We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Chip Feedback

Comments

-

Thanks I just checked with Barclays they have gone through with a reference date of 19th May on Barclays but a future processing date of 22 May 11:33 AM request by chip , Maybe to do with the weekend.masonic said:dont_use_vistaprint said:

No I did a few by Apple Pay / card but there’s a max £500 so I linked my account with open banking and did several £5K deposits.masonic said:dont_use_vistaprint said:So just tried again still no luck. What I have noticed is all the 5K manual saves done on 19th still show as processing which maybe explains itDid you pay in by debit card? If so, then the debit card transactions will take a couple of working days to clear and become available for withdrawal. This is pretty standard for debit card transactions.You won't start to earn interest until they have cleared, which is why you'll see people warning against paying in by debit card.

the balance is correct but all the £500 and £5000 deposits show as processingOdd, as I haven't noticed any delay between OB deposits and the money being available for withdrawal, nor any payments showing as processing. The £500 payments haven't had time to clear, but it sounds like the £5000 deposits have been held by the sending bank, perhaps the pattern of transactions was considered suspicious?If you're keen to get the money back ASAP, it might be worth checking with Barclays the OB transactions have definitely gone through. If not they might be able to cancel them.They said they haven’t been flagged by fraud and all went though with in-app approval so Hopefully at 11:33 tomorrow it will all clearThe greatest prediction of your future is your daily actions.0 -

Thanks for that.Band7 said:

These terms don't apply to the instant access account. CHIP do also offer investment accounts, for which 5 working days to settle isn't unusual.Rollinghome said:Their T&Cs state that withdrawals to the nominated account "may take up to five working days following a withdrawal request" but I don't recall seeing what the maximum daily withdrawal rate is, or whether there is one. Does anyone know?

I've made test withdrawals of a few hundred, which were instant, but nothing seriously large.

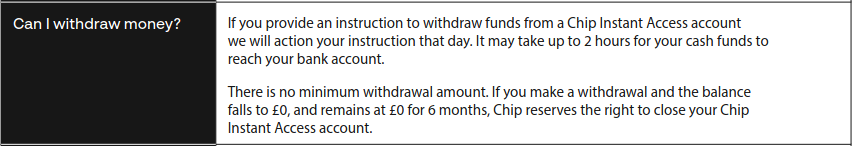

The terms pertaining to the IA state it may take up to 2 hours for your cash funds to reach your bank account. I have made countless withdrawals, incl, quite substantial 5-figure ones, which have always been instant.

The terms don't specify a withdrawal amount limit, and I am not aware that anyone has encountered one. I certainly haven't.

I notice that those terms do say "You should read these terms along with Chip’s terms". The word "terms" is under-lined, but there's no link, and it doesn't say which of their many pages of terms that refers to. The reference to withdrawal times is in the Summary Box below, and I assume that can reasonably be considered part of the terms.

They could help themselves, and quell a lot of the suspicion, by being a lot clearer on t&cs. They seem way too keen to have savers download their app without any prior sight of the terms. Nor, from memory, are the terms available within the app, as they are with Zopa etc. That would be more useful than the guff about "Share Your Story" etc and the link to "Get the Best rate" interestingly showing "With our 3.55% (sic) AER interest rate on the Chip Instant Access Account".

T&Cs can be seen during the savings account opening process, and I'd assumed/hoped we'd have easy access to copies. There's also a link to "Important Documents" at the foot of the webpage, but that leads to a paper-chase of links.

I've three other EA accounts that I haven't filled yet, offering 3.60%, 3.60% and 3.69%, all building societies. So my inclination is to withdraw down to around just £20k or so to take advantage of Chip's lightening fast withdrawals and move the rest elsewhere - unless Chip's rate became irresistible. The Skipton rate tracker v1, at 3.60% from Monday, could be interesting with the possibility of further BoE rate rises, and as I remember Skipton do fast withdrawals via FP. For +0.02% Chip doesn't make the grade.

0 -

Rollinghome said:I notice that those terms do say "You should read these terms along with Chip’s terms". The word "terms" is under-lined, but there's no link, and it doesn't say which of their many pages of terms that refers to. The reference to withdrawal times is in the Summary Box below, and I assume that can reasonably be considered part of the terms.The full journey to access the T&Cs is https://getchip.uk -> Savings -> Instant Access -> scroll down to "Got A Question?"The terms that are pertinent to the Instant Access account are the ones Band7 linked, which must be read in conjunction with the Clearbank terms. Previously, the savings account was not provided by Clearbank and instead lumped in with the other products, for which those other terms pertain.With regard to withdrawals, the first document states in the summary box:

The second (Clearbank) document goes into more detail:

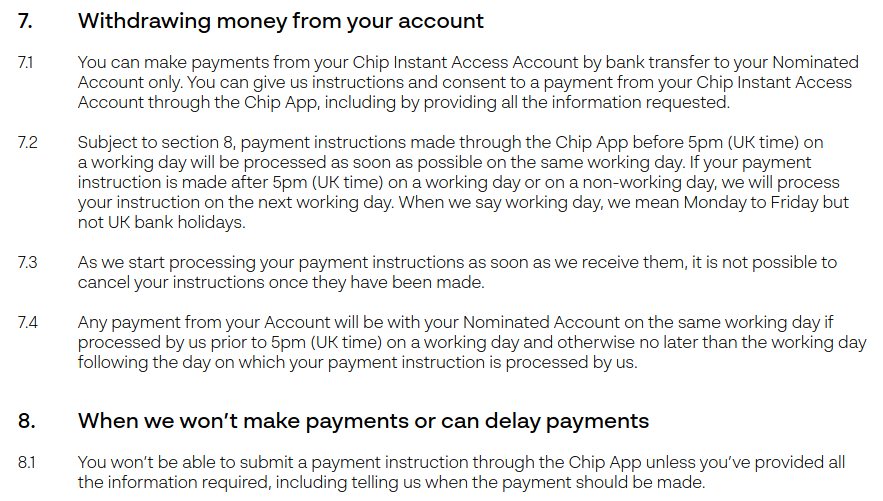

The second (Clearbank) document goes into more detail: In reality, instructions seem to be processed immediately even outside of business hours.0

In reality, instructions seem to be processed immediately even outside of business hours.0 -

Yes, it is quite a journey; made worse by having barrow-loads of obsolete files littering the site. And to tell customers that the terms they are reading, entitled "Chip Instant Access Terms and Conditions", must be read along with "Chip's terms" without saying which "Chip's terms" that might be, or where they can be found, isn't helpful or reassuring.

The T&Cs shouldn't need a search party to find them. It's an app-based account, and clear terms and conditions should be available from the app.

Which is a pity because, in my experience, the service of Clearbank can't be faulted, but is let down by the unimpressive mess between them and the customer that is Chip.

0 -

It does rather look like the task of modifying the terms for compatibility with the new Clearbank offering was quite the rush-job.

0 -

But they state they can take up to one business day to respond even during those hours , my queries made at 8am are showing as unread.Band7 said:Apparently their support desk is manned by humans between 8am and 8pm weekdays but not at weekends

https://www.getchip.uk/contactThe greatest prediction of your future is your daily actions.0 -

When I google chip reviews the summary says most refer to experiencing technical issues when it comes to withdrawing and withdrawals take on average 3-5 working days. This should have been stated on the savings page it’s clearly not a true instant access account like banks and building societiesThe greatest prediction of your future is your daily actions.0

-

My withdrawals are instant 🤷♂️0

-

They finally replied.

deposits made on Fridays will not start to process until the following week and should be available by the following Tuesday evening

The greatest prediction of your future is your daily actions.0 -

That's weird, and sounds as it might be a recent change. I must admit, I rarely deposit at weekends but I did one on Saturday May 6, which credited instantly, like all my OB/Faster Payment deposits have done so far.dont_use_vistaprint said:They finally replied.

deposits made on Fridays will not start to process until the following week and should be available by the following Tuesday evening

Withdrawals are in my experience instant, without fail. I have not seen anyone on MSE report that their withdrawals "take on average 3-5 working days" so it seems odds that these allegedly happen to people who convene elsewhere on the interweb.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards