We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

How much longer will this bear market go on for?

Comments

-

And there will be literally millions who don't have enough in the form of either spare cash or discretionary spends to be able to cover such a huge increase. The usual monetary solutions don't work when all the spending is on essentials. Bad times are coming.Bobziz said:Not suggesting doom and gloom but my mortgage and heating costs will increase by at least £500/month from Oct. This will reduce my spending in other areas. I won't be the only one in this situation.2 -

It's not going to be good for businesses that rely on people having disposable income each month.

If you had £500 "spare", and now you won't, that's money not now going to all those discretionary providers we "choose" to use and spend with.

If you don't now have £10 spare for a once a week treat in a local cafe....you don't have it.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

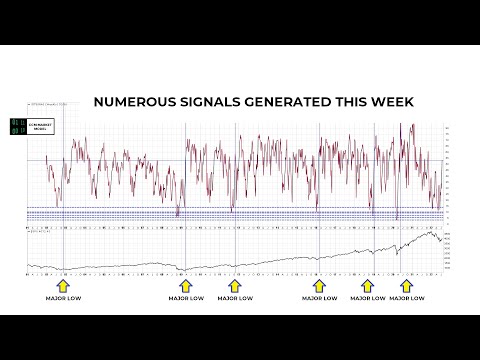

Swipe said:Based on the technical analysis, those support lines / areas have been re-tested multiple times since 2001. It might suggest that most of the fear factors such as the current war in Ukraine, current rate of inflation, current disruption in supply chain, current global chips shortages have been baked in the market.

Using the F&G index, the VIX is quite accurate to gauge the market temperature. You could test it yourself. I did and I presented the result on another thread.Technical Analysis has never been 100% accurate, but it is one of the most recognisable tools used by experts, acute traders, hedge funds. Also it is not developed from the thin air, but it is based on statistical and probability analysis. So it is much better than baseless guessing.In my personal opinion what has not been incorporated is that other unexpected occurrence, geopolitical events happen in the future such as more aggressive action from Russia leading to more severe sanction and followed by retaliation;Also currently it is Biden, the current government, the FED, the current party interest to calm the market, hiding inflation using a different terminology as the Mid term Election in the US will be coming on Tuesday, November 8, 2022. After mid tern election, they might start with a more hawkish narrative again, who knows.Not to mention another black swan event such as China invade Taiwan, new pandemic, new variant of COVID that might lead to another lockdown. All of these are very difficult (if possible) to be included in the predictive model.The confirmation that the bear market is over might be better decided by looking into the "general consensus" of experts. There are a lot of them reported /presented on CNBC TV, CNN, Finance, Bloomberg, Reuters, Yahoo Finance, Forbes, Fox Business, etc0

Using the F&G index, the VIX is quite accurate to gauge the market temperature. You could test it yourself. I did and I presented the result on another thread.Technical Analysis has never been 100% accurate, but it is one of the most recognisable tools used by experts, acute traders, hedge funds. Also it is not developed from the thin air, but it is based on statistical and probability analysis. So it is much better than baseless guessing.In my personal opinion what has not been incorporated is that other unexpected occurrence, geopolitical events happen in the future such as more aggressive action from Russia leading to more severe sanction and followed by retaliation;Also currently it is Biden, the current government, the FED, the current party interest to calm the market, hiding inflation using a different terminology as the Mid term Election in the US will be coming on Tuesday, November 8, 2022. After mid tern election, they might start with a more hawkish narrative again, who knows.Not to mention another black swan event such as China invade Taiwan, new pandemic, new variant of COVID that might lead to another lockdown. All of these are very difficult (if possible) to be included in the predictive model.The confirmation that the bear market is over might be better decided by looking into the "general consensus" of experts. There are a lot of them reported /presented on CNBC TV, CNN, Finance, Bloomberg, Reuters, Yahoo Finance, Forbes, Fox Business, etc0 -

Sea_Shell said:It's not going to be good for businesses that rely on people having disposable income each month.

If you had £500 "spare", and now you won't, that's money not now going to all those discretionary providers we "choose" to use and spend with.

If you don't now have £10 spare for a once a week treat in a local cafe....you don't have it.

My gas and electric has gone up by 100% and I can imagine if folk are getting similar emails dropping then local businesses are going to suffer all over again. My local pub is the quietest its been in years, its like someone turned off the tap. I think plenty of priorities will be changing pretty sharpish in the next few months. I've noticed the same on our pay and play golf course and also the local adventure type park where they charge £12 a car - very quiet for the time of year.

1 -

Although lower income individuals are foreseeing major difficulties the thread is about a global bear market. It is far from clear that these are strongly linked. After all even the poorest in this country are still spending much the same amount of money, but on different things. Whilst local pubs may lose a significant amount of custom the energy suppliers are showing high profits.

1 -

I am not convinced we are in a bear market at the moment. My investments are climbing again and some global indexes are faring better than others. There is just a lot of noise at the moment given high inflation, rising interest rates and tightening of monetary policy. I do have a feeling there is worse to come though so I am not investing at the moment but keeping money in reserve.I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

The 365 Day 1p Challenge 2025 #1 £667.95/£667.95

Save £12k in 2025 #1 £12000/£150000 -

I see a lot of names on here who were debating with me on here 6 months ago that high inflation will be a minor blip in the economy and won't be around for long. I was warning it will only get worse but it seemed it just went in one ear and out of the other. Now it looks like you are all worried about it, and you should be because it is only going to get much worse than I anticipated.

Interest rates will only be going be higher and in 2023 two million homeowners will be hit by a mortgage rate shock. Factor in the cost of living crisis a lot of people are going to be underwater. When the banks do their "stress test", do they factor in everything else going up 20-100% at the same time? Probably not.

I know there will be many people on here who will disagree with me because they have a vested interest, so are too emotionally involved but the true reality is that we are heading for an economic disaster.1 -

TonyTeacake said:I see a lot of names on here who were debating with me on here 6 months ago that high inflation will be a minor blip in the economy and won't be around for long. I was warning it will only get worse but it seemed it just went in one ear and out of the other. Now it looks like you are all worried about it, and you should be because it is only going to get much worse than I anticipated.

Interest rates will only be going be higher and in 2023 two million homeowners will be hit by a mortgage rate shock. Factor in the cost of living crisis a lot of people are going to be underwater. When the banks do their "stress test", do they factor in everything else going up 20-100% at the same time? Probably not.

I know there will be many people on here who will disagree with me because they have a vested interest, so are too emotionally involved but the true reality is that we are heading for an economic disaster.

When you have a step rise in prices it will stay on the annual CPI figures for 1 year. 6 months is too early to conclude "it will only get worse". So far the inflation is due to external events - price of oil/gas and supply problems resulting from Covid and the over reliance of world industry on JIT (Just In Time) stock management. To what extent that translates into a long term internal inflationary spiral is yet to be determined.

9.4% in 1 year is very different to 20%-100%. During the 4 years 1974-1977 inflation was over 15%/year. The world did not end. In any real meaning of the words there was no economic disaster.

Many people disagree with you because they doubt your ability to predict the future with any useful degree of accuracy. It requires an almost pathological level of self belief to "know" that people who think you could be wrong are fools or a crooks Exactly how can disagreeing with you be the result of "a vested interest"?

Personally I have no vested interest nor much emotional involvement in the matter. The future is unknown and the world will do what it will. There is no "true reality" about tomorrow. The best one can do is to manage ones financial affairs as far as one is able with sufficient slack and diversification of income and wealth to withstand most storms.12 -

I prefer crumpets.1

-

I have to disagree with you. This inflation monster was started off by turning the money printers into overdrive, and to add to that we now have the shocks of external events pushing inflation higher. If you do your homework correctly the inflation we have now is much worse in comparison to the 70s, most of us know this it's down to how governments measure the CPi and a lot of things are not included now compared back to then.Linton said:

TonyTeacake said:I see a lot of names on here who were debating with me on here 6 months ago that high inflation will be a minor blip in the economy and won't be around for long. I was warning it will only get worse but it seemed it just went in one ear and out of the other. Now it looks like you are all worried about it, and you should be because it is only going to get much worse than I anticipated.

Interest rates will only be going be higher and in 2023 two million homeowners will be hit by a mortgage rate shock. Factor in the cost of living crisis a lot of people are going to be underwater. When the banks do their "stress test", do they factor in everything else going up 20-100% at the same time? Probably not.

I know there will be many people on here who will disagree with me because they have a vested interest, so are too emotionally involved but the true reality is that we are heading for an economic disaster.

When you have a step rise in prices it will stay on the annual CPI figures for 1 year. 6 months is too early to conclude "it will only get worse". So far the inflation is due to external events - price of oil/gas and supply problems resulting from Covid and the over reliance of world industry on JIT (Just In Time) stock management. To what extent that translates into a long term internal inflationary spiral is yet to be determined.

9.4% in 1 year is very different to 20%-100%. During the 4 years 1974-1977 inflation was over 15%/year. The world did not end. In any real meaning of the words there was no economic disaster.

Many people disagree with you because they doubt your ability to predict the future with any useful degree of accuracy. It requires an almost pathological level of self belief to "know" that people who think you could be wrong are fools or a crooks Exactly how can disagreeing with you be the result of "a vested interest"?

Personally I have no vested interest nor much emotional involvement in the matter. The future is unknown and the world will do what it will. There is no "true reality" about tomorrow. The best one can do is to manage ones financial affairs as far as one is able with sufficient slack and diversification of income and wealth to withstand most storms.

54% energy increase in April and it is estimated it could go up another 78% in October, who knows what it will be in January 2023? it looks like it is going to be a lot higher than the 4% estimated with Russia cutting the gas pipelines into Europe by 80%, this is going o be disastrous. You can argue we get most of our gas from Norway but this will have a massive effect on global prices. Factor in petrol & diesel prices going sky high in comparison to 12 months ago, this backs up what I say "when the banks do their stress test, do they factor in everything else going up 20-100% at the same time? Probably not.

You don't have to be a mathematician to work out what is going on with prices.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=w3Zv1JGMCnU

https://www.youtube.com/watch?v=w3Zv1JGMCnU