We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

WASPI ‘victory’

Comments

-

Well there is "Child Benefit" so I guess we are still (not for much longer) "on benefits"ColdIron said:

I was shocked when I discovered that all my friends with children were on benefitsPat38493 said:I know a few state pensioners who would be horrified if you suggested that they were on benefits 0

0 -

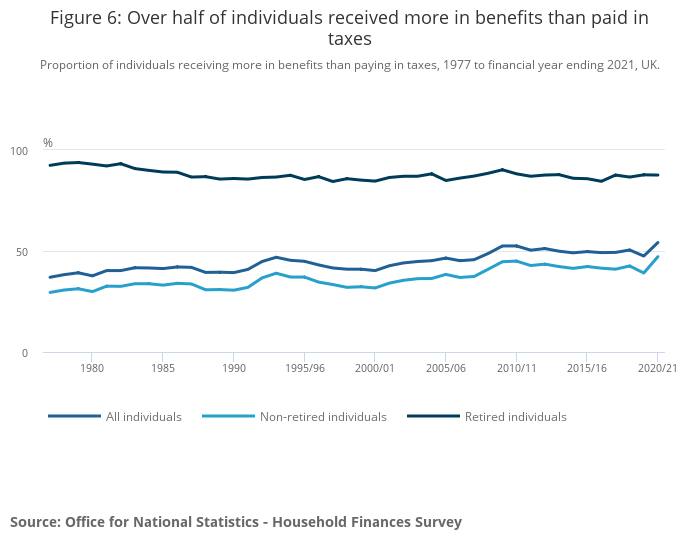

No. This is ONS’s chart. All households, All taxes, All benefits, All services.Pat38493 said:

Is there a chart like this that shows the situation over people's entire lifetime rather than annual snapshots which this seems to be?BlackKnightMonty said:

You’ve nailed the UK fiscal paradox!ex-pat_scot said:My NI on salary around the £100k mark (after whopping pension contributions, to keep out of the high marginal tax rate) is around £6,400 pa.

At 35 years of this it would give c£225,000 total NI contributions. This is rather unrealistic, but serves to show how modest even a high earner's contributions are, when set against the broad equivalent annuity cost of the SP at around £250,000 and also the other notional social benefits such as NHS, welfare etc.

(My actual NI contributions to date are not much more than £100,000 for 33 full years of contribution and a few partial years - I wasn't a v high earner until later in my career).

This also neatly highlights that the state pension is considered as a benefit rather than a "right" as it's clearly being considered as a benefits in this chart. I know a few state pensioners who would be horrified if you suggested that they were on benefits

Forget the terminology; this is pure money in and money out.0 -

xylophone said:Ohh not everyone has family surrounding them - much less so now than when I was young.

That is perfectly true - but working women had older female colleagues and those who weren't working for the most part at least had neighbours/friends.

It isn't impossible that some of the affected women had absolutely no idea of the SPA increase - I just find it difficult to understand how most didn't have some idea.

Particularly when the 1995 change definately appeared in at least one of the women's magazines in some form, because I do remember spotting it in one.

0 -

Perhaps overplaying the situation but I think it is the argument that is so incredible, that unless you were isolated and left on a desert island, like the soldier still waiting for the war to finish, it is inconceivable that this was not discussed.xylophone said:So the people that didn't understand or recognise that things might change took all their advice from people who most likely were born before the Great War and before suffrage, before powered flight, grandparents, and between the Wars, before computers and the internet and much more readily available information, parents.I think that you are deliberately misunderstanding my point that a woman aged 45 in 1995 had become used to the status quo and probably had given no or little thought to the fact that SPA might change.

Indeed, if she had been a member of a contracted out pension scheme from 1978, she would certainly have been expecting her SP at 60 because of the way that increases on the GMP in her occupational pension were expected to dovetail with increases on Additional State Pension.

As for access to information in 1995, a computer at home was by no means that common and the web not even nearly as sophisticated as it has now become.

I was not saying that it was impossible for such a woman to obtain information about the SPA change - indeed I made the point that it was rather surprising if she had totally missed the boat!

And even if not discussed before, at the time it remains incumbent upon the individual before taking those significant financial or life decisions to ensure the planning information is robust, to validate any assumptions to ensure they are still sound, to understand the risks and to do some sensitivity analysis.Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!4 -

LHW99 said:xylophone said:Ohh not everyone has family surrounding them - much less so now than when I was young.

That is perfectly true - but working women had older female colleagues and those who weren't working for the most part at least had neighbours/friends.

It isn't impossible that some of the affected women had absolutely no idea of the SPA increase - I just find it difficult to understand how most didn't have some idea.

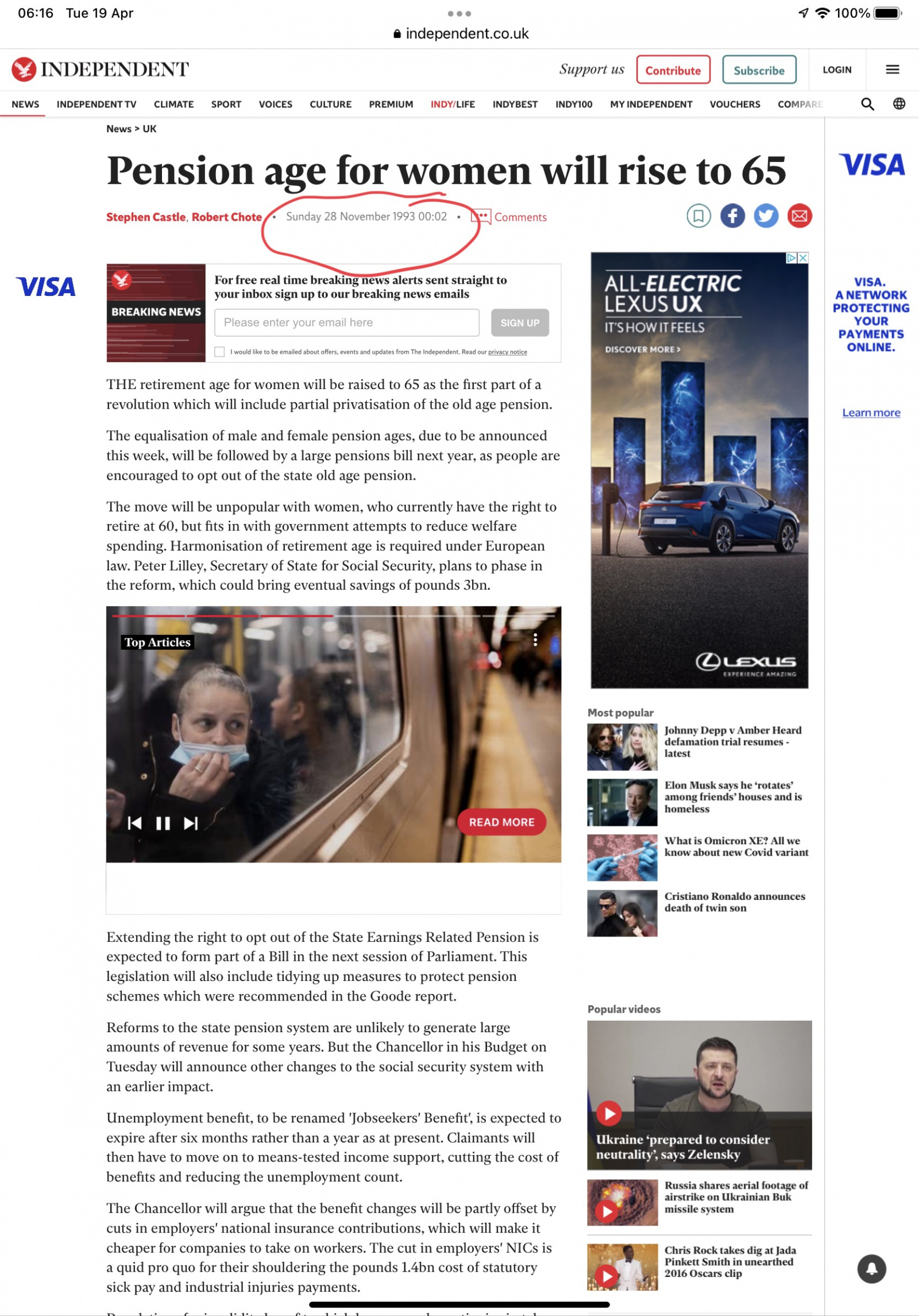

Particularly when the 1995 change definately appeared in at least one of the women's magazines in some form, because I do remember spotting it in one.And here, note the date! 4

4 -

curious - I wonder why they said I had overpaid?artyboy said:

Nope, there is a 2% band that starts around the higher rate income tax threshold, and has no upper cap. I've paid as much as £10k NI in years gone by...Flugelhorn said:

Isn't there a max NI? most years when I had 2-3 part time jobs I ended up paying over 5K and HMRC used to send me some back - they are just checking on a couple of other years nowex-pat_scot said:My NI on salary around the £100k mark (after whopping pension contributions, to keep out of the high marginal tax rate) is around £6,400 pa.

At 35 years of this it would give c£225,000 total NI contributions. This is rather unrealistic, but serves to show how modest even a high earner's contributions are, when set against the broad equivalent annuity cost of the SP at around £250,000 and also the other notional social benefits such as NHS, welfare etc.

(My actual NI contributions to date are not much more than £100,000 for 33 full years of contribution and a few partial years - I wasn't a v high earner until later in my career).

It was possibly because each employer deducted the normal rate as if they were my only employer when it sounds like all the amount over the higher rate threshold should have been at 2% not the higher rate whatever that was. Oh well always nice to get a cheque back .0 -

See https://www.taxrebateservices.co.uk/tax-faqs/national-insurance/claim-a-national-insurance-refund#:~:text=Circumstances%20that%20mean%20you%20may,applied%20for%20any%20NI%20deferment.Flugelhorn said:

curious - I wonder why they said I had overpaid?artyboy said:

Nope, there is a 2% band that starts around the higher rate income tax threshold, and has no upper cap. I've paid as much as £10k NI in years gone by...Flugelhorn said:

Isn't there a max NI? most years when I had 2-3 part time jobs I ended up paying over 5K and HMRC used to send me some back - they are just checking on a couple of other years nowex-pat_scot said:My NI on salary around the £100k mark (after whopping pension contributions, to keep out of the high marginal tax rate) is around £6,400 pa.

At 35 years of this it would give c£225,000 total NI contributions. This is rather unrealistic, but serves to show how modest even a high earner's contributions are, when set against the broad equivalent annuity cost of the SP at around £250,000 and also the other notional social benefits such as NHS, welfare etc.

(My actual NI contributions to date are not much more than £100,000 for 33 full years of contribution and a few partial years - I wasn't a v high earner until later in my career).

It was possibly because each employer deducted the normal rate as if they were my only employer when it sounds like all the amount over the higher rate threshold should have been at 2% not the higher rate whatever that was. Oh well always nice to get a cheque back .Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

thanks @marcon those explain it - TBH when they contacted me to say I had probably paid too much and to complete a form, I didn't argue - just was pleased to get the cheques for 2-3KMarcon said:

See https://www.taxrebateservices.co.uk/tax-faqs/national-insurance/claim-a-national-insurance-refund#:~:text=Circumstances%20that%20mean%20you%20may,applied%20for%20any%20NI%20deferment.Flugelhorn said:

curious - I wonder why they said I had overpaid?artyboy said:

Nope, there is a 2% band that starts around the higher rate income tax threshold, and has no upper cap. I've paid as much as £10k NI in years gone by...Flugelhorn said:

Isn't there a max NI? most years when I had 2-3 part time jobs I ended up paying over 5K and HMRC used to send me some back - they are just checking on a couple of other years nowex-pat_scot said:My NI on salary around the £100k mark (after whopping pension contributions, to keep out of the high marginal tax rate) is around £6,400 pa.

At 35 years of this it would give c£225,000 total NI contributions. This is rather unrealistic, but serves to show how modest even a high earner's contributions are, when set against the broad equivalent annuity cost of the SP at around £250,000 and also the other notional social benefits such as NHS, welfare etc.

(My actual NI contributions to date are not much more than £100,000 for 33 full years of contribution and a few partial years - I wasn't a v high earner until later in my career).

It was possibly because each employer deducted the normal rate as if they were my only employer when it sounds like all the amount over the higher rate threshold should have been at 2% not the higher rate whatever that was. Oh well always nice to get a cheque back .0 -

No. You pay standard rate 10% NI up to higher rate tax threshold (unless you are in Scotland), then 2% above that.Flugelhorn said:

Isn't there a max NI? most years when I had 2-3 part time jobs I ended up paying over 5K and HMRC used to send me some back - they are just checking on a couple of other years nowex-pat_scot said:My NI on salary around the £100k mark (after whopping pension contributions, to keep out of the high marginal tax rate) is around £6,400 pa.

At 35 years of this it would give c£225,000 total NI contributions. This is rather unrealistic, but serves to show how modest even a high earner's contributions are, when set against the broad equivalent annuity cost of the SP at around £250,000 and also the other notional social benefits such as NHS, welfare etc.

(My actual NI contributions to date are not much more than £100,000 for 33 full years of contribution and a few partial years - I wasn't a v high earner until later in my career).

Employers NIC is 13.8%0 -

If you had 5 part time jobs, each paying £10k per annum, as each pays less than £12,570 - would any NI be deducted at all?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards