We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

trading 212

Comments

-

Dird said:Unless you're investing a lot quickly then it's not really needed to open multiple unless you just want to collect the free shares on sign up; in that case I'd open freetrade & InvestEngine and just add the minimum required to get the free share/sign up cash. T212 has FCFS protection up to 85k so you could just keep using it as your main up until getting near that limit; it's better than those other 2 mentioned anywayThanks. Can you just open them, get the shares and let them sit there? I think some brokers charge fees for inactivity or something like that. Or at least it used to be when I read about it many years ago.I thought your 212 money are not covered by the FSCS when they're in QMMF.

So what exactly is covered? Just cash if it's not earning interest? I assume stocks are not covered by the FSCS, but I'm not sure.

In what way is 212 better than the other two?EPICA - the best symphonic metal band in the world !0 -

And 2 more questions:1 - since I'm looking to invest less then 20k, should I only use 212 ISA? My cash is currently in the 212 Invest section.2 - is there any reason why not to convert my GBP to HUF and earn 7% on it instead of 5.2% ? Is there some higher risk associated with it?EPICA - the best symphonic metal band in the world !0

-

1. If you're not using your ISA allowance for something else (E.g. cash ISA) then you may as well use it. Even if there is no tax to pay on your interest/dividends, using the ISA preserves your allowance for future years, and also simplifies your tax return should you need to complete one.Alex9384 said:And 2 more questions:1 - since I'm looking to invest less then 20k, should I only use 212 ISA? My cash is currently in the 212 Invest section.2 - is there any reason why not to convert my GBP to HUF and earn 7% on it instead of 5.2% ? Is there some higher risk associated with it?

2. Exchange rate risk. Presumably you'll want to convert the HUF back to GBP at some point. If the exchange rates move against you, you could make a loss. The loss may be covered by the 1.8% extra interest, or it may not.2 -

Alex9384,I understand you have a 212 Invest account already, but have you opened the 212 ISA?Trading 212 offer 1% cashback on 24/25 ISA deposits if ISA opened before end of April.....today!2

-

Securities of the same type of shares, unit trusts/OEICs, ETF, bonds etc. form the class that identifies a single asset. Some companies have A and B ordinary shares and multiple issues of preference shares, for instance Aviva - aka General Accident - has four issues of preference shares listed in London. These would all be different classes. Aviva ordinary shares would certainly be a separate 'class' to Legal & General ordinary shares.Alex9384 said:wmb194 said:That sounds weird; No, you just lump everything together and put it on the same tax return.You have to be cognisant of the section 104 pooling rule for capital gains e.g., if you own shares in the same company with multiple brokers you need to treat them for CGT as one pool, not individually per broker. Particularly for partial disposals, the easiest way to avoid this potential headache is not to hold the same security simultaneously with multiple brokers or if you do try to make use of Isas.

Using multiple brokers might increase the risk of breaching the bed and breakfasting 30 day rule.

The more brokers you have the more important it becomes to keep good records.

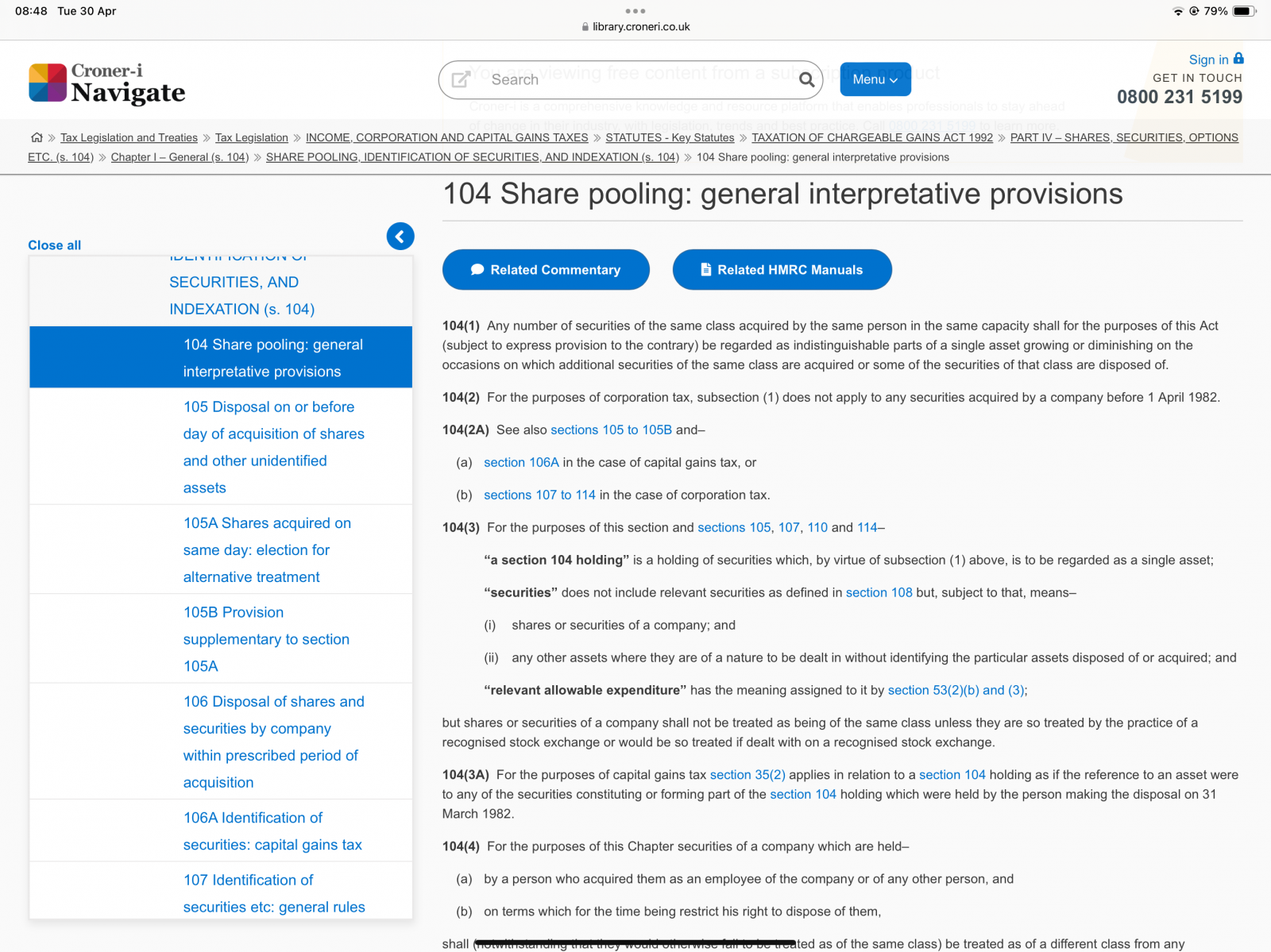

Thanks. Good to know. I quickly checked the section 104 and it mentions "same class" rather than same security. Does that mean the same asset class? That would mean any stock, as far as I understand it.

I see I still need to learn many things, such as the bed and breakfasting 30 day rule, although I'm not planning to buy and sell stock or ETFs in a short period. But who knows...

The interpretation notes to the Act:

https://library.croneri.co.uk/cch_uk/btl/tcga92-it-s-104

1 -

Read the T&Cs of the account and understand the fees. At the moment T212 doesn't have any, Freetrade is free for the basic account tier but charges for the tiers that offer Isas and Investengine is free for the self-directed account.Alex9384 said:Dird said:Unless you're investing a lot quickly then it's not really needed to open multiple unless you just want to collect the free shares on sign up; in that case I'd open freetrade & InvestEngine and just add the minimum required to get the free share/sign up cash. T212 has FCFS protection up to 85k so you could just keep using it as your main up until getting near that limit; it's better than those other 2 mentioned anywayThanks. Can you just open them, get the shares and let them sit there? I think some brokers charge fees for inactivity or something like that. Or at least it used to be when I read about it many years ago.I thought your 212 money are not covered by the FSCS when they're in QMMF.

So what exactly is covered? Just cash if it's not earning interest? I assume stocks are not covered by the FSCS, but I'm not sure.

In what way is 212 better than the other two?

For investments FSCS covers brokerage accounts for fraud and maladministration and IIRC it'll pay towards broker wind-up fees.

1 -

Aidanmc said:Alex9384,I understand you have a 212 Invest account already, but have you opened the 212 ISA?Trading 212 offer 1% cashback on 24/25 ISA deposits if ISA opened before end of April.....today!Thanks for reminding me.The ISA is already there whether you open it or not, you just need to activate it.

I activated it yesterday and just deposited £1k now.

I have £6k in the 212 Investment account but it seems I can't just transfer the money from it to the ISA. I need to pay it in from my bank.

EPICA - the best symphonic metal band in the world !0 -

You can easily transfer cash from the Invest into the ISA. If eligible then you also get cashback when you do.Alex9384 said:Aidanmc said:Alex9384,I understand you have a 212 Invest account already, but have you opened the 212 ISA?Trading 212 offer 1% cashback on 24/25 ISA deposits if ISA opened before end of April.....today!Thanks for reminding me.The ISA is already there whether you open it or not, you just need to activate it.

I activated it yesterday and just deposited £1k now.

I have £6k in the 212 Investment account but it seems I can't just transfer the money from it to the ISA. I need to pay it in from my bank.2 -

Alex9384 said:Aidanmc said:Alex9384,I understand you have a 212 Invest account already, but have you opened the 212 ISA?Trading 212 offer 1% cashback on 24/25 ISA deposits if ISA opened before end of April.....today!Thanks for reminding me.The ISA is already there whether you open it or not, you just need to activate it.

I activated it yesterday and just deposited £1k now.

I have £6k in the 212 Investment account but it seems I can't just transfer the money from it to the ISA. I need to pay it in from my bank.Yes, as already mentioned you can transfer funds from your Invest account to ISA account and still get cashback.On the Invest account click on 3 dashes at top, then Manage funds, then the blue button at bottom Move funds1 -

... And it looks like you can get cashback by moving the same money backwards and forwards, at the expense of using up your ISA allowance.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards