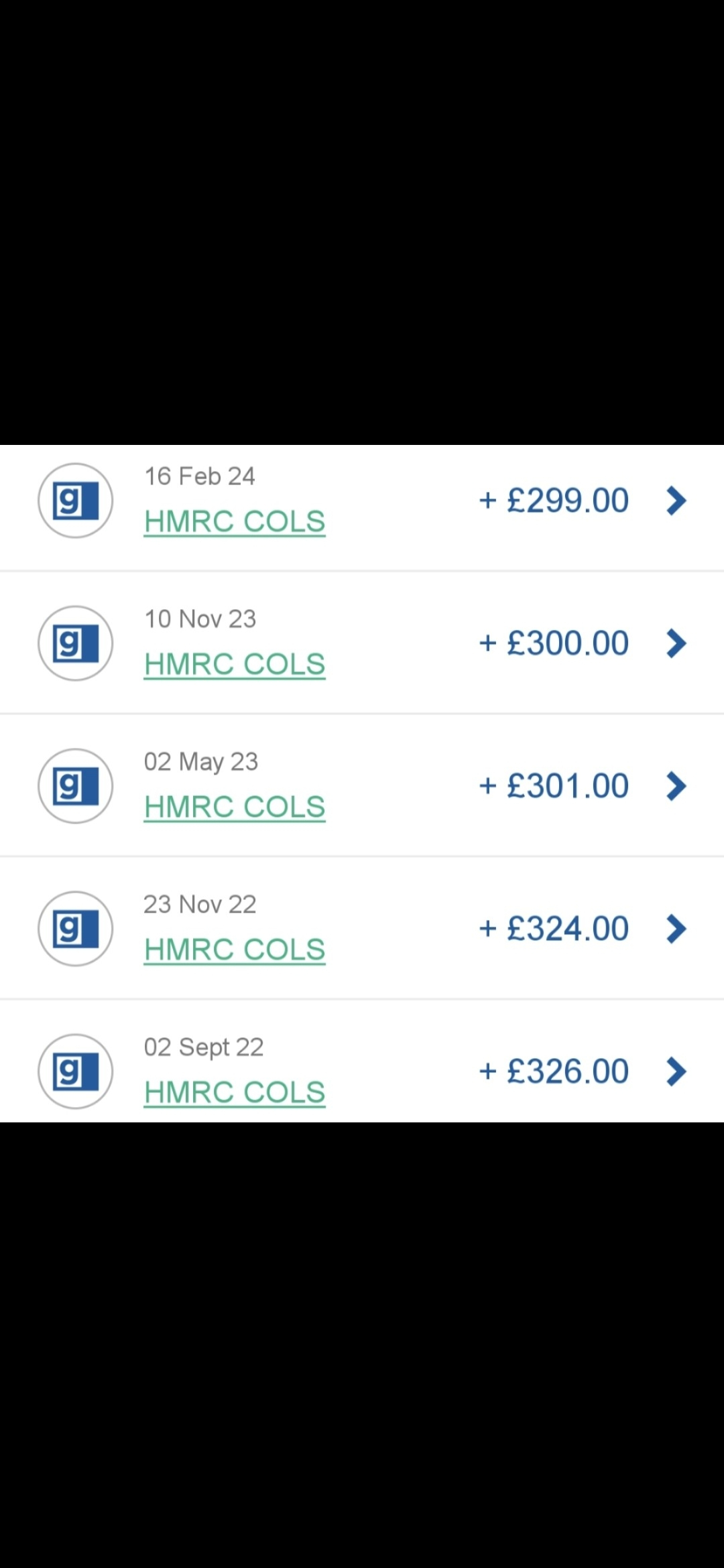

I've found all my COF payments. (Unless ther3 could be anymore under a different name? Anyone know? Anyone know how I can find out from dwp all of them?)

Could I ask the UC to disregard these payments I have attached from my capital?

I'll get bank statements to show UC and ask them to disregard them my capital indefinitely unless ofcourse I go below the total amount of them. Can I ask is there any legislation you can give me a link to that shows these are permanently disregarded as capital and only if we go below the amount of them in savings are they then affected?

Thanks all

0 -

I have been unable to get my col payments disregarded I put in for a mandatory reconsideration in January and have heard nothing since.

There reason for not allowing the disregard was that the account the money was paid into went into a lower balance than the col payments this was due to me moving the money into a savings account my over all savings during the time were always above the total col payments and still are.

Also be aware that every time your savings reduce a payment blocker may be added to your account until you provide bank statements this has happened to me twice now in the past 6 month it never happens when the saving increase.

1 -

That is evidence of £1550 CoL payments, these are disregarded indufinitely so will reduce your capital, for UC purposes, by that amount.Whilst im sure it isn't the intention of the rules, the reality is it is impossible to separate these disregarded amounts out from other capital to say you have spent them. That could only happen if your total capital reduced below £1550 at which point any previously disregarded capital cannot be replaced.PS, the term is indefinitely, an undefined period of time. This is not the same as 'forever' as at some point in the future that period of time may be defined, however unlikely that may be.0

-

Did you take it to a tribunal?allison445 said:I have been unable to get my col payments disregarded I put in for a mandatory reconsideration in January and have heard nothing since.

There reason for not allowing the disregard was that the account the money was paid into went into a lower balance than the col payments this was due to me moving the money into a savings account my over all savings during the time were always above the total col payments and still are.

Also be aware that every time your savings reduce a payment blocker may be added to your account until you provide bank statements this has happened to me twice now in the past 6 month it never happens when the saving increase.

Let's Be Careful Out There0 -

The legislation doesn't specify any time period or 'indefinitely' or any other term. It simply says "no account is to be taken … when considering a person's entitlement to a benefit … "

8 Payments to be disregarded for the purposes of tax and social security

No account is to be taken of an additional payment in considering a person’s—

(a)liability to tax,

(b)entitlement to benefit under an enactment relating to social security (irrespective of the name or nature of the benefit), or

(c)entitlement to a tax credit.

https://www.legislation.gov.uk/ukpga/2022/38/section/8

https://www.legislation.gov.uk/ukpga/2023/7/section/8

It is not mentioned, as far as I can find, in the official guidance about capital disregards. In all honesty if it followed the pattern of other other welfare / support payments mentioned in there, it would be logical to conclude they should only have been disregarded for 12 months (which makes sense as they were intended to be spent) - but they didn't specify that in the legislation, for some reason. I think the energy rebate payments were, but the above is exactly what the law says. "No account is to be taken".

However in the guidance is some precedent for assuming capital spent is not the disregarded capital. This is in context of Special compensation schemes so I'm not saying it's definitive for COL payments, it's just interesting the concept does explicitly exist:

"Payment included with other capital

H2053 If the payment is included with other capital the disregard does not apply to the other capital.

H2054 If money is withdrawn from an account which includes the payment and other capital accept the money withdrawn is from the other capital and not the payment. If there is evidence to show the money withdrawn is from the payment and not the other capital accept that evidence."

0 -

I am still waiting on the outcome of the Mandatory Reconsideration I have asked for an update a few times in my Journal but have had no reply since JanuaryHillStreetBlues said:

Did you take it to a tribunal?allison445 said:I have been unable to get my col payments disregarded I put in for a mandatory reconsideration in January and have heard nothing since.

There reason for not allowing the disregard was that the account the money was paid into went into a lower balance than the col payments this was due to me moving the money into a savings account my over all savings during the time were always above the total col payments and still are.

Also be aware that every time your savings reduce a payment blocker may be added to your account until you provide bank statements this has happened to me twice now in the past 6 month it never happens when the saving increase.1 -

I think a Decision Maker faced with being asked to disregard COL payments will ask for Bank Statements right back to when the first COL payment was made up to the current date. They need to see evidence of accumulation of capital including COL payments. Otherwise everyone in receipt of the COL payments going above £16000 capital is going to try to get disregard, when the reality might be the COL payments were spent years ago.

The comments I post are personal opinion. Always refer to official information sources before relying on internet forums. If you have a problem with any organisation, enter into their official complaints process at the earliest opportunity, as sometimes complaints have to be started within a certain time frame.1 -

I agree a person might have to prove they "kept" the CoL payments and not been spent.huckster said:I think a Decision Maker faced with being asked to disregard COL payments will ask for Bank Statements right back to when the first COL payment was made up to the current date. They need to see evidence of accumulation of capital including COL payments. Otherwise everyone in receipt of the COL payments going above £16000 capital is going to try to get disregard, when the reality might be the COL payments were spent years ago.

Let's Be Careful Out There1 -

huckster said:1) you declare money, savings and investments held on the last day of the assessment period

2) yes it is the actual amount on the last day of the assessment period that is relevant

3) yes no different.

4) Job Centre may ask for Bank statements etc after new money, savings and investments declarations.

What you are essentially pointing out with your posts, is that this is very murky territory, as to what is being declared and when it is declared. This is particularly the case for those with money, savings and investments close to £16000.

It would be much easier if you found reason to have household items that need to be replaced and spent some of the savings, to bring these down to a level, where fluctuations close to £16000 were not such an issue.

I note what you say here in particular

"It would be much easier if you found reason to have household items that need to be replaced and spent some of the savings, to bring these down to a level, where fluctuations close to £16000 were not such an issue."

We would have to go down to about 11k to do this and that would be a huge shame as we have tried hard to set aside and save for emergencies. Yes there is debts etc which are within UC guidelines which would not be considered as deprivation of capital etc we could use it for to bring to such a level to never go over 16k at any point. But we would prefer to stay at 14k or 13k.

But the problem being is that my wife's pay and other benefits come in round the last day of the AP and this means that on the last day of the AP my wife's income and certain benefits will tip us over 16k. So what do we do? When we add up all our capital on the last day if the AP and it comes to over 16k we make a note to say "Please disregard my wife's pay of £1,900 today and the other benefits which were also paid today, which once subtracted, brings our capital to a total of £14,600, please use this figure?"

Would this be ok?

Also sometimes my wife is paid twice within the same AP and it motmally falls on the last day of tge AP and they always move one of her wages payments into the next AP. When this happens it will also cause us to go over 16k.

Could we again request this wage to also not just be move to next AP but also be disregarded as capital for that AP?

Basically there's no way we can even avoid income or benefits from taking us over 16k on the last day of the AP temporarily.0 -

So basically put my question is.

- most of month we are below 16k on UC, however we can not avoid my wife's wage and certain benefits some months falling on the last day of AP taking us temporarily over 16k. What do we do? What happens? It is not savings its income for the month ahead not spent yet. If you minis - those benefits and income on the last day if AP you get to a savings figure below 16k. What do we do please? Its annoying as it's the last day of AP this will happen on. Can I just write in journal on last day of AP this is how much we have in our account today for example 17k, today my wife got paid her salary of £1,000 and we got benefits for £1,000 which is disregarded as capital as its income for month ahead, therefore our capital today is actually 15k. Thank you.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards