We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Co-op Bank: Can They Really Be That Bad?

Comments

-

Payments from co-op to other banks is Instant. Payments from other banks to co-op still take about 20 minsgsmh said:My experience with the Co-operative bank is very different from what has been posted here. If we were discussing the bank a year or so ago I would agree with most of the negative comments. The issue of faster payments is, from my experience, no longer an issue and such payments arrive at their destination at most a couple of minutes later. Faster payments into the account are pretty quick too. I have had one single payment held, it was to my credit card and was the first such payment. I made many payments subsequently to that and other destinations and not a single one was held for investigation. I'm sure there's nothing special about me that I had no issues, it's surprising others managed to find fault.0 -

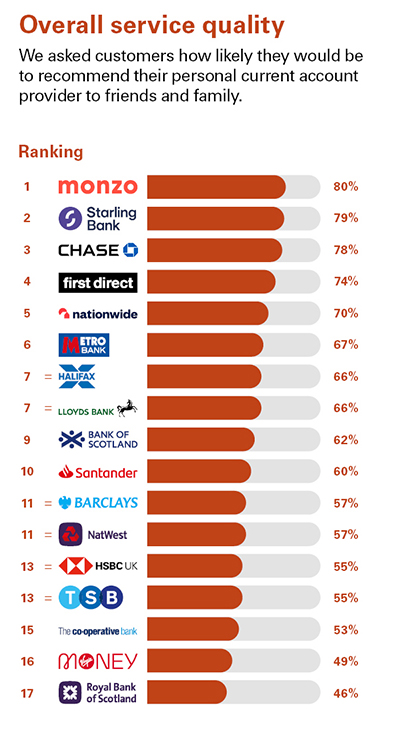

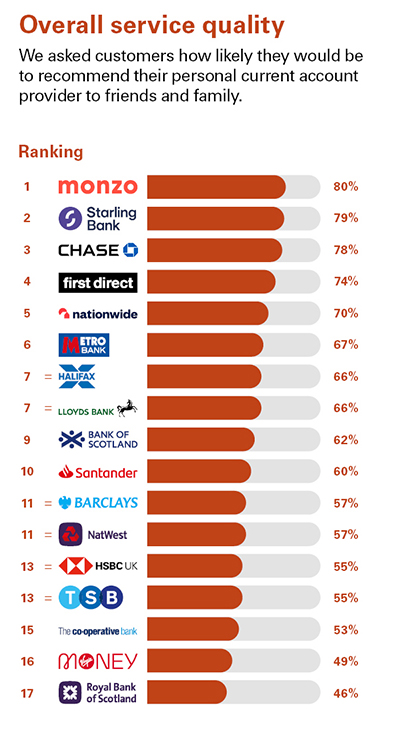

Number 6 has just been fined 16.7 millioneskbanker said:Depends what you mean by 'that bad' - if you read threads about any bank (on here or Trustpilot reviews, etc) then you'll see a mix of positive and negative? If you've been with all the other high street players and (implicitly) don't want to return then you presumably don't rate them either?

Edit: I should have added that a less subjective assessment of relative merits is available via the bi-annual surveys conducted by Ipsos on behalf of the CMA, which use proper surveying methods rather than being unduly swayed by 'who shouts loudest':

https://www.ipsos.com/en-uk/en-uk/personal-banking-service-quality-great-britain-august-20240 -

And....?35har1old said:

Number 6 has just been fined 16.7 millioneskbanker said:Depends what you mean by 'that bad' - if you read threads about any bank (on here or Trustpilot reviews, etc) then you'll see a mix of positive and negative? If you've been with all the other high street players and (implicitly) don't want to return then you presumably don't rate them either?

Edit: I should have added that a less subjective assessment of relative merits is available via the bi-annual surveys conducted by Ipsos on behalf of the CMA, which use proper surveying methods rather than being unduly swayed by 'who shouts loudest':

https://www.ipsos.com/en-uk/en-uk/personal-banking-service-quality-great-britain-august-2024

Many of them will have been fined for a variety of misdemeanours (TSB last month, Starling the month before, HSBC in May, Santander less than two years ago, etc), but what does that have to do with customer service?2 -

That was me. The way i see is that the app is the main or only way you interact with your bank, so I want the app to do as much as possible. I find it bizarre that companies whose whole business is banking put so little effort into their apps. You can get apps that do all sorts of clever things like ai photo editing, so it seems unbelievable to me that some banks dont do something as rudimentary as giving you a notification when a transaction has occurred. You'd think that would be one of the first exercises on an app development course. Each to their own I suppose, but i find it odd that people are happy with such archaic banks.Middle_of_the_Road said:

Totally agree, it does everything I need to. The areas in which their systems is inferior are in aspects that I never knew existed. These additions are highly important to some, and most of the 'app only banks' have made them almost essential in today's "need it now"world.gsmh said:I have had accounts with pretty much every UK bank. I currently have current accounts with Starling, The Royal Bank of Scotland, Metro Bank, Santander and Nationwide. I don't find the more recent incarnation of The Co-operative Bank any worse than any other bank in terms of the functionality I need. As I said before, a year ago it was a very different story - you didn't even get to see pending transactions. Now I would say their systems are much improved. I have no complaints.

Someone posted a list of such features recently in a similar thread, the only one I can remember was 'split the bill'. Had to look that up.🙄4 -

It’s not a co operative. It’s owned by hedge funds. See no point in the bank.0

-

Rob5342 said:i find it odd that people are happy with such archaic banks.

So your definition of an archaic bank is one which has an app with a leaner set of features, so presumably a modern bank has everything but the kitchen sink in its app? The banks whose apps I dislike the most are Monzo at number one, Barclays at number two and Starling at number three. The Monzo app in particular was absolutely dreadful IMO. It felt like banking in Toytown. I certainly don't judge a bank by the sheer number of features in its app. There's a lot more to it than that.Hopefully the purchase of The Co-operative Bank by The Coventry Building Society should go through early next year so the very tired argument about it being owned by hedge-funders can be laid to rest.

0 -

A bank is a business, choice is good. Seeing 'no point' in one particular bank is a very odd comment. What is the point of Metro Bank, or Santander or any one of the other banks? What is the point of Lidl when we have Aldi? What is the point of life itself?Theleak250 said:It’s not a co operative. It’s owned by hedge funds. See no point in the bank.

0 -

Modern banks do make a good effort with their apps. A good app is important to me as that's the main way you interact with your bank. My definition of an archaic bank would be one like Nationwide who don't even have transaction notifications. A banking app without notifications is like a car that still has a starting handle.0

-

That just shows how we're all different. I turn off such notifications. I open the app regularly to check what's going on, I don't want my notifications littered with messages about banking transactions. I know what's going on.Rob5342 said:Modern banks do make a good effort with their apps. A good app is important to me as that's the main way you interact with your bank. My definition of an archaic bank would be one like Nationwide who don't even have transaction notifications. A banking app without notifications is like a car that still has a starting handle.

1 -

I kind of agree with both sides here. I'm certainly not going to be persuaded to join a bank simply because it has "bill-splitting" or (apparently essential to some) "pots" or a link to Google Maps showing where the spending took place (!!!!!!), but OTOH I do want transaction notifications.gsmh said:

That just shows how we're all different. I turn off such notifications. I open the app regularly to check what's going on, I don't want my notifications littered with messages about banking transactions. I know what's going on.Rob5342 said:Modern banks do make a good effort with their apps. A good app is important to me as that's the main way you interact with your bank. My definition of an archaic bank would be one like Nationwide who don't even have transaction notifications. A banking app without notifications is like a car that still has a starting handle.

If someone has started to empty one of my accounts fraudulently then I'd like to know about it asap.4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards