We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

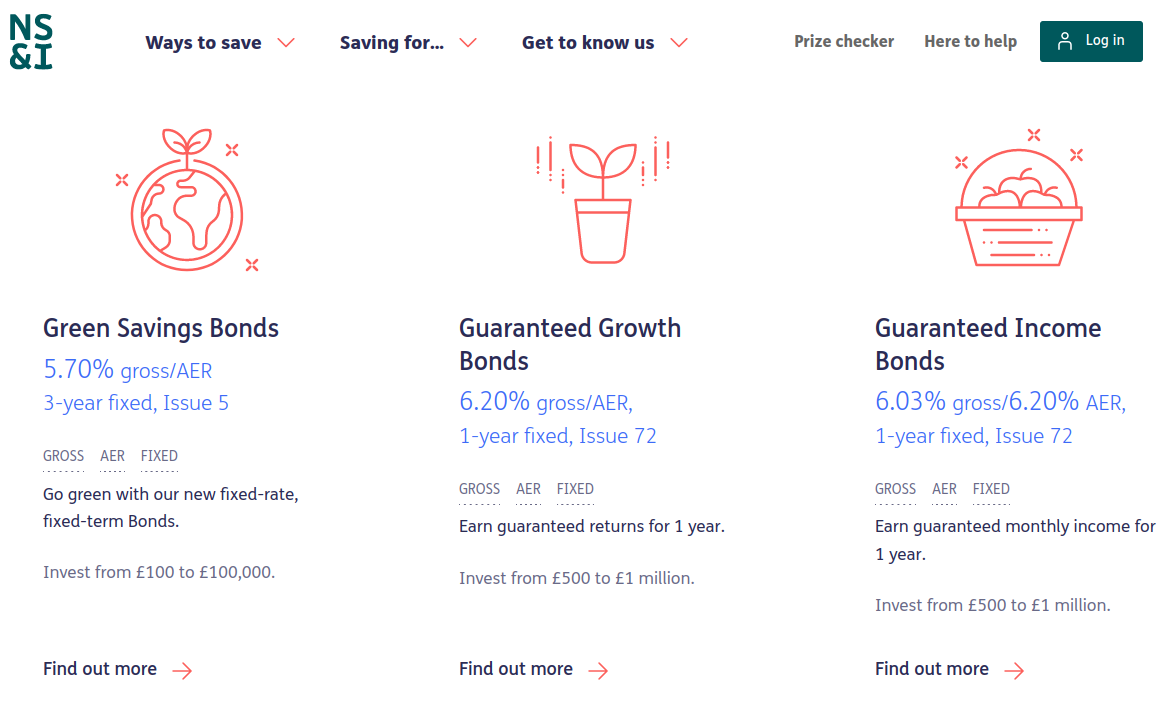

NS&I 1 Year Guaranteed Growth Bonds and Guaranteed Income Bonds at 6.20%

Comments

-

sparkiemalarkie said:

I can see the income bond but not the growth bond. I will take another lookfriolento said:sparkiemalarkie said:Has this finished now? I couldn't see it when I logged onto my NS&I account.

sx

They are still there for me, when logged in , and when not logged in

Thanks

sx

https://www.nsandi.com/guaranteed-returns

0 -

Ahhh, I can see it now. I have already bought one and wanted another . I was looking at the the advertised bonds on the site and the growth bonds weren't mentioned but, if I I look at my bond account, it gives me the option to "Buy a new bond" ...

I couldn't see for looking...too anxious in case I had missed my chance

sx0 -

Hi

How can a rate of 6.2% apply to the GIB account? This should read 6.03%, shouldn't it?

Just curious.

Paul0 -

They quote the AER of 6.20% for the GIBs as if you could have your interest paid into it (and allow it to compound) even though this isn't actually an option. As it can only be paid away, this means you can only achieve the gross rate of 6.03% for this account, as you say.PaulR2020 said:Hi

How can a rate of 6.2% apply to the GIB account? This should read 6.03%, shouldn't it?

Just curious.

Paul

I guess they are possibly forced to use the AER for comparison purposes but in this case, as it can't actually be achieved, then it's misleading IMO.0 -

Yes, they are forced to use the AER for comparison purposes, and that is the ONLY purpose the AER should be used for, as it can't actually be achieved in many accounts/circumstances. It is however very useful for comparing disparate accounts.refluxer said:

They quote the AER of 6.20% for the GIBs as if you could have your interest paid into it (and allow it to compound) even though this isn't actually an option. As it can only be paid away, this means you can only achieve the gross rate of 6.03% for this account, as you say.PaulR2020 said:Hi

How can a rate of 6.2% apply to the GIB account? This should read 6.03%, shouldn't it?

Just curious.

Paul

I guess they are possibly forced to use the AER for comparison purposes but in this case, as it can't actually be achieved, then it's misleading IMO.

Eco Miser

Saving money for well over half a century1 -

Can't understand why we can't fund the NS&I bond with a bank transfer like usual savings accounts. I want to invest £50,000 but it only gives you the option of a one-off debit card payment, and my bank does not allow sizeable debit card payments. Hence I seem to be stuck. Any way to get around this?0

-

Open a direct saver and fund it with a bank transfer. Then use that as the source of funds for your growth bond.StevieB66 said:Can't understand why we can't fund the NS&I bond with a bank transfer like usual savings accounts. I want to invest £50,000 but it only gives you the option of a one-off debit card payment, and my bank does not allow sizeable debit card payments. Hence I seem to be stuck. Any way to get around this?1 -

Open up an NS&I Direct Saver - fund that increments up to £50k - then open the new NS&I bond of your choice, funding it from the Direct Saver.StevieB66 said:Can't understand why we can't fund the NS&I bond with a bank transfer like usual savings accounts. I want to invest £50,000 but it only gives you the option of a one-off debit card payment, and my bank does not allow sizeable debit card payments. Hence I seem to be stuck. Any way to get around this?2 -

You can always open multiple bonds. Each one at or under your banks debit card limit.StevieB66 said:Can't understand why we can't fund the NS&I bond with a bank transfer like usual savings accounts. I want to invest £50,000 but it only gives you the option of a one-off debit card payment, and my bank does not allow sizeable debit card payments. Hence I seem to be stuck. Any way to get around this?0 -

I might take the plunge...nearly did yesterday until I realised it was Debit Card payment only. May have to work around that annoyance.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards