We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Autumn statement - ISA rule changes from April 2024

Comments

-

Also no tax to be paid on withdrawal from a LISA once you are 60.eskbanker said:

I don't really see the new regime making a material difference to the LISA proposition - the fundamental restrictions with that product remain the same, i.e. limited contributions, withdrawal penalties, etc, and the benefits side of the equation (the 25% bonus) is also unaltered, so why/how would the April 2024 changes affect the comparison between LISAs and SIPPs?ircE said:Assuming I understand this correctly, and the new freedoms will apply to LISAs, what will be the point of using a LISA for retirement? Surely you'd just be subjecting yourself to more restrictions than a SIPP, so people will just use that vehicle instead. Won't LISAs now just become government subsidies for first-time home-buyers?

As you say I do not see the recently announced changes to ISA's affecting the pros and cons of LISA vs pension.

@ircE

Pros and cons explained later in this link.

Lifetime ISA (LISA): how they work & best buys (moneysavingexpert.com)

1 -

To be pedantic, there's never any tax to be paid on withdrawal from any ISA at any time!Albermarle said:

Also no tax to be paid on withdrawal from a LISA once you are 60.

But yes, no withdrawal penalties after 60....0 -

I wonder how this would work with flexible ISAs. I've currently got £20k sitting in a flexible cash ISA that I've put in this year, as well as subscribing to a S&S ISA. As long as I take out of my cash ISA an equivalent amount that I've paid into my S&S ISA before the end of the tax year, this is acceptable.

What will stop people paying into multiple flexible ISAs during the course of the year, but then withdrawing from them before 5th April?I consider myself to be a male feminist. Is that allowed?1 -

Good question. I think the whole thing could be completely unmanageable and might get reversed quite soon afterwards. Like you say, as long as you have the correct balance at the end of the year which is reported to HMRC then a higher amount is allowed during that year which could be in multiple accounts.surreysaver said:What will stop people paying into multiple flexible ISAs during the course of the year, but then withdrawing from them before 5th April?Remember the saying: if it looks too good to be true it almost certainly is.1 -

Let's wait until we get there. It is possible there will be changes to reporting that go hand in hand with these increased freedoms - although I wouldn't be surprised if this aspect is not addressed.

1 -

I'm wondering if I've misunderstood ? Anyone who pays more than £20k of new subscriptions in total into any combination of ISAs of any type in the same tax year will have broken the £20k ISA limit rule and therefore made a false statement on any cash ISA declarations, regardless of the state of play at the end of the tax year or whether that's now or during the next tax year (after the rule changes).surreysaver said:I wonder how this would work with flexible ISAs. I've currently got £20k sitting in a flexible cash ISA that I've put in this year, as well as subscribing to a S&S ISA. As long as I take out of my cash ISA an equivalent amount that I've paid into my S&S ISA before the end of the tax year, this is acceptable.

What will stop people paying into multiple flexible ISAs during the course of the year, but then withdrawing from them before 5th April?"I declare that I have not subscribed/made a payment to and will not subscribe/make a payment more than the overall subscription limit in total to any combination of permitted ISA types in the same tax year"1 -

This echoes a discussion on here from a year ago:refluxer said:

I'm wondering if I've misunderstood ? Anyone who pays more than £20k of new subscriptions in total into any combination of ISAs of any type in the same tax year will have broken the £20k ISA limit rule and therefore made a false statement on any cash ISA declarations, regardless of the state of play at the end of the tax year or whether that's now or during the next tax year (after the rule changes).surreysaver said:I wonder how this would work with flexible ISAs. I've currently got £20k sitting in a flexible cash ISA that I've put in this year, as well as subscribing to a S&S ISA. As long as I take out of my cash ISA an equivalent amount that I've paid into my S&S ISA before the end of the tax year, this is acceptable.

What will stop people paying into multiple flexible ISAs during the course of the year, but then withdrawing from them before 5th April?"I declare that I have not subscribed/made a payment to and will not subscribe/make a payment more than the overall subscription limit in total to any combination of permitted ISA types in the same tax year"

https://forums.moneysavingexpert.com/discussion/6407177/flexible-cash-isa-and-s-s-isa-rules/p1

1 -

You have misunderstood. Here's the thread started by myself earlier this yearrefluxer said:

I'm wondering if I've misunderstood ? Anyone who pays more than £20k of new subscriptions in total into any combination of ISAs of any type in the same tax year will have broken the £20k ISA limit rule and therefore made a false statement on any cash ISA declarations, regardless of the state of play at the end of the tax year or whether that's now or during the next tax year (after the rule changes).surreysaver said:I wonder how this would work with flexible ISAs. I've currently got £20k sitting in a flexible cash ISA that I've put in this year, as well as subscribing to a S&S ISA. As long as I take out of my cash ISA an equivalent amount that I've paid into my S&S ISA before the end of the tax year, this is acceptable.

What will stop people paying into multiple flexible ISAs during the course of the year, but then withdrawing from them before 5th April?"I declare that I have not subscribed/made a payment to and will not subscribe/make a payment more than the overall subscription limit in total to any combination of permitted ISA types in the same tax year"

https://forums.moneysavingexpert.com/discussion/6438967/flexible-cash-isa-plus-stocks-shares-isa

This article on MSE is wrong, as you cannot have a flexible S&S ISAI consider myself to be a male feminist. Is that allowed?0 -

surreysaver said:

You have misunderstood. Here's the thread started by myself earlier this yearrefluxer said:

I'm wondering if I've misunderstood ? Anyone who pays more than £20k of new subscriptions in total into any combination of ISAs of any type in the same tax year will have broken the £20k ISA limit rule and therefore made a false statement on any cash ISA declarations, regardless of the state of play at the end of the tax year or whether that's now or during the next tax year (after the rule changes).surreysaver said:I wonder how this would work with flexible ISAs. I've currently got £20k sitting in a flexible cash ISA that I've put in this year, as well as subscribing to a S&S ISA. As long as I take out of my cash ISA an equivalent amount that I've paid into my S&S ISA before the end of the tax year, this is acceptable.

What will stop people paying into multiple flexible ISAs during the course of the year, but then withdrawing from them before 5th April?"I declare that I have not subscribed/made a payment to and will not subscribe/make a payment more than the overall subscription limit in total to any combination of permitted ISA types in the same tax year"

https://forums.moneysavingexpert.com/discussion/6438967/flexible-cash-isa-plus-stocks-shares-isa

This article on MSE is wrong, as you cannot have a flexible S&S ISAI'm not sure what it is exactly that you think @refluxer has misunderstood. It is certainly the case, as was discussed in your other thread, that to be compliant with the ISA declaration, you must not at any time exceed the overall subscription limit within a single tax year.I'm also not sure what specifically within the MSE article you think is wrong. You can have a flexible S&S ISA, and in fact two major providers offer them (Vanguard and Charles Stanley Direct). There are probably others who escape me at this time.The HMRC text that you have screenshotted refers to Lifetime ISAs, not S&S ISAs. LISAs (either cash or S&S variants) cannot be flexible due to the additional restrictions placed upon them related to earning a bonus on contributions.3 -

ISA declaration and HMRC rules appear to be two different things.masonic said:surreysaver said:

You have misunderstood. Here's the thread started by myself earlier this yearrefluxer said:

I'm wondering if I've misunderstood ? Anyone who pays more than £20k of new subscriptions in total into any combination of ISAs of any type in the same tax year will have broken the £20k ISA limit rule and therefore made a false statement on any cash ISA declarations, regardless of the state of play at the end of the tax year or whether that's now or during the next tax year (after the rule changes).surreysaver said:I wonder how this would work with flexible ISAs. I've currently got £20k sitting in a flexible cash ISA that I've put in this year, as well as subscribing to a S&S ISA. As long as I take out of my cash ISA an equivalent amount that I've paid into my S&S ISA before the end of the tax year, this is acceptable.

What will stop people paying into multiple flexible ISAs during the course of the year, but then withdrawing from them before 5th April?"I declare that I have not subscribed/made a payment to and will not subscribe/make a payment more than the overall subscription limit in total to any combination of permitted ISA types in the same tax year"

https://forums.moneysavingexpert.com/discussion/6438967/flexible-cash-isa-plus-stocks-shares-isa

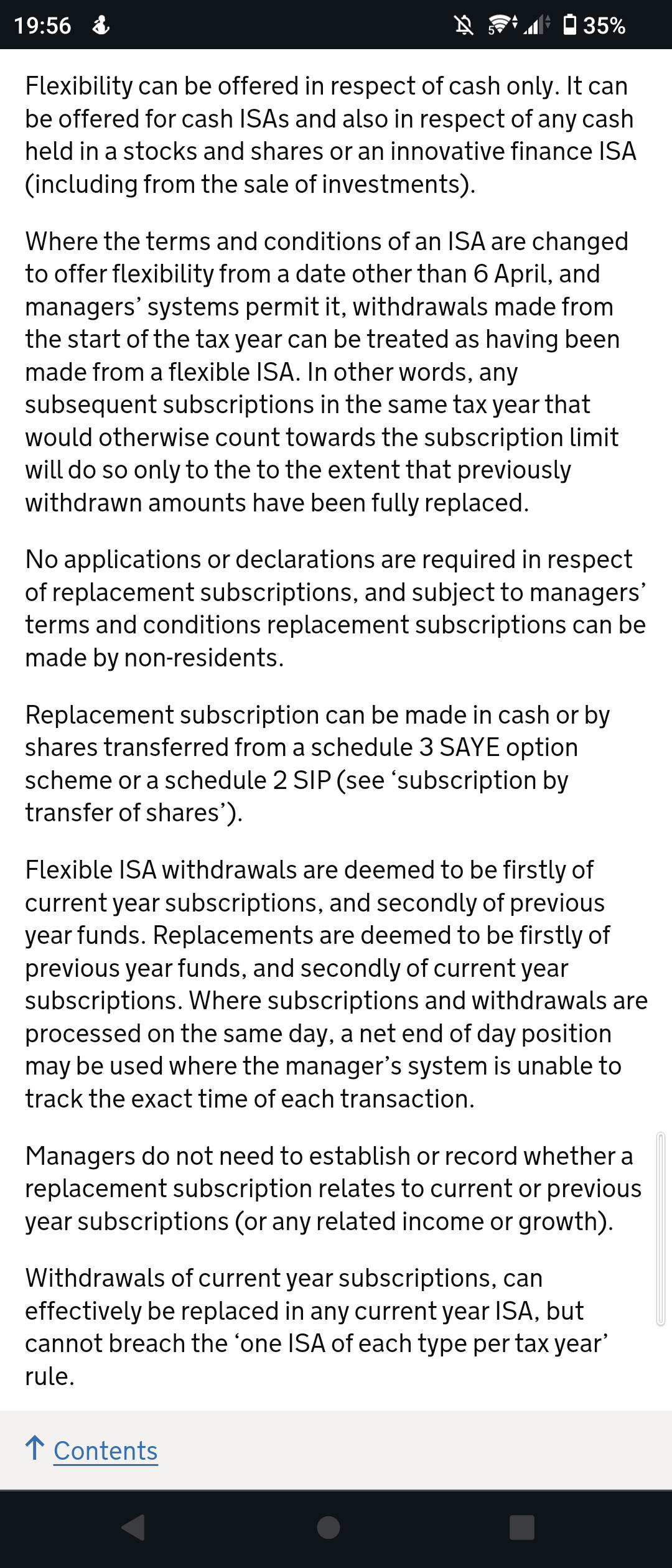

This article on MSE is wrong, as you cannot have a flexible S&S ISAI'm not sure what it is exactly that you think @refluxer has misunderstood. It is certainly the case, as was discussed in your other thread, that to be compliant with the ISA declaration, you must not at any time exceed the overall subscription limit within a single tax year.I'm also not sure what specifically within the MSE article you think is wrong. You can have a flexible S&S ISA, and in fact two major providers offer them (Vanguard and Charles Stanley Direct). There are probably others who escape me at this time.The HMRC text that you have screenshotted refers to Lifetime ISAs, not S&S ISAs. LISAs (either cash or S&S variants) cannot be flexible due to the additional restrictions placed upon them related to earning a bonus on contributions.

With a S&S ISA, only cash held within it can be flexible, as in my link I consider myself to be a male feminist. Is that allowed?0

I consider myself to be a male feminist. Is that allowed?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards