We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Am i okay to "deflate"? Please sanity check my model / thinking!

Comments

-

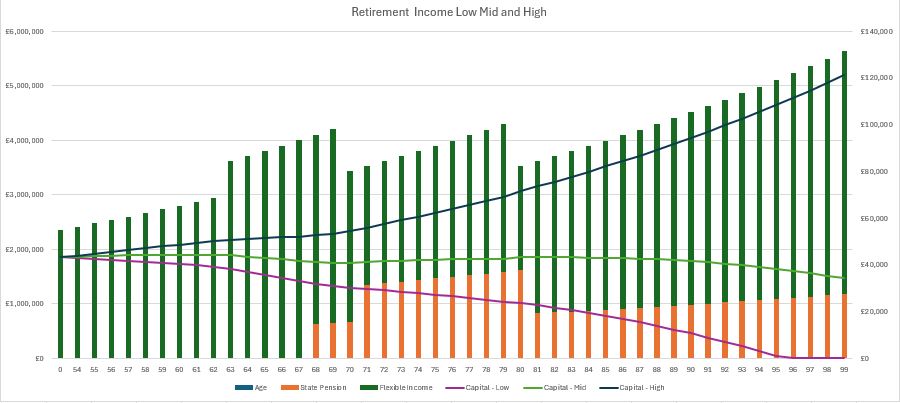

Graph depiction of the same

0 -

This is a good watch for you Starmer...at least some food for thought.

https://www.youtube.com/watch?v=S53lmvWIZXo

1 -

I have discussed that with many delivery supermarket drivers. One was a solicitor, another a city banker, a doctor and an army brigadier are some that I've spoken to. Retired to get away from the stress of the 2020's workspace and needed to do a bit of something for pocket money.Cobbler_tone said:Work doesn't have to be a 'hard stop', unless that is a non-negotiable in your plans. Every Sainsbury delivery driver is a 50 something with a corporate back story!2 -

MetaPhysical said:

I have discussed that with many delivery supermarket drivers. One was a solicitor, another a city banker, a doctor and an army brigadier are some that I've spoken to. Retired to get away from the stress of the 2020's workspace and needed to do a bit of something for pocket money.Cobbler_tone said:Work doesn't have to be a 'hard stop', unless that is a non-negotiable in your plans. Every Sainsbury delivery driver is a 50 something with a corporate back story!

Yup - i would have no issue with this a few evenings per week (maybe after my retirement honeymoon) - i have spoke to our Tesco delivery guys about it pretty often!

I think what this model also tells me or empowers me, is that i can speak to work and seek changing my role and working 3-4 days per week as a possible glide path to full retirement.

However, there is zero precedent to do this in my company (to give you some context - i have worked in same company for over 2 decades and seen no sebaticals, no career breaks, they didnt even agree to adopt a cycle to work as it was felt too onerous.....they only contribute 4% pension...zero other perks... EXCEPT there are significant Commision bonuses if you perform really well...hence working my !!!!!! off and securing the £1.8m DC pension - but i feel like im now "over it".

So if the reduced working is not viable (which i suspect - despite working often 10- 12 hrs per day and no breaks they want me to do / achieve more and travel more etc etc) then i have the "walk away" fall back position

0 -

On the other hand, Amazon drivers and other parcel delivery drivers, seem to come from a different demographic.MetaPhysical said:

I have discussed that with many delivery supermarket drivers. One was a solicitor, another a city banker, a doctor and an army brigadier are some that I've spoken to. Retired to get away from the stress of the 2020's workspace and needed to do a bit of something for pocket money.Cobbler_tone said:Work doesn't have to be a 'hard stop', unless that is a non-negotiable in your plans. Every Sainsbury delivery driver is a 50 something with a corporate back story!

I suppose a supermarket delivery driver has to engage pleasantly with the customers, whilst if you are just dropping a parcel on a doorstep and ringing a bell before dashing off, it does not matter about your social graces or whether you even speak English or not.1 -

So if the reduced working is not viable (which i suspect - despite working often 10- 12 hrs per day and no breaks they want me to do / achieve more and travel more etc etc) then i have the "walk away" fall back position

Having the FU money is a good stage to be at!0 -

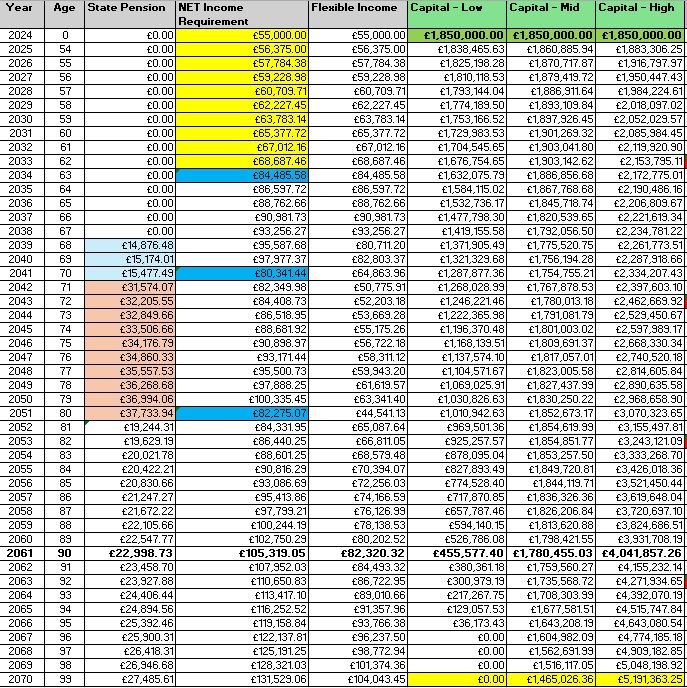

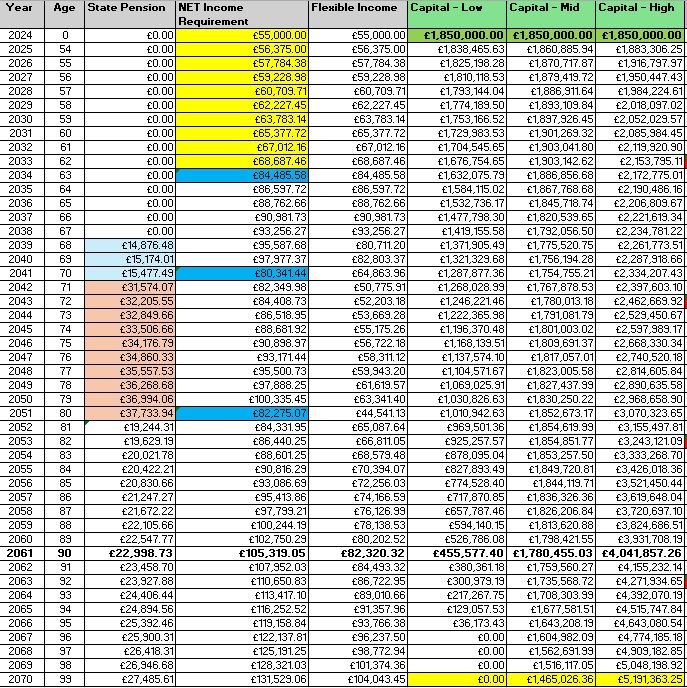

Starmer24 said:so ive updated my model

- for net £55k p.a income

- First 10 yrs are tax free (be that isa or pension lump) - then after that at 63 ive increased by 20% = £66k gross in current prices (assuming 2.5% inflation)

- Then at 70 reduced by 20% = £53k gross in current pricing

- Then reduced again at 80 by a further 20% = £42k in current money.

- I have edited the 3 models to be

low = 2.5%med = 3.75%high = 5%

A few thoughts.

1) Inflation and returns are not smooth like in this useful first model, the 'stress test' (which was in your first table but not the above one), is a more realistic worst case (i.e., bad things happen early on in retirement).

2) Trying to predict future expenditure is tricky - research is not entirely clear cut (some studies suggest a gradual reduction in real expenditure with age, while others suggest little or no change, e.g. see https://ifs.org.uk/publications/how-does-spending-change-through-retirement-0 ).

3) If you purchase an RPI annuity at 55 (it looks like you might possibly be affected by the change in age of access to pensions going from 55 to 57), with current rates (about 3% for a joint, 100% annuity at 55, see https://www.williamburrows.com/calculators/annuity-tables/ ), £600k would purchase £18k of lifetime inflation adjusted income. Notwithstanding my comments about projected future expenditure, post-80yo this combined with your SP (£24k) would supply all of your required income. The remaining portfolio (£1.2m) would then only have to provide flexible income until that age.

0 -

You want to make sure you use as much of your (and your wife's) personal allowance as you can every year even if it means drawing money from pension that you then save into ISA. Also if with the stat pension there is any chance of being a higher rate tax payer post state pension age then you also want to use as much of you basic rate band as you can put into ISAs before state pension ageStarmer24 said:so ive updated my model- for net £55k p.a income

- First 10 yrs are tax free (be that isa or pension lump) - then after that at 63 ive increased by 20% = £66k gross in current prices (assuming 2.5% inflation)

- Then at 70 reduced by 20% = £53k gross in current pricing

- Then reduced again at 80 by a further 20% = £42k in current money.

- I have edited the 3 models to be

low = 2.5%med = 3.75%high = 5% I think....1

I think....1 -

Future expenditure is very individual and depends on your outlook. My folks pull in £40k per year gross (well in their 80’s, Dad pushing 90) and they must spend £15k a year max. If you are budgeting for private care then you just have to add some zeros. Kids are very self sufficient.

Unless you are intending a life of round the world cruises well into old age (and possibly have a very expensive house to run) the typical older household don’t need much. It’s about maximising your fun and adventure whilst you are still able to do so.I personally plan to have self funded health care and have my heating blasting all year round if needed.

I figure some work towards leaving their kids as much as possible (which is admirable) but IMO not the sole purpose of being on the planet, especially those without them!2 -

I would say your assumptions are very conservative.

Assuming your DC and ISA is all in globally diverse equities, then a return of 7% (I'm too new to post links but google monevator pension returns) is average. However, S&P500 has historically returned on average 9%.

Average CPI of 2.5%, and fees of 0.5%.

Real word returns of therefore 4% (this is much higher than your high assumption which ignores inflation and I assume fees).

By subtracting inflation and fees from your returns at source, you can ignore inflation for the rest of your calculation.

So your target then becomes £50K pa until you are 75. £40k after.

It's also just easier to understand what the numbers mean keeping it all in today's money.

I plan on keeping all my savings in equities so I can enjoy hopefully continued growth through my retirement.

Your testing with market crashes ignores the rebound after. You're in it for the long term so not sure I would factor them in. But you do want to plan for them.

You have lots of cash so have the luxury of relying on your cash during recessions.

Looking at your figures I struggle to see any scenario that will leave you with less than you have now in todays money when rigor mortis sets in.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards