We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Am i okay to "deflate"? Please sanity check my model / thinking!

Comments

-

Thanks a lot for all the feedback to date - i really do appreciate it.

So some answers to questions posted above:- What to do after retirement?

- £2880 for wife?

Yes we do this - she has £35k accumulated via this route to date- School and Uni fees

Our kids all went to state schools (one still is). Eldest two half way through their respective Uni course. We have taken student loans as per guidance from MSE and will re-assess later in life depending on their earnings and our wealth to help them out.- IHT

i hadnt really thought about this - i think my DC goes to my wife tax free?Our £600k ISAs i assume the same (we have 50% each).So looks like I need to review the latest budget changes and see if there is anything we need to consider for tax planning purposes.- Personal rate of pension

We are pretty conservative i think and i dont see any changes for at least 8 yrs until youngest leaves the nest. To illustrate - my vehicle was a 2006 plate and recently died / replaced a couple of months back - this new vehicle will likely be mine forever more. My wifes car is 2010 and no sign of giving up (yet) - We definately dont buy new things for the sake of it! We have a young child so no exotic couple holidays...cruises not our thing. No golf but watersports kit isnt cheap either. Holidays will be Walking, Watersports and Camping in Europe. I used to travel a lot with work and im over it - kinda dislike flying etc if im honest. We are not a "weekend in New York" kinda couple...rarely do city breaks but maybe in the winter the odd one perhaps. Id prefer a walk in the peak district! id happily holiday in the Hebrides every year if i could. We live in the country, so Opera and fancy dining not really on the cards. Maybe a trip to London once a year.3 -

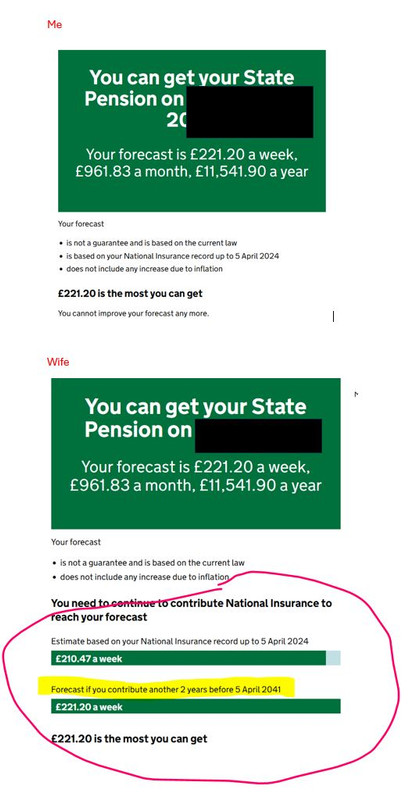

State pensionI think we are good - mine seems to check out and my wife has 2 more years to run, which she will earn as NI Credits due to youngest child (the cut off is 12, in 2 yrs so that works out).

1 -

I am going to check our numbers and see if (at this early retirement age) we can live with our hobby / life needs etc.

I am increasingly aware i dont wanna be one of these "just one more year" guys, or wait for a medical issue to force my hand. Also i think its TIME i want more, not more money. if i could live as im today then im very very content with that. But i do want to maintain our current status quo in terms of expenditure etc...i dont want to stop work and not pursue my sports hobbies due to lack of funds.

0 -

How did you arrive at the £50k income requirement?From your plan it looks like you have decided that £50k will avoid any risk of running out of money. What level of income will you actually need to enjoy retirement?Have you factored in any help you might want to give your kids eg. deposit on a property?This seems like a very conservative plan with a good chance you'll leave a large amount of money, probably millions, when you die depending on how you are invested.To guard against this you could take a fixed-term annuity to cover the period between 55 and when your state pensions kick in.1

-

This seems like a very conservative plan with a good chance you'll leave a large amount of money, probably millions, when you die depending on how you are invested.

OP - as per the above comment. Nobody knows the future but most of the withdrawal strategies we see on here are based on a 'safety first' principle ( like yours) . This means that the projections are likely to turn out to be too pessimistic and you ( and others) may well end up dying with significantly more than you start off retirement with.

Not saying this is necessarily a bad thing, but something to be aware of.

You might well be a significant contributor of inheritance tax to HM Treasury !i hadnt really thought about this - i think my DC goes to my wife tax free?Our £600k ISAs i assume the same (we have 50% each).So looks like I need to review the latest budget changes and see if there is anything we need to consider for tax planning purposes.

Currently you can pass all your assets to your spouse tax free when you die. For a married couple, normally IHT is only calculated on the second death. There are numerous threads on the forum on the subject, since the budget announced that unused DC pension pots will be brought into the scope of IHT.

However in the next 40 years there could be a lot more changes of course.1 -

Regarding the comment in bold.Cobbler_tone said:It's clear reading many of these threads that (some) people are too concerned whether they will have enough £. Probably why so many continue to slave away when they don't need/want to. Maybe it is human nature and how many are programmed.

It is good to be aware of your position though. I work with so many people who have no idea on their pension etc and convinced many could actually retire if they wanted to.

There was another thread worrying about funding care. If we all want to fund potentially 10 years+ of private care then it probably isn't worth giving up work for most of us.

For me it is pretty straight forward. Factor in any kids, mortgages, pets, healthcare, cars, chosen lifestyle and what you spend now and what would change in retirement. Work out your required net income and work back from there, adding the boost of the relevant state pension. To make it simple have your guaranteed pensions and use a modest savings rate for cash in the bank. I would personally assume that I will spend less in later life.

The other thing to consider (although many don't want that 'pressure') is that if you give up your current grind is that it is easy (health permitting) to pick up an income of some kind. Work doesn't have to be a 'hard stop', unless that is a non-negotiable in your plans. Every Sainsbury delivery driver is a 50 something with a corporate back story!

At the same time, if people do want/need £50k+ net a year then you need a decent amount if you are in your 50's.

What impresses me the most is that the OP wants to retire with his (non-working) partner at 53 and 50. I'd personally factor in the cost of a divorce.

Do not forget that people posting regularly ( or just reading) on a pensions forum are not representative of the public at large.

I am sure 'out there' there are many people making totally inadequate/no provision for their retirement, even when they have the means to do so.2 -

This is all true. I doubt there will be any significant change to the tax free inheritance between spouses though. Without protection for existing arrangements certainly. It would cause too much grief for too many people - too much hissing of the geese.Albermarle said:Currently you can pass all your assets to your spouse tax free when you die. For a married couple, normally IHT is only calculated on the second death. ...

However in the next 40 years there could be a lot more changes of course.

2 -

I'm not sure, I think there is a varied demographic. I work with people who have 30 years services, struggling a bit with health and never logged onto their pension and could probably comfortably retire. Some who never joined the pension until 10 years ago and some younger ones who I nag to lump into the pension.Albermarle said:

Regarding the comment in bold.Cobbler_tone said:It's clear reading many of these threads that (some) people are too concerned whether they will have enough £. Probably why so many continue to slave away when they don't need/want to. Maybe it is human nature and how many are programmed.

It is good to be aware of your position though. I work with so many people who have no idea on their pension etc and convinced many could actually retire if they wanted to.

There was another thread worrying about funding care. If we all want to fund potentially 10 years+ of private care then it probably isn't worth giving up work for most of us.

For me it is pretty straight forward. Factor in any kids, mortgages, pets, healthcare, cars, chosen lifestyle and what you spend now and what would change in retirement. Work out your required net income and work back from there, adding the boost of the relevant state pension. To make it simple have your guaranteed pensions and use a modest savings rate for cash in the bank. I would personally assume that I will spend less in later life.

The other thing to consider (although many don't want that 'pressure') is that if you give up your current grind is that it is easy (health permitting) to pick up an income of some kind. Work doesn't have to be a 'hard stop', unless that is a non-negotiable in your plans. Every Sainsbury delivery driver is a 50 something with a corporate back story!

At the same time, if people do want/need £50k+ net a year then you need a decent amount if you are in your 50's.

What impresses me the most is that the OP wants to retire with his (non-working) partner at 53 and 50. I'd personally factor in the cost of a divorce.

Do not forget that people posting regularly ( or just reading) on a pensions forum are not representative of the public at large.

I am sure 'out there' there are many people making totally inadequate/no provision for their retirement, even when they have the means to do so.

Where the demographic isn't typical is those looking to move investment funds, building guilt ladders etc, where I'd imagine most 'common folk' may use ISA's and settle for their 4.75% (if they are lucky) in a boosted saving pot.

There are clearly a number of people who could comfortably retire on here, who could do with recognising that time is their most precious resource. Certainly not many thinking they can live out their days on the state pension, which you'd hope being a pension forum! I do get that people by nature are normally risk adverse.4 -

leosayer said:How did you arrive at the £50k income requirement?From your plan it looks like you have decided that £50k will avoid any risk of running out of money. What level of income will you actually need to enjoy retirement?Have you factored in any help you might want to give your kids eg. deposit on a property?This seems like a very conservative plan with a good chance you'll leave a large amount of money, probably millions, when you die depending on how you are invested.To guard against this you could take a fixed-term annuity to cover the period between 55 and when your state pensions kick in.

The £50k p.a is net based on current expenditure pattens and expected future spend maintaining the status quo. For sure we could expect to reduce this when older and indeed i have modelled this with a couple of revisions as we get older.

The kids already have circa £40k each (x3) we have ear marked in ISAs, but the £1.8m number above is independent of these. If i retire i doubt i wont be able to continue to invest at the level i have been in their pots, unless after a few years the projections are better than my (apparently) pessimistic model.

i am going to re-run my model again, with slight tweaks - next post!

1 -

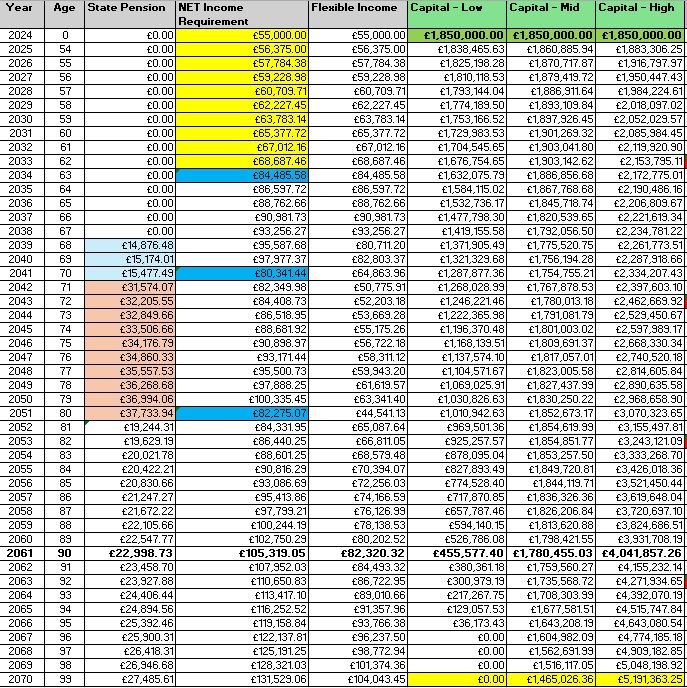

so ive updated my model

- for net £55k p.a income

- First 10 yrs are tax free (be that isa or pension lump) - then after that at 63 ive increased by 20% = £66k gross in current prices (assuming 2.5% inflation)

- Then at 70 reduced by 20% = £53k gross in current pricing

- Then reduced again at 80 by a further 20% = £42k in current money.

- I have edited the 3 models to be

low = 2.5%med = 3.75%high = 5%

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards