We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Octopus have adjusted my direct debit

Comments

-

It may just be a typo on their side 😉, a bit like yours was.0

-

Having seen this thread I checked my Octopus account and they've changed my future Direct Debits without sending email notification. They are £67 lower, and no account taken of the price increases.

Plus I've not been notified of what that price increase is and it's less than a week away. I can't find that through my account but did manage to find it on their main website (by masquerading as a new customer, I think).

Not ideal, but still prefer Octopus than the SoLR suppliers I've been lumbered with over the last few years.Decluttering awards 2025: 🏅🏅🏅🏅⭐️⭐️⭐️ ⭐️⭐️, DH: 🏅🏅⭐️, DD1: 🏅 and one for Mum: 🏅0 -

At least I had the good sense to edit my mistake........k_man said:It may just be a typo on their side 😉, a bit like yours was.

1 -

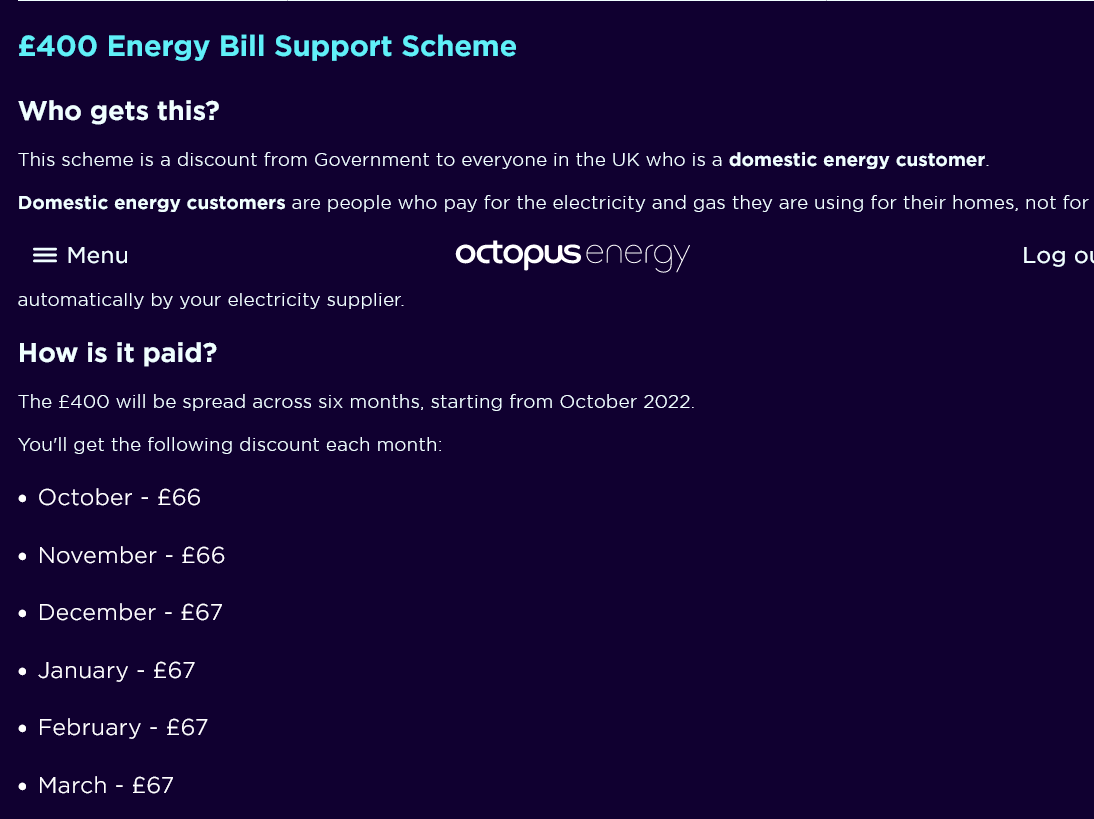

From what I read, I think that suppliers are causing a lot of concern through their mixed messaging. Logically, the EPG should result in a revised annual cost and an updated DD payment. Given that the EPG is in all but name a fixed tariff this is a pretty simple calculation.

From the revised DD, you then deduct the 6 months of Government support. Consumer friendly words like ‘payment holiday’ offer absolutely no clarification whatsoever.0 -

Have you seen anything to suggest that Santander have raised their £5 per month maximum cashback for energy to coincide with their increased rate of 4%? I have a Santander 123 Lite account but haven't, although I may well have missed this.QrizB said:I read this post in the E.ON Next DD thread and realised I had to check my account too.Sure enough, Octopus had helpfully reduced my DD - which I'd set at £250 specifically to take advantage of the Santander 1-2-3 cashback promo - to £183.Fortunately my payment is late enough in October that I could change it back to £250. I'd have been ever-so-slightly peeved if I'd missed out on 4% of £67 - that's £2.68 after all!

If the £5 ceiling hasn't been increased then a DD for £125 will maximise the cashback on the 4% rate, with worrying about differences in DD amounts above this being moot.0 -

I have just seen this (posted 14 hours ago):

The £400 Energy Bill Support Scheme kicks in soon. Here's what you need to know.Each month from Oct til March:- We’ll credit your energy account £67- Your Direct Debit will be reduced by £67These credits add up to £400 in non-refundable govt support for every home. More info and FAQS: https://octopus.energy/blog/energy-crisis-information

energy account £67- Your Direct Debit will be reduced by £67These credits add up to £400 in non-refundable govt support for every home. More info and FAQS: https://octopus.energy/blog/energy-crisis-information What if I don't want my Direct Debit put down? If you’d prefer to build up the govt support as credit, you can change your Direct Debit online any time

What if I don't want my Direct Debit put down? If you’d prefer to build up the govt support as credit, you can change your Direct Debit online any time octopus.energy/dashboard

octopus.energy/dashboard What if my DD is already lower than £67, or I don't pay by Direct Debit?Your DD will be reduced to zero. This'll be marked as a 'payment holiday' on your dashboard. Any extra will be credited to your

What if my DD is already lower than £67, or I don't pay by Direct Debit?Your DD will be reduced to zero. This'll be marked as a 'payment holiday' on your dashboard. Any extra will be credited to your account each month.

account each month. What happens if I have leccy and gas with different suppliers?The Energy Bills Support is paid towards your electric bill, so whichever supplier you pay for electricity will be responsible for giving you the govt support

What happens if I have leccy and gas with different suppliers?The Energy Bills Support is paid towards your electric bill, so whichever supplier you pay for electricity will be responsible for giving you the govt support

What if I have prepay meters? We'll send customers with traditional (non-smart) prepayment meters vouchers that you can redeem as top-up credit.Smart prepay customers will have the discount applied as a credit to their meters.3

What if I have prepay meters? We'll send customers with traditional (non-smart) prepayment meters vouchers that you can redeem as top-up credit.Smart prepay customers will have the discount applied as a credit to their meters.3 -

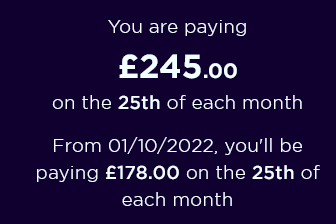

Eon Next are doing the same. I suspect it is because it is far easier to tell the computer to deduct £67 per month for the whole 6 months and have £1 per month less for the 2 months credited to the account. This had to be implemented fairly quickly and was not something the system was designed to do, the more complications the more likely something could go wrong.youravinalarrrf said:Correct me if I'm wrong but Octopus appear to be reducing my Direct Debit by £67 (£245 down to £178) from 1st October not the £66 as posted in their blog https://octopus.energy/blog/energy-crisis-support/#400energybillspayment ?Are they incapable of doing simple arithmetic?

0 -

Santander has increased the minimum payout from £5 to £10 as well as increasing the cashback from 2% to 4%. Ive done the same as QrizB and increased my DD to £250 to maximise the cashback.Ultrasonic said:

Have you seen anything to suggest that Santander have raised their £5 per month maximum cashback for energy to coincide with their increased rate of 4%? I have a Santander 123 Lite account but haven't, although I may well have missed this.QrizB said:I read this post in the E.ON Next DD thread and realised I had to check my account too.Sure enough, Octopus had helpfully reduced my DD - which I'd set at £250 specifically to take advantage of the Santander 1-2-3 cashback promo - to £183.Fortunately my payment is late enough in October that I could change it back to £250. I'd have been ever-so-slightly peeved if I'd missed out on 4% of £67 - that's £2.68 after all!

If the £5 ceiling hasn't been increased then a DD for £125 will maximise the cashback on the 4% rate, with worrying about differences in DD amounts above this being moot.

Santander website states:This means that you'll get to enjoy the following.

- 4% instead of 2% on gas and electricity bills, for all qualifying Select, Private, 1|2|3 and 1|2|3 Lite current accounts.

- As well as on your gas and electricity bills, you’ll also earn 4% cashback on your Santander home and life insurance premiums for these accounts (polices provided by Aviva).

- We’ll also be doubling the cap on the above category from £5 to £10.

Original Debt £37,493.25 @ 25/05/2019 - Now £0 @ 24/02/2023 - £37,493.25 - 100% paid3 -

Thanks for that - it explains the situation I've encountered - which has ended up with what I was actually hoping for - I don't know whether by design, or pure fluke. My DD had been dropped from £100 to £33 - which was way too low, even with the Government credit - as I'd dropped my DD earlier this year due to a build up of credit. I'd intended to increase it again from October due to the price rises. But my forecast and suggested DD were different amounts.[Deleted User] said:I have just seen this (posted 14 hours ago):

[snip] What if I don't want my Direct Debit put down? If you’d prefer to build up the govt support as credit, you can change your Direct Debit online any time

What if I don't want my Direct Debit put down? If you’d prefer to build up the govt support as credit, you can change your Direct Debit online any time octopus.energy/dashboard

octopus.energy/dashboard

In the end, I went with their suggested [and un-adjustable] increase to £151.91 - which will be a smidge too much - my own optimal number was £146, and as I'd already allowed a 10% usage contingency, that should have been more than enough. If it then rises by +67 in April, which I suspect that it will, I'll have to adjust it back down. At £151.91 + the Government credit, I should remain [indeed, slightly build] in decent credit going forwards.0 -

I have offered some feedback to Octopus as I don't think that they have communicated very well with their customers. Arguably, as I am a low energy user and I have what Octopus calls a payment holiday they have artificially increased my monthly payment without any re-calculation to show that it is necessary. All that is needed is a few words of explanation not hidden away in social media. I rarely look at Facebook and never Twitter.BooJewels said:

Thanks for that - it explains the situation I've encountered - which has ended up with what I was actually hoping for - I don't know whether by design, or pure fluke. My DD had been dropped from £100 to £33 - which was way too low, even with the Government credit - as I'd dropped my DD earlier this year due to a build up of credit. I'd intended to increase it again from October due to the price rises. But my forecast and suggested DD were different amounts.[Deleted User] said:I have just seen this (posted 14 hours ago):

[snip] What if I don't want my Direct Debit put down? If you’d prefer to build up the govt support as credit, you can change your Direct Debit online any time

What if I don't want my Direct Debit put down? If you’d prefer to build up the govt support as credit, you can change your Direct Debit online any time octopus.energy/dashboard

octopus.energy/dashboard

In the end, I went with their suggested [and un-adjustable] increase to £151.91 - which will be a smidge too much - my own optimal number was £146, and as I'd already allowed a 10% usage contingency, that should have been more than enough. If it then rises by +67 in April, which I suspect that it will, I'll have to adjust it back down. At £151.91 + the Government credit, I should remain [indeed, slightly build] in decent credit going forwards.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards