We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Are we expecting BOE to remain at 4.75% on 8th February 2025?

Comments

-

I'm not sure what you want me to say? Congratulations?fewcloudy said:

@lojo1000lojo1000 said:

Property is the most leveraged asset globally including the UK. Whilst the banks will not want to repossess they will eventually be forced into this.fewcloudy said:

For many of us who enjoyed the upside since 2008, there is no downside in the way you are thinking.lojo1000 said:

If you wanted low interest rates and enjoyed the upside for many years, I hope you prepare for the downside.

The mortgage has gone, due to massive overpayments made possible by over a decade of near zero interest rate.

Those same overpayments are now just called payments, and are diverted into various savings, pension pots, car/holidays etc. Plus the savings themselves are now offering the highest interest rates seen in over a decade.

I would suggest those most affected by a 'downside' are unfortunately those least likely to have benefited from very low interest rates for many years. i.e. first time buyers or younger borrowers.

As I said earlier, asset values will decline (relative to goods and services inflation) but liabilities will remain.

If the govts try and save property owners then I expect the young will be up in arms since it will once again be at their expense.

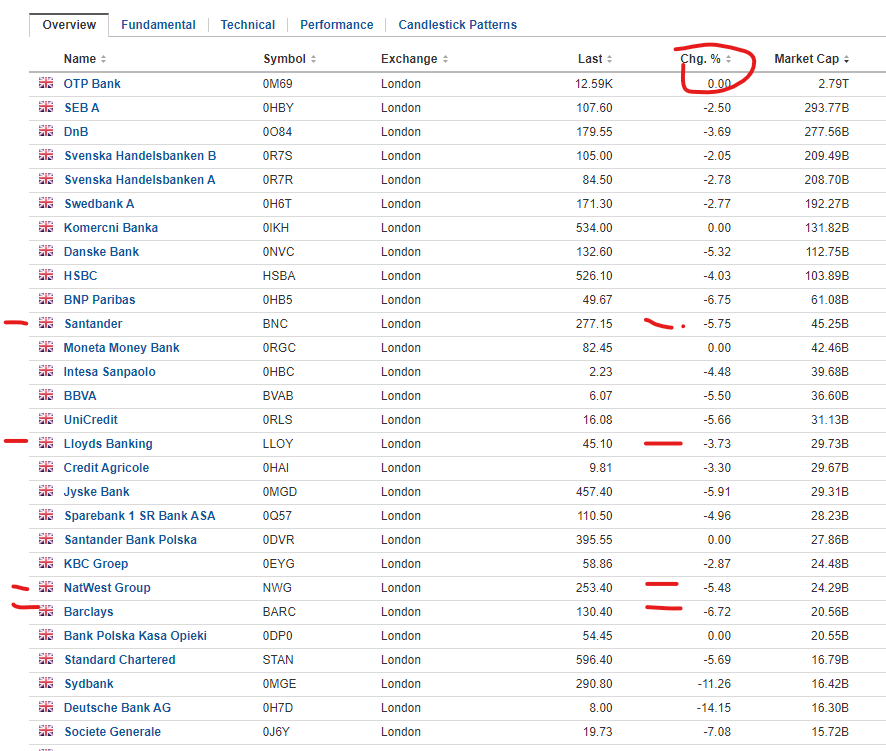

Here are the UK mortgage bank stocks this morning with their 1 day moves. Are you buying?

All very interesting, but it doesn't affect me nor address anything I said

After high interest rates through the 90's, I DID want low interest rates thanks, and I DID enjoy the upside for many years thanks, and due to the age and stage I am at in life now, I am very much enjoying these higher interest rates thanks.

All your facts and figures, and what is most leveraged etc won't change that for me and many others.

And I'm not unusual in my circle of friends/family either; you do realise there were many of us on very low rate trackers for nearly a decade right?

Did you know lenders even tried (but failed), to use the courts to be allowed to cancel mortgage agreements because they said they never envisioned customers sitting on near zero percent for life of mortgage? aww those poor lenders my heart bleeds.

It was brilliant.

I'm simply pointing out, to the many on this forum who seem uninformed, that asset prices will see significant falls unless central banks/govts are prepared to once again sacrifice the fortunes of the younger generations for the benefit of the older generations.To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

Governments do whatever is going to secure them the most votes.lojo1000 said:

I'm not sure what you want me to say? Congratulations?fewcloudy said:

@lojo1000lojo1000 said:

Property is the most leveraged asset globally including the UK. Whilst the banks will not want to repossess they will eventually be forced into this.fewcloudy said:

For many of us who enjoyed the upside since 2008, there is no downside in the way you are thinking.lojo1000 said:

If you wanted low interest rates and enjoyed the upside for many years, I hope you prepare for the downside.

The mortgage has gone, due to massive overpayments made possible by over a decade of near zero interest rate.

Those same overpayments are now just called payments, and are diverted into various savings, pension pots, car/holidays etc. Plus the savings themselves are now offering the highest interest rates seen in over a decade.

I would suggest those most affected by a 'downside' are unfortunately those least likely to have benefited from very low interest rates for many years. i.e. first time buyers or younger borrowers.

As I said earlier, asset values will decline (relative to goods and services inflation) but liabilities will remain.

If the govts try and save property owners then I expect the young will be up in arms since it will once again be at their expense.

Here are the UK mortgage bank stocks this morning with their 1 day moves. Are you buying?

All very interesting, but it doesn't affect me nor address anything I said

After high interest rates through the 90's, I DID want low interest rates thanks, and I DID enjoy the upside for many years thanks, and due to the age and stage I am at in life now, I am very much enjoying these higher interest rates thanks.

All your facts and figures, and what is most leveraged etc won't change that for me and many others.

And I'm not unusual in my circle of friends/family either; you do realise there were many of us on very low rate trackers for nearly a decade right?

Did you know lenders even tried (but failed), to use the courts to be allowed to cancel mortgage agreements because they said they never envisioned customers sitting on near zero percent for life of mortgage? aww those poor lenders my heart bleeds.

It was brilliant.

I'm simply pointing out, to the many on this forum who seem uninformed, that asset prices will see significant falls unless central banks/govts are prepared to once again sacrifice the fortunes of the younger generations for the benefit of the older generations.

Given that we have an aging population which end of the market do you think they will look after most?0 -

That's not how UK constituency voting works. If old and young were evenly distributed across constituencies, govts may focus on the majority vote across the nation. But it's the marginal seats in more densely populated areas which matter more and they have a larger leaning toward the younger generations.RelievedSheff said:

Governments do whatever is going to secure them the most votes.lojo1000 said:

I'm not sure what you want me to say? Congratulations?fewcloudy said:

@lojo1000lojo1000 said:

Property is the most leveraged asset globally including the UK. Whilst the banks will not want to repossess they will eventually be forced into this.fewcloudy said:

For many of us who enjoyed the upside since 2008, there is no downside in the way you are thinking.lojo1000 said:

If you wanted low interest rates and enjoyed the upside for many years, I hope you prepare for the downside.

The mortgage has gone, due to massive overpayments made possible by over a decade of near zero interest rate.

Those same overpayments are now just called payments, and are diverted into various savings, pension pots, car/holidays etc. Plus the savings themselves are now offering the highest interest rates seen in over a decade.

I would suggest those most affected by a 'downside' are unfortunately those least likely to have benefited from very low interest rates for many years. i.e. first time buyers or younger borrowers.

As I said earlier, asset values will decline (relative to goods and services inflation) but liabilities will remain.

If the govts try and save property owners then I expect the young will be up in arms since it will once again be at their expense.

Here are the UK mortgage bank stocks this morning with their 1 day moves. Are you buying?

All very interesting, but it doesn't affect me nor address anything I said

After high interest rates through the 90's, I DID want low interest rates thanks, and I DID enjoy the upside for many years thanks, and due to the age and stage I am at in life now, I am very much enjoying these higher interest rates thanks.

All your facts and figures, and what is most leveraged etc won't change that for me and many others.

And I'm not unusual in my circle of friends/family either; you do realise there were many of us on very low rate trackers for nearly a decade right?

Did you know lenders even tried (but failed), to use the courts to be allowed to cancel mortgage agreements because they said they never envisioned customers sitting on near zero percent for life of mortgage? aww those poor lenders my heart bleeds.

It was brilliant.

I'm simply pointing out, to the many on this forum who seem uninformed, that asset prices will see significant falls unless central banks/govts are prepared to once again sacrifice the fortunes of the younger generations for the benefit of the older generations.

Given that we have an aging population which end of the market do you think they will look after most?To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

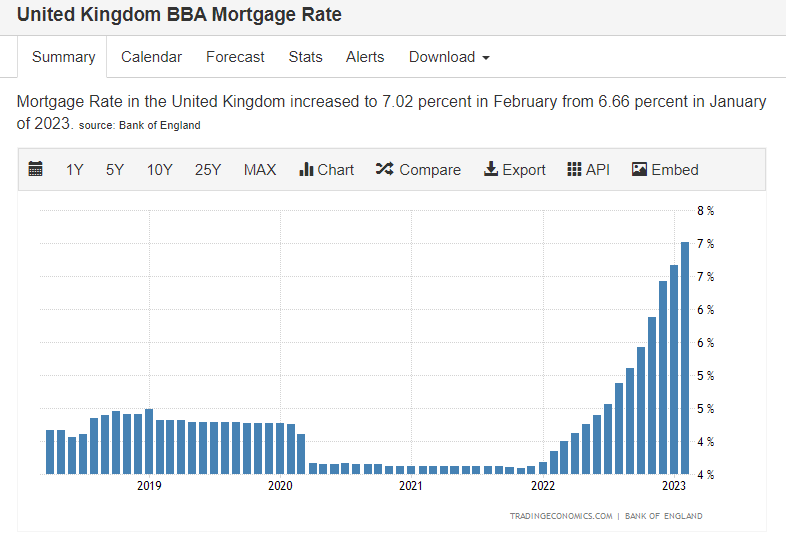

Not sure what the last few posts were about but I was wrong about BOE base rate increase to 4.25%

Wow we have come a long way in the last 16/17 months and very very painful for millions of mortgage holders.

Tough times ahead0 -

dimbo61 said:Not sure what the last few posts were about but I was wrong about BOE base rate increase to 4.25%

Wow we have come a long way in the last 16/17 months and very very painful for millions of mortgage holders.

Tough times ahead

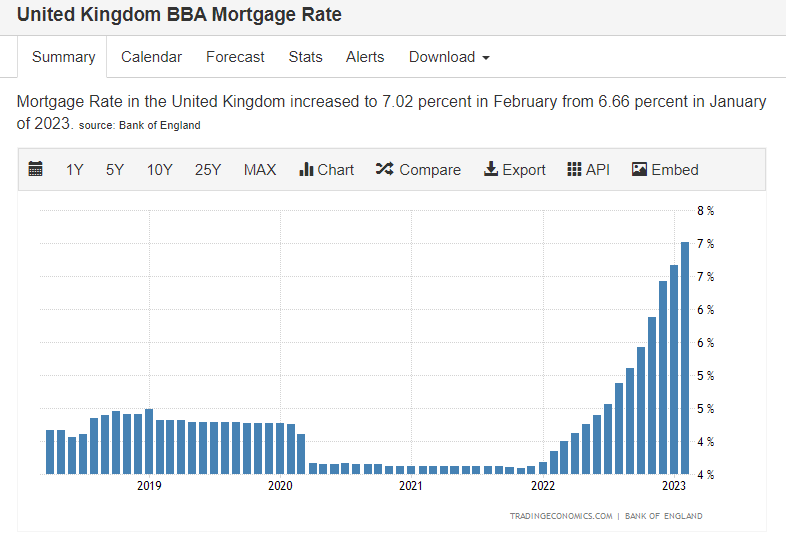

And the UK mortgage rate just isn't falling as the BoE fails to take inflation seriously (or rather the fear of an economic collapse from raising rates is greater than the fear from an economic collapse from inflation).To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

We are in a bad situation when it's not the manual workers that are striking, but the university educated too.

And the UK mortgage rate just isn't falling as the BoE fails to take inflation seriously (or rather the fear of an economic collapse from raising rates is greater than the fear from an economic collapse from inflation).

With inflation at 10%+ and pay increases at around 5% that means millions of people will have less money to spend. With a rise in oil prices today, if 5% is taken out of the economy for a second year, the pain will continue.2 -

Thought I would update the thread title!2

-

I had wanted to go tracker, but the increase in oil concerns me and means I've gone for 5 years fixed at 4.11 (no fees) instead1

-

The idea of edging towards 4.75/5% is kept in mind.dimbo61 said:Not sure what the last few posts were about but I was wrong about BOE base rate increase to 4.25%

Wow we have come a long way in the last 16/17 months and very very painful for millions of mortgage holders.

Tough times aheadReplenished CRA Reports.2020 Nissan Leaf 128-149 miles top charge. Savings depleted. VM Stream tv M250 Volted to M350 then M500 since returned to 1gb0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards