We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Buying a little piece of Middle England; Manifesting my way to mortgage free.

Comments

-

Had a total panic when Immersion was mentioned here so went to ask DP as I also remember years ago my mum got a high bill with one of these ...but apparently we don't have one. We DO have an electric shower but only I use it. It's in our room and tiny I'm the only one and DD who fits in it. But I'm the only one who chooses to use it. Surely it can't be that 😨 If so I'm not using it nowslm6002 said:I was going mention the emersion too as have in the past had that on and got a bigger billEmergency Fund goal - £717.77/1500

Weight loss goal 1 - 1/7 lb

Mortgage OP goal 2026 - £103.62/£4500

New Diary- https://forums.moneysavingexpert.com/discussion/6647063/investing-in-us-holidays-health-and-the-road-to-150k#latest1 -

If you have daily meter readings then it suggests the smart meter is working. Make sure you are set up for half hourly readings as that gives you a more accurate view (on electricity - I don’t have gas so have no clue about that) of when the usage happened. It could be a fridge or freezer compressor kicking in (they don’t run continuously and old ones can be energy hungry), there may have been things left on/left on standby.Is the unexpected cost on the gas or electricity? You should have separate readings for each meter, and separate information about usage and costs even if you only have one bill.2

-

I use an electric shower. It’s certainly not that expensive!I am a Forum Ambassador and I support the Forum Team on Mortgage Free Wannabe & Local Money Saving Scotland & Disability Money Matters. If you need any help on those boards, do let me know.Please note that Ambassadors are not moderators. Any post you spot in breach of the Forum Rules should be reported via the report button , or by emailing forumteam@moneysavingexpert.com. All views are my own & not the official line of Money Saving Expert.

Lou~ Debt free Wanabe No 55 DF 03/14.**Credit card debt free 30/06/10~** MFW. Finally mortgage free O2/ 2021****

"A large income is the best recipe for happiness I ever heard of" Jane Austen in Mansfield Park.

***Fall down seven times,stand up eight*** ~~Japanese proverb. ***Keep plodding*** Out of debt, out of danger. ***Be the difference.***

One debt remaining. Home improvement loan.1 -

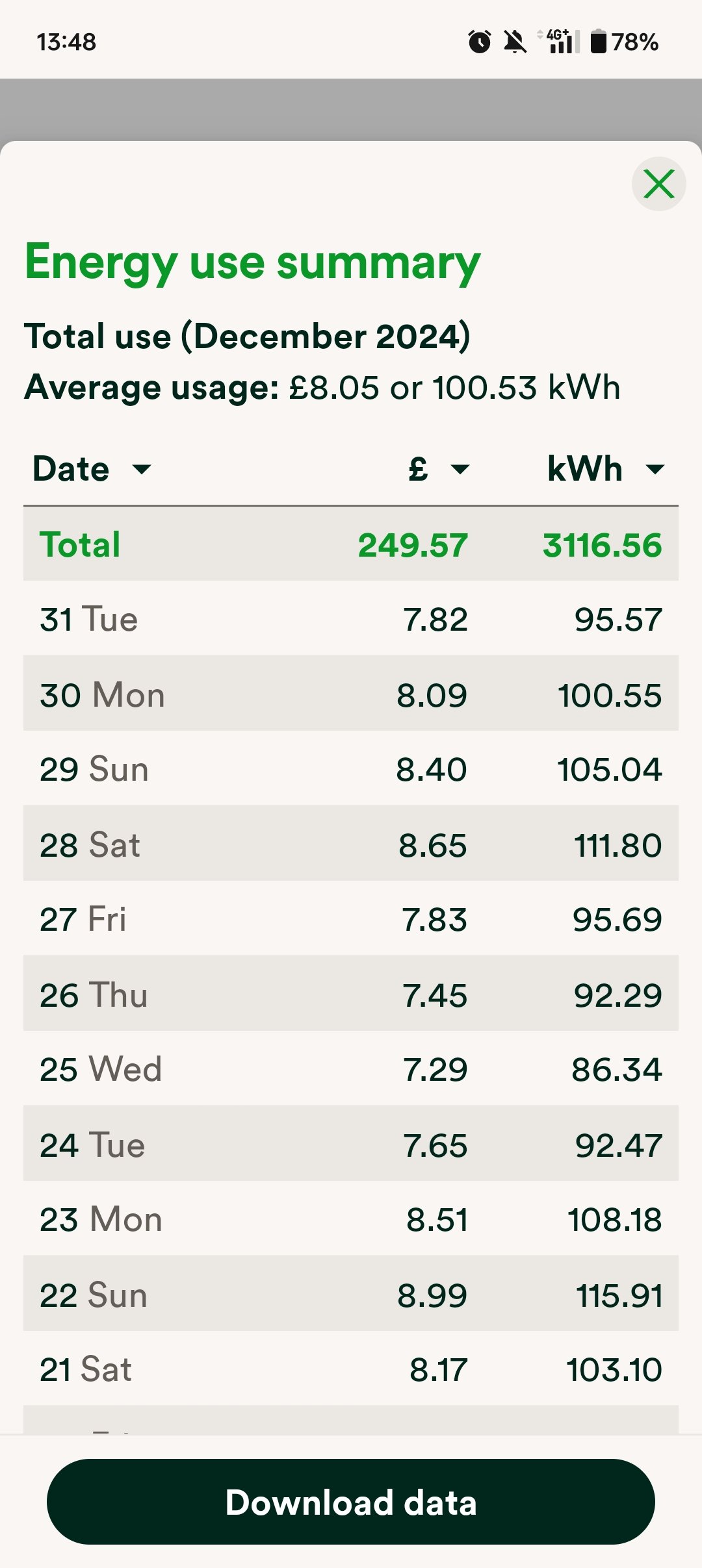

Is that not a table of kWh usage..? Elec on the left and Gas on the right?

2 -

I agree with Lil Smiler, that is your KWH consumption, not the charges.

It may help to share this:

My December gas was 1988.2 kWh @ 5.420p/kWh £107.76 ( think my boiler was not working for part of that)

My December electric was 1133.0 kWh @ 20.996p/kWh £237.88 (see above - running electric heating and immersion for HW) - if your December electric use was 250 KWH then you did about a quarter of mine. This is charges for actual use, the standing charge is on top of that.My mortgage free diary: +++ Divide by Cucumber Error. Please reinstall universe and reboot+++

GNU Mr Redo1 -

I was going to ask if some of it is the standing charge tooMe, DD1 20, DS 18, DD2 15, Debt Free 04/18, Single Mum since 11/191

-

As others have said, that could be showing units used. 8 units used @22p a unit is £1.76 but it seems your bill is showing a debt rather than what your smart meter is showing.One thing you can do is take a reading, turn everything off you can think of that uses electricity for one hour and then read the meter again. If there has been no movement on the reading then your meter is accurate.

If the reading has gone up then either there is a problem with the meter or you have something else plugged in that you haven’t turned off so you’d need to investigate that first. Anything outside/up in the attic/down in the basement etc.

Electric showers can be expensive as they are heating water but you tend to use them for a short time so the overall cost is usually low.

So to explain most showers are 8.5kW to 10.5kW. I’ll take 10kW to make it easier. Assume your shower is 10kW. What that means is if it was used for an hour it would use 10 electricity units costing you your unit price (24.86p if you are on the energy cap). Therefore an hour’s usage of this shower would cost £2.48. If you used it 15 mins a day then it would take 4 days to cost £2.48. Hope that makes sense and sorry if I’m teaching you to suck eggs!

An oven is usually around 3kW so will use 3 units if on for an hour costing just shy of 75p for every hour it’s on.

People tend to focus on cost of their bill for obvious reasons but you need initially focus on what electric appliances you have, what they use per hour, and how often you use them. That helps you understand what your high cost appliances are.I’m happy to look at the actual bill you’ve received if you would like me to and I can try and explain how they’ve got to the figures they have. I’d need to see all the figures for gas and electric, readings, standing charges, pence per unit and dates. I don’t know if you can send it me privately and obviously redact your name and address or crop it. Only if you want to!CC Debt at LBM Nov 08 - £25000+ DFD Dec 2012Second DFD May 2021Starting my MFW journey: Opening Balance: £138,000; July 2019: £135107.33; July 2024 £52974.60; July 2025 £11140.232025 MFW #361 -

I think it's the combined cost. It's the electric I was more concerned with. The gas kinda looked right to me? And was expected.

They tried to call me earlier but I was in work so had to end the call and will have to speak to them another time.

Thank you for all the comments it's helped a bit. I think that 1- the shower is taking up a lot of what I hadn't thought about. And 2- all of the spotlights.

T4mof I was concerned more with the cost tbh now I've looked at usage I can see better what could have been used.

Redo that's helpful thank you- although the ta ble is £ not kWh I think? I shared a better pic above.

Before we moved I got rid of everything that cost too much to run but obviously things like showers and lights came with the house. Lights in the kitchen/ dining room are here forthwith banned from use(we have twenty I just counted). Ditto for our bedroom.

Also yes I think some was accruing debt because the smart meter was broken and now it's on it is adding on debt to debt each month because the DD is not covering it.

Standing charges I had considered already but perhaps not the right amount considering all the price hikes. I'm usually really savvy with these bills and it's just thrown me totally as I wasn't expecting it to be so much. I need to speak to them they seemed keen to help on the phone but I have zero headspace right now and had a horrible day at work. Which is why I'm not responding to each of you separately (sorry) I do appreciate all the help and I'll be honest you've all calmed me down somewhat 🙈🤣Emergency Fund goal - £717.77/1500

Weight loss goal 1 - 1/7 lb

Mortgage OP goal 2026 - £103.62/£4500

New Diary- https://forums.moneysavingexpert.com/discussion/6647063/investing-in-us-holidays-health-and-the-road-to-150k#latest2 -

Sorry to hear about your bad day at work. Just shout up if you need any more help with your bill but sounds like it’s making more sense to you.CC Debt at LBM Nov 08 - £25000+ DFD Dec 2012Second DFD May 2021Starting my MFW journey: Opening Balance: £138,000; July 2019: £135107.33; July 2024 £52974.60; July 2025 £11140.232025 MFW #360

-

My head feels like mashed potato this evening. I've had a really stressful day at work and ended up in tears for around an hour after a huge trigger set me off and then a massive argument with a student.... actually 3 students as two jumped in- all ganging up on me but one main one. Teacher had left the class with another student who was misbehaving and I was on my own.

I managed to keep it together until I left the classroom and then someone said the words that always set you off ...are you okay? And that was it. Spent an hour in an office sobbing.

One of my biggest triggers with my cptsd is loud noises and intimidating males. And one walked past me and literally shouted at the top of his voice into my personal space (into my face) and then expected me to not react. He scared the life out of me. I'm jumpy as anything always have been since a child. And have a horrible nervous disposition. Then three of them argued with me when I told the one who did it they were in the wrong for doing so. I raised my voice which made them all gang up and start shouting at me. One calling me a b1tch. One is on a final warning for behaviour already and should be gone. But they just have excuses after excuses to keep them on even when they disrupt every single class they're in. I had a genuine apology from the one who called me a name the other two sniggered and went back to pretending they were gangsters.

I was swapped to a different class for the rest of the day but it took me two hours to stop shaking and feeling tearful. I still do now I'm fact and no doubt will dread my Fridays even more going forward.

Dinner tonight is take away and OVO can wait until Monday when I have headspace to talk to them about it. - ps I think all I'm concerned about there is now very expensive standing charges on days where my house is empty and nothing was switched on; that still seems wrong to me?

Take away deserved by all this week.

DS has fallen out with his girlfriend and was tearful yesterday. Although I think he's made up with her now.

DD has been having a tough week too. And well mine was okay aside from today. DP has to listen to my moaning about work 🤣🙈Emergency Fund goal - £717.77/1500

Weight loss goal 1 - 1/7 lb

Mortgage OP goal 2026 - £103.62/£4500

New Diary- https://forums.moneysavingexpert.com/discussion/6647063/investing-in-us-holidays-health-and-the-road-to-150k#latest2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards