We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Co-op Bank: Can They Really Be That Bad?

UKX69

Posts: 243 Forumite

Good afternoon all,

Those of you who will have read my posts probably know that I bank with NatWest. I have two current accounts, main one joint with Mrs T and one sole. (A hangover from my share trading days). I’m looking about for an account with another bank for the purpose of emergencies in case I get frozen out of NW. I have been with probably every (Bricks & Mortar) bank in the country over the years except the Co-op. I’ve picked up on comments in other posts that some say they’re appalling and some say they’re no problem. I quite fancy switching my sole account to the Co-op, bung in a few quid, open the regular saver and let it self finance until needed. Can the Co-op bank surely be that bad?

Those of you who will have read my posts probably know that I bank with NatWest. I have two current accounts, main one joint with Mrs T and one sole. (A hangover from my share trading days). I’m looking about for an account with another bank for the purpose of emergencies in case I get frozen out of NW. I have been with probably every (Bricks & Mortar) bank in the country over the years except the Co-op. I’ve picked up on comments in other posts that some say they’re appalling and some say they’re no problem. I quite fancy switching my sole account to the Co-op, bung in a few quid, open the regular saver and let it self finance until needed. Can the Co-op bank surely be that bad?

0

Comments

-

Depends what you mean by 'that bad' - if you read threads about any bank (on here or Trustpilot reviews, etc) then you'll see a mix of positive and negative? If you've been with all the other high street players and (implicitly) don't want to return then you presumably don't rate them either?

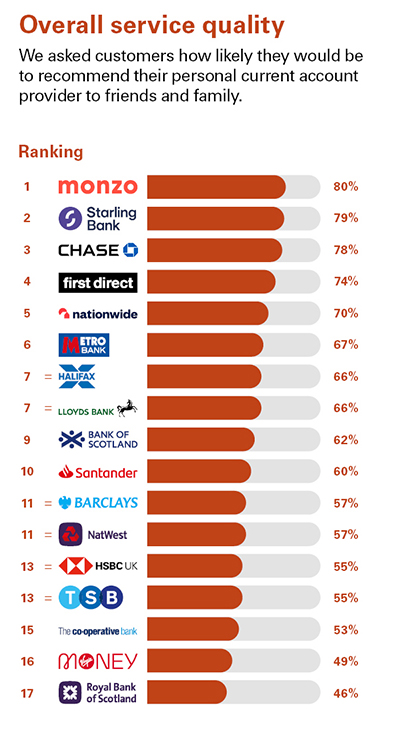

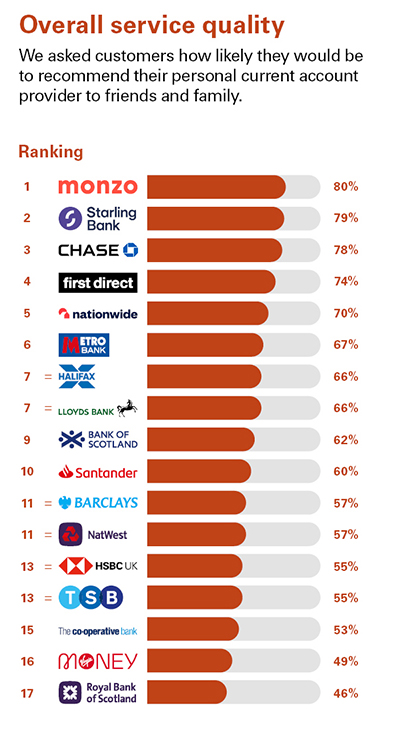

Edit: I should have added that a less subjective assessment of relative merits is available via the bi-annual surveys conducted by Ipsos on behalf of the CMA, which use proper surveying methods rather than being unduly swayed by 'who shouts loudest':

https://www.ipsos.com/en-uk/en-uk/personal-banking-service-quality-great-britain-august-20242 -

My personal experience is good, some of the way things are done are a bit old fashioned but it does everything I need it to do and I like the ethical bank factor. They are particularly helpful in branch which may or may not impact you. I'm really surprise how low in that table they are."You've been reading SOS when it's just your clock reading 5:05 "1

-

What I mean by ‘that bad’, is one comment I read on another post was a customer complaining that the bank kept blocking payments from their account even though the amount was small. Of course, we cannot know the payment history of the customer so we only speculate that the co-op may be a bit over the top. I’ve seen quite a few negative comments on the co-op and you have to take into consideration that people tend to post when faced with bad service, but not when service is good.eskbanker said:Depends what you mean by 'that bad' - if you read threads about any bank (on here or Trustpilot reviews, etc) then you'll see a mix of positive and negative? If you've been with all the other high street players and (implicitly) don't want to return then you presumably don't rate them either?

Edit: I should have added that a less subjective assessment of relative merits is available via the bi-annual surveys conducted by Ipsos on behalf of the CMA, which use proper surveying methods rather than being unduly swayed by 'who shouts loudest':

https://www.ipsos.com/en-uk/en-uk/personal-banking-service-quality-great-britain-august-2024

As to my previous banking experience, all were ‘ok’, with Lloyds on top. Just an idea formed in my head about the regular saver with the co-op.0 -

Yes, my thoughts exactly. I prefer the old fashioned touch and I think my local branch of Nationwide was or is like that. No Co-op near me.sammyjammy said:My personal experience is good, some of the way things are done are a bit old fashioned but it does everything I need it to do and I like the ethical bank factor. They are particularly helpful in branch which may or may not impact you. I'm really surprise how low in that table they are.0 -

As above, if you're easily swayed by individual negative comments then you wouldn't open a bank account with anyone, but if you're primarily looking for the regular saver and a secondary contingency current account, then what's stopping you from opening a Co-op one and rarely using it? Or opening a Co-op one specifically for the regular saver, plus a Lloyds (or A N Other) for the contingency purposes? Many on here have numerous current accounts, each for a specific purpose....DasTechniker said:

What I mean by ‘that bad’, is one comment I read on another post was a customer complaining that the bank kept blocking payments from their account even though the amount was small. Of course, we cannot know the payment history of the customer so we only speculate that the co-op may be a bit over the top. I’ve seen quite a few negative comments on the co-op and you have to take into consideration that people tend to post when faced with bad service, but not when service is good.eskbanker said:Depends what you mean by 'that bad' - if you read threads about any bank (on here or Trustpilot reviews, etc) then you'll see a mix of positive and negative? If you've been with all the other high street players and (implicitly) don't want to return then you presumably don't rate them either?

Edit: I should have added that a less subjective assessment of relative merits is available via the bi-annual surveys conducted by Ipsos on behalf of the CMA, which use proper surveying methods rather than being unduly swayed by 'who shouts loudest':

https://www.ipsos.com/en-uk/en-uk/personal-banking-service-quality-great-britain-august-2024

As to my previous banking experience, all were ‘ok’, with Lloyds on top. Just an idea formed in my head about the regular saver with the co-op.1 -

Main downside to co-op is that faster payments take ages to arrive, and can't do am internal transfer to savings accounts via app, have to do by website. Oh, and payments to credit card take to days to leave your account even though it's internal transfer. Mind the issues I have with co-op are quite similar to what I have with first direct, but they score highly on ratings lists

1 -

I think they are easily down there with the worst of the "known" high street banks. Slow, clunky and addicted to sending me paper even though I have opted out.

Here's an example. I opened a current account to get their switching bonus. That was slow but I expected that. I then wanted to open a savings account. With some other banks that is as easy as a few clicks and it's open immediately and available to fund. After all, they did the ID and verification stuff for the current account and I'm logged in on the secure app.

But Co-op made me type all my details in again and wait for the welcome letter via snail mail then greeted me as if I was a brand new customer. It took 10 or 11 days to get a working savings account. That's crazy.

Maybe Coventry BS buying them will make a difference but for, in my opinion, now they are bad with a capital B.1 -

I'm somewhat puzzled by the survey results for HSBC and First Direct are the same bank although much apart on the survey.Similarly RBS is regarded much worse than NatWest although they are the same bank and to my mind work very much the same odd way. Are the Scots more critical of banks than the English? Note the lower result for BOS compared with Halifax although the same bank.I take all these comparisons with a pinch of salt.2

-

That’s right about a regular saver. Just let the bank account tick over in the background.eskbanker said:

As above, if you're easily swayed by individual negative comments then you wouldn't open a bank account with anyone, but if you're primarily looking for the regular saver and a secondary contingency current account, then what's stopping you from opening a Co-op one and rarely using it? Or opening a Co-op one specifically for the regular saver, plus a Lloyds (or A N Other) for the contingency purposes? Many on here have numerous current accounts, each for a specific purpose....DasTechniker said:

What I mean by ‘that bad’, is one comment I read on another post was a customer complaining that the bank kept blocking payments from their account even though the amount was small. Of course, we cannot know the payment history of the customer so we only speculate that the co-op may be a bit over the top. I’ve seen quite a few negative comments on the co-op and you have to take into consideration that people tend to post when faced with bad service, but not when service is good.eskbanker said:Depends what you mean by 'that bad' - if you read threads about any bank (on here or Trustpilot reviews, etc) then you'll see a mix of positive and negative? If you've been with all the other high street players and (implicitly) don't want to return then you presumably don't rate them either?

Edit: I should have added that a less subjective assessment of relative merits is available via the bi-annual surveys conducted by Ipsos on behalf of the CMA, which use proper surveying methods rather than being unduly swayed by 'who shouts loudest':

https://www.ipsos.com/en-uk/en-uk/personal-banking-service-quality-great-britain-august-2024

As to my previous banking experience, all were ‘ok’, with Lloyds on top. Just an idea formed in my head about the regular saver with the co-op.0 -

But they're not the same in terms of the customer service experience, regardless of the common corporate ownership - FD was set up to be deliberately different, with its pioneering phone banking operation rather than the more traditional branch-based style of its parent.Descrabled said:I'm somewhat puzzled by the survey results for HSBC and First Direct are the same bank although much apart on the survey.

Less of an obvious rationale for the other variances you highlight but ultimately these results are still subjective, even though the fact that they're judged by many hundreds of respondents per bank ought to eliminate some of the outlier observations that tend to be highlighted on threads like this.

Moving away from qualitative data into more objective quantitative measures, each bank is required to publish their performance against a range of metrics, although these are all shown on their own sites rather than a consolidated table:

https://www.fca.org.uk/data/mandated-voluntary-information-current-account-services/providers-links3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards