We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Am i okay to "deflate"? Please sanity check my model / thinking!

Starmer24

Posts: 25 Forumite

So kinda related to this thread

https://forums.moneysavingexpert.com/post/discussion/pensions-annuities-retirement-planning

id love some critique of my numbers and the basic cash flow model i did one late night this week

FYI

Here is my model - that i edited from the one on YouTube https://www.youtube.com/watch?v=7Wkr5QtY-G8 Edmund Bailey

https://forums.moneysavingexpert.com/post/discussion/pensions-annuities-retirement-planning

id love some critique of my numbers and the basic cash flow model i did one late night this week

FYI

- I am 53.5 (paye, fulltime) and other half 50 (no employment)

- I

have a DC pot of £1.0m

- £600k ISAs

- Cash of £200k

- So essentially £1.8m at time of writing

- Mortgage paid off, 3 kids (1 of school age)

Here is my model - that i edited from the one on YouTube https://www.youtube.com/watch?v=7Wkr5QtY-G8 Edmund Bailey

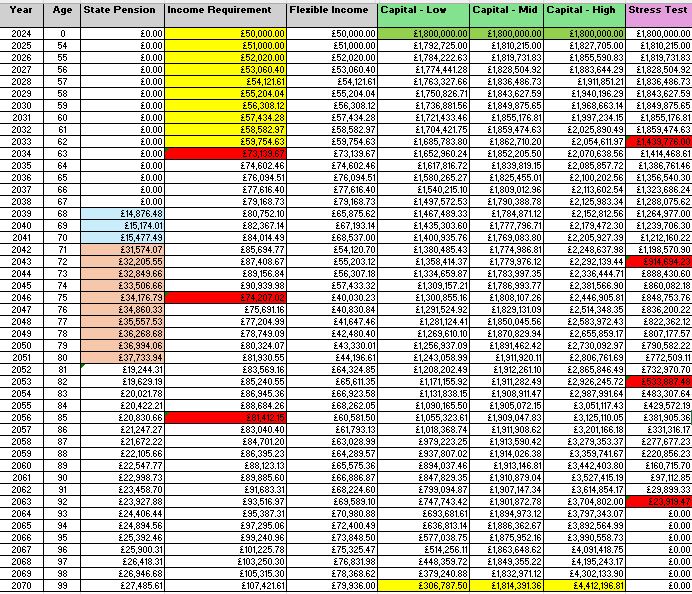

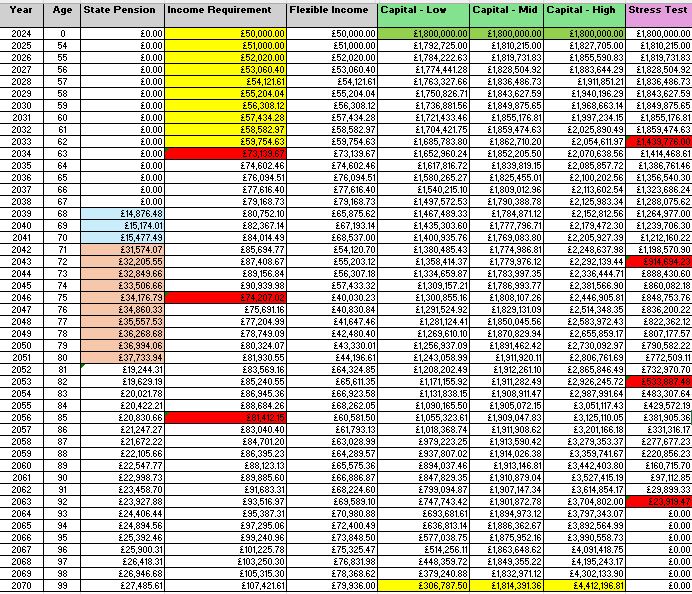

Some comments on the table:

- In the state pension column, my state pension starts in 2039, wife 3 years later.

- I have assumed 2% increase p.a on this throughout the model.

- So we get 2 x State pensions from my age 71, and then i have parred it back to model just 1 state pension from 10 yrs later ie one of us is deceased...

- For Income Requirement i have modelled that we need £50k per anum NET (in todays terms).

- For the first 10 years i have assumed this translates at £50k gross as i can use ISA / tax free lump etc

- After 10 years i have assumed we need £60k gross - to give us the £50k net.

- Age 75 i have assumed we might need less - so 20% less (so equating to £40k net in todays numbers)

- Age

85 i have given the income numbers a further haircut - a reduction of a

further 10% as im guessing we wont need (£35k net in todays numbers)

- All the income is subject to 2% inflation throughout

- Taking the state pension from the Income Requirement gives me the difference ie the "Flexible Income" - this is essentially what i need my assets (cash, DC pension, ISA) to cover ie the diff between the state pension and my Income Requirement

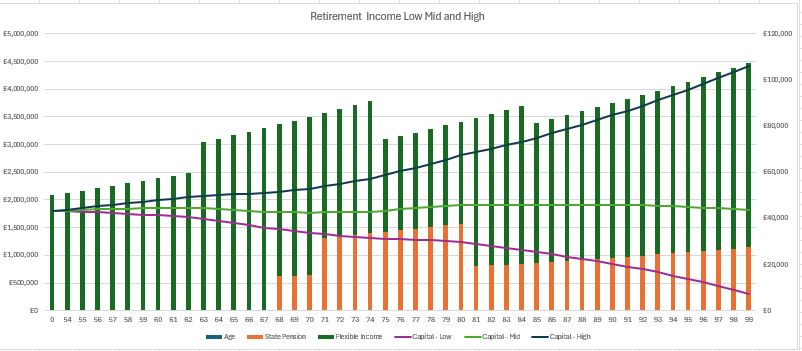

- And

against this target i have modelled 3 scenarios that cover low, med and

high growth - at 2.5%, 3.5% and 4.5% respectively for the duration.

- The

end of all this modelling shows i will have £300k left if one of us

reaches 99 on the low growth model, £1.8m in the med growth model and

£4m in the high growth model.

- i then did a simple stress test, and using the med growth 3.5% model, assumed a 20% asset crash every 10 years.....the outome is we would run out of money aged 85.

>>>Thoughts? is this model reasonable or way off the mark?

>>>Do you think the reduction in income requirements at 75 and 85 are rational?

>>>is it okay that i lumped all our assets into one pot for the purpose of this exercise?

>>>Are the asset growth rates (low, med, high) vs CPI too pessimistic, optimistic?

>>>Anything crucial i am not thinking about?

>>>So based on these models im now thinking i can retire any time i want from here on, probably, perhaps, nooooo??!!!

Apologies for the looong post - id love to hear any feedback from the experts on this brilliant forum!

0

Comments

-

key assumptions

0 -

graph here

0

0 -

Could you model as buying a ladder of index linked gilts to cover SP until SP age for each of you - so 14 x 12k for you and 17 x 12k for your wife. (I am assuming you and DW both have full SP)

Deduct this from your pot and then see how much annuity you could buy with the remainder on a fully indexed 100% joint life basis (I model that the surviving spouse will want the full income less one lost state pension)

This will give you a 'worse case guaranteed income' starting point. You can then decide to what extent you want to go annuity vs drawdown based on your appetite for risk.

I model all this including historic SWR using the SWR Toolbox google sheet

https://earlyretirementnow.com/2017/01/25/the-ultimate-guide-to-safe-withdrawal-rates-part-7-toolboxI think....2 -

>>>Thoughts? is this model reasonable or way off the mark?

I think it's a reasonable model. Of course, it's not sophisticated enough to model all the potential sequences of return, but your stress test is better than nothing. Your average return rates seems sensible. My rate of return on my retirement potfolio has been about 5.3% on average. This is a DIY portfolio consisting of a diversified portfolio of Investment Trusts and Exchange Traded funds with a UK bias and aimed at producing income (rather than growth). I retired at 53, and have been drawing down on the pension for five years. I lived off savings for the first two years.>>>Do you think the reduction in income requirements at 75 and 85 are rational?

Yes, there will come a point when your desire and ability to live a wild retirement will start to reduce. 75 is a good a point to imagine this occuring as any other. At 85, it is likely that your health will have deterioriated to the point that caring for each other becomes your main focus.>>>is it okay that i lumped all our assets into one pot for the purpose of this exercise?

In reality, some of your savings will always be held back as cash and will never form part of your investable wealth, but this will be a small portion of your overall assets, so lumping them together is ok for this level of modeling.>>>Are the asset growth rates (low, med, high) vs CPI too pessimistic, optimistic?

If anything, I would say they are too pessimistic, but I would not change them until you have been retired for at least five years. Once you are five years into your retirement, you will have more information about how your plan is working and how much money you might need going forward. (Most of us retirees struggle to spend enough in the early years of retirement!)

>>>Anything crucial i am not thinking about?

I don't think there is anything crucial missing. You know how much you need to live, and you have a large enough pot to be able to generate the income you need from it in most, if not all scenarios.>>>So based on these models im now thinking i can retire any time i want from here on, probably, perhaps, nooooo??!!!

It is always going to be risky to rely on investment performance (rather than buying an annuity) to secure your retirement, but my feeling is that the risks inherent in doing so can be managed. You can adjust your spending and have plenty of time to recover from the occasional setback.The comments I post are my personal opinion. While I try to check everything is correct before posting, I can and do make mistakes, so always try to check official information sources before relying on my posts.2 -

Couple of thoughts, I would use inflation of 2.5%. Also I would put cash and equities in separate buckets, modelling cash as 1%, therefore real terms reduction.

Also will you take money out of equities or cash and replenish?

Have you checked you both have full state pensions?

Will your children be going to uni? If so that could be an additional cost. Mine cost approx 25k each for a 3 year course.

It's just my opinion and not advice.1 -

Your personal rate of inflation may well be very different to CPI. How do you intend spending your early retirement years? Travelling, playing golf, eating out, going to the opera? Plans to move house, buy an expensive new car?1

-

So you have [DC pension, ISA, cash] assets of around 1.8M, & you are essentially after around 4-4.5K pa to live on?

A 2.5% drawdown?

Congrats: relax, I think you’ve got this 💪

Have yourself you accounted for occasional major purchases (replacement car, central heating, house renovations, etc)? I am sure your numbers will still stack up, & you have a great buffer of cash to help deal with any market downturns.

Retire now: offspring heading to Uni can take the max loan (‘just’ a tax on future income). You can pay their accommodation - should be well under £1K pcm.

As someone else asked - do *properly* check your State pensions are at the maximum you can get (the smaller number under the larger one online: I have highlighted in red below - check it matches the numbers in the green box which is what you *could* get 😉), otherwise you may have to buy some years…

(sorry I couldn’t shrink the picture!!)

The much bigger question is what are you retiring TO?

How will you and your wife spend your days & weeks?You could have 40+ years to fill 😎👍Plan for tomorrow, enjoy today!2 -

You could shift £2880 of your money into a pension for your wife (every year until she is 75) and she would get the £720 tax relief, and have some pension she could draw down within her personal tax relief limit.Have you check what happens if you pass first, particularly if the planned IHT changes on pensions come in in 2027?(again a projection / guess, but no harm in considering if it would change your plans).1

-

It's clear reading many of these threads that (some) people are too concerned whether they will have enough £. Probably why so many continue to slave away when they don't need/want to. Maybe it is human nature and how many are programmed.

It is good to be aware of your position though. I work with so many people who have no idea on their pension etc and convinced many could actually retire if they wanted to.

There was another thread worrying about funding care. If we all want to fund potentially 10 years+ of private care then it probably isn't worth giving up work for most of us.

For me it is pretty straight forward. Factor in any kids, mortgages, pets, healthcare, cars, chosen lifestyle and what you spend now and what would change in retirement. Work out your required net income and work back from there, adding the boost of the relevant state pension. To make it simple have your guaranteed pensions and use a modest savings rate for cash in the bank. I would personally assume that I will spend less in later life.

The other thing to consider (although many don't want that 'pressure') is that if you give up your current grind is that it is easy (health permitting) to pick up an income of some kind. Work doesn't have to be a 'hard stop', unless that is a non-negotiable in your plans. Every Sainsbury delivery driver is a 50 something with a corporate back story!

At the same time, if people do want/need £50k+ net a year then you need a decent amount if you are in your 50's.

What impresses me the most is that the OP wants to retire with his (non-working) partner at 53 and 50. I'd personally factor in the cost of a divorce. 4

4 -

"What impresses me the most is that the OP wants to retire with his (non-working) partner at 53 and 50. I'd personally factor in the cost of a divorce" - ha!!

I was 'lucky' in that my last 22 years was technically working from home. I was out & about a LOT, but my spouse was used to me being around a lot....maybe that made things easy for us.

I agree - most worry more about the finances than how they are going to spend their time. Clearly finances will dictate things to a point, but more important is how you enjoy the third phase of your life.Plan for tomorrow, enjoy today!1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards