We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

TSB £180 switch offer

Comments

-

k_man said:I think point 5 just means you can't cancel the DDs straight after switching.Going by the terms, you can cancel the direct debits after 18 November.So if the switch completes, with the two direct debits, just a few days before the deadline of the 18th, then on the 18 November they will still show on the TSB account which has then met the terms of the switch cashback.You can then cancel them on say, 20 November, before any of them are collected and before the cashback is paid0

-

I'm a little bit confused now... Do the 2 active direct debits need to be switched from the donor account or can I set them up manually on the newly opened TSB account and still qualify?

EPICA - the best symphonic metal band in the world !1 -

Are you assuming they'll show for 6 months even if they've been moved & will still qualify for the follow up cashback?Asghar said:k_man said:I think point 5 just means you can't cancel the DDs straight after switching.Going by the terms, you can cancel the direct debits after 18 November.So if the switch completes, with the two direct debits, just a few days before the deadline of the 18th, then on the 18 November they will still show on the TSB account which has then met the terms of the switch cashback.You can then cancel them on say, 20 November, before any of them are collected and before the cashback is paid

Not saying you're wrong, but sounds optimistic.

Are you testing the theory?0 -

They must be on the switched in account.Alex9384 said:I'm a little bit confused now... Do the 2 active direct debits need to be switched from the donor account or can I set them up manually on the newly opened TSB account and still qualify?

The bit that may confuse you is 2 DDs must be in existence on the TSB account until and to qualify for, the 31st May £55 additional cashback.

Must "have a minimum of 2 active Direct Debits on your new Spend & Save or Spend & Save Plus account"

My understanding is TSB have taken into account that expecting them to be the same DDs that switched would be too onerous.

eta spilling correction 0

0 -

I presume if one of your DD's in your donor account last paid out 23.5 months ago (so last 'active' 23.5 months ago), and it's switched to the new TSB spend and save or spend and save plus account, and it doesn't pay out in the two weeks or so following the switch it will become inactive and it may cause you not to qualify for the switch offer.The_Green_Hornet said:AFAIK once a direct debit appears on your account it is considered active and I have done switches in the past where no payment has been collected before and after the switch and I still received the incentive.

Again, AFAIK, a direct debit only goes inactive if it hasn't been used for 24 months under dormancy rules.

Why the banks use the term "active direct debit" is a mystery.

p.s: according to this:

https://newseventsinsights.wearepay.uk/news-in-brief/direct-debit-dormancy-period-temporarily-extended/

And As you say the default dormancy period is 24 months, however the link above says some DD's have dormancy period greater than 24 months. I've never seen anywhere where this dormancy period is mentioned for each DD (not within online banking or the DD setup notification letter), so I guess we assume 24 months (minimum) unless we're notified of any change. Apparently, it was changed from 12 to 24 months during the COVID-19 pandemic.0 -

Can I ask a question for anyone who's opened a TSB account recently?

I've received a welcome email, and I've received a debit card. Am I right in thinking my online banking details are sent by post too? Hope they're not held up by the strikes!

Do TSB send the card PIN by post, or do they display it in their app like some other banks do now a days?

Thanks!0 -

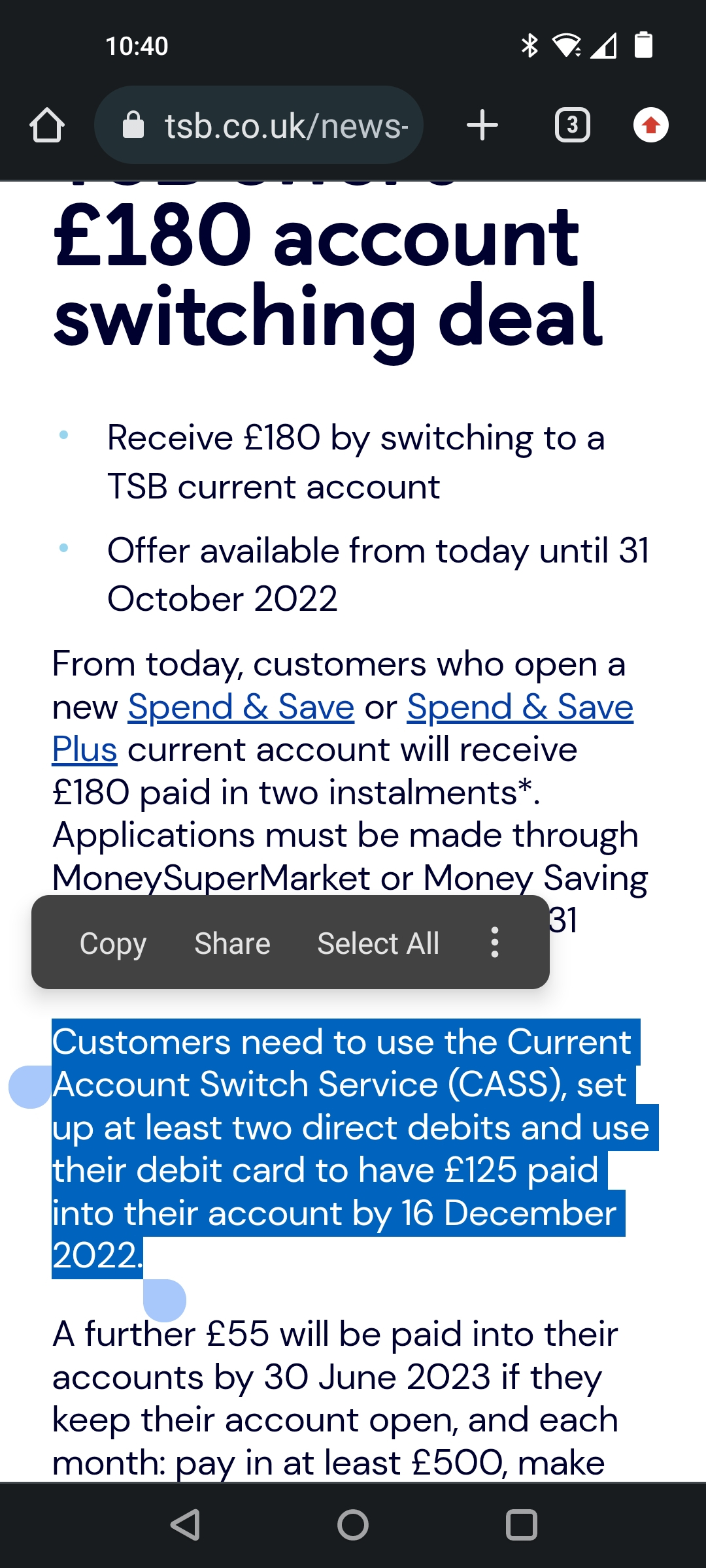

I'm obviously having a mind fart here. I can't make sense of the following main TSB page.

' set up at least 2 direct debits and use their debit card to have £125 paid into their account by 16 December 2022'

How does one use their debit card to pay money into their account?

Like I say, probably a mind fart and its obvious (not to me it seems).

The only thing I can think of is to go into a branch, hand over your card and £125 and get the cashier to ring it through??0 -

I can't find this in the T&Csbilly2shots said:I'm obviously having a mind fart here. I can't make sense of the following line from t&c's

' set up at least 2 direct debits and use their debit card to have £125 paid into their account by 16 December 2022'

How does one use their debit card to pay money into their account?

Like I say, probably a mind fart and its obvious (not to me it seems).

The only thing I can think of is to go into a branch, hand over your card and £125 and get the cashier to ring it through??0 -

packing to allow postDaliah said:

I can't find this in the T&Csbilly2shots said:I'm obviously having a mind fart here. I can't make sense of the following line from t&c's

' set up at least 2 direct debits and use their debit card to have £125 paid into their account by 16 December 2022'

How does one use their debit card to pay money into their account?

Like I say, probably a mind fart and its obvious (not to me it seems).

The only thing I can think of is to go into a branch, hand over your card and £125 and get the cashier to ring it through??

That appears on the main page of the offer. To be fair it is missing from the t&c's0 -

That seems to be a news article, not the T&Cs. You are right, it make no sense.

the T&Cs are here: https://www.tsb.co.uk/tsb-current-account-switch-offer-terms-and-conditions.pdf (downloads a PDF)1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards