We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Am i okay to "deflate"? Please sanity check my model / thinking!

Comments

-

montyjohn said:I would say your assumptions are very conservative.

Assuming your DC and ISA is all in globally diverse equities, then a return of 7% (I'm too new to post links but google monevator pension returns) is average. However, S&P500 has historically returned on average 9%.

Average CPI of 2.5%, and fees of 0.5%.

Real word returns of therefore 4% (this is much higher than your high assumption which ignores inflation and I assume fees).

By subtracting inflation and fees from your returns at source, you can ignore inflation for the rest of your calculation.

So your target then becomes £50K pa until you are 75. £40k after.

It's also just easier to understand what the numbers mean keeping it all in today's money.

I plan on keeping all my savings in equities so I can enjoy hopefully continued growth through my retirement.

Your testing with market crashes ignores the rebound after. You're in it for the long term so not sure I would factor them in. But you do want to plan for them.

You have lots of cash so have the luxury of relying on your cash during recessions.

Looking at your figures I struggle to see any scenario that will leave you with less than you have now in todays money when rigor mortis sets in.

There are arguments for both with and without inflation.

Including inflation enables you to model stuff like a frozen tax thresholds, capped DB pension increases and, probably most importantly, periods of exceptionally high and low inflation for stress testing purposes. It models the future reality. These things are largely hidden with a "today's money" approach.

It also means that you can look back to see how your model compared to your projections - although does anyone actually do that? I did once and it was laughable how different it was.

1 -

This ^^ - sometimes paying 20% tax earlier and over several years, is better than paying 40% tax later, especially in future when pensions will no longer be exempt from IHT (unless passed to spouse). Depends on your situation and needs.michaels said:

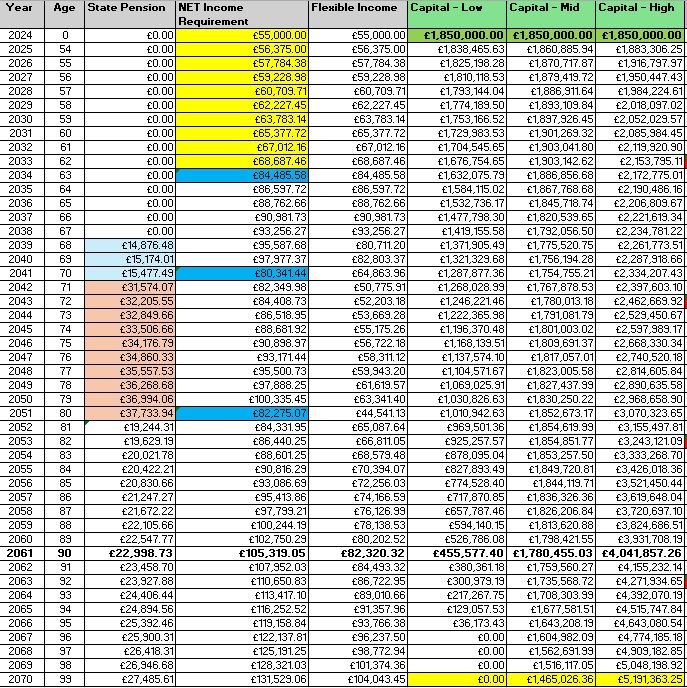

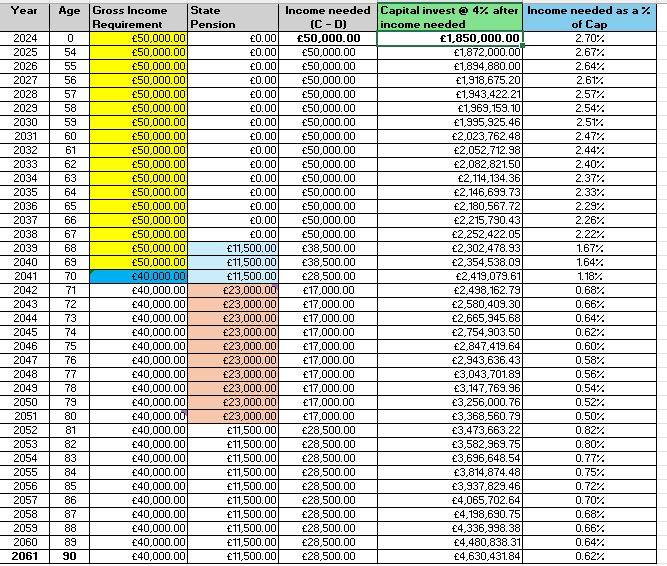

You want to make sure you use as much of your (and your wife's) personal allowance as you can every year even if it means drawing money from pension that you then save into ISA. Also if with the stat pension there is any chance of being a higher rate tax payer post state pension age then you also want to use as much of you basic rate band as you can put into ISAs before state pension ageStarmer24 said:so ive updated my model- for net £55k p.a income

- First 10 yrs are tax free (be that isa or pension lump) - then after that at 63 ive increased by 20% = £66k gross in current prices (assuming 2.5% inflation)

- Then at 70 reduced by 20% = £53k gross in current pricing

- Then reduced again at 80 by a further 20% = £42k in current money.

- I have edited the 3 models to be

low = 2.5%med = 3.75%high = 5% 2

2 -

Thanks. So you mean per attached?montyjohn said:I would say your assumptions are very conservative.

Assuming your DC and ISA is all in globally diverse equities, then a return of 7% (I'm too new to post links but google monevator pension returns) is average. However, S&P500 has historically returned on average 9%.

Average CPI of 2.5%, and fees of 0.5%.

Real word returns of therefore 4% (this is much higher than your high assumption which ignores inflation and I assume fees).

By subtracting inflation and fees from your returns at source, you can ignore inflation for the rest of your calculation.

So your target then becomes £50K pa until you are 75. £40k after.

It's also just easier to understand what the numbers mean keeping it all in today's money.

1 -

Here's my sense check. Assuming your investments only match inflation to keep things simple. £800k cash gives you £50k for 16 years taking you into retirement age when you will have two state pensions and a £1m pension pot. Your issue is that you wont be spending enough.2

-

By taking the the mean returns and assuming they are constant you are ignoring two thingsmontyjohn said:I would say your assumptions are very conservative.

Assuming your DC and ISA is all in globally diverse equities, then a return of 7% (I'm too new to post links but google monevator pension returns) is average. However, S&P500 has historically returned on average 9%.

Average CPI of 2.5%, and fees of 0.5%.

Real word returns of therefore 4% (this is much higher than your high assumption which ignores inflation and I assume fees).

By subtracting inflation and fees from your returns at source, you can ignore inflation for the rest of your calculation.

So your target then becomes £50K pa until you are 75. £40k after.

It's also just easier to understand what the numbers mean keeping it all in today's money.

I plan on keeping all my savings in equities so I can enjoy hopefully continued growth through my retirement.

Your testing with market crashes ignores the rebound after. You're in it for the long term so not sure I would factor them in. But you do want to plan for them.

You have lots of cash so have the luxury of relying on your cash during recessions.

Looking at your figures I struggle to see any scenario that will leave you with less than you have now in todays money when rigor mortis sets in.

1) Returns have varied even taken over long periods, e.g. real returns on UK equities over 40 years have varied from 1.7% (worst case), 5.0% (median case) to 9.1% (best case). Planning for the median case is unwise. For a portfolio that also includes 50% bonds, the values are -0.3%, 2.7%, and 7.8% (but the volatility is much lower).

2) Sequence of returns. Poor returns early on in retirement have a much larger effect on the outcomes than poor returns late on even if the overall return is the same. This consideration is the basis for 'safe withdrawal rates' (although taking constant inflation adjusted withdrawals from a varying portfolio is somewhat flawed).

1 -

More positively, I'd agree that the OP has enough even for the worst historical UK casesmontyjohn said:I would say your assumptions are very conservative.

Assuming your DC and ISA is all in globally diverse equities, then a return of 7% (I'm too new to post links but google monevator pension returns) is average. However, S&P500 has historically returned on average 9%.

Average CPI of 2.5%, and fees of 0.5%.

Real word returns of therefore 4% (this is much higher than your high assumption which ignores inflation and I assume fees).

By subtracting inflation and fees from your returns at source, you can ignore inflation for the rest of your calculation.

So your target then becomes £50K pa until you are 75. £40k after.

It's also just easier to understand what the numbers mean keeping it all in today's money.

I plan on keeping all my savings in equities so I can enjoy hopefully continued growth through my retirement.

Your testing with market crashes ignores the rebound after. You're in it for the long term so not sure I would factor them in. But you do want to plan for them.

You have lots of cash so have the luxury of relying on your cash during recessions.

Looking at your figures I struggle to see any scenario that will leave you with less than you have now in todays money when rigor mortis sets in.

For example,

The SWR over 45 years (see https://www.2020financial.co.uk/pension-drawdown-calculator/ for a calculator using historical data for UK retirees, the SWR can be found by adjusting the withdrawal percentage until there were no cases where the money ran out) for a 70% equities, 30% cash portfolio was 2.7%.

For a 17 year planning horizon, the SWR was about 5.0%.

So, supplying £40k per year (from the portfolio) for 45 years would cost ~£1500k

While supplying an additional £10k for the first 17 years would cost £200k for a total of £1700k

So supplying more income than is required (because the above rough calculation ignores the state pension) the worst UK historical case still left a small surplus at the end. Once the state pension is factored in the surplus would be larger.

0 -

That's a very relative thing though. Fun and adventure for me would be making my lunch at 12.50 instead of 12.55!Cobbler_tone said:It’s about maximising your fun and adventure whilst you are still able to do so.3 -

I think I met you at a party once.eastcorkram said:

That's a very relative thing though. Fun and adventure for me would be making my lunch at 12.50 instead of 12.55!Cobbler_tone said:It’s about maximising your fun and adventure whilst you are still able to do so. 3

3 -

I think you can go as soon as you would like.Starmer24 said:So kinda related to this thread

https://forums.moneysavingexpert.com/post/discussion/pensions-annuities-retirement-planning

id love some critique of my numbers and the basic cash flow model i did one late night this week

FYI- I am 53.5 (paye, fulltime) and other half 50 (no employment)

- I

have a DC pot of £1.0m

- £600k ISAs

- Cash of £200k

- So essentially £1.8m at time of writing

- Mortgage paid off, 3 kids (1 of school age)

Here is my model - that i edited from the one on YouTube https://www.youtube.com/watch?v=7Wkr5QtY-G8 Edmund Bailey Some comments on the table:

Some comments on the table:- In the state pension column, my state pension starts in 2039, wife 3 years later.

- I have assumed 2% increase p.a on this throughout the model.

- So we get 2 x State pensions from my age 71, and then i have parred it back to model just 1 state pension from 10 yrs later ie one of us is deceased...

- For Income Requirement i have modelled that we need £50k per anum NET (in todays terms).

- For the first 10 years i have assumed this translates at £50k gross as i can use ISA / tax free lump etc

- After 10 years i have assumed we need £60k gross - to give us the £50k net.

- Age 75 i have assumed we might need less - so 20% less (so equating to £40k net in todays numbers)

- Age

85 i have given the income numbers a further haircut - a reduction of a

further 10% as im guessing we wont need (£35k net in todays numbers)

- All the income is subject to 2% inflation throughout

- Taking the state pension from the Income Requirement gives me the difference ie the "Flexible Income" - this is essentially what i need my assets (cash, DC pension, ISA) to cover ie the diff between the state pension and my Income Requirement

- And

against this target i have modelled 3 scenarios that cover low, med and

high growth - at 2.5%, 3.5% and 4.5% respectively for the duration.

- The

end of all this modelling shows i will have £300k left if one of us

reaches 99 on the low growth model, £1.8m in the med growth model and

£4m in the high growth model.

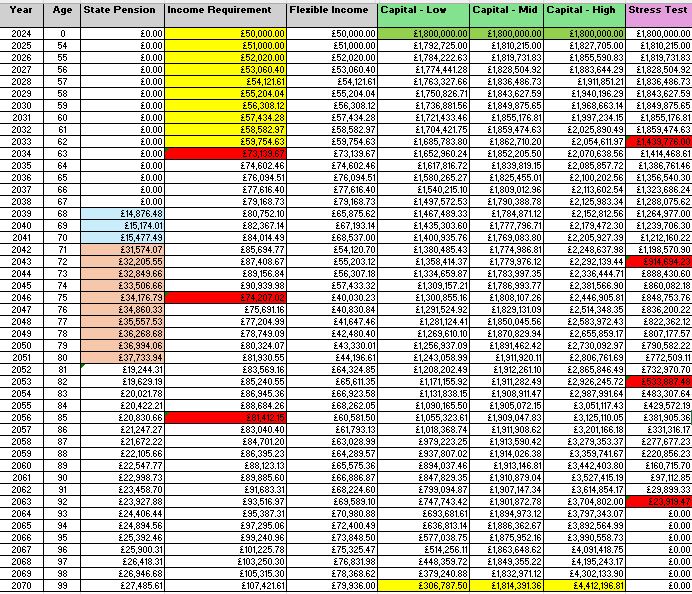

- i then did a simple stress test, and using the med growth 3.5% model, assumed a 20% asset crash every 10 years.....the outome is we would run out of money aged 85.

>>>Thoughts? is this model reasonable or way off the mark?>>>Do you think the reduction in income requirements at 75 and 85 are rational?>>>is it okay that i lumped all our assets into one pot for the purpose of this exercise?>>>Are the asset growth rates (low, med, high) vs CPI too pessimistic, optimistic?>>>Anything crucial i am not thinking about?>>>So based on these models im now thinking i can retire any time i want from here on, probably, perhaps, nooooo??!!!Apologies for the looong post - id love to hear any feedback from the experts on this brilliant forum!

I used the same spreadsheet to run my figures a short while ago. I think just as part of the thought process of de accumulation it was a good starting point. The market corrections highlighted the impact of a sequence of poor returns. This reminded me of some very good advice from a regular contributor on here, Linton, who has implemented his strategy (unlike many on here that are still in the planning stage) - “why are you still playing the game (trying to increase your pots) when you have already won?” His strategy (hopefully he’ll correct my misunderstanding/misinterpretation) is to have 3 loosely connected ‘pots’ - the first has a number of years of cash (which could be a gilt/bond/savings ladder) - the second has wealth preservation/income funds which top up the first pot as income is generated - the 3rd part is your growth element which you can top slice and treat much as in the accumulation phase. You could use fixed term annuities until SPA as part of the strategy.You could utilise your tax allowances from 57 by drawing down on your DC pension. This together with your 25% tax free and OH’s SIPP will defer the payment of tax. If you draw down the 25% tax free sum asap you could put investments in OH’s name and they could utilise PA until funds were moved into ISA’s.

Is your expenditure based on now (which includes your 3 children) so maybe has a margin of error in it?

I looked at what I guessed our requirements would be once 2nd SP was in payment and how that was funded. I looked at the fund needed at a SWR of about 4% (on the basis that we were closer to a reduced income requirement and 25 year drawdown would take us well into our 90’s). This calculation then gave me a figure to fund the gap which with no need to preserve capital allowed a more conservative approach.Having said all of that OH, who is self employed, found a mixture of contracts that she likes so continues to work. We are able to travel, now, with her commitments so will probably need less in retirement than forecast and our children will need less financially (like you youngest still at school and middle two just finishing Uni). So we/you can forecast but the key is adapting, as we have done throughout our lives.

Good luck1 -

Just in very simple terms, and addressing the original question.

£1.8m available.OP cost for bridge to SP - assuming £12k = 14x12 = £168k, OP Partner = 17x12 = £204k.So if we take that out of the £1.8m that leaves £1,428k.4% of that is £57k, 5% is £71kSo that means in theory and especially if the OP is willing to forego the occasional inflation rise then they could retire now on between £81k and £95k gross.Personally I went at 52 and haven't regretted it.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards