We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

HMRC incorrectly state that we've claimed UC via a partially completed online form?

Comments

-

I think you've misunderstood. There is only one claim form; filling in details and clicking 'Submit' is submitting a claim, whether you've completed all the sections or not.Algorithm_Blues said:poppy12345 said:Algorithm_Blues said:

From my perspective, I feel there was no warning that my 'child tax credits' would instantly be removed because of a simple engagement with an online form. I could have been anyone really in this day and age. I've accepted now that I'll have to reimburse the over payment though. However, I do not agree with the methods.. it's all a bit underhand in my view... but we live and learn.

When you submitted that claim you would have also had a warning to say that doing so would end a Tax credits claim.

Unfortunately that was not the case... certainly not in a format that was immediately obvious. I guess this information could be hidden in the T&Cs somewhere, however this was not clear and upfront. If filling in some details as a precursor to completing the form later is deemed a claim, then that doesn't seem right to me.

The gov.uk page for starting a UC claim even says "Your claim starts on the date you submit it in your account."

Not that hindsight is much help to you now in this situation, but hopefully if you come across anything similar in future it will help to know there can be a difference between saving details and submitting the form.0 -

peteuk said:

Nothing underhand - as noted above for you to get to the stage you would have had to fully submit a claim an be advised that your TC will cease. You may have done this by mistake or in doing so not realised.Algorithm_Blues said:

From my perspective, I feel there was no warning that my 'child tax credits' would instantly be removed because of a simple engagement with an online form. I could have been anyone really in this day and age. I've accepted now that I'll have to reimburse the over payment though. However, I do not agree with the methods.. it's all a bit underhand in my view... but we live and learn.

"Underhand" is probably a bit strong... perhaps, not designed well enough for the average person. As in - it's not clear as you move through the form that you've come to the point where you're crossing the 'Rubicon'. You have to click a button to move from one section of the form to another, at no point is there a break from the format that lets you know that this is an important step you are taking. It's simply another 'submit' button.

Such an important decision should have a "Don't Panic" flashing sign indicating what's about to occur. I don't feel like I made a mistake, or didn't realise - this 'unmarked' step was the reason (in my opinion) I conscientiously chose not to 'commit'. Which was the whole premise of my original question - i.e. - What level of information given constitutes completion?

0 -

Just a random punter here.poppy12345 said:

It's not hidden anywhere, it pops up as a message on the screen, once you click submit.Algorithm_Blues said:poppy12345 said:Algorithm_Blues said:

From my perspective, I feel there was no warning that my 'child tax credits' would instantly be removed because of a simple engagement with an online form. I could have been anyone really in this day and age. I've accepted now that I'll have to reimburse the over payment though. However, I do not agree with the methods.. it's all a bit underhand in my view... but we live and learn.

When you submitted that claim you would have also had a warning to say that doing so would end a Tax credits claim.

Unfortunately that was not the case... certainly not in a format that was immediately obvious. I guess this information could be hidden in the T&Cs somewhere, however this was not clear and upfront. If filling in some details as a precursor to completing the form later is deemed a claim, then that doesn't seem right to me.

What is the purpose of a message that pops up on the screen, once you have clicked submit?

Surely a message should pop up on the screen before you click submit?

Or more sensibly IMO, a single click should trigger a warning "Are you sure that you want to submit this UC claim now? If you click submit again, you cannot review this application. Click "save" to defer your application or "submit" to confirm your application.If you've have not made a mistake, you've made nothing1 -

poppy12345 said:

It's not hidden anywhere, it pops up as a message on the screen, once you click submit. When you fill out the form, nothing will happen unless YOU actually click "submit" which is why you can start filling out the form in advance of submitting the claim. You can even save it and go back to it and you have 28 days to complete it. If you don't within that time anything you've saved will be lost.Algorithm_Blues said:poppy12345 said:Algorithm_Blues said:

From my perspective, I feel there was no warning that my 'child tax credits' would instantly be removed because of a simple engagement with an online form. I could have been anyone really in this day and age. I've accepted now that I'll have to reimburse the over payment though. However, I do not agree with the methods.. it's all a bit underhand in my view... but we live and learn.

When you submitted that claim you would have also had a warning to say that doing so would end a Tax credits claim.

Unfortunately that was not the case... certainly not in a format that was immediately obvious. I guess this information could be hidden in the T&Cs somewhere, however this was not clear and upfront. If filling in some details as a precursor to completing the form later is deemed a claim, then that doesn't seem right to me.

It's impossible to actually start a claim without submitting it, which you obviously did but didn't realise.

"...it pops up as a message on the screen, once you click submit". This seems to be counterintuitive - as in perhaps the consequences of your decision should be relayed before you push the big red button.

My experience is partially filling out the form, then at some indistinguishable point being confronted with an option to commit to the information I'd been given 'or else'... that is when I left the building - as I was denied the option the check the information I had provide up to that point.It's possible I might have had an option to save, although as I've said I was denied the choice to go back to revue my previous information. Also, I certainly didn't have 28 days to gather the missing details to complete it as you say - as I was inundated with numerous invitations to meetings and phone interviews over the next few days... which as an aside felt very A.I. orientated!

Perhaps, it would have been fairer to have '28 Days" - a rather dystopian choice I must say - to choose whether or not to continue with the process, rather that being blindsided into a choice that I didn't have time to consider carefully - which seems like something a dodgy sales person might do!

0 -

Algorithm_Blues said:

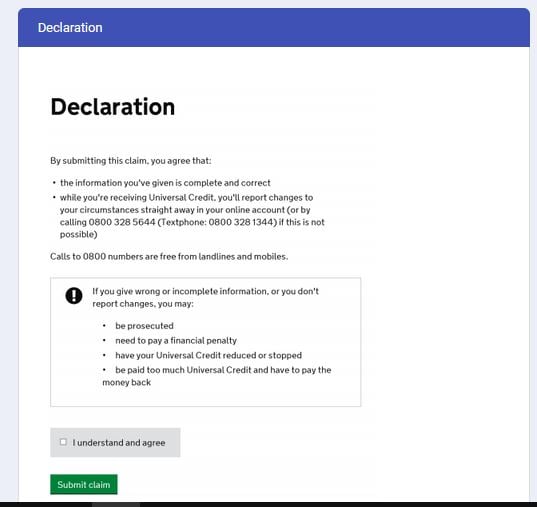

Such an important decision should have a "Don't Panic" flashing sign indicating what's about to occur. I don't feel like I made a mistake, or didn't realise - this 'unmarked' step was the reason (in my opinion) I conscientiously chose not to 'commit'. Which was the whole premise of my original question - i.e. - What level of information given constitutes completion?Any level of information. it's submitting the claim -complete or not - that counts.TBH it's unlikely that anyone would 'Submit claim' by mistake, although I suppose that it could happen if someone was just clicking through (in a hurry?) without reading.All the green buttons on the online claim form say 'Continue' (or 'Next') - up to and including the 2 pre-final pages entitled "Confirm your details are correct" and "Your responsibilities" which both have "Next".After which is the final page "Declaration" on which the green button says "Submit claim" If you are completely 100% sure that you didn't click the boxes and then 'Next' or 'Submit claim' on those final 3 pages then I don't know what else to say.

If you are completely 100% sure that you didn't click the boxes and then 'Next' or 'Submit claim' on those final 3 pages then I don't know what else to say.

I think that it would be difficult to persuade anyone otherwise, (DWP, HMRC, or even a tribunal), unless you can find others who are saying the same thing.4 -

Newcad said:Algorithm_Blues said:

Such an important decision should have a "Don't Panic" flashing sign indicating what's about to occur. I don't feel like I made a mistake, or didn't realise - this 'unmarked' step was the reason (in my opinion) I conscientiously chose not to 'commit'. Which was the whole premise of my original question - i.e. - What level of information given constitutes completion?Any level of information. it's submitting the claim -complete or not - that counts.TBH it's unlikely that anyone would 'Submit claim' by mistake, although I suppose that it could happen if someone was just clicking through (in a hurry?) without reading.All the green buttons on the online claim form say 'Continue' (or 'Next') - up to and including the 2 pre-final pages entitled "Confirm your details are correct" and "Your responsibilities" which both have "Next".After which is the final page "Declaration" on which the green button says "Submit claim" If you are completely 100% sure that you didn't click the boxes and then 'Next' or 'Submit claim' on those final 3 pages then I don't know what else to say.

If you are completely 100% sure that you didn't click the boxes and then 'Next' or 'Submit claim' on those final 3 pages then I don't know what else to say.

I think that it would be difficult to persuade anyone otherwise, (DWP, HMRC, or even a tribunal), unless you can find others who are saying the same thing.

"Any level of information. it's submitting the claim - complete or not - that counts".

So, if I followed this logic in any other arena - finance, legal, business, etc - you think that would be fine?

I was reading carefully - how carefully is subjective. I know how serious these processes are which is why I decided not to continue without giving the proper information. I chose not to make the 'commitement'.

All those green buttons are quite powerful signifiers don't you think? Which I would imagine the majority of people might associate with a positive aspect, such as: go ahead, it's safe, it's healthy, etc. I would also say that the text is rather small and not very clearly deliniated, especially if you are using a tablet or smart phone for example.Perhaps an amber or red button might be helpful to distinguish when a choice has more import or has irreversible consequences. Constant greens I would say might encourage some to 'hurry' through as you put it.

I absolutely didn't reach this 'declaration' page... although I notice that the very first bulletpoint states:-

"the information you've given is complete and correct"

Therefore, if I had clicked the "I understand and agree" button - I would have been liable to:-

Be prosecuted or face a financial penalty!

No one can be absolutely one hundred percent sure of anything really, as all of us have the capacity to lie to ourselves for multiple reasons - whether we're aware of it or not. I'm also averse to banging my head against a brick wall forever hoping for a crumb of solace from those behemoths you mention... I will accept my punishment gracefully and inform my children that 'ice cream' has been deemed no longer necessary!

On your final point, I really hope that I'm in the minority on this, as there will be a lot of people being forced down this route against their own instincts, out of necessity.

0 -

Underhand is the word you used, in one of your replies. Thousands of people use the claim system (including my 18 yr old son) if you failed to complete a section, planing on returning to it then thats the way you planned to apply. Im not sure how many people choose this option, surely with something so important you devote time and complete it fully (I get this isn’t always possible for a number of reasons)Algorithm_Blues said:peteuk said:

Nothing underhand - as noted above for you to get to the stage you would have had to fully submit a claim an be advised that your TC will cease. You may have done this by mistake or in doing so not realised.Algorithm_Blues said:

From my perspective, I feel there was no warning that my 'child tax credits' would instantly be removed because of a simple engagement with an online form. I could have been anyone really in this day and age. I've accepted now that I'll have to reimburse the over payment though. However, I do not agree with the methods.. it's all a bit underhand in my view... but we live and learn.

"Underhand" is probably a bit strong... perhaps, not designed well enough for the average person. As in - it's not clear as you move through the form that you've come to the point where you're crossing the 'Rubicon'. You have to click a button to move from one section of the form to another, at no point is there a break from the format that lets you know that this is an important step you are taking. It's simply another 'submit' button.

Such an important decision should have a "Don't Panic" flashing sign indicating what's about to occur. I don't feel like I made a mistake, or didn't realise - this 'unmarked' step was the reason (in my opinion) I conscientiously chose not to 'commit'. Which was the whole premise of my original question - i.e. - What level of information given constitutes completion?

Bottom line now is you applied, you withdrew, your TC continued (wrongly in my view) you have an overpayment…you can complain about this however I believe even if the overpayment is technically HMRCs mistake the claimant is still liable for the overpayment. In their defence they would show you your migration letter that states your TC will stop once you apply for UC or at the end of your migration period. It will also point to your successful application for UC, which you subsequently withdrew from. So in the eyes of HMRC/DWP you knew you shouldn’t be receiving TC at that point.

Proud to have dealt with our debtsStarting debt 2005 £65.7K.

Current debt ZERO.DEBT FREE0 -

Again, this happened because you clicked submit and started the claim. None of that happens before clicking submit because a claim hasn't been started before that.Algorithm_Blues said:poppy12345 said:

It's not hidden anywhere, it pops up as a message on the screen, once you click submit. When you fill out the form, nothing will happen unless YOU actually click "submit" which is why you can start filling out the form in advance of submitting the claim. You can even save it and go back to it and you have 28 days to complete it. If you don't within that time anything you've saved will be lost.Algorithm_Blues said:poppy12345 said:Algorithm_Blues said:

From my perspective, I feel there was no warning that my 'child tax credits' would instantly be removed because of a simple engagement with an online form. I could have been anyone really in this day and age. I've accepted now that I'll have to reimburse the over payment though. However, I do not agree with the methods.. it's all a bit underhand in my view... but we live and learn.

When you submitted that claim you would have also had a warning to say that doing so would end a Tax credits claim.

Unfortunately that was not the case... certainly not in a format that was immediately obvious. I guess this information could be hidden in the T&Cs somewhere, however this was not clear and upfront. If filling in some details as a precursor to completing the form later is deemed a claim, then that doesn't seem right to me.

It's impossible to actually start a claim without submitting it, which you obviously did but didn't realise.It's possible I might have had an option to save, although as I've said I was denied the choice to go back to revue my previous information. Also, I certainly didn't have 28 days to gather the missing details to complete it as you say - as I was inundated with numerous invitations to meetings and phone interviews over the next few days... which as an aside felt very A.I. orientated!2 -

It's asking if you're certain you want to do that. The reason it says that is during the pandemic many people claimed UC and didn't realise by doing so would end Tax credits and any other means tested benefits they may have been claiming. There were many people that wouldn't have been entitled to UC but didn't realise their Tax credits ended after submitting the claim.Algorithm_Blues said:poppy12345 said:

It's not hidden anywhere, it pops up as a message on the screen, once you click submit. When you fill out the form, nothing will happen unless YOU actually click "submit" which is why you can start filling out the form in advance of submitting the claim. You can even save it and go back to it and you have 28 days to complete it. If you don't within that time anything you've saved will be lost.Algorithm_Blues said:poppy12345 said:Algorithm_Blues said:

From my perspective, I feel there was no warning that my 'child tax credits' would instantly be removed because of a simple engagement with an online form. I could have been anyone really in this day and age. I've accepted now that I'll have to reimburse the over payment though. However, I do not agree with the methods.. it's all a bit underhand in my view... but we live and learn.

When you submitted that claim you would have also had a warning to say that doing so would end a Tax credits claim.

Unfortunately that was not the case... certainly not in a format that was immediately obvious. I guess this information could be hidden in the T&Cs somewhere, however this was not clear and upfront. If filling in some details as a precursor to completing the form later is deemed a claim, then that doesn't seem right to me.

It's impossible to actually start a claim without submitting it, which you obviously did but didn't realise.

"...it pops up as a message on the screen, once you click submit". This seems to be counterintuitive - as in perhaps the consequences of your decision should be relayed before you push the big red button.

You are the one that filled in the form, you are the one that submitted the claim. When I fill out any form I always make sure I read everything.2 -

Just to be absolutely clear here:I do accept that the OP may not have actually clicked the 'Submit Claim' button and submitted the claim.But that whole argument is a Red Herring - it makes no difference here.The Managed Migration notice is primarily a notice that your Tax Credits (and/or any legacy IR benefits) will end on a certain date.

It also tells you that if you choose to claim UC instead then special 'Transitional' rules will apply to that claim if made before the notified date.Whether you choose to claim UC or not is your choice, but whatever choice you make the Tax Credits (and/or legacy benefits) still end on the notified date.They don't end because you have claimed UC - you claim UC (or not) because they are ending.If TCs (and/or legacy benefits) continue to be paid after that notified date then that is an error and an overpayment.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.5K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.9K Spending & Discounts

- 244.5K Work, Benefits & Business

- 599.8K Mortgages, Homes & Bills

- 177.2K Life & Family

- 258.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards