We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

List of banks with hard vs soft searches for current accounts

Comments

-

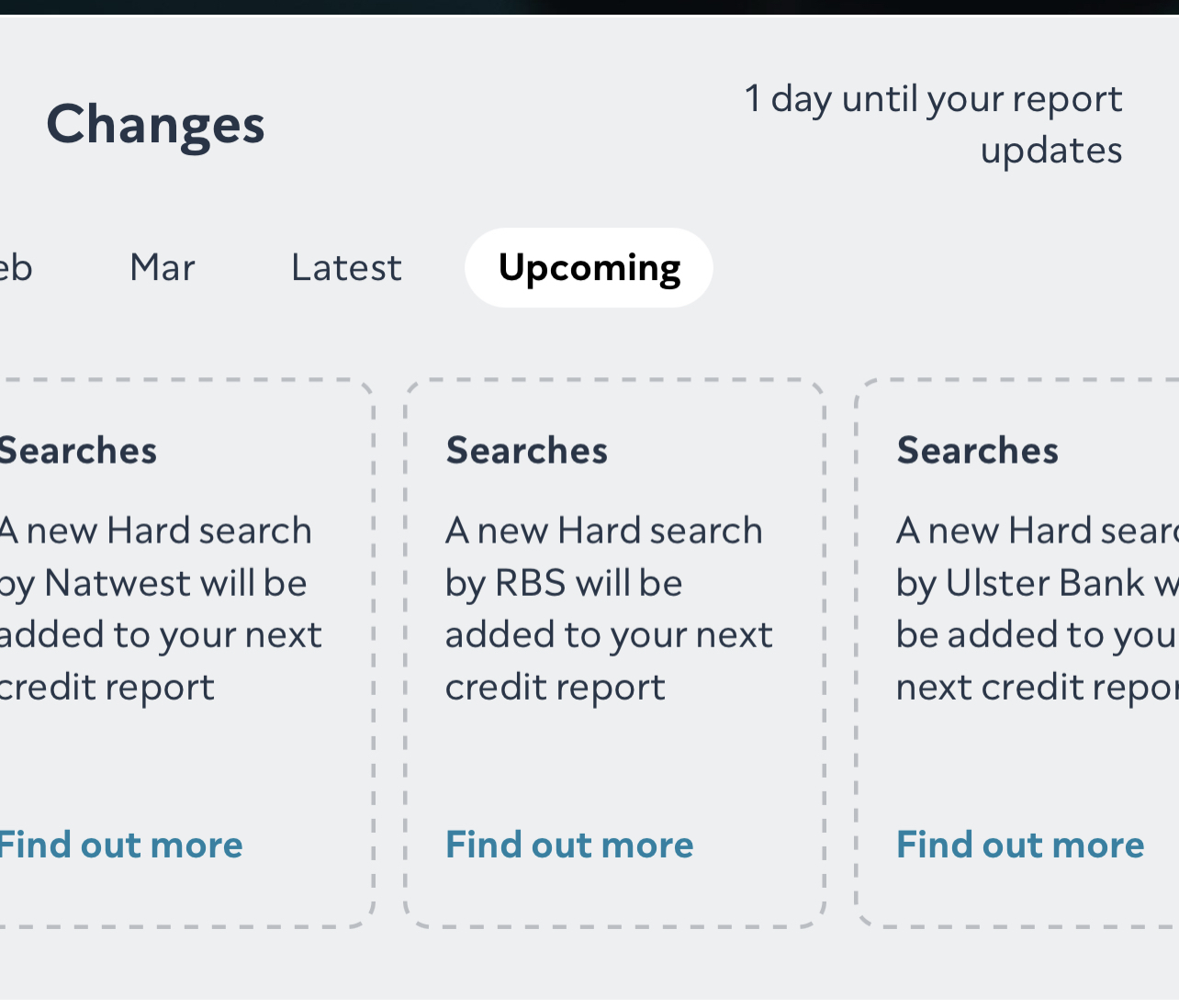

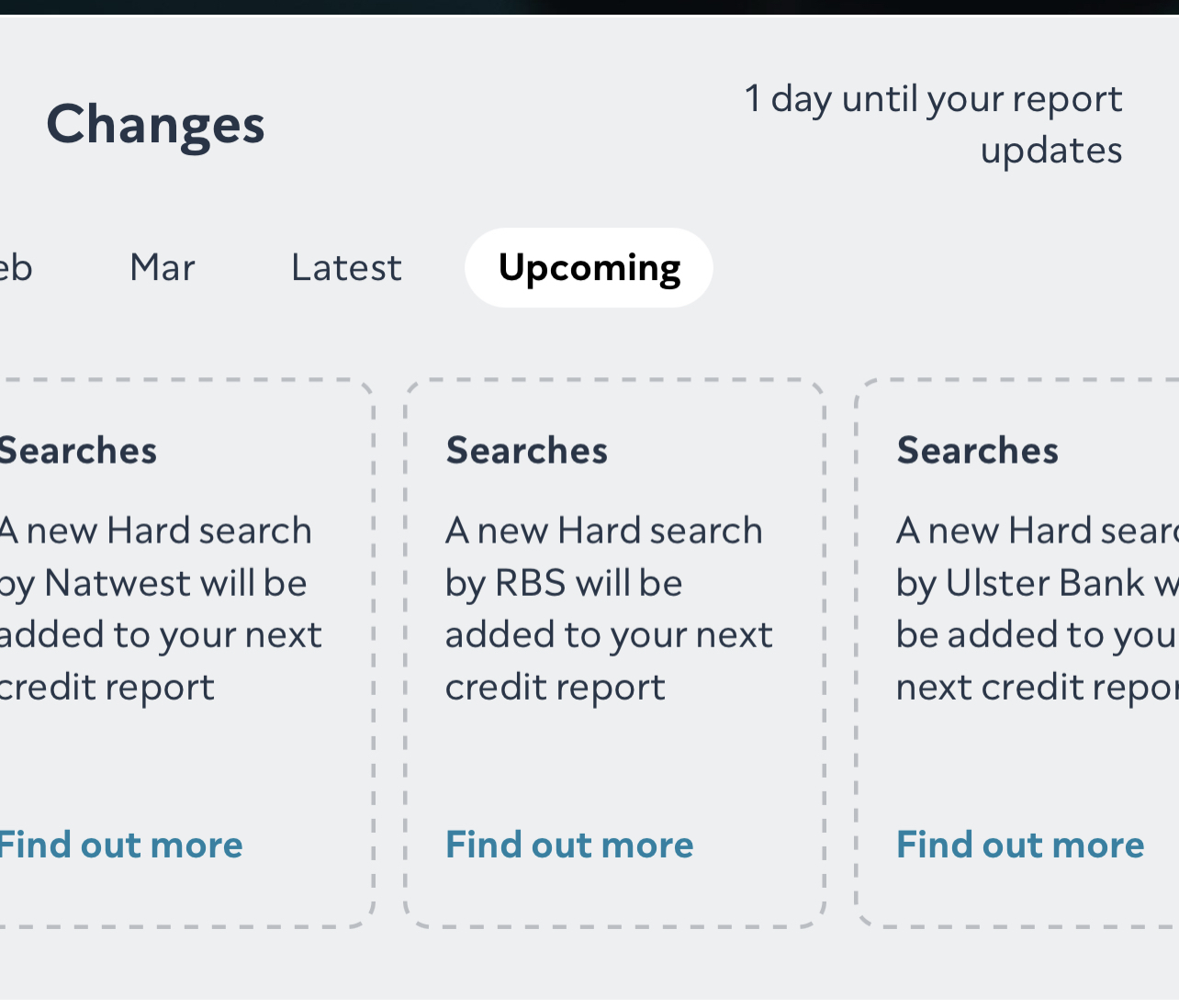

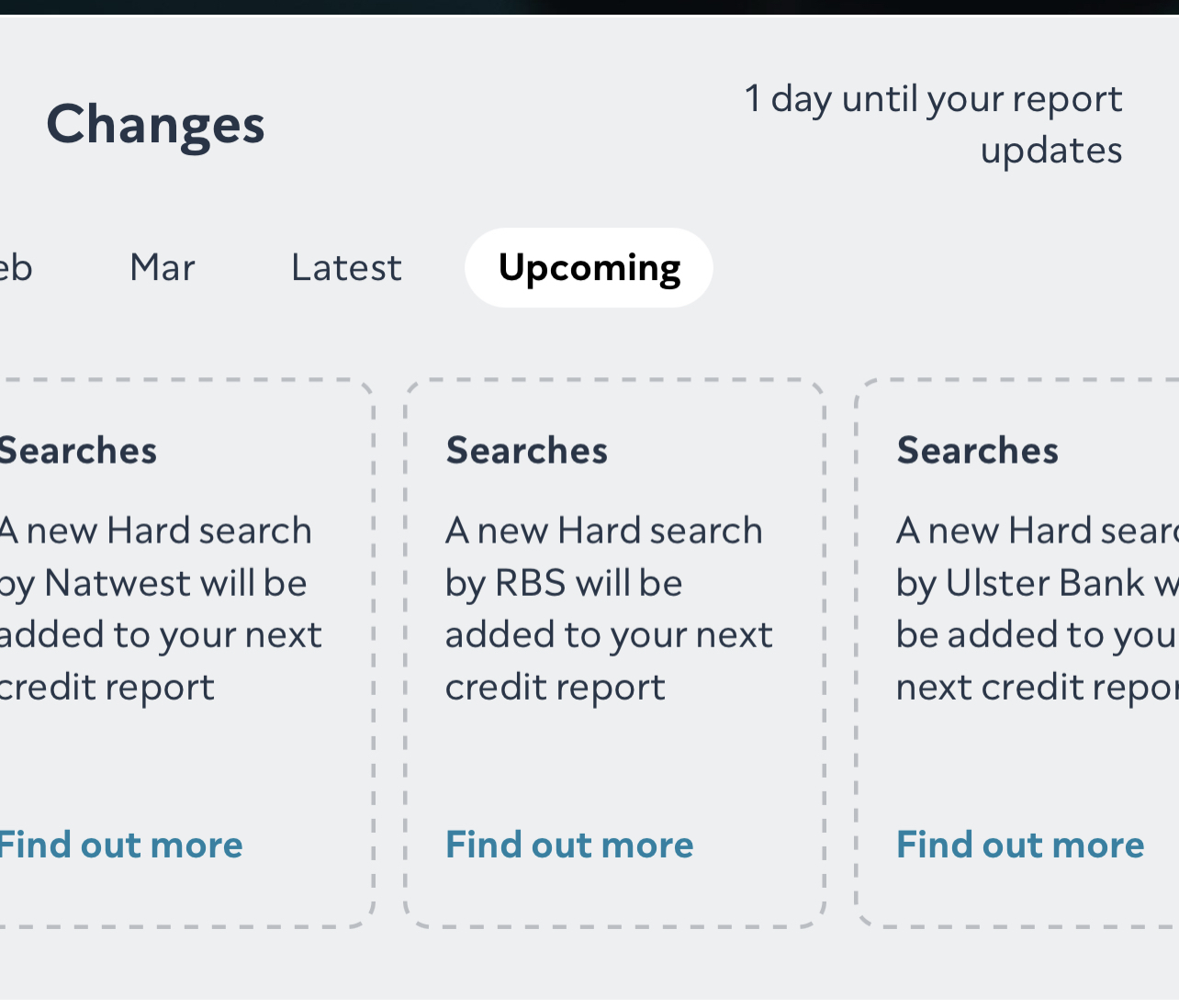

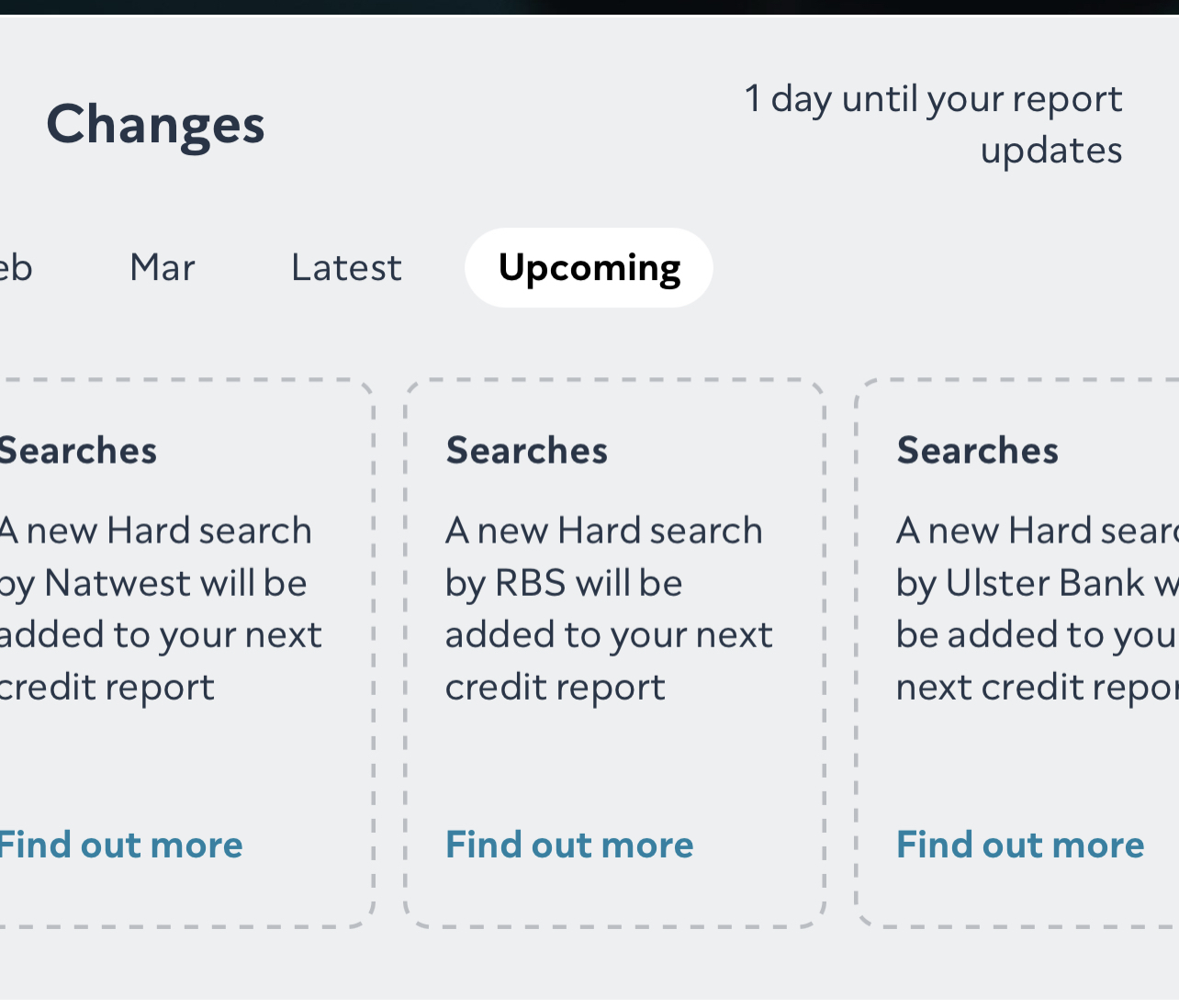

Thank you for this - I was told that they wouldn’t be doing a credit search over the phone so it’s helpful to know.Band7 said:I am an existing RBS, Natwest and Ulster account holder, and applied for a new current account, no O/Ds, with each of them on Friday. I can’t recall I was asked/told about credit searches, and initially, no searches were showing on any of the CRAs. CreditKarma has now just notified me that 3 hard searches will be added. Not that this worries me as I won’t be applying for any actual credit any time soon.

I likely won’t be applying for credit anytime within the next year (I gave up with CCs as the soft search eligibility checkers didn’t give me much hope), but I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

When I was under 18 I didn’t have to think about this - it was a great time 😂.

I cannot be found on any of the statutory report sites, or the MSE credit club etc - I think I need to allow a little time for my report to begin.

In the past week, I’ve upgraded some accounts which I don’t think incurs a search, and I’ve also opened some new current accounts (including with LBG with whom I am an existing customer)

Halifax Reward upgrade - pretty sure there will be no hard search

Club Lloyds CA upgrade - pretty sure there will be no hard search

BoS Classic new account as an existing customer - pretty sure no hard search

Lloyds Classic new account as an existing customer - pretty sure no hard search

Nationwide FlexAccount - told me during application it was doing a hard search

Santander Basic Bank account - sounds like there is no hard search

Metro Bank CA - they said there would be a hard search when I called them, and when I messaged them on Twitter, but people’s experiences suggest there won’t be

Nationwide FlexDirect - told me during application it was doing a hard search

RBS upgraded to select so could prepare direct debits for reward - they told me no hard search

First Direct CA - they told me on Twitter there would be a hard search

I didn’t apply for an overdraft with any, but first direct seems to search to see if they can offer one regardless as they didn’t give me the option to opt out, and it told me at the end I couldn’t get one, only the account itself.

This means I will have got between 3 and 4 hard searches before I even open the RBS NW and Ulster ones to switch into.

I feel like 6-7 hard searches so early on may begin to be a problem, even given that I’m not looking to apply for credit and only for current accountsIf you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

If I may be so bold ... HAPPY BIRTHDAY @ForumUser7 ... a great credit to the forum.

When I was under 18 I didn’t have to think about this - it was a great time 😂.

...4 -

Thank you very much @dealyboydealyboy said:

If I may be so bold ... HAPPY BIRTHDAY @ForumUser7 ... a great credit to the forum.

When I was under 18 I didn’t have to think about this - it was a great time 😂.

... If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

Not in my experience. I have had well over a dozen hard searches showing at times, and still got accepted for further current accounts. My mythical CRA credit scores took a dive, from excellent to good, because of the many searches but it didn't matter to me as the only accounts I was after were current accounts w/o O/Ds. It would obviously quite different if I wanted a mortgage, a loan, a credit card, or an overdraft.ForumUser7 said:I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

For current account applications, it also doesn't appear to matter if you already have several dozen showing on your credit files.

BUT.....banks can change their rules any time they like, so the only way to find out what actually happens for you at any given point in time is to make an application.

I don't know whether age plays a role - I am very much at the other end of the age scale. I am sure you will find outForumUser7 said:

When I was under 18 I didn’t have to think about this - it was a great time 😂. 1

1 -

The thing with credit cards is that they're a bit of a catch 22. You will struggle to get credit if you've no credit history but the best way to show good credit history is to have a credit card which you use regularly. From the lenders perspective they would rather lend money to someone who has a long established history of borrowing money but always paying it back on time rather than someone who has never borrowed before. This fact is compounded I think by the fact that your credit report isn't available yet, so you could easily stand a better chance of getting a CC once the reports are available.ForumUser7 said:

Thank you for this - I was told that they wouldn’t be doing a credit search over the phone so it’s helpful to know.Band7 said:I am an existing RBS, Natwest and Ulster account holder, and applied for a new current account, no O/Ds, with each of them on Friday. I can’t recall I was asked/told about credit searches, and initially, no searches were showing on any of the CRAs. CreditKarma has now just notified me that 3 hard searches will be added. Not that this worries me as I won’t be applying for any actual credit any time soon.

I likely won’t be applying for credit anytime within the next year (I gave up with CCs as the soft search eligibility checkers didn’t give me much hope), but I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

When I was under 18 I didn’t have to think about this - it was a great time 😂.

I cannot be found on any of the statutory report sites, or the MSE credit club etc - I think I need to allow a little time for my report to begin.

In the past week, I’ve upgraded some accounts which I don’t think incurs a search, and I’ve also opened some new current accounts (including with LBG with whom I am an existing customer)

Halifax Reward upgrade - pretty sure there will be no hard search

Club Lloyds CA upgrade - pretty sure there will be no hard search

BoS Classic new account as an existing customer - pretty sure no hard search

Lloyds Classic new account as an existing customer - pretty sure no hard search

Nationwide FlexAccount - told me during application it was doing a hard search

Santander Basic Bank account - sounds like there is no hard search

Metro Bank CA - they said there would be a hard search when I called them, and when I messaged them on Twitter, but people’s experiences suggest there won’t be

Nationwide FlexDirect - told me during application it was doing a hard search

RBS upgraded to select so could prepare direct debits for reward - they told me no hard search

First Direct CA - they told me on Twitter there would be a hard search

I didn’t apply for an overdraft with any, but first direct seems to search to see if they can offer one regardless as they didn’t give me the option to opt out, and it told me at the end I couldn’t get one, only the account itself.

This means I will have got between 3 and 4 hard searches before I even open the RBS NW and Ulster ones to switch into.

I feel like 6-7 hard searches so early on may begin to be a problem, even given that I’m not looking to apply for credit and only for current accounts

The eligibility checkers weren't optimistic for me either at your age (in 2021) if it's any consolation. This is one of the reasons why I'd recommend getting the HSBC student account as you will likely be able to get hold of their student credit card and demonstrate good credit usage from that, indeed this was the first credit card I was able to get my hands on. Plus the HSBC student account comes with a large 0% OD to stooze.

After I'd switched HSBC to TSB, resulting in me having to close the HSBC credit card, leaving me with no credit cards I found myself ineligible for any credit cards until August when Amex came along. Pretty much as soon as Amex showed on my credit report I was able to get 2 more credit cards (Capital One and Tesco) so left it at that. From that point until the Barclays default appeared the eligibility checkers showed I was eligible for around half a dozen others.

I tend to just ignore hard searches myself. If my memory serves me well I had around 10 hard searches on my report at the time I applied for Amex if that's any use to you.2 -

Thanks for this information @bridlington1Bridlington1 said:

The thing with credit cards is that they're a bit of a catch 22. You will struggle to get credit if you've no credit history but the best way to show good credit history is to have a credit card which you use regularly. From the lenders perspective they would rather lend money to someone who has a long established history of borrowing money but always paying it back on time rather than someone who has never borrowed before. This fact is compounded I think by the fact that your credit report isn't available yet, so you could easily stand a better chance of getting a CC once the reports are available.ForumUser7 said:

Thank you for this - I was told that they wouldn’t be doing a credit search over the phone so it’s helpful to know.Band7 said:I am an existing RBS, Natwest and Ulster account holder, and applied for a new current account, no O/Ds, with each of them on Friday. I can’t recall I was asked/told about credit searches, and initially, no searches were showing on any of the CRAs. CreditKarma has now just notified me that 3 hard searches will be added. Not that this worries me as I won’t be applying for any actual credit any time soon.

I likely won’t be applying for credit anytime within the next year (I gave up with CCs as the soft search eligibility checkers didn’t give me much hope), but I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

When I was under 18 I didn’t have to think about this - it was a great time 😂.

I cannot be found on any of the statutory report sites, or the MSE credit club etc - I think I need to allow a little time for my report to begin.

In the past week, I’ve upgraded some accounts which I don’t think incurs a search, and I’ve also opened some new current accounts (including with LBG with whom I am an existing customer)

Halifax Reward upgrade - pretty sure there will be no hard search

Club Lloyds CA upgrade - pretty sure there will be no hard search

BoS Classic new account as an existing customer - pretty sure no hard search

Lloyds Classic new account as an existing customer - pretty sure no hard search

Nationwide FlexAccount - told me during application it was doing a hard search

Santander Basic Bank account - sounds like there is no hard search

Metro Bank CA - they said there would be a hard search when I called them, and when I messaged them on Twitter, but people’s experiences suggest there won’t be

Nationwide FlexDirect - told me during application it was doing a hard search

RBS upgraded to select so could prepare direct debits for reward - they told me no hard search

First Direct CA - they told me on Twitter there would be a hard search

I didn’t apply for an overdraft with any, but first direct seems to search to see if they can offer one regardless as they didn’t give me the option to opt out, and it told me at the end I couldn’t get one, only the account itself.

This means I will have got between 3 and 4 hard searches before I even open the RBS NW and Ulster ones to switch into.

I feel like 6-7 hard searches so early on may begin to be a problem, even given that I’m not looking to apply for credit and only for current accounts

The eligibility checkers weren't optimistic for me either at your age (in 2021) if it's any consolation. This is one of the reasons why I'd recommend getting the HSBC student account as you will likely be able to get hold of their student credit card and demonstrate good credit usage from that, indeed this was the first credit card I was able to get my hands on. Plus the HSBC student account comes with a large 0% OD to stooze.

After I'd switched HSBC to TSB, resulting in me having to close the HSBC credit card, leaving me with no credit cards I found myself ineligible for any credit cards until August when Amex came along. Pretty much as soon as Amex showed on my credit report I was able to get 2 more credit cards (Capital One and Tesco) so left it at that. From that point until the Barclays default appeared the eligibility checkers showed I was eligible for around half a dozen others.

I tend to just ignore hard searches myself. If my memory serves me well I had around 10 hard searches on my report at the time I applied for Amex if that's any use to you.

And that's precisely what I'm thinking! I was wondering about seeing if I can be added as an authorised user on my parents credit card - they have a good history and always pay off in full etc. My only concern is if me not having any history, and lots of hard searches affects their limit of anything. And yes, that seems likely. I'm going to try reregistering for clearscore, credit karma, mse credit club, and the statutory reports after the exams in June. I imagine by then I should be up and running, and I can try the eligibility checkers again.

Did you have a qualifying regular income when you applied for the HSBC Student CC? I don't have a job currently since COVID, but I get a small allowance each month from my parents, but money from parents doesn't usually seem to count for the eligibility checkers. Maybe it's different for HSBC, but TSB said it wouldn't be considered. HSBCs website states a guaranteed overdraft of £1,000, so maybe that is one to go for - seems it wouldn't matter if my credit report was a shambles or not. Unless they just didn't accept the application for the account itself. I currently hold conditional offers, so I'm not eligible for the account just yet anyway. Once I have a confirmed place (not sure if they just mean to have attained the required grades), I'll likely get the HSBC account. This would mean my TSB account would have to be closed, so if there was a good switching offer around at the time anywhere, I could just switch my TSB account out right? That would close that student account, leaving me free to apply for a different student account.

Re the HSBC -> TSB, is closure of the HSBC CC only applicable if you switch out/close the HSBC Student Account? As opposed to switching out any account with them? I ask because they 'upgraded' my 'MyAccount' into a bank account, so once I've opened the student account this would be ripe for switching. Unless I can upgrade this one, and avoid the initial credit search.

That's helpful to know, thank you. Is there any distinction made on the credit report as to whether you applied for credit when they carried out the hard search, or if they just carried it out to open a non-credit account? The providers must also look at available credit, and if they see none, maybe they realise some were just current account w/o overdraft hard searches.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

I would say it's probably wise to keep you and your parent's credit files de-linked. I would suggest just doing the usual making sure you are on the electoral register etc for now and maybe hold off maxing out and stoozing ODs till you get the HSBC OD.ForumUser7 said:

Thanks for this information @bridlington1Bridlington1 said:

The thing with credit cards is that they're a bit of a catch 22. You will struggle to get credit if you've no credit history but the best way to show good credit history is to have a credit card which you use regularly. From the lenders perspective they would rather lend money to someone who has a long established history of borrowing money but always paying it back on time rather than someone who has never borrowed before. This fact is compounded I think by the fact that your credit report isn't available yet, so you could easily stand a better chance of getting a CC once the reports are available.ForumUser7 said:

Thank you for this - I was told that they wouldn’t be doing a credit search over the phone so it’s helpful to know.Band7 said:I am an existing RBS, Natwest and Ulster account holder, and applied for a new current account, no O/Ds, with each of them on Friday. I can’t recall I was asked/told about credit searches, and initially, no searches were showing on any of the CRAs. CreditKarma has now just notified me that 3 hard searches will be added. Not that this worries me as I won’t be applying for any actual credit any time soon.

I likely won’t be applying for credit anytime within the next year (I gave up with CCs as the soft search eligibility checkers didn’t give me much hope), but I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

When I was under 18 I didn’t have to think about this - it was a great time 😂.

I cannot be found on any of the statutory report sites, or the MSE credit club etc - I think I need to allow a little time for my report to begin.

In the past week, I’ve upgraded some accounts which I don’t think incurs a search, and I’ve also opened some new current accounts (including with LBG with whom I am an existing customer)

Halifax Reward upgrade - pretty sure there will be no hard search

Club Lloyds CA upgrade - pretty sure there will be no hard search

BoS Classic new account as an existing customer - pretty sure no hard search

Lloyds Classic new account as an existing customer - pretty sure no hard search

Nationwide FlexAccount - told me during application it was doing a hard search

Santander Basic Bank account - sounds like there is no hard search

Metro Bank CA - they said there would be a hard search when I called them, and when I messaged them on Twitter, but people’s experiences suggest there won’t be

Nationwide FlexDirect - told me during application it was doing a hard search

RBS upgraded to select so could prepare direct debits for reward - they told me no hard search

First Direct CA - they told me on Twitter there would be a hard search

I didn’t apply for an overdraft with any, but first direct seems to search to see if they can offer one regardless as they didn’t give me the option to opt out, and it told me at the end I couldn’t get one, only the account itself.

This means I will have got between 3 and 4 hard searches before I even open the RBS NW and Ulster ones to switch into.

I feel like 6-7 hard searches so early on may begin to be a problem, even given that I’m not looking to apply for credit and only for current accounts

The eligibility checkers weren't optimistic for me either at your age (in 2021) if it's any consolation. This is one of the reasons why I'd recommend getting the HSBC student account as you will likely be able to get hold of their student credit card and demonstrate good credit usage from that, indeed this was the first credit card I was able to get my hands on. Plus the HSBC student account comes with a large 0% OD to stooze.

After I'd switched HSBC to TSB, resulting in me having to close the HSBC credit card, leaving me with no credit cards I found myself ineligible for any credit cards until August when Amex came along. Pretty much as soon as Amex showed on my credit report I was able to get 2 more credit cards (Capital One and Tesco) so left it at that. From that point until the Barclays default appeared the eligibility checkers showed I was eligible for around half a dozen others.

I tend to just ignore hard searches myself. If my memory serves me well I had around 10 hard searches on my report at the time I applied for Amex if that's any use to you.

And that's precisely what I'm thinking! I was wondering about seeing if I can be added as an authorised user on my parents credit card - they have a good history and always pay off in full etc. My only concern is if me not having any history, and lots of hard searches affects their limit of anything. And yes, that seems likely. I'm going to try reregistering for clearscore, credit karma, mse credit club, and the statutory reports after the exams in June. I imagine by then I should be up and running, and I can try the eligibility checkers again.

Did you have a qualifying regular income when you applied for the HSBC Student CC? I don't have a job currently since COVID, but I get a small allowance each month from my parents, but money from parents doesn't usually seem to count for the eligibility checkers. Maybe it's different for HSBC, but TSB said it wouldn't be considered. HSBCs website states a guaranteed overdraft of £1,000, so maybe that is one to go for - seems it wouldn't matter if my credit report was a shambles or not. Unless they just didn't accept the application for the account itself. I currently hold conditional offers, so I'm not eligible for the account just yet anyway. Once I have a confirmed place (not sure if they just mean to have attained the required grades), I'll likely get the HSBC account. This would mean my TSB account would have to be closed, so if there was a good switching offer around at the time anywhere, I could just switch my TSB account out right? That would close that student account, leaving me free to apply for a different student account.

Re the HSBC -> TSB, is closure of the HSBC CC only applicable if you switch out/close the HSBC Student Account? As opposed to switching out any account with them? I ask because they 'upgraded' my 'MyAccount' into a bank account, so once I've opened the student account this would be ripe for switching. Unless I can upgrade this one, and avoid the initial credit search.

That's helpful to know, thank you. Is there any distinction made on the credit report as to whether you applied for credit when they carried out the hard search, or if they just carried it out to open a non-credit account? The providers must also look at available credit, and if they see none, maybe they realise some were just current account w/o overdraft hard searches.

HSBC do count your student maintenance loan as income. I also had a part time job (which I've still got) when I applied for mine. TSB and some others don't class student maintenance loan as income so your income will vary depending on who you're talking to at the time, in my case my annual income in August 2021 (when I applied for the HSBC student account) was around £13k with HSBC (maintenance loan +bursary +job), but only around £3k with TSB (just job) so you've got to double check what each individual bank classes as income.

If I recall correctly a "confirmed conditional" offer was enough to make me eligible for the HSBC student account so as long as you have confirmed your uni choices you should be able to get it now if you wanted (though you should double check this as it was 2 years since I last checked), though I'd wait until they start launching account opening bribes (usually cash plus an Uber Eats gift card in HSBC's case).

Also you would need to upgrade your existing HSBC current account to a student account which if I recall correctly left me with 3 hard searches (one for upgrading, one for the OD and one for the CC). You can't have any other HSBC current account if you hold the student account.

Just make sure the TSB student account is fully closed before applying for HSBC though as I made this mistake with Barclays in November and look where it got me...

When I switched out of HSBC it was my only HSBC account remaining so I had to close the CC. I continued to hold no accounts with them until they launched their 5% regular saver. I wish I'd kept the HSBC student account now though.

There's no distinction between hard searches, all that appears is Hard Search, company who carried it out and date in my experience.1 -

Yes, I thought this would probably be the case. I am definitely on the electoral roll, I double checked with my LA a couple of weeks ago, and they confirmed I was and CRAs should have my data soon I haven't got any arranged ODs so far. First Direct decided to check for one without giving me the option to opt out, and wouldn't offer it. With Nationwide Flex Direct, they gave me the option to apply for one in the application. I chose not to. Seems it may have been a mistake, as they carried out a hard search anyway, so maybe it was worth a try - feels unlikely they would carry out two during the same application. But anyway, no ODs available to stooze right now.Bridlington1 said:

I would say it's probably wise to keep you and your parent's credit files de-linked. I would suggest just doing the usual making sure you are on the electoral register etc for now and maybe hold off maxing out and stoozing ODs till you get the HSBC OD.ForumUser7 said:

Thanks for this information @bridlington1Bridlington1 said:

The thing with credit cards is that they're a bit of a catch 22. You will struggle to get credit if you've no credit history but the best way to show good credit history is to have a credit card which you use regularly. From the lenders perspective they would rather lend money to someone who has a long established history of borrowing money but always paying it back on time rather than someone who has never borrowed before. This fact is compounded I think by the fact that your credit report isn't available yet, so you could easily stand a better chance of getting a CC once the reports are available.ForumUser7 said:

Thank you for this - I was told that they wouldn’t be doing a credit search over the phone so it’s helpful to know.Band7 said:I am an existing RBS, Natwest and Ulster account holder, and applied for a new current account, no O/Ds, with each of them on Friday. I can’t recall I was asked/told about credit searches, and initially, no searches were showing on any of the CRAs. CreditKarma has now just notified me that 3 hard searches will be added. Not that this worries me as I won’t be applying for any actual credit any time soon.

I likely won’t be applying for credit anytime within the next year (I gave up with CCs as the soft search eligibility checkers didn’t give me much hope), but I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

When I was under 18 I didn’t have to think about this - it was a great time 😂.

I cannot be found on any of the statutory report sites, or the MSE credit club etc - I think I need to allow a little time for my report to begin.

In the past week, I’ve upgraded some accounts which I don’t think incurs a search, and I’ve also opened some new current accounts (including with LBG with whom I am an existing customer)

Halifax Reward upgrade - pretty sure there will be no hard search

Club Lloyds CA upgrade - pretty sure there will be no hard search

BoS Classic new account as an existing customer - pretty sure no hard search

Lloyds Classic new account as an existing customer - pretty sure no hard search

Nationwide FlexAccount - told me during application it was doing a hard search

Santander Basic Bank account - sounds like there is no hard search

Metro Bank CA - they said there would be a hard search when I called them, and when I messaged them on Twitter, but people’s experiences suggest there won’t be

Nationwide FlexDirect - told me during application it was doing a hard search

RBS upgraded to select so could prepare direct debits for reward - they told me no hard search

First Direct CA - they told me on Twitter there would be a hard search

I didn’t apply for an overdraft with any, but first direct seems to search to see if they can offer one regardless as they didn’t give me the option to opt out, and it told me at the end I couldn’t get one, only the account itself.

This means I will have got between 3 and 4 hard searches before I even open the RBS NW and Ulster ones to switch into.

I feel like 6-7 hard searches so early on may begin to be a problem, even given that I’m not looking to apply for credit and only for current accounts

The eligibility checkers weren't optimistic for me either at your age (in 2021) if it's any consolation. This is one of the reasons why I'd recommend getting the HSBC student account as you will likely be able to get hold of their student credit card and demonstrate good credit usage from that, indeed this was the first credit card I was able to get my hands on. Plus the HSBC student account comes with a large 0% OD to stooze.

After I'd switched HSBC to TSB, resulting in me having to close the HSBC credit card, leaving me with no credit cards I found myself ineligible for any credit cards until August when Amex came along. Pretty much as soon as Amex showed on my credit report I was able to get 2 more credit cards (Capital One and Tesco) so left it at that. From that point until the Barclays default appeared the eligibility checkers showed I was eligible for around half a dozen others.

I tend to just ignore hard searches myself. If my memory serves me well I had around 10 hard searches on my report at the time I applied for Amex if that's any use to you.

And that's precisely what I'm thinking! I was wondering about seeing if I can be added as an authorised user on my parents credit card - they have a good history and always pay off in full etc. My only concern is if me not having any history, and lots of hard searches affects their limit of anything. And yes, that seems likely. I'm going to try reregistering for clearscore, credit karma, mse credit club, and the statutory reports after the exams in June. I imagine by then I should be up and running, and I can try the eligibility checkers again.

Did you have a qualifying regular income when you applied for the HSBC Student CC? I don't have a job currently since COVID, but I get a small allowance each month from my parents, but money from parents doesn't usually seem to count for the eligibility checkers. Maybe it's different for HSBC, but TSB said it wouldn't be considered. HSBCs website states a guaranteed overdraft of £1,000, so maybe that is one to go for - seems it wouldn't matter if my credit report was a shambles or not. Unless they just didn't accept the application for the account itself. I currently hold conditional offers, so I'm not eligible for the account just yet anyway. Once I have a confirmed place (not sure if they just mean to have attained the required grades), I'll likely get the HSBC account. This would mean my TSB account would have to be closed, so if there was a good switching offer around at the time anywhere, I could just switch my TSB account out right? That would close that student account, leaving me free to apply for a different student account.

Re the HSBC -> TSB, is closure of the HSBC CC only applicable if you switch out/close the HSBC Student Account? As opposed to switching out any account with them? I ask because they 'upgraded' my 'MyAccount' into a bank account, so once I've opened the student account this would be ripe for switching. Unless I can upgrade this one, and avoid the initial credit search.

That's helpful to know, thank you. Is there any distinction made on the credit report as to whether you applied for credit when they carried out the hard search, or if they just carried it out to open a non-credit account? The providers must also look at available credit, and if they see none, maybe they realise some were just current account w/o overdraft hard searches.

HSBC do count your student maintenance loan as income. I also had a part time job (which I've still got) when I applied for mine. TSB and some others don't class student maintenance loan as income so your income will vary depending on who you're talking to at the time, in my case my annual income in August 2021 (when I applied for the HSBC student account) was around £13k with HSBC (maintenance loan +bursary +job), but only around £3k with TSB (just job) so you've got to double check what each individual bank classes as income.

If I recall correctly a "confirmed conditional" offer was enough to make me eligible for the HSBC student account so as long as you have confirmed your uni choices you should be able to get it now if you wanted (though you should double check this as it was 2 years since I last checked), though I'd wait until they start launching account opening bribes (usually cash plus an Uber Eats gift card in HSBC's case).

Also you would need to upgrade your existing HSBC current account to a student account which if I recall correctly left me with 3 hard searches (one for upgrading, one for the OD and one for the CC). You can't have any other HSBC current account if you hold the student account.

Just make sure the TSB student account is fully closed before applying for HSBC though as I made this mistake with Barclays in November and look where it got me...

When I switched out of HSBC it was my only HSBC account remaining so I had to close the CC. I continued to hold no accounts with them until they launched their 5% regular saver. I wish I'd kept the HSBC student account now though.

There's no distinction between hard searches, all that appears is Hard Search, company who carried it out and date in my experience.

That's good to know they count it. It's interesting, because I messaged HSBC and they've told me that they don't require any income for their student CC. Probably having income makes it more likely you'll be accepted, but at least not having it doesn't rule it out. TSB specifies on their product page regular income is needed, but HSBC doesn't. I wonder how they avoid being done for irresponsible lending - maybe they request information around savings and the parents income too?

They said to me it will be when I have my place confirmed by the university apparently - I'm not sure when this usually is. But yes, I will be waiting for the account opening bonuses. Also because I may move through other banks first to get their bonuses. Will need to be careful to ensure my student account is closed before I apply for a new one, and I won't bother with the Barclays Student Account.

I think you've mentioned the 3 Hard Searches before, it's madness! If the applications are being done on the same day, the credit report is unlikely to change so they should just use the same report IMO.

Will do! I'll probably switch it, and then get written confirmation from TSB that it is closed. Then maybe wait a few days/a week to ensure any back office closure processes are completed.

I wonder if HSBC allows the student account to be converted back to a bank account. That's probably what I'd do if I decided to switch out, but I doubt I would.

Do you remember how many months after your birthday you were able to successfully check your report please? Even the NatWest Group/Lloyds Banking Group in-app features cannot match me up.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

I suppose with HSBC you can get the credit card before you've actually started your course. I had the credit card for a month before my first year course actually began so I imagine their argument would be that technically the maintenance loan wasn't part of my income at that point, hence why they are saying you can apply with no income, you have no income now but will have soon. HSBC never asked me for details of my parents's income, nor have any of the other banks for that matter, it's only the SLC that ever have.ForumUser7 said:

Yes, I thought this would probably be the case. I am definitely on the electoral roll, I double checked with my LA a couple of weeks ago, and they confirmed I was and CRAs should have my data soon I haven't got any arranged ODs so far. First Direct decided to check for one without giving me the option to opt out, and wouldn't offer it. With Nationwide Flex Direct, they gave me the option to apply for one in the application. I chose not to. Seems it may have been a mistake, as they carried out a hard search anyway, so maybe it was worth a try - feels unlikely they would carry out two during the same application. But anyway, no ODs available to stooze right now.Bridlington1 said:

I would say it's probably wise to keep you and your parent's credit files de-linked. I would suggest just doing the usual making sure you are on the electoral register etc for now and maybe hold off maxing out and stoozing ODs till you get the HSBC OD.ForumUser7 said:

Thanks for this information @bridlington1Bridlington1 said:

The thing with credit cards is that they're a bit of a catch 22. You will struggle to get credit if you've no credit history but the best way to show good credit history is to have a credit card which you use regularly. From the lenders perspective they would rather lend money to someone who has a long established history of borrowing money but always paying it back on time rather than someone who has never borrowed before. This fact is compounded I think by the fact that your credit report isn't available yet, so you could easily stand a better chance of getting a CC once the reports are available.ForumUser7 said:

Thank you for this - I was told that they wouldn’t be doing a credit search over the phone so it’s helpful to know.Band7 said:I am an existing RBS, Natwest and Ulster account holder, and applied for a new current account, no O/Ds, with each of them on Friday. I can’t recall I was asked/told about credit searches, and initially, no searches were showing on any of the CRAs. CreditKarma has now just notified me that 3 hard searches will be added. Not that this worries me as I won’t be applying for any actual credit any time soon.

I likely won’t be applying for credit anytime within the next year (I gave up with CCs as the soft search eligibility checkers didn’t give me much hope), but I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

When I was under 18 I didn’t have to think about this - it was a great time 😂.

I cannot be found on any of the statutory report sites, or the MSE credit club etc - I think I need to allow a little time for my report to begin.

In the past week, I’ve upgraded some accounts which I don’t think incurs a search, and I’ve also opened some new current accounts (including with LBG with whom I am an existing customer)

Halifax Reward upgrade - pretty sure there will be no hard search

Club Lloyds CA upgrade - pretty sure there will be no hard search

BoS Classic new account as an existing customer - pretty sure no hard search

Lloyds Classic new account as an existing customer - pretty sure no hard search

Nationwide FlexAccount - told me during application it was doing a hard search

Santander Basic Bank account - sounds like there is no hard search

Metro Bank CA - they said there would be a hard search when I called them, and when I messaged them on Twitter, but people’s experiences suggest there won’t be

Nationwide FlexDirect - told me during application it was doing a hard search

RBS upgraded to select so could prepare direct debits for reward - they told me no hard search

First Direct CA - they told me on Twitter there would be a hard search

I didn’t apply for an overdraft with any, but first direct seems to search to see if they can offer one regardless as they didn’t give me the option to opt out, and it told me at the end I couldn’t get one, only the account itself.

This means I will have got between 3 and 4 hard searches before I even open the RBS NW and Ulster ones to switch into.

I feel like 6-7 hard searches so early on may begin to be a problem, even given that I’m not looking to apply for credit and only for current accounts

The eligibility checkers weren't optimistic for me either at your age (in 2021) if it's any consolation. This is one of the reasons why I'd recommend getting the HSBC student account as you will likely be able to get hold of their student credit card and demonstrate good credit usage from that, indeed this was the first credit card I was able to get my hands on. Plus the HSBC student account comes with a large 0% OD to stooze.

After I'd switched HSBC to TSB, resulting in me having to close the HSBC credit card, leaving me with no credit cards I found myself ineligible for any credit cards until August when Amex came along. Pretty much as soon as Amex showed on my credit report I was able to get 2 more credit cards (Capital One and Tesco) so left it at that. From that point until the Barclays default appeared the eligibility checkers showed I was eligible for around half a dozen others.

I tend to just ignore hard searches myself. If my memory serves me well I had around 10 hard searches on my report at the time I applied for Amex if that's any use to you.

And that's precisely what I'm thinking! I was wondering about seeing if I can be added as an authorised user on my parents credit card - they have a good history and always pay off in full etc. My only concern is if me not having any history, and lots of hard searches affects their limit of anything. And yes, that seems likely. I'm going to try reregistering for clearscore, credit karma, mse credit club, and the statutory reports after the exams in June. I imagine by then I should be up and running, and I can try the eligibility checkers again.

Did you have a qualifying regular income when you applied for the HSBC Student CC? I don't have a job currently since COVID, but I get a small allowance each month from my parents, but money from parents doesn't usually seem to count for the eligibility checkers. Maybe it's different for HSBC, but TSB said it wouldn't be considered. HSBCs website states a guaranteed overdraft of £1,000, so maybe that is one to go for - seems it wouldn't matter if my credit report was a shambles or not. Unless they just didn't accept the application for the account itself. I currently hold conditional offers, so I'm not eligible for the account just yet anyway. Once I have a confirmed place (not sure if they just mean to have attained the required grades), I'll likely get the HSBC account. This would mean my TSB account would have to be closed, so if there was a good switching offer around at the time anywhere, I could just switch my TSB account out right? That would close that student account, leaving me free to apply for a different student account.

Re the HSBC -> TSB, is closure of the HSBC CC only applicable if you switch out/close the HSBC Student Account? As opposed to switching out any account with them? I ask because they 'upgraded' my 'MyAccount' into a bank account, so once I've opened the student account this would be ripe for switching. Unless I can upgrade this one, and avoid the initial credit search.

That's helpful to know, thank you. Is there any distinction made on the credit report as to whether you applied for credit when they carried out the hard search, or if they just carried it out to open a non-credit account? The providers must also look at available credit, and if they see none, maybe they realise some were just current account w/o overdraft hard searches.

HSBC do count your student maintenance loan as income. I also had a part time job (which I've still got) when I applied for mine. TSB and some others don't class student maintenance loan as income so your income will vary depending on who you're talking to at the time, in my case my annual income in August 2021 (when I applied for the HSBC student account) was around £13k with HSBC (maintenance loan +bursary +job), but only around £3k with TSB (just job) so you've got to double check what each individual bank classes as income.

If I recall correctly a "confirmed conditional" offer was enough to make me eligible for the HSBC student account so as long as you have confirmed your uni choices you should be able to get it now if you wanted (though you should double check this as it was 2 years since I last checked), though I'd wait until they start launching account opening bribes (usually cash plus an Uber Eats gift card in HSBC's case).

Also you would need to upgrade your existing HSBC current account to a student account which if I recall correctly left me with 3 hard searches (one for upgrading, one for the OD and one for the CC). You can't have any other HSBC current account if you hold the student account.

Just make sure the TSB student account is fully closed before applying for HSBC though as I made this mistake with Barclays in November and look where it got me...

When I switched out of HSBC it was my only HSBC account remaining so I had to close the CC. I continued to hold no accounts with them until they launched their 5% regular saver. I wish I'd kept the HSBC student account now though.

There's no distinction between hard searches, all that appears is Hard Search, company who carried it out and date in my experience.

That's good to know they count it. It's interesting, because I messaged HSBC and they've told me that they don't require any income for their student CC. Probably having income makes it more likely you'll be accepted, but at least not having it doesn't rule it out. TSB specifies on their product page regular income is needed, but HSBC doesn't. I wonder how they avoid being done for irresponsible lending - maybe they request information around savings and the parents income too?

They said to me it will be when I have my place confirmed by the university apparently - I'm not sure when this usually is. But yes, I will be waiting for the account opening bonuses. Also because I may move through other banks first to get their bonuses. Will need to be careful to ensure my student account is closed before I apply for a new one, and I won't bother with the Barclays Student Account.

I think you've mentioned the 3 Hard Searches before, it's madness! If the applications are being done on the same day, the credit report is unlikely to change so they should just use the same report IMO.

Will do! I'll probably switch it, and then get written confirmation from TSB that it is closed. Then maybe wait a few days/a week to ensure any back office closure processes are completed.

I wonder if HSBC allows the student account to be converted back to a bank account. That's probably what I'd do if I decided to switch out, but I doubt I would.

Do you remember how many months after your birthday you were able to successfully check your report please? Even the NatWest Group/Lloyds Banking Group in-app features cannot match me up.

I received an email confirming my place at uni at 8:37am on the day I got my A-level results so expect to have your place confirmed by the university on 17th August.

I imagine HSBC will allow you to convert the account back into a bank account afterwards but I see no real advantage of doing so given that they offer the largest 0% OD out of any of the student accounts.

I never bothered to check my credit report for the first time until November 2021, some 9 months after my 18th birthday, even now I only check them once every 2-3 months. However clearscore includes a timeline of your credit history (equifax) in the web app and that has always gone back to April 2021. As my birthday is late February I can only assume your report will appear 4-8 weeks after your 18th birthday so expect it to appear around May/June.1 -

I suppose that makes sense, but that income is dependent on actually applying for the maintenance loan, which not everyone does. I guess they'd get in contact to discuss it down the line if they got concerned.Bridlington1 said:

I suppose with HSBC you can get the credit card before you've actually started your course. I had the credit card for a month before my first year course actually began so I imagine their argument would be that technically the maintenance loan wasn't part of my income at that point, hence why they are saying you can apply with no income, you have no income now but will have soon. HSBC never asked me for details of my parents's income, nor have any of the other banks for that matter, it's only the SLC that ever have.ForumUser7 said:

Yes, I thought this would probably be the case. I am definitely on the electoral roll, I double checked with my LA a couple of weeks ago, and they confirmed I was and CRAs should have my data soon I haven't got any arranged ODs so far. First Direct decided to check for one without giving me the option to opt out, and wouldn't offer it. With Nationwide Flex Direct, they gave me the option to apply for one in the application. I chose not to. Seems it may have been a mistake, as they carried out a hard search anyway, so maybe it was worth a try - feels unlikely they would carry out two during the same application. But anyway, no ODs available to stooze right now.Bridlington1 said:

I would say it's probably wise to keep you and your parent's credit files de-linked. I would suggest just doing the usual making sure you are on the electoral register etc for now and maybe hold off maxing out and stoozing ODs till you get the HSBC OD.ForumUser7 said:

Thanks for this information @bridlington1Bridlington1 said:

The thing with credit cards is that they're a bit of a catch 22. You will struggle to get credit if you've no credit history but the best way to show good credit history is to have a credit card which you use regularly. From the lenders perspective they would rather lend money to someone who has a long established history of borrowing money but always paying it back on time rather than someone who has never borrowed before. This fact is compounded I think by the fact that your credit report isn't available yet, so you could easily stand a better chance of getting a CC once the reports are available.ForumUser7 said:

Thank you for this - I was told that they wouldn’t be doing a credit search over the phone so it’s helpful to know.Band7 said:I am an existing RBS, Natwest and Ulster account holder, and applied for a new current account, no O/Ds, with each of them on Friday. I can’t recall I was asked/told about credit searches, and initially, no searches were showing on any of the CRAs. CreditKarma has now just notified me that 3 hard searches will be added. Not that this worries me as I won’t be applying for any actual credit any time soon.

I likely won’t be applying for credit anytime within the next year (I gave up with CCs as the soft search eligibility checkers didn’t give me much hope), but I may well be applying for more current accounts without overdrafts. Do lots of hard searches cause problems for these too please?

When I was under 18 I didn’t have to think about this - it was a great time 😂.

I cannot be found on any of the statutory report sites, or the MSE credit club etc - I think I need to allow a little time for my report to begin.

In the past week, I’ve upgraded some accounts which I don’t think incurs a search, and I’ve also opened some new current accounts (including with LBG with whom I am an existing customer)

Halifax Reward upgrade - pretty sure there will be no hard search

Club Lloyds CA upgrade - pretty sure there will be no hard search

BoS Classic new account as an existing customer - pretty sure no hard search

Lloyds Classic new account as an existing customer - pretty sure no hard search

Nationwide FlexAccount - told me during application it was doing a hard search

Santander Basic Bank account - sounds like there is no hard search

Metro Bank CA - they said there would be a hard search when I called them, and when I messaged them on Twitter, but people’s experiences suggest there won’t be

Nationwide FlexDirect - told me during application it was doing a hard search

RBS upgraded to select so could prepare direct debits for reward - they told me no hard search

First Direct CA - they told me on Twitter there would be a hard search

I didn’t apply for an overdraft with any, but first direct seems to search to see if they can offer one regardless as they didn’t give me the option to opt out, and it told me at the end I couldn’t get one, only the account itself.

This means I will have got between 3 and 4 hard searches before I even open the RBS NW and Ulster ones to switch into.

I feel like 6-7 hard searches so early on may begin to be a problem, even given that I’m not looking to apply for credit and only for current accounts

The eligibility checkers weren't optimistic for me either at your age (in 2021) if it's any consolation. This is one of the reasons why I'd recommend getting the HSBC student account as you will likely be able to get hold of their student credit card and demonstrate good credit usage from that, indeed this was the first credit card I was able to get my hands on. Plus the HSBC student account comes with a large 0% OD to stooze.

After I'd switched HSBC to TSB, resulting in me having to close the HSBC credit card, leaving me with no credit cards I found myself ineligible for any credit cards until August when Amex came along. Pretty much as soon as Amex showed on my credit report I was able to get 2 more credit cards (Capital One and Tesco) so left it at that. From that point until the Barclays default appeared the eligibility checkers showed I was eligible for around half a dozen others.

I tend to just ignore hard searches myself. If my memory serves me well I had around 10 hard searches on my report at the time I applied for Amex if that's any use to you.

And that's precisely what I'm thinking! I was wondering about seeing if I can be added as an authorised user on my parents credit card - they have a good history and always pay off in full etc. My only concern is if me not having any history, and lots of hard searches affects their limit of anything. And yes, that seems likely. I'm going to try reregistering for clearscore, credit karma, mse credit club, and the statutory reports after the exams in June. I imagine by then I should be up and running, and I can try the eligibility checkers again.

Did you have a qualifying regular income when you applied for the HSBC Student CC? I don't have a job currently since COVID, but I get a small allowance each month from my parents, but money from parents doesn't usually seem to count for the eligibility checkers. Maybe it's different for HSBC, but TSB said it wouldn't be considered. HSBCs website states a guaranteed overdraft of £1,000, so maybe that is one to go for - seems it wouldn't matter if my credit report was a shambles or not. Unless they just didn't accept the application for the account itself. I currently hold conditional offers, so I'm not eligible for the account just yet anyway. Once I have a confirmed place (not sure if they just mean to have attained the required grades), I'll likely get the HSBC account. This would mean my TSB account would have to be closed, so if there was a good switching offer around at the time anywhere, I could just switch my TSB account out right? That would close that student account, leaving me free to apply for a different student account.

Re the HSBC -> TSB, is closure of the HSBC CC only applicable if you switch out/close the HSBC Student Account? As opposed to switching out any account with them? I ask because they 'upgraded' my 'MyAccount' into a bank account, so once I've opened the student account this would be ripe for switching. Unless I can upgrade this one, and avoid the initial credit search.

That's helpful to know, thank you. Is there any distinction made on the credit report as to whether you applied for credit when they carried out the hard search, or if they just carried it out to open a non-credit account? The providers must also look at available credit, and if they see none, maybe they realise some were just current account w/o overdraft hard searches.

HSBC do count your student maintenance loan as income. I also had a part time job (which I've still got) when I applied for mine. TSB and some others don't class student maintenance loan as income so your income will vary depending on who you're talking to at the time, in my case my annual income in August 2021 (when I applied for the HSBC student account) was around £13k with HSBC (maintenance loan +bursary +job), but only around £3k with TSB (just job) so you've got to double check what each individual bank classes as income.

If I recall correctly a "confirmed conditional" offer was enough to make me eligible for the HSBC student account so as long as you have confirmed your uni choices you should be able to get it now if you wanted (though you should double check this as it was 2 years since I last checked), though I'd wait until they start launching account opening bribes (usually cash plus an Uber Eats gift card in HSBC's case).

Also you would need to upgrade your existing HSBC current account to a student account which if I recall correctly left me with 3 hard searches (one for upgrading, one for the OD and one for the CC). You can't have any other HSBC current account if you hold the student account.

Just make sure the TSB student account is fully closed before applying for HSBC though as I made this mistake with Barclays in November and look where it got me...

When I switched out of HSBC it was my only HSBC account remaining so I had to close the CC. I continued to hold no accounts with them until they launched their 5% regular saver. I wish I'd kept the HSBC student account now though.

There's no distinction between hard searches, all that appears is Hard Search, company who carried it out and date in my experience.

That's good to know they count it. It's interesting, because I messaged HSBC and they've told me that they don't require any income for their student CC. Probably having income makes it more likely you'll be accepted, but at least not having it doesn't rule it out. TSB specifies on their product page regular income is needed, but HSBC doesn't. I wonder how they avoid being done for irresponsible lending - maybe they request information around savings and the parents income too?

They said to me it will be when I have my place confirmed by the university apparently - I'm not sure when this usually is. But yes, I will be waiting for the account opening bonuses. Also because I may move through other banks first to get their bonuses. Will need to be careful to ensure my student account is closed before I apply for a new one, and I won't bother with the Barclays Student Account.

I think you've mentioned the 3 Hard Searches before, it's madness! If the applications are being done on the same day, the credit report is unlikely to change so they should just use the same report IMO.

Will do! I'll probably switch it, and then get written confirmation from TSB that it is closed. Then maybe wait a few days/a week to ensure any back office closure processes are completed.

I wonder if HSBC allows the student account to be converted back to a bank account. That's probably what I'd do if I decided to switch out, but I doubt I would.

Do you remember how many months after your birthday you were able to successfully check your report please? Even the NatWest Group/Lloyds Banking Group in-app features cannot match me up.

I received an email confirming my place at uni at 8:37am on the day I got my A-level results so expect to have your place confirmed by the university on 17th August.

I imagine HSBC will allow you to convert the account back into a bank account afterwards but I see no real advantage of doing so given that they offer the largest 0% OD out of any of the student accounts.

I never bothered to check my credit report for the first time until November 2021, some 9 months after my 18th birthday, even now I only check them once every 2-3 months. However clearscore includes a timeline of your credit history (equifax) in the web app and that has always gone back to April 2021. As my birthday is late February I can only assume your report will appear 4-8 weeks after your 18th birthday so expect it to appear around May/June.

That's really helpful to know - I think I remember reading somewhere about students finding out they've been confirmed onto their course before getting their results.

I would only probably get it converted back after I was no longer a student/classed as a graduate by them. Although this is probably an automatic process.

That would be perfect timing for me actually - I intend to register to view it after the June exams. That means if there are any markings/hard searches I dispute, I will have the time required to sort it out.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards