We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Are we expecting BOE to remain at 4.75% on 8th February 2025?

Comments

-

I agree, if they do increase on some products, I think it will be less than 0.25%. I imagine most will just stay the same given the interest rate rise makes very little difference in real termsdougson said:

My suspicion is that there won't be much change. Expectation was to hit 4.25 at some point, only thing likely to change that is if a further increase is expected and by being at 4.25 the jump to 4.5 is more likely than it was when we were at 4.jm475 said:What do you think the interest rise and longer term outlook will do for new fixed rate mortgage products? Do you think banks have anticipated this and will offer lower interest rates on new products or will new products have higher interest rates? I know it's a crystal ball thing....just keen to hear your thoughts!

Due to renew before June. Currently seeing 4.63 with Santander. L&C will be looking for other products from tomorrow.

Thanks!!! 2

2 -

Bailey’s comments about inflation….I would say to people who are setting prices - please understand, if we get inflation embedded, interest rates will have to go up further and higher inflation really benefits nobody,"https://www.bbc.co.uk/news/technology-65056733

As if any company is going to listen to him telling them to be careful about putting their prices up. Many will look on this as a golden opportunity to maximise their profits!0 -

Not if demand dries up, they won't - and it already is drying up.Aberdeenangarse said:Bailey’s comments about inflation….I would say to people who are setting prices - please understand, if we get inflation embedded, interest rates will have to go up further and higher inflation really benefits nobody,"https://www.bbc.co.uk/news/technology-65056733

As if any company is going to listen to him telling them to be careful about putting their prices up. Many will look on this as a golden opportunity to maximise their profits!3 -

Why are retail sales increasing then?lmitchell said:

Not if demand dries up, they won't - and it already is drying up.Aberdeenangarse said:Bailey’s comments about inflation….I would say to people who are setting prices - please understand, if we get inflation embedded, interest rates will have to go up further and higher inflation really benefits nobody,"https://www.bbc.co.uk/news/technology-65056733

As if any company is going to listen to him telling them to be careful about putting their prices up. Many will look on this as a golden opportunity to maximise their profits!

https://www.bloomberg.com/news/articles/2023-03-24/uk-retail-sales-rise-more-than-forecast-as-outlook-brightens?leadSource=uverify%20wall

0 -

No idea because from everyone I know, from low earners to people paying well into additional rate tax, all are cutting back on expenditure. Worryingly though consumer debt, especially on buy now pay later, Klarna type operations etc seems to be skyrocketing and doing so by people purchasing non-essentials.Aberdeenangarse said:

Why are retail sales increasing then?lmitchell said:

Not if demand dries up, they won't - and it already is drying up.Aberdeenangarse said:Bailey’s comments about inflation….I would say to people who are setting prices - please understand, if we get inflation embedded, interest rates will have to go up further and higher inflation really benefits nobody,"https://www.bbc.co.uk/news/technology-65056733

As if any company is going to listen to him telling them to be careful about putting their prices up. Many will look on this as a golden opportunity to maximise their profits!

https://www.bloomberg.com/news/articles/2023-03-24/uk-retail-sales-rise-more-than-forecast-as-outlook-brightens?leadSource=uverify%20wall0 -

Property is the most leveraged asset globally including the UK. Whilst the banks will not want to repossess they will eventually be forced into this.fewcloudy said:

For many of us who enjoyed the upside since 2008, there is no downside in the way you are thinking.lojo1000 said:

If you wanted low interest rates and enjoyed the upside for many years, I hope you prepare for the downside.

The mortgage has gone, due to massive overpayments made possible by over a decade of near zero interest rate.

Those same overpayments are now just called payments, and are diverted into various savings, pension pots, car/holidays etc. Plus the savings themselves are now offering the highest interest rates seen in over a decade.

I would suggest those most affected by a 'downside' are unfortunately those least likely to have benefited from very low interest rates for many years. i.e. first time buyers or younger borrowers.

As I said earlier, asset values will decline (relative to goods and services inflation) but liabilities will remain.

If the govts try and save property owners then I expect the young will be up in arms since it will once again be at their expense.

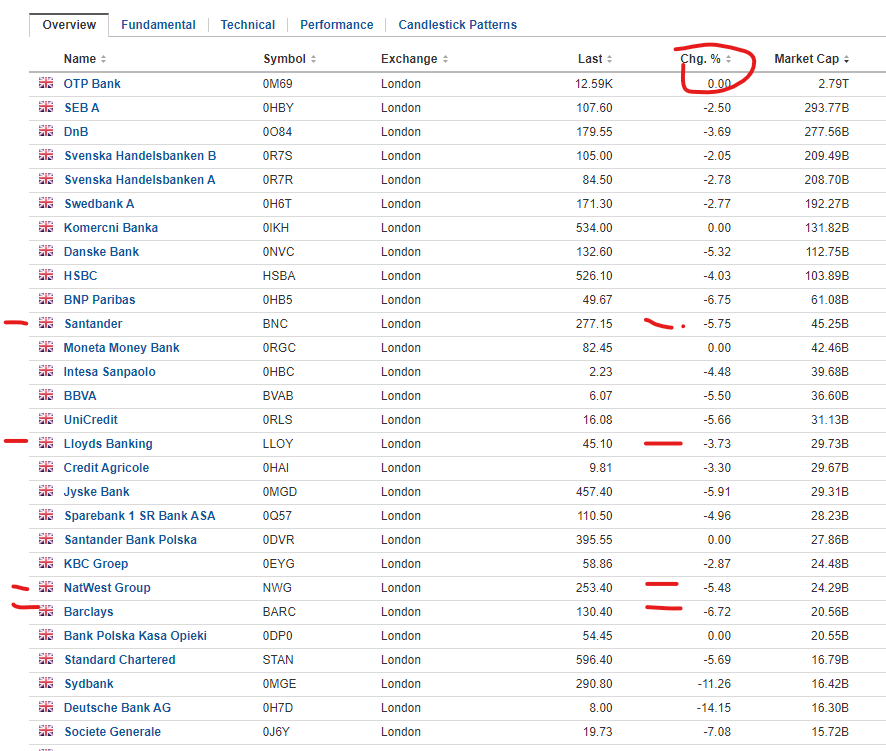

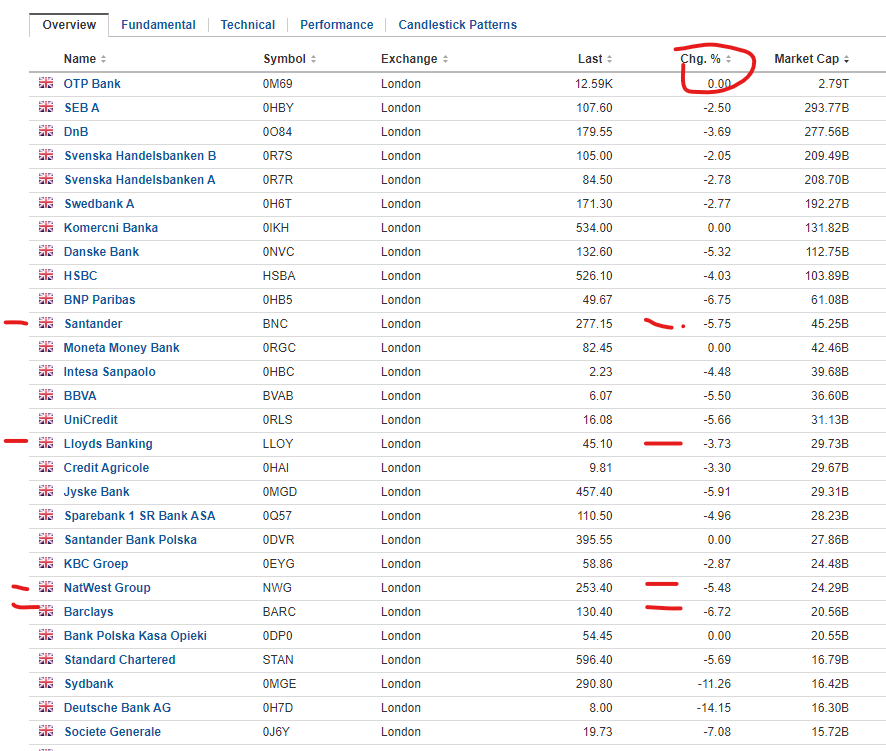

Here are the UK mortgage bank stocks this morning with their 1 day moves. Are you buying? To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

That's an outlier out of the last 4-6 months of retail data...Aberdeenangarse said:

Why are retail sales increasing then?lmitchell said:

Not if demand dries up, they won't - and it already is drying up.Aberdeenangarse said:Bailey’s comments about inflation….I would say to people who are setting prices - please understand, if we get inflation embedded, interest rates will have to go up further and higher inflation really benefits nobody,"https://www.bbc.co.uk/news/technology-65056733

As if any company is going to listen to him telling them to be careful about putting their prices up. Many will look on this as a golden opportunity to maximise their profits!

https://www.bloomberg.com/news/articles/2023-03-24/uk-retail-sales-rise-more-than-forecast-as-outlook-brightens?leadSource=uverify%20wall0 -

Retail sales should be good. Employment is strong.Aberdeenangarse said:

Why are retail sales increasing then?lmitchell said:

Not if demand dries up, they won't - and it already is drying up.Aberdeenangarse said:Bailey’s comments about inflation….I would say to people who are setting prices - please understand, if we get inflation embedded, interest rates will have to go up further and higher inflation really benefits nobody,"https://www.bbc.co.uk/news/technology-65056733

As if any company is going to listen to him telling them to be careful about putting their prices up. Many will look on this as a golden opportunity to maximise their profits!

https://www.bloomberg.com/news/articles/2023-03-24/uk-retail-sales-rise-more-than-forecast-as-outlook-brightens?leadSource=uverify%20wall

The issue we face going forward is we have an inverted yield curve and investors are (finally) waking up to this.

Banks borrow short and lend long. Meaning banks take in deposits which are often current account or short term fixed accounts and lend fixed over a longer period. In the UK this is often 2-5 years on residential mortgages but 5-15years on commercial property.

Due to too much fiscal and monetary expansion during Covid (and in my opinion for the last 20 years) too many people chased too few investment opportunities. Money followed money into property, stocks, NFTs and sneakers (!). A complete waste of money that could have been put into productive projects but was simply chasing assets in the secondary market (already produced).

Eventually, due to constrained goods supply, that same money started outstripping the supply of goods (and eventually labour) leading to inflation.

In order to stop inflation and bring down the excess money to a level better commensurate with the level of goods & services in the economy, central banks raised rates.

Banks are now faced with paying depositors a decent rate on their savings or see their deposit base move to other better investment opportunities (eg. in the UK, National Savings).

So banks lent against property at low rates over the last 1-10 years and now face paying higher rates.

They either: keep paying depositors low rates and see their assets walk out the door or pay higher rates and make a loss.

They potentially go out of business either way until the yield curve de-inverts.

That happens 2 ways, either short rates come down or long rates go up. If long rates go up, byebye to property values. More likely short rates come down below long rates. But if this happens it is not a good sign, as it is either due to a deflationary economy or central banks are once again trying to solve a long term problem with short term (money) solutions.

We may not enjoy low inflation as we did over the last 20 years, as relations with China have gone downhill and there is a growing alliance between many Eastern nations who feel the West are trying to keep them poor (green energy laws, labour laws, etc). Whilst the West enjoyed 20 years of growth, the West is now trying to rule over them and keep them from 'levelling up'.To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.4 -

If you are long property (not your home) on this forum, will you please tell me how much attention you pay to economics and world events.

This is not meant to be a facetious comment, I am trying to understand how much attention the average property buyer pays to macro events.

Thank you.To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

@lojo1000lojo1000 said:

Property is the most leveraged asset globally including the UK. Whilst the banks will not want to repossess they will eventually be forced into this.fewcloudy said:

For many of us who enjoyed the upside since 2008, there is no downside in the way you are thinking.lojo1000 said:

If you wanted low interest rates and enjoyed the upside for many years, I hope you prepare for the downside.

The mortgage has gone, due to massive overpayments made possible by over a decade of near zero interest rate.

Those same overpayments are now just called payments, and are diverted into various savings, pension pots, car/holidays etc. Plus the savings themselves are now offering the highest interest rates seen in over a decade.

I would suggest those most affected by a 'downside' are unfortunately those least likely to have benefited from very low interest rates for many years. i.e. first time buyers or younger borrowers.

As I said earlier, asset values will decline (relative to goods and services inflation) but liabilities will remain.

If the govts try and save property owners then I expect the young will be up in arms since it will once again be at their expense.

Here are the UK mortgage bank stocks this morning with their 1 day moves. Are you buying?

All very interesting, but it doesn't affect me nor address anything I said

After high interest rates through the 90's, I DID want low interest rates thanks, and I DID enjoy the upside for many years thanks, and due to the age and stage I am at in life now, I am very much enjoying these higher interest rates thanks.

All your facts and figures, and what is most leveraged etc won't change that for me and many others.

And I'm not unusual in my circle of friends/family either; you do realise there were many of us on very low rate trackers for nearly a decade right?

Did you know lenders even tried (but failed), to use the courts to be allowed to cancel mortgage agreements because they said they never envisioned customers sitting on near zero percent for life of mortgage? aww those poor lenders my heart bleeds.

It was brilliant.Feb 2008, 20year lifetime tracker with "Sproggit and Sylvester"... 0.14% + base for 2 years, then 0.99% + base for life of mortgage...base was 5.5% in 2008...but not for long. Credit to my mortgage broker2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards