We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

LBG closing all my accounts on 18th May

Comments

-

5% AER (4.89% gross a year) in-credit interest fixed for 12 months on balances up to £1,500.masonic said:dealyboy said:

"Why choose our FlexDirect

Get interest on your money

5% AER (4.89% gross a year) in-credit interest fixed for 12 months on balances up to £1,500. You’ll need to pay in at least £1,000 a month, not counting transfers from other Nationwide accounts or Visa credits. After the first 12 months, it’s 0.25% AER (0.24% gross a year) variable. Interest is calculated on the last day of each month and is paid on the first day of the next month.

"

Consumer Rights Act 2015 Part 2.62 Requirement for contract terms and notices to be fair

(1)An unfair term of a consumer contract is not binding on the consumer.

(2)An unfair consumer notice is not binding on the consumer.

(3)This does not prevent the consumer from relying on the term or notice if the consumer chooses to do so.

(4)A term is unfair if, contrary to the requirement of good faith, it causes a significant imbalance in the parties’ rights and obligations under the contract to the detriment of the consumer.

The contractual term being discussed is fair because it is balanced in favour of the consumer. The consumer does not need to provide notice but the firm does. The consumer should rely on the term in the contract, because it is fair.You seem to be confusing the term "term", which refers to a clause in an agreement with the "term" of an interest rate, which is the length of time that rate applies. If either party close an account while it is within a particular interest term, it is of no consequence, because there will be zero balance in the account upon which to earn interest. The rate will be unchanged.

I would contend that any variation in this term by a financial services company to the detriment of the consumer is unfair if it is not correlated with a breach by the consumer.

I would expect the consumer to be compensated to be put in the same position as he/she/they would have been had they completed the duration of the term.

As I have said I would not expect this to happen as a financial services company would not wish to be in conflict with the FCA Principle 6."Customers' interests

... A firm must pay due regard to the interests of its customers and treat them fairly."

0 -

Can you post a screenshot of the entry on your credit file showing the marker?Bridlington1 said:

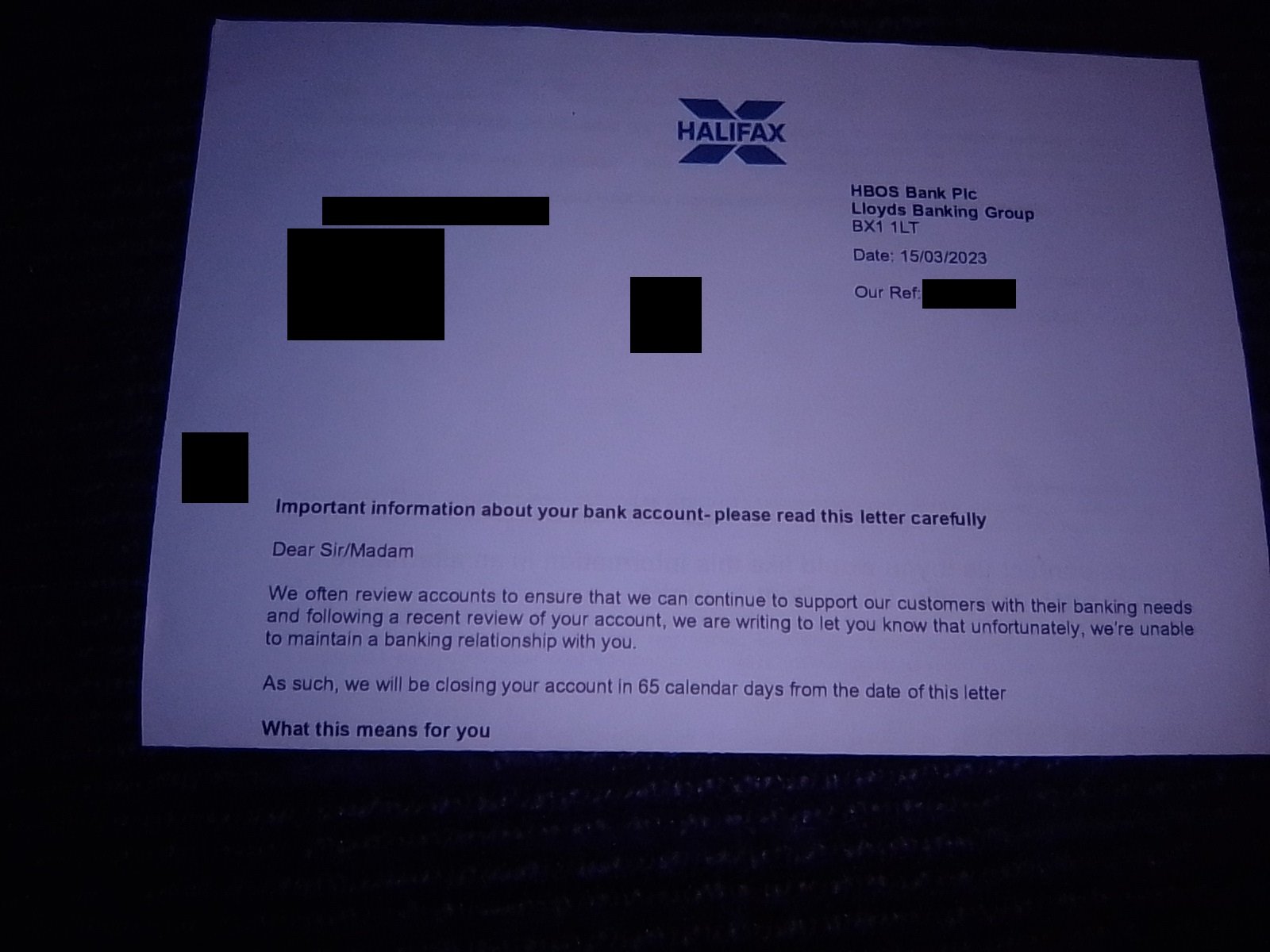

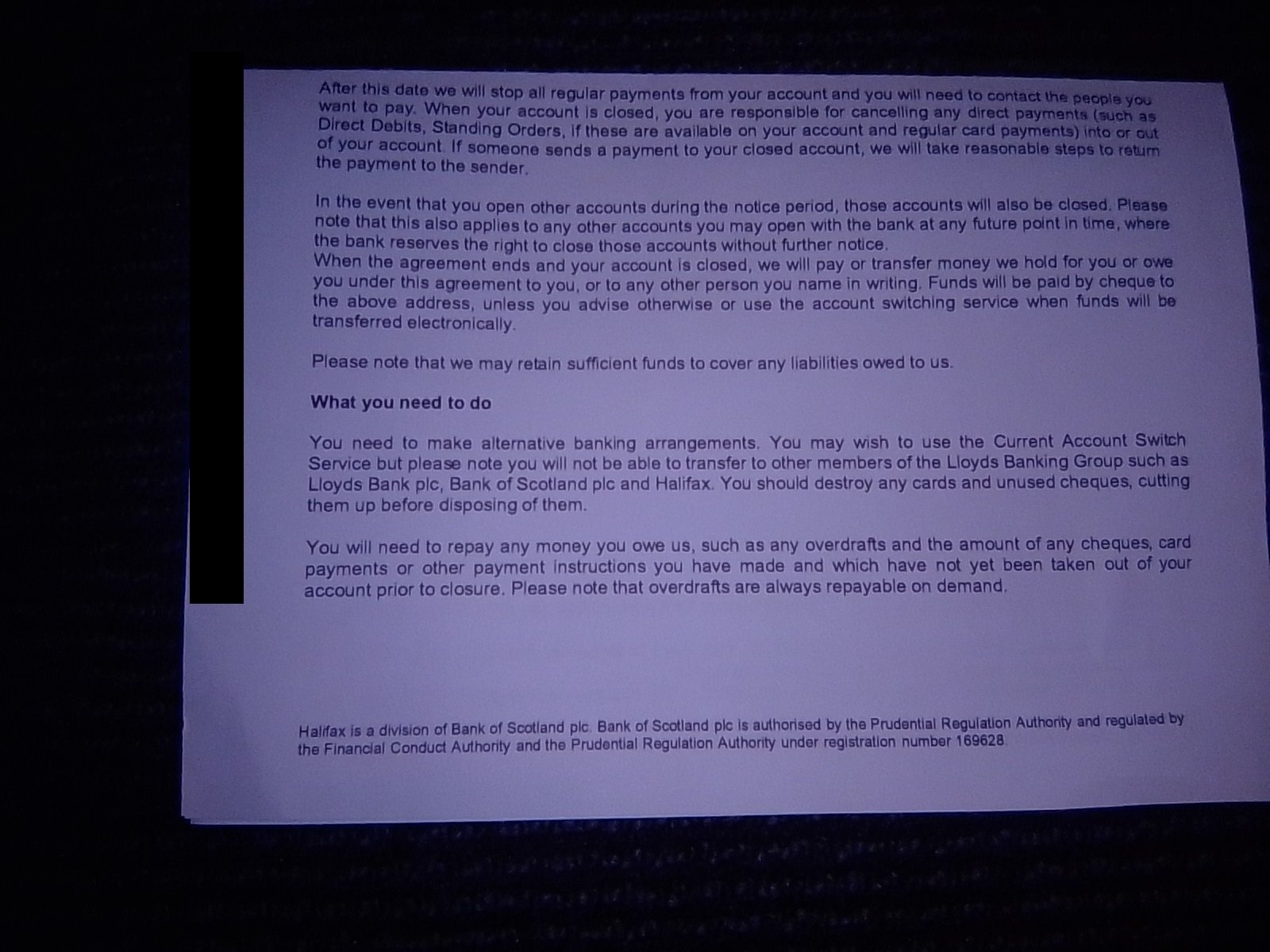

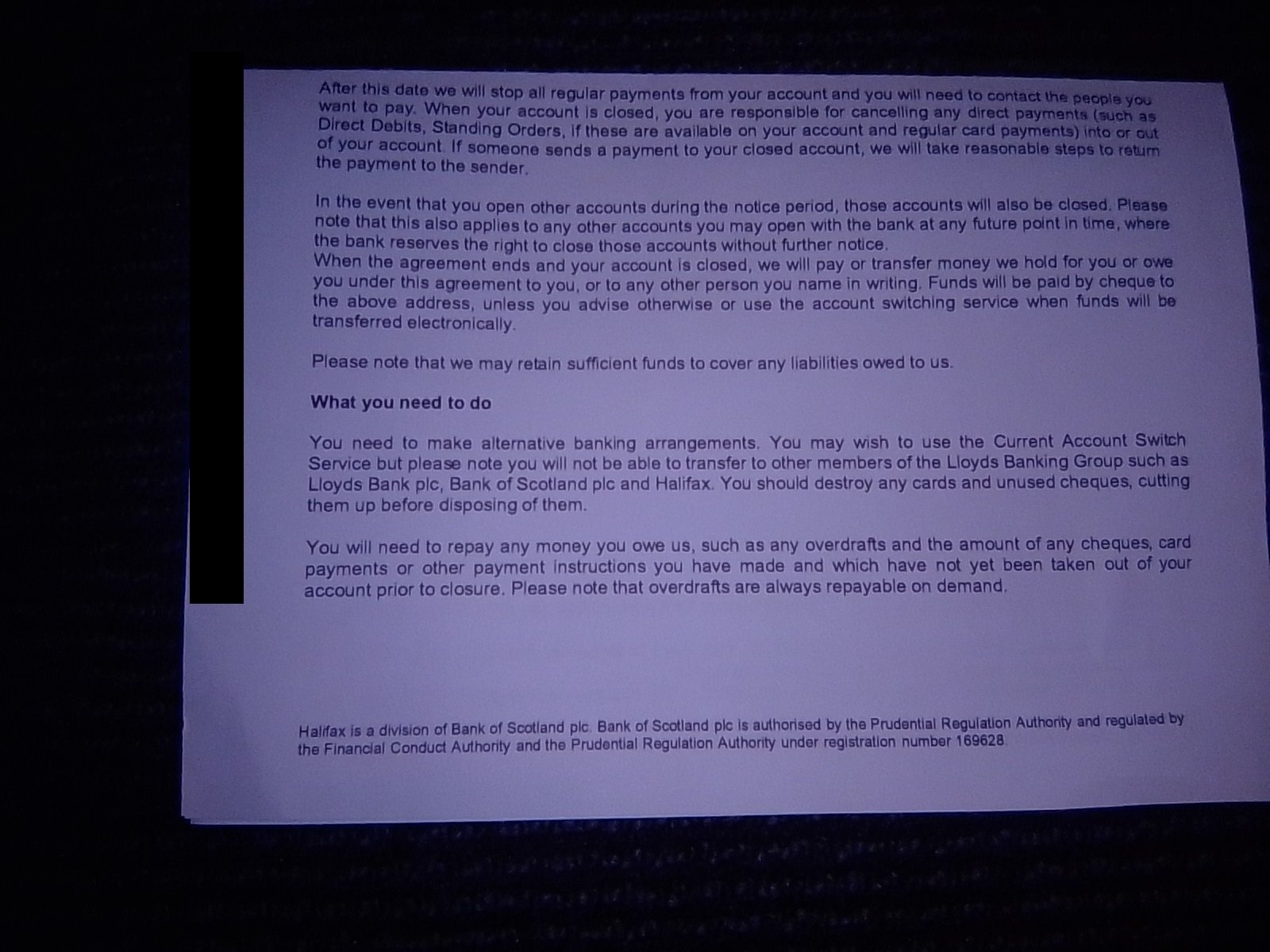

Here is a copy of the letter I got from Halifax. It doesn't look like there's any way back.AmityNeon said:Bridlington1 said:That'll probably explain it then. In January I opened 5 Club Lloyds savers as well as 3 current accounts within LBG (1 with each bank) and have been bouncing £1 through them for the YouGov finance points ever since. My suspicion is now that this has tipped them over the edge. I never thought much of it at the time as I was able to open 3 Halifax reward accounts in a single day last spring but evidently LBG have taken offence by this.As it's likely an internal commercial decision, I would surmise it's a combination of the overdraft stoozing and the nine(?) current accounts opened within the space of a year (six of which were promptly switched away), in conjunction with a lack of holding any products from which they can profit (e.g. mortgage, credit cards), as well as perhaps not having a long-standing history.

Did they provide any possible avenue for you to potentially explain or appeal? It's terribly unfortunate when an institution makes a final decision of lifelong permanence, without prior warning or providing any form of recourse. At least Skipton BS sent a written notice of admonishment to those regularly depositing via 15+ different debit cards per month over an extended period.

Your experience with Barclays is even more perplexing considering you held the accounts for barely a month or so, and presumably, there was nothing to remotely suggest why they allowed the accounts to be opened, only to forcibly have them closed soon after.

The Barclays closure doesn't surprise me too much as it was a student account. I used to hold a TSB student account but when Barclays launched their rainy day saver and I decided to switch my TSB student account to Barclays as Barclays won't let students open their standard bank account. When in branch they told me that I could open the Barclays student account as long as I closed the TSB student account shortly after opening the Barclays student account (I closed the TSB student account about half an hour of opening Barclays).

As a result I held two student accounts for around half an hour that day, which was against Barclays's Ts&Cs so the account was closed 17 days later. They refused to tell me exactly why they closed the account but I'm pretty sure it was that.

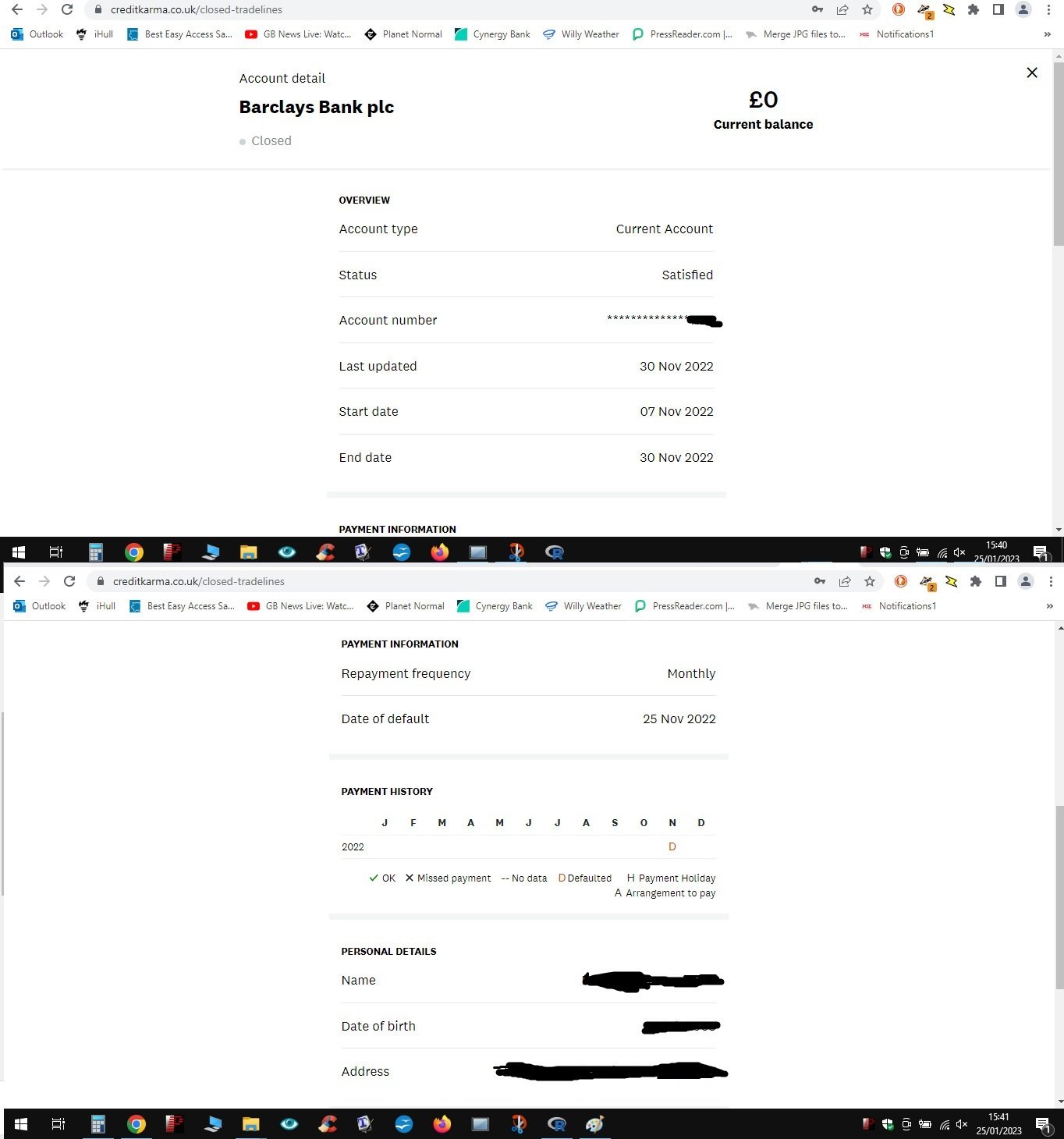

The only thing that puzzles me about Barclays is why the default? The account was in credit for its entire duration, indeed I have the account's only statement to prove it. Barclays are denying that they put it on there on the grounds that there was no OD facility to default and the CRAs are saying they are only reporting what they've been told by Barclays.0 -

You would be wrong. If Nationwide decided to close your account and/or terminate their relationship with you, their is no right to 'compensation' as you suggest.dealyboy said:

5% AER (4.89% gross a year) in-credit interest fixed for 12 months on balances up to £1,500.masonic said:dealyboy said:

"Why choose our FlexDirect

Get interest on your money

5% AER (4.89% gross a year) in-credit interest fixed for 12 months on balances up to £1,500. You’ll need to pay in at least £1,000 a month, not counting transfers from other Nationwide accounts or Visa credits. After the first 12 months, it’s 0.25% AER (0.24% gross a year) variable. Interest is calculated on the last day of each month and is paid on the first day of the next month.

"

Consumer Rights Act 2015 Part 2.62 Requirement for contract terms and notices to be fair

(1)An unfair term of a consumer contract is not binding on the consumer.

(2)An unfair consumer notice is not binding on the consumer.

(3)This does not prevent the consumer from relying on the term or notice if the consumer chooses to do so.

(4)A term is unfair if, contrary to the requirement of good faith, it causes a significant imbalance in the parties’ rights and obligations under the contract to the detriment of the consumer.

The contractual term being discussed is fair because it is balanced in favour of the consumer. The consumer does not need to provide notice but the firm does. The consumer should rely on the term in the contract, because it is fair.You seem to be confusing the term "term", which refers to a clause in an agreement with the "term" of an interest rate, which is the length of time that rate applies. If either party close an account while it is within a particular interest term, it is of no consequence, because there will be zero balance in the account upon which to earn interest. The rate will be unchanged.

I would contend that any variation in this term by a financial services company to the detriment of the consumer is unfair if it is not correlated with a breach by the consumer.

I would expect the consumer to be compensated to be put in the same position as he/she/they would have been had they completed the duration of the term.12 -

Bridlington1 said:It doesn't look like there's any way back.

At the very least, they've provided an option for you to discuss the matter further by contacting your local LBG branch. At worst, you lose a bit of time, but hopefully you can learn more about the reasons behind their decision, and maybe, just maybe, find an opportunity to reverse it.

Didn't they previously offer you the opportunity for a meeting with a relationship manager?

2 -

Ed-1 said:

Can you post a screenshot of the entry on your credit file showing the marker?Bridlington1 said:

Here is a copy of the letter I got from Halifax. It doesn't look like there's any way back.AmityNeon said:Bridlington1 said:That'll probably explain it then. In January I opened 5 Club Lloyds savers as well as 3 current accounts within LBG (1 with each bank) and have been bouncing £1 through them for the YouGov finance points ever since. My suspicion is now that this has tipped them over the edge. I never thought much of it at the time as I was able to open 3 Halifax reward accounts in a single day last spring but evidently LBG have taken offence by this.As it's likely an internal commercial decision, I would surmise it's a combination of the overdraft stoozing and the nine(?) current accounts opened within the space of a year (six of which were promptly switched away), in conjunction with a lack of holding any products from which they can profit (e.g. mortgage, credit cards), as well as perhaps not having a long-standing history.

Did they provide any possible avenue for you to potentially explain or appeal? It's terribly unfortunate when an institution makes a final decision of lifelong permanence, without prior warning or providing any form of recourse. At least Skipton BS sent a written notice of admonishment to those regularly depositing via 15+ different debit cards per month over an extended period.

Your experience with Barclays is even more perplexing considering you held the accounts for barely a month or so, and presumably, there was nothing to remotely suggest why they allowed the accounts to be opened, only to forcibly have them closed soon after.

The Barclays closure doesn't surprise me too much as it was a student account. I used to hold a TSB student account but when Barclays launched their rainy day saver and I decided to switch my TSB student account to Barclays as Barclays won't let students open their standard bank account. When in branch they told me that I could open the Barclays student account as long as I closed the TSB student account shortly after opening the Barclays student account (I closed the TSB student account about half an hour of opening Barclays).

As a result I held two student accounts for around half an hour that day, which was against Barclays's Ts&Cs so the account was closed 17 days later. They refused to tell me exactly why they closed the account but I'm pretty sure it was that.

The only thing that puzzles me about Barclays is why the default? The account was in credit for its entire duration, indeed I have the account's only statement to prove it. Barclays are denying that they put it on there on the grounds that there was no OD facility to default and the CRAs are saying they are only reporting what they've been told by Barclays.

There's Transunion. Equifax follows suit. The weird thing is that neither the account nor the default appear on Experian though, yet the experian credit score dropped by around 200 shortly after the account was closed.1 -

I disagree, they would be behaving unfairly, illegally and unlawfully ... to be tested ...gt94sss2 said:

You would be wrong. If Nationwide decided to close your account and/or terminate their relationship with you, their is no right to 'compensation' as you suggest.dealyboy said:

5% AER (4.89% gross a year) in-credit interest fixed for 12 months on balances up to £1,500.masonic said:dealyboy said:

"Why choose our FlexDirect

Get interest on your money

5% AER (4.89% gross a year) in-credit interest fixed for 12 months on balances up to £1,500. You’ll need to pay in at least £1,000 a month, not counting transfers from other Nationwide accounts or Visa credits. After the first 12 months, it’s 0.25% AER (0.24% gross a year) variable. Interest is calculated on the last day of each month and is paid on the first day of the next month.

"

Consumer Rights Act 2015 Part 2.62 Requirement for contract terms and notices to be fair

(1)An unfair term of a consumer contract is not binding on the consumer.

(2)An unfair consumer notice is not binding on the consumer.

(3)This does not prevent the consumer from relying on the term or notice if the consumer chooses to do so.

(4)A term is unfair if, contrary to the requirement of good faith, it causes a significant imbalance in the parties’ rights and obligations under the contract to the detriment of the consumer.

The contractual term being discussed is fair because it is balanced in favour of the consumer. The consumer does not need to provide notice but the firm does. The consumer should rely on the term in the contract, because it is fair.You seem to be confusing the term "term", which refers to a clause in an agreement with the "term" of an interest rate, which is the length of time that rate applies. If either party close an account while it is within a particular interest term, it is of no consequence, because there will be zero balance in the account upon which to earn interest. The rate will be unchanged.

I would contend that any variation in this term by a financial services company to the detriment of the consumer is unfair if it is not correlated with a breach by the consumer.

I would expect the consumer to be compensated to be put in the same position as he/she/they would have been had they completed the duration of the term.0 -

Well it hasn't happened to me ... I will duck out ... thanks @Bridlington1 and I do hope you get some satisfaction.0

-

I'll pop into a Lloyds and a Halifax branch at come point over the next week or two but they've picked a pint in time in which I'm going to be somewhat pressed for time with my university studies. BOS could be difficult as I live near Hull so trying to get to a BOS branch could be tricky.AmityNeon said:Bridlington1 said:It doesn't look like there's any way back.At the very least, they've provided an option for you to discuss the matter further by contacting your local LBG branch. At worst, you lose a bit of time, but hopefully you can learn more about the reasons behind their decision, and maybe, just maybe, find an opportunity to reverse it.

Didn't they previously offer you the opportunity for a meeting with a relationship manager?

Lloyds have previously invited me to try their personal wealth management, private banking and briefly Mayfair banking, though this was confined to advertisements in online banking. I just took it as a compliment and ignored it. Halifax stuck to trying to get me to invest and buy a house.

I am doubting I can get them to reverse their decision but will give it a shot, but I suspect I will need to play the student saving frantically for a house deposit who wants info on home insurance card for all it's worth if I am to stand any chance of making them budge.

Regardless I have shifted the moneybox DD to RBS and set a switch in motion from one of my BOS donor accounts with 2 DDs to my donor Natwest account so am not taking any chances.2 -

My local Halifax can service BoS accounts - they said Halifax is the England version of BoS. Kind of like how NatWest and RBS can service each others accounts. N.B. My local Lloyds would not service my BoS account or my Halifax accountBridlington1 said:

I'll pop into a Lloyds and a Halifax branch at come point over the next week or two but they've picked a pint in time in which I'm going to be somewhat pressed for time with my university studies. BOS could be difficult as I live near Hull so trying to get to a BOS branch could be tricky.AmityNeon said:Bridlington1 said:It doesn't look like there's any way back.At the very least, they've provided an option for you to discuss the matter further by contacting your local LBG branch. At worst, you lose a bit of time, but hopefully you can learn more about the reasons behind their decision, and maybe, just maybe, find an opportunity to reverse it.

Didn't they previously offer you the opportunity for a meeting with a relationship manager?

Lloyds have previously invited me to try their personal wealth management, private banking and briefly Mayfair banking, though this was confined to advertisements in online banking. I just took it as a compliment and ignored it. Halifax stuck to trying to get me to invest and buy a house.

I am doubting I can get them to reverse their decision but will give it a shot, but I suspect I will need to play the student saving frantically for a house deposit who wants info on home insurance card for all it's worth if I am to stand any chance of making them budge.

Regardless I have shifted the moneybox DD to RBS and set a switch in motion from one of my BOS donor accounts with 2 DDs to my donor Natwest account so am not taking any chances.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

Pity, I was hoping they'd give me a free trip to Scotland as part of the complaint I shall make. Oh well at least it should save me some time.ForumUser7 said:

My local Halifax can service BoS accounts - they said Halifax is the England version of BoS. Kind of like how NatWest and RBS can service each others accounts. N.B. My local Lloyds would not service my BoS account or my Halifax accountBridlington1 said:

I'll pop into a Lloyds and a Halifax branch at come point over the next week or two but they've picked a pint in time in which I'm going to be somewhat pressed for time with my university studies. BOS could be difficult as I live near Hull so trying to get to a BOS branch could be tricky.AmityNeon said:Bridlington1 said:It doesn't look like there's any way back.At the very least, they've provided an option for you to discuss the matter further by contacting your local LBG branch. At worst, you lose a bit of time, but hopefully you can learn more about the reasons behind their decision, and maybe, just maybe, find an opportunity to reverse it.

Didn't they previously offer you the opportunity for a meeting with a relationship manager?

Lloyds have previously invited me to try their personal wealth management, private banking and briefly Mayfair banking, though this was confined to advertisements in online banking. I just took it as a compliment and ignored it. Halifax stuck to trying to get me to invest and buy a house.

I am doubting I can get them to reverse their decision but will give it a shot, but I suspect I will need to play the student saving frantically for a house deposit who wants info on home insurance card for all it's worth if I am to stand any chance of making them budge.

Regardless I have shifted the moneybox DD to RBS and set a switch in motion from one of my BOS donor accounts with 2 DDs to my donor Natwest account so am not taking any chances.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards