We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much longer will this bear market go on for?

Comments

-

billy2shots said:When do we stop pretending this is a UK thing?Most of the talk in this thread is about the US bear market.

The FTSE 100 has a total return of -3.8% YTD and is down less than 2% over the past week. It's actually been a relative safe haven within equities. FTSE All Share is not much worse at -7% YTD and -1.5% over the past week.billy2shots said:Last week. YTD<snip>U.K. -7.3 -19.2

3 -

My god this is an uplifting thread, almost as cheery as the doomsayers on youtube.1

-

masonic said:billy2shots said:When do we stop pretending this is a UK thing?Most of the talk in this thread is about the US bear market.

The FTSE 100 has a total return of -3.8% YTD and is down less than 2% over the past week. It's actually been a relative safe haven within equities.billy2shots said:Last week. YTD<snip>U.K. -7.3 -19.2

My post was in response to saying the the mini budget has caused stocks to fall.

It hasn't. Global stocks have fallen. This is a global issue not just a UK one brought about by the mini budget.1 -

billy2shots said:

My post was in response to saying the the mini budget has caused stocks to fall.masonic said:billy2shots said:When do we stop pretending this is a UK thing?Most of the talk in this thread is about the US bear market.

The FTSE 100 has a total return of -3.8% YTD and is down less than 2% over the past week. It's actually been a relative safe haven within equities.billy2shots said:Last week. YTD<snip>U.K. -7.3 -19.2

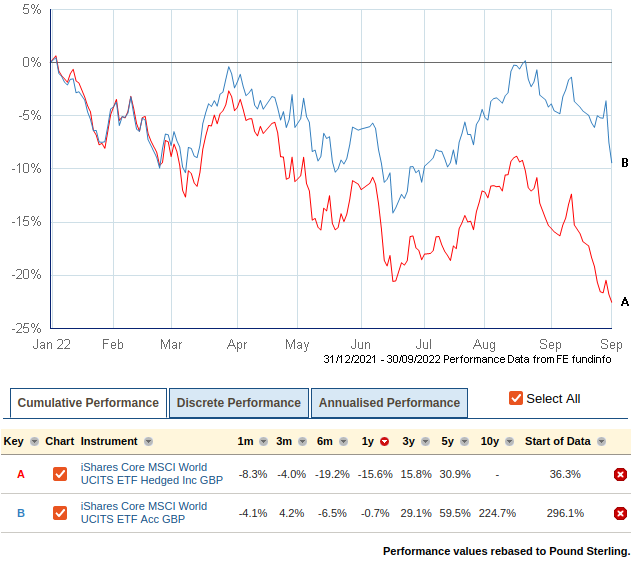

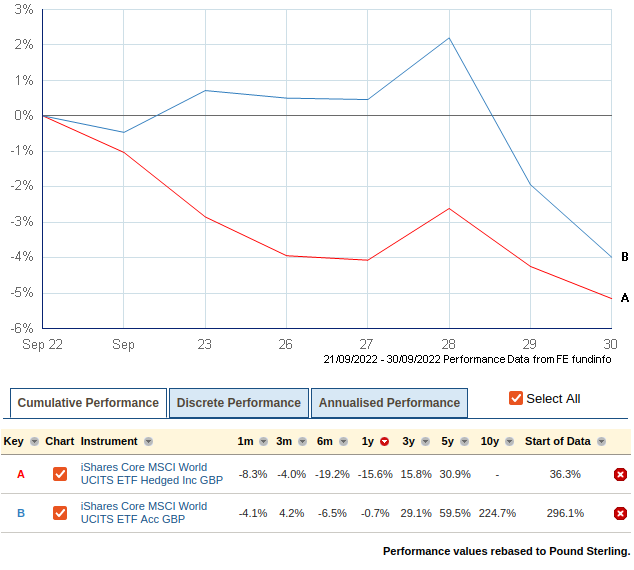

It hasn't. Global stocks have fallen. This is a global issue not just a UK one brought about by the mini budget.I think MK62 was just making a joke. In nominal terms, the budget had a positive influence on equities due to the weakening of GBP. You can see the effect by comparing a hedged fund with its equivalent unhedged version: What we have seen as a 10% drawdown in global equities YTD has looked more like >20% elsewhere. Zooming in, you can actually see that, in GBP terms, equities were going up immediately following the budget due to the pound tanking, with a partial reversal this week. That partial reversal did create a much steeper drop, just because equities had been falling over the previous week in other currencies and the pound was just catching up.

What we have seen as a 10% drawdown in global equities YTD has looked more like >20% elsewhere. Zooming in, you can actually see that, in GBP terms, equities were going up immediately following the budget due to the pound tanking, with a partial reversal this week. That partial reversal did create a much steeper drop, just because equities had been falling over the previous week in other currencies and the pound was just catching up. In summary, a tanking currency makes equities look better, not worse.4

In summary, a tanking currency makes equities look better, not worse.4 -

The mainstream media was more about Sterling.billy2shots said:My post was in response to saying the the mini budget has caused stocks to fall.

It hasn't. Global stocks have fallen. This is a global issue not just a UK one brought about by the mini budget.

Did any foreign governments need to intervene in their bond markets?

I guess you aren't actually saying that the mini budget was a good budget?0 -

sevenhills said:

The mainstream media was more about Sterling.billy2shots said:My post was in response to saying the the mini budget has caused stocks to fall.

It hasn't. Global stocks have fallen. This is a global issue not just a UK one brought about by the mini budget.

Did any foreign governments need to intervene in their bond markets?

I guess you aren't actually saying that the mini budget was a good budget?

Copied my post from a different thread. Sorry to be repetitive.

Was the mini budget well thought out and reviewed clearly, listening to the OBR before going public. NoHowever critics have come out of the woodwork and are making this all sound like a UK problem.Everyday the news from around the globe worsens with inflation still hotter than expected in the EU as announced today. That will be spun to be somehow the fault of the mini budget.In one week since the announcement, the £ has dropped 2p versus the doller. It's done that dozens of times this year pre budget.People may then argue it's only because the BOE got involved. Sure, but that's their remit.Or look at it another way ,Sept 22nd (the day before the shock mini budget) the £ was $1.13 to the £.Peak to trough before help it hit $1.07 to the £A drop of 6p Vs the $. That time was pre budget to pre BOE intervention.

6p!!!Do we want to talk about the year to date stopping on the 22nd September the day before the mini budget?If we do, it's a 22p decline on the $. People are losing their mind over a 6p (now only 2p) drop and calling Armageddon due to the budget but 6p Vs 22p, come on folks.Will inflation hurt, yes of course.Will mortgage rates and lending rise to historic norms. Yes, at least temporarily.But that's happening everywhere not just the UK.We are so damn pessimistic in this country.

The $ is very strong. Not particularly a good thing and it's very strength could cause issues very soon. We are a couple of weeks from earning season reports being issued in the US. The strength in the $ could hinder results and kick off am earnings recession.2 -

billy2shots said:Sept 22nd (the day before the shock mini budget) the £ was £1.13 to the $.Peak to trough before help it hit £1.07A drop of 6p Vs the $. That time was pre budget to pre BOE intervention.

6p!!!Quite right that it was $1.13 immediately before the budget (that's $1.13 to the £, not £1.13 to the $ which would be really bad). Already significantly undervalued compared with purchasing power parity of ~$1.40.That well known government hating lefty rag the Daily Mail reported that the trough was $1.04, which is an 8% drop or 9p. That's quite something in currency markets. They also reported that it was enough for Kwarteng's ex-boss Crispin Odey to make a killing shorting the pound. It's reported elsewhere he's been repeating this feat each time ministers make a statement that pours more petrol on the fire.I suppose this isn't the thread for hating on those who set out to profit from doom, but people like Mr Odious are probably a more suitable target for criticism.

I'm open to others' views, but earnings season could well be quite bearish for stocks, which generally causes a flight to the reserve currency and could see the dollar strengthen even more. The $ is usually seen to strengthen when equities are tanking.billy2shots said:The $ is very strong. Not particularly a good thing and it's very strength could cause issues very soon. We are a couple of weeks from earning season reports being issued in the US. The strength in the $ could hinder results and kick off am earnings recession.1 -

masonic said:billy2shots said:Sept 22nd (the day before the shock mini budget) the £ was £1.13 to the $.Peak to trough before help it hit £1.07A drop of 6p Vs the $. That time was pre budget to pre BOE intervention.

6p!!!Quite right that it was $1.13 immediately before the budget (that's $1.13 to the £, not £1.13 to the $ which would be really bad). Already significantly undervalued compared with purchasing power parity of ~$1.40.That well known government hating lefty rag the Daily Mail reported that the trough was $1.04, which is an 8% drop or 9p. That's quite something in currency markets. They also reported that it was enough for Kwarteng's ex-boss Crispin Odey to make a killing shorting the pound. It's reported elsewhere he's been repeating this feat each time ministers make a statement that pours more petrol on the fire.I suppose this isn't the thread for hating on those who set out to profit from doom, but people like Mr Odious are probably a more suitable target for criticism.

I'm open to others' views, but earnings season could well be quite bearish for stocks, which generally causes a flight to the reserve currency and could see the dollar strengthen even more. The $ is usually seen to strengthen when equities are tanking.billy2shots said:The $ is very strong. Not particularly a good thing and it's very strength could cause issues very soon. We are a couple of weeks from earning season reports being issued in the US. The strength in the $ could hinder results and kick off am earnings recession.

Thanks for pointing out my £ and $ the wrong way around 😂.

But you see the point. The mini budget may have contributed to this year's drop against the $ but it's a small drop compared to what took place before but media commentary ignores that.

Now we just have one giant echo chamber and it's getting boring now.

As for the lows. I always prefer closing figures rather than intraday so the Daily Mail can report what they like.0 -

Following currencies is now something I do, but your postings seem rather politically biased.billy2shots said:Now we just have one giant echo chamber and it's getting boring now.0 -

billy2shots said:As for the lows. I always prefer closing figures rather than intraday so the Daily Mail can report what they like.In this case the Daily Mail is 100% correct to report the low as the actual low. To do otherwise would be disingenuous.Imagine if the S&P500 breaches -80% briefly intra-day before closing higher. Type_45 isn't going to accept that as a fail on his scorecard, nor should he.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards