We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

New Lloyds Bank £200 Switch Offer - January 2023

Comments

-

Sounds spot on. Although Lloyds will be doing a credit check in any case but this way avoids a second bank's check.battenburg88 said:

I hope my previous post is just badly phrased...Katiehound said:

I really hope you don't mean that!battenburg88 said:

Ah, interesting. I hadn't thought of just opening another current account with a bank that I already use. Infact, I don't think I realised this was an option. I may well then just ask to open a second current account with Halifax (leaving my Cardcash account and existing current account as is) and then just close this new one.AmityNeon said:battenburg88 said:AmityNeon said:Does the Cardcash account appear on your credit report? If it does, you may want to keep the account (as it's very old) and open a new standard account to switch instead.I don't know - would I need to look at my credit report to find out? Its the first bank account I ever had (one with a passbook!) that was gradually upgraded by Halifax and now just sits alongside another account I have with them because I didn't need or want to close it. So, its certainly my longest standing bank account with any provider.

Is it better to maintain my longstanding bank accounts even if that means having credit check where I've applied for a new account just for the purpose of switching (and then presumably the check for the switch itself)? I'm not about to apply for a mortgage or anything, but I have opened a couple of bank accounts just recently in the hunt for deals and rates etc.

Yes you would need to check your credit report to find out, and you can check all three for free (TransUnion, Equifax, Experian).

A longstanding account's opening date is fixed and never disappears, whereas search history drops off after a year. Halifax won't hard search you when you apply for additional current accounts, so they're convenient for quickly setting up new accounts for switching (you also get to see the full 16-digit card number in the app before the card arrives in the post).

Cheers!

No, the idea is to switch the new account to get a 'welcome handshake'!

I intend to open a second current account with Halifax giving me 1) an old Cardcash account, 2) an old current account and 3) a new additional current account. I would then switch 3) the new current account to Lloyds to make use of their switching offer.

That would then leave me my longstanding Halifax accounts - 1) and 2) - but also allow me to make use of the switching offer and hopefully without having to consider a new bank having to do a credit check.

Does that sound correct or am I completely missing something?!0 -

No, that is right!battenburg88 said:

I hope my previous post is just badly phrased...Katiehound said:

I really hope you don't mean that!battenburg88 said:

Ah, interesting. I hadn't thought of just opening another current account with a bank that I already use. Infact, I don't think I realised this was an option. I may well then just ask to open a second current account with Halifax (leaving my Cardcash account and existing current account as is) and then just close this new one.AmityNeon said:battenburg88 said:AmityNeon said:Does the Cardcash account appear on your credit report? If it does, you may want to keep the account (as it's very old) and open a new standard account to switch instead.I don't know - would I need to look at my credit report to find out? Its the first bank account I ever had (one with a passbook!) that was gradually upgraded by Halifax and now just sits alongside another account I have with them because I didn't need or want to close it. So, its certainly my longest standing bank account with any provider.

Is it better to maintain my longstanding bank accounts even if that means having credit check where I've applied for a new account just for the purpose of switching (and then presumably the check for the switch itself)? I'm not about to apply for a mortgage or anything, but I have opened a couple of bank accounts just recently in the hunt for deals and rates etc.

Yes you would need to check your credit report to find out, and you can check all three for free (TransUnion, Equifax, Experian).

A longstanding account's opening date is fixed and never disappears, whereas search history drops off after a year. Halifax won't hard search you when you apply for additional current accounts, so they're convenient for quickly setting up new accounts for switching (you also get to see the full 16-digit card number in the app before the card arrives in the post).

Cheers!

No, the idea is to switch the new account to get a 'welcome handshake'!

I intend to open a second current account with Halifax giving me 1) an old Cardcash account, 2) an old current account and 3) a new additional current account. I would then switch 3) the new current account to Lloyds to make use of their switching offer.

That would then leave me my longstanding Halifax accounts - 1) and 2) - but also allow me to make use of the switching offer and hopefully without having to consider a new bank having to do a credit check.

Does that sound correct or am I completely missing something?!

I never just close a bank account when it could go off for a little jaunt collecting £200 when it passes 'Go'

(or some other sum but the Monopoly phrase is so well known that I couldn't resist!- and Lloyds is £200!))Being polite and pleasant doesn't cost anything!

-Stash bust:in 2022:337

Stash bust :2023. 120duvets, 24bags,43dogcoats, 2scrunchies, 10mitts, 6 bootees, 8spec cases, 2 A6notebooks, 59cards, 6 lav bags,36 angels,9 bones,1 blanket, 1 lined bag,3 owls, 88 pyramids = total 420total spend £5.Total for 'Dogs for Good' £546.82

2024:Sewn:59Doggy ds,52pyramids,18 bags,6spec cases,6lav.bags.

Knits:6covers,4hats,10mitts,2 bootees.

Crotchet:61angels, 229cards=453 £158.55profit!!!

2025 3dduvets0 -

Well i had no more sacrificial accounts to switch as most of incentives i had already had and not included in eligiblity, however finally can do this one from lloyds as my last account switch was 2019.

I have applied for and been accepted for a metro account this morning to use as a sacrificial account, so hopefully the metro debit card arrives before lloyds withdraw the incentive.MFW#105 - 2015 Overpaid £8095 / 2016 Overpaid £6983.24 / 2017 Overpaid £3583.12 / 2018 Overpaid £2583.12 / 2019 Overpaid £2583.12 / 2020 Overpaid £2583.12/ 2021 overpaid £1506.82 /2022 Overpaid £2975.28 / 2023 Overpaid £2677.30 / 2024 Overpaid £2173.61 Total OP since mortgage started in 2015 = £37,286.86 2025 MFW target £1700, payments to date at April 2025 - £1712.07..0 -

My Metro card arrived today, took 2 days from opening to now going to switch and Mrs pecunianonolet got her card today as well. That's £380 assuming I have to pay for 1 month of Silver account fees if the switch is completed by 31st Jan otherwise they possibly charge us for Jan and Feb a fee.anna42hmr said:Well i had no more sacrificial accounts to switch as most of incentives i had already had and not included in eligiblity, however finally can do this one from lloyds as my last account switch was 2019.

I have applied for and been accepted for a metro account this morning to use as a sacrificial account, so hopefully the metro debit card arrives before lloyds withdraw the incentive.

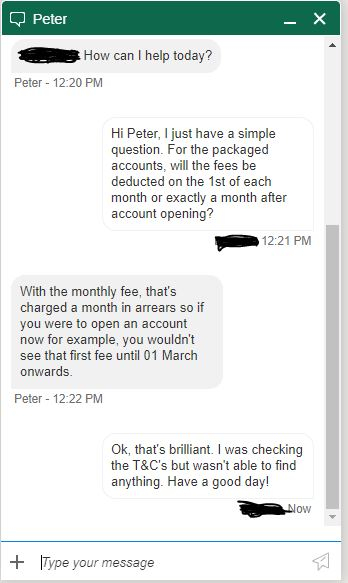

Does anyone know if they charge monthly from account opening or take the fee on the first of each month, regardless of when the account got opened?1 -

thats great it was so quick, fingers crossed mine will be as well!pecunianonolet said:

My Metro card arrived today, took 2 days from opening to now going to switch and Mrs pecunianonolet got her card today as well. That's £380 (assuming I have to pay for 1 month of Silver account fees.anna42hmr said:Well i had no more sacrificial accounts to switch as most of incentives i had already had and not included in eligiblity, however finally can do this one from lloyds as my last account switch was 2019.

I have applied for and been accepted for a metro account this morning to use as a sacrificial account, so hopefully the metro debit card arrives before lloyds withdraw the incentive.MFW#105 - 2015 Overpaid £8095 / 2016 Overpaid £6983.24 / 2017 Overpaid £3583.12 / 2018 Overpaid £2583.12 / 2019 Overpaid £2583.12 / 2020 Overpaid £2583.12/ 2021 overpaid £1506.82 /2022 Overpaid £2975.28 / 2023 Overpaid £2677.30 / 2024 Overpaid £2173.61 Total OP since mortgage started in 2015 = £37,286.86 2025 MFW target £1700, payments to date at April 2025 - £1712.07..0 -

I'd be surprised if any charges come out if you downgrade it before month end.pecunianonolet said:

My Metro card arrived today, took 2 days from opening to now going to switch and Mrs pecunianonolet got her card today as well. That's £380 assuming I have to pay for 1 month of Silver account fees if the switch is completed by 31st Jan otherwise they possibly charge us for Jan and Feb a fee.anna42hmr said:Well i had no more sacrificial accounts to switch as most of incentives i had already had and not included in eligiblity, however finally can do this one from lloyds as my last account switch was 2019.

I have applied for and been accepted for a metro account this morning to use as a sacrificial account, so hopefully the metro debit card arrives before lloyds withdraw the incentive.

Does anyone know if they charge monthly from account opening or take the fee on the first of each month, regardless of when the account got opened?0 -

They say it takes 10 working days for the switch to complete and receiving the benefit. So should I wait until 1st Feb to open and downgrade end of Feb and not pay any fee with the risk the offer is withdrawn or get on it and risk being charged 10 quid as I would open in Jan and downgrade in early Feb.Ed-1 said:

I'd be surprised if any charges come out if you downgrade it before month end.

If I open today, will they take the fee on the 2nd Feb or on the 21st Feb. Anyone able to confirm?

EDIT: Online chat confirmed the below so we should all be able to benefit from the full amount.

0 -

whatever you do you 'risk paying £10' (your words, not mine)

However, you stand to gain £190 and of course the offer may be pulled at any time.

I would think that was a bit of a no-brainer as you will still be quids in.Being polite and pleasant doesn't cost anything!

-Stash bust:in 2022:337

Stash bust :2023. 120duvets, 24bags,43dogcoats, 2scrunchies, 10mitts, 6 bootees, 8spec cases, 2 A6notebooks, 59cards, 6 lav bags,36 angels,9 bones,1 blanket, 1 lined bag,3 owls, 88 pyramids = total 420total spend £5.Total for 'Dogs for Good' £546.82

2024:Sewn:59Doggy ds,52pyramids,18 bags,6spec cases,6lav.bags.

Knits:6covers,4hats,10mitts,2 bootees.

Crotchet:61angels, 229cards=453 £158.55profit!!!

2025 3dduvets0 -

Switches and account opening process done, they did not even ask for ID and said all will be completed by 31st (earliest day). I was always calculating with 190 gain but 200 is betterKatiehound said:whatever you do you 'risk paying £10' (your words, not mine)

However, you stand to gain £190 and of course the offer may be pulled at any time.

I would think that was a bit of a no-brainer as you will still be quids in. 0

0 -

I think you are wise because offers can be pulled early which then means a mad scramble or missing out completely : a bird in the hand ... and all that! (oh , and Lloyds often pay out before the actual switch.)pecunianonolet said:

Switches and account opening process done, they did not even ask for ID and said all will be completed by 31st (earliest day). I was always calculating with 190 gain but 200 is betterKatiehound said:whatever you do you 'risk paying £10' (your words, not mine)

However, you stand to gain £190 and of course the offer may be pulled at any time.

I would think that was a bit of a no-brainer as you will still be quids in. Being polite and pleasant doesn't cost anything!

Being polite and pleasant doesn't cost anything!

-Stash bust:in 2022:337

Stash bust :2023. 120duvets, 24bags,43dogcoats, 2scrunchies, 10mitts, 6 bootees, 8spec cases, 2 A6notebooks, 59cards, 6 lav bags,36 angels,9 bones,1 blanket, 1 lined bag,3 owls, 88 pyramids = total 420total spend £5.Total for 'Dogs for Good' £546.82

2024:Sewn:59Doggy ds,52pyramids,18 bags,6spec cases,6lav.bags.

Knits:6covers,4hats,10mitts,2 bootees.

Crotchet:61angels, 229cards=453 £158.55profit!!!

2025 3dduvets0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards