We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Bonds via funds

Comments

-

The numbers certainly don't bear that out, or they would have paid more than £11m in tax, perhaps the key words are "received by the funds". Based on note 5b, they deducted £8m from corporation tax, that equates to £40m of the income not being taxed. That's the vast majority of distributed income. Same picture in 2022, £4.4m in tax, £4.0m deducted, actual charge £0.4m with distributions of £22.6m. You will probably find the tax relates to income used to cover non-allowable expenses (agent's fees of £4.7m?), property income distributions (which are taxed at source), etc.Compound_2 said:Yes, that is the same figure I saw. What made me think the tax relates to the income from bonds was the following from the Taxation section of the OpenFunds Prospectus:'Dividends received by the Funds are generally exempt from corporation tax. Income other than dividends

received by the Funds is liable to corporation tax after deducting allowable expenses of management...

Where a Fund holds an investment in any other onshore or offshore fund that during the Fund’s accounting

period is broadly greater than 60% invested, directly or indirectly (through similar funds or derivatives) in cash,

bonds or derivatives linked to similar assets, any amounts accounted for as income will be taxable income of

the Fund for the period concerned.'

0 -

I would distinguish between deductions (management expenses) and exempt amounts (dividends). Thus it seems to me that the Fund's income after deductions is being taxed 20% for interest and 0% for dividends. The Prospectus is a regulated document; incorrect information would be a serious matter.

0 -

Compound_2 said:I would distinguish between deductions (management expenses) and exempt amounts (dividends). Thus it seems to me that the Fund's income after deductions is being taxed 20% for interest and 0% for dividends. The Prospectus is a regulated document; incorrect information would be a serious matter.The information in the prospectus contradicts what you are suggesting. This information will not be incorrect. So the bond interest is not distributed net of 20% corporation tax. You have misinterpreted the text you quoted above.The fund contains less than 20% equities, so it is preposterous to suggest £40m of the £61.9m total revenue came from dividends. £40m being the untaxed amount. This will clearly consist primarily of interest together with a small amount of dividends.0

-

Balanced Portfolio is approximately 60% equities.The fund contains less than 20% equities, so it is preposterous to suggest £40m of the £61.9m total revenue came from dividends.

0 -

Compound_2 said:

Balanced Portfolio is approximately 60% equities.The fund contains less than 20% equities, so it is preposterous to suggest £40m of the £61.9m total revenue came from dividends.Apologies, you've completely confused me. I had the Trustnet page open for Cautious and opened the annual report from there. I hadn't noticed we'd drifted so far up the risk scale. I'd assumed this thread was about bond funds.The yield from the equities part will be about 1.6% whereas the yield from the bonds part will be about 2.5%. Which suggests a fairly even split between interest income and dividend income. If what you are suggesting is true, you'd expect them to have paid 20% tax on about half the income (about £6m in tax rather than the £3.3m actually paid), so the figures still don't support your interpretation.The earlier example I posted of the simpler corporate bond fund shows no tax paid. So something funny is going on within these multi-asset funds, but I don't understand exactly what it is.1 -

Looking at the last part of the quoted text above, perhaps that's the explanation. The fund holds a mixture of direct fixed interest securities and indirect holdings through sub-funds. If it were just the latter that had been taxed, then I think that explains the numbers.So it looks like a fund of funds issue, which is why the simple corporate bond fund is unaffected.1

-

This might be helpful here.. https://techzone.abrdn.com/anon/public/investment/Guide-Taxation-of-Collectives3

-

MK62 said:This might be helpful here.. https://techzone.abrdn.com/anon/public/investment/Guide-Taxation-of-CollectivesIf I am reading between the lines correctly, it implies it is the fact that the fund is making dividend distributions rather than interest distributions that prevents the tax on interest income being relievable. So it is the act of transforming interest into dividends that blocks tax relief. I suppose the income received by the fund cannot be matched to an equivalent distribution to unit holders of the fund.However, I still don't think all of the interest income could have been taxed at 20% in the HSBC example. Perhaps the explanation for this is foreign withholding tax that is relieved by double taxation treaty. Most of the interest income will be foreign and close to half of it appears to have had relief.If correct, then that would suggest multi-asset funds containing 40% equities or more (dividend distributions) are less tax efficient than holding separate equity and bond funds, due to irrecoverable tax when held within ISA/SIPP and potential double taxation of dividends when held unwrapped. Is this really the case? It would be news to me. As it happens, I have always kept my own bond exposure separate, but not for this reason.1

-

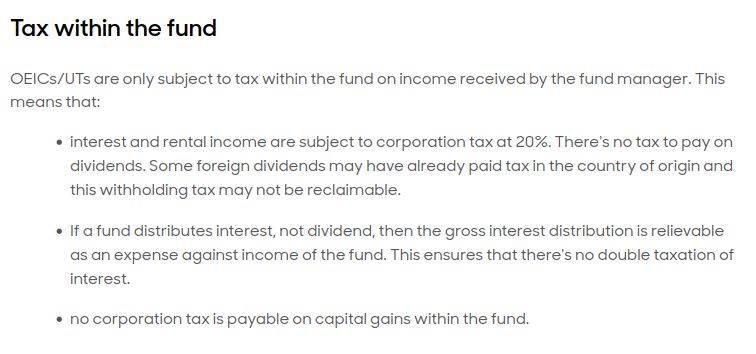

Hmmm.....my take was slightly different.....for the fund, no corporation tax is payable on dividends received, and corporation tax is chargeable on any interest received, but relieved against any of that interest which is distributed (less other allowable deductions).

For the individual, the income they receive from the fund is treated entirely as a dividend (the equity is above 40%), but of that income, neither the dividend nor the interest components have previously been taxed, so there is no double taxation.

The same applies if the equity is below 40%, but now the income is classed as interest to the individual, but again, neither of the underlying components of that income has previously been taxed.

1 -

MK62 said:Hmmm.....my take was slightly different.....for the fund, no corporation tax is payable on dividends received, and corporation tax is chargeable on any interest received, but relieved against any of that interest which is distributed (less other allowable deductions).

For the individual, the income they receive from the fund is treated entirely as a dividend (the equity is above 40%), but of that income, neither the dividend nor the interest components have previously been taxed, so there is no double taxation.

The same applies if the equity is below 40%, but now the income is classed as interest to the individual, but again, neither of the underlying components of that income has previously been taxed.That was my initial understanding too, but it is not consistent with the annual report data for this multi-asset fund where corporation tax clearly has been deducted, and a distribution made net of that tax. UK OEICs must distribute all of the income they receive (less deduction of expenses where they are structured to deduct these from income rather than capital). It was this section that I think addresses the issue at hand, particularly the second bullet point: In the example we have been looking at, the fund distributes a dividend, not interest, so it follows that the interest distribution is not relievable as an expense against the income, and without that relief double taxation is not prevented.1

In the example we have been looking at, the fund distributes a dividend, not interest, so it follows that the interest distribution is not relievable as an expense against the income, and without that relief double taxation is not prevented.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards