We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Bonds via funds

Compound_2

Posts: 310 Forumite

From my reading, it seems OEICs pay 20% corporation tax on income from bonds. Is this right and does it make the asset class less desirable considering fees too? Most people can earn such interest free of deductions if holding direct (ISA/PSA). In the case of a fund of funds, could corpration tax double up?

0

Comments

-

No idea on the corporation tax status for OEICs, but since performance is reported after fees it's easy to compare desirability vs other asset classes.Compound_2 said:From my reading, it seems OEICs pay 20% corporation tax on income from bonds. Is this right and does it make the asset class less desirable considering fees too? Most people can earn such interest free of deductions if holding direct (ISA/PSA). In the case of a fund of funds, could corpration tax double up?

1 -

Compound_2 said:From my reading, it seems OEICs pay 20% corporation tax on income from bonds. Is this right and does it make the asset class less desirable considering fees too? Most people can earn such interest free of deductions if holding direct (ISA/PSA). In the case of a fund of funds, could corpration tax double up?Companies would pay corporation tax on their profits. Company dividends would be distributed net of any corporation tax. Interest on bonds would be taxable on the end investor, not the fund itself. I doubt there is double taxation when received into an OEIC, especially as they have to distribute all of the income they receive to investors. Perhaps you could post a link to your source.0

-

The source is HSBC Global Asset Management (OEIC Prospectus, Annual Report).Evaluating bond fund performance figures could be problematic when their data is for recent years, a period of bonds underperforming cash due to central banks raising interest rates.0

-

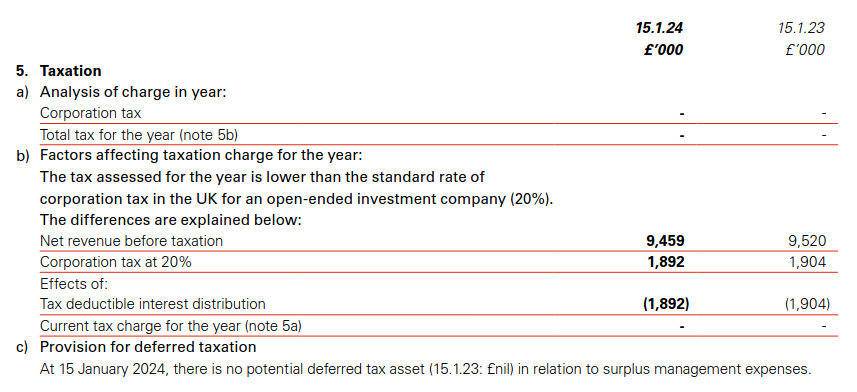

Compound_2 said:The source is HSBC Global Asset Management (OEIC Prospectus, Annual Report).That report states: "Corporation tax is charged at 20% of the revenue liable to corporation tax less expenses"Taking for example the Corporate Bond fund, here is the section on taxation:

Could you point out where in those past 2 years any corporation tax was paid? Looks to me like it was 100% deductible owing to the interest distributions. Total tax for the year (5a) was zero with the breakdown shown in 5b. None of the income was retained by the OEIC, so it was not taxed. The income is taxable on the fund's investors.2

Could you point out where in those past 2 years any corporation tax was paid? Looks to me like it was 100% deductible owing to the interest distributions. Total tax for the year (5a) was zero with the breakdown shown in 5b. None of the income was retained by the OEIC, so it was not taxed. The income is taxable on the fund's investors.2 -

I was looking at the documents for the multi-asset Global Strategy Portfolios (HSBC OpenFunds).

0 -

and what do the figures show there?Compound_2 said:I was looking at the documents for the multi-asset Global Strategy Portfolios (HSBC OpenFunds).

1 -

Over 3m tax in Balanced Portfolio for year ending April 2023.

0 -

Link and screenshot?Compound_2 said:Over 3m tax in Balanced Portfolio for year ending April 2023.1 -

Files are accessible via the HSBC website but you must first agree to their regulatory disclaimers.

0 -

Yes, that is the same figure I saw. What made me think the tax relates to the income from bonds was the following from the Taxation section of the OpenFunds Prospectus:'Dividends received by the Funds are generally exempt from corporation tax. Income other than dividends

received by the Funds is liable to corporation tax after deducting allowable expenses of management...

Where a Fund holds an investment in any other onshore or offshore fund that during the Fund’s accounting

period is broadly greater than 60% invested, directly or indirectly (through similar funds or derivatives) in cash,

bonds or derivatives linked to similar assets, any amounts accounted for as income will be taxable income of

the Fund for the period concerned.'

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards