We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Asda credit card

Comments

-

cymruchris said:

So you told them that you might be facing financial difficulties - and you're surprised they said no? If you've said you can't cope with your current finances, their unlikely to offer you a new credit card. Did you mean to answer 'No'?inspectorperez said:Not to be outwitted by ASDA, I've had another go, this time using Opera browser.Same details except this time I answered the question "might you be facing financial difficulties..." yesTotally different answer this time - "your application has been rejected. If you want to find out more, phone TransUnion......."Time to go in the huff with ASDA The question wasn't quite phrased in the words you use in your post. The words were as I quoted in my post i.e. "might" rather than the word "can't" as you have used in phrasing your question to me. To answer your question however, I did deliberately reply "yes" just to see if the online interaction really was working given that the previous responses were along the lines of "oops, we can't process your application right now - would you like to restart?"As I indicated in my post, the subsequent answer was different proving at least that there was something on in the background which resulted in a different answer.The results of all my application attempts suggested to me that based on the fact that I know my credit score is high, that the soft credit checks which were being supposedly carried out were not necessarily to establish that you had a high score, but may have been more to do with the fact that I always settle credit card balances in full on the due date.Failing to obtain a £1,200 line of credit from ASDA is no big deal to me, but I would have appreciated the cashback feature particularly on petrol purchases.0

The question wasn't quite phrased in the words you use in your post. The words were as I quoted in my post i.e. "might" rather than the word "can't" as you have used in phrasing your question to me. To answer your question however, I did deliberately reply "yes" just to see if the online interaction really was working given that the previous responses were along the lines of "oops, we can't process your application right now - would you like to restart?"As I indicated in my post, the subsequent answer was different proving at least that there was something on in the background which resulted in a different answer.The results of all my application attempts suggested to me that based on the fact that I know my credit score is high, that the soft credit checks which were being supposedly carried out were not necessarily to establish that you had a high score, but may have been more to do with the fact that I always settle credit card balances in full on the due date.Failing to obtain a £1,200 line of credit from ASDA is no big deal to me, but I would have appreciated the cashback feature particularly on petrol purchases.0 -

You are aware that when applying for credit (even eligibility checkers) that your details are shared in terms of the responses you give? Iminspectorperez said:cymruchris said:

So you told them that you might be facing financial difficulties - and you're surprised they said no? If you've said you can't cope with your current finances, their unlikely to offer you a new credit card. Did you mean to answer 'No'?inspectorperez said:Not to be outwitted by ASDA, I've had another go, this time using Opera browser.Same details except this time I answered the question "might you be facing financial difficulties..." yesTotally different answer this time - "your application has been rejected. If you want to find out more, phone TransUnion......."Time to go in the huff with ASDA I did deliberately reply "yes" just to see if the online interaction really was working

I did deliberately reply "yes" just to see if the online interaction really was working

not personally aware of exactly what’s shared - but there is a database of applications on national hunter that look to spot issues in terms of things like application fraud? It might not be such a good idea to give a deliberately wrong answer to something just to test if it’s working… as that might end up coming back and biting you on the backside at a later date.0 -

cymruchris said:

You are aware that when applying for credit (even eligibility checkers) that your details are shared in terms of the responses you give? Iminspectorperez said:cymruchris said:

So you told them that you might be facing financial difficulties - and you're surprised they said no? If you've said you can't cope with your current finances, their unlikely to offer you a new credit card. Did you mean to answer 'No'?inspectorperez said:Not to be outwitted by ASDA, I've had another go, this time using Opera browser.Same details except this time I answered the question "might you be facing financial difficulties..." yesTotally different answer this time - "your application has been rejected. If you want to find out more, phone TransUnion......."Time to go in the huff with ASDA I did deliberately reply "yes" just to see if the online interaction really was working

I did deliberately reply "yes" just to see if the online interaction really was working

not personally aware of exactly what’s shared - but there is a database of applications on national hunter that look to spot issues in terms of things like application fraud? It might not be such a good idea to give a deliberately wrong answer to something just to test if it’s working… as that might end up coming back and biting you on the backside at a later date.Interesting and helpful observation.Also interesting that according to Transunion it's all good news on my credit file:" Good news! By having your ****** account open for 40 years you have shown stability in your financial relationships....You have improved your score by having a significant total credit limit available to you. You have improved your credit score by being registered on the electoral register for 19 years. You have never missed a payment on your credit report.You are using 6% of your available credit. You're using less than 50% of your available credit on each of your credit accounts........"ASDA must have some gold plated customers!I'm sticking to my theory until something proves me wrong.0 -

Given nobody but you sees the score, the fact something makes it go up or down is irrelevant.

Asda's systems evidently had an issue with an application but then applying again and saying you were in financial trouble, per responsible lending rules they won't issue you with the card.0 -

Interesting and helpful observation - that you think anything a CRA says about you or your worthiness for credit affects the decision at the lenders.inspectorperez said:cymruchris said:

You are aware that when applying for credit (even eligibility checkers) that your details are shared in terms of the responses you give? Iminspectorperez said:cymruchris said:

So you told them that you might be facing financial difficulties - and you're surprised they said no? If you've said you can't cope with your current finances, their unlikely to offer you a new credit card. Did you mean to answer 'No'?inspectorperez said:Not to be outwitted by ASDA, I've had another go, this time using Opera browser.Same details except this time I answered the question "might you be facing financial difficulties..." yesTotally different answer this time - "your application has been rejected. If you want to find out more, phone TransUnion......."Time to go in the huff with ASDA I did deliberately reply "yes" just to see if the online interaction really was working

I did deliberately reply "yes" just to see if the online interaction really was working

not personally aware of exactly what’s shared - but there is a database of applications on national hunter that look to spot issues in terms of things like application fraud? It might not be such a good idea to give a deliberately wrong answer to something just to test if it’s working… as that might end up coming back and biting you on the backside at a later date.Interesting and helpful observation.Also interesting that according to Transunion it's all good news on my credit file:" Good news! By having your ****** account open for 40 years you have shown stability in your financial relationships....You have improved your score by having a significant total credit limit available to you. You have improved your credit score by being registered on the electoral register for 19 years. You have never missed a payment on your credit report.You are using 6% of your available credit. You're using less than 50% of your available credit on each of your credit accounts........"ASDA must have some gold plated customers!I'm sticking to my theory until something proves me wrong.

Phrases like "you have improved your score" mean nothing, jack diddly squat, nadda. Because the numerical fictional score the CRA's provide you with mean nothing to the lender.

Some lenders won't see 6% utilisation as a good thing (it means there is 94% waiting to be spent in an instant, which could lead to repayment trouble).Life isn't about the number of breaths we take, but the moments that take our breath away. Like choking....1 -

"Phrases like "you have improved your score" mean nothing, jack diddly squat, nadda. Because the numerical fictional score the CRA's provide you with mean nothing to the lender." Thanks for that and good to know"Some lenders won't see 6% utilisation as a good thing (it means there is 94% waiting to be spent in an instant, which could lead to repayment trouble)." Agree but in this particular scenario, just wished the application was rejected outright rather than the "we can't process your application right now" response which initially left me wondering if it was an online technical issue.

1 -

The correct thing to do when applications stall part way through is to call customer service, if neccessary waiting until their next working day.0

-

If your considering the Asda Credit Card and your a likely candidate to just pay the minimum payment (thus racking up hefty interest charges) you'll more than likely be accepted.However - have a good or very good credit rating with a 20% or less Credit Utilisation score - have a healthy income with good or great repayment history, own your own property outright with no mortgage and your 90%+ likely to be turned down.How might I know this .... well a group of us [8+ with 3 actual Asda colleges] sat down this afternoon to test out the JaJa application site and every application was turned down.I guess that old German saying of ''Ja Ja does not always mean yes. Yes?'' is very true.We're now in the process of having all our supplied details removed from their system and as for their buck passing to ''TransUnion''. That's a non starter as each member of our test group has a TransUnion checker account with each person having an above average rating and credit history. Some even going back 25+ years!Lastly with a max credit limit of £1200 ... really. For many that's not even a fortnights use!Can I recommend the Asda CC or JaJa Finance. In a word. NO1

-

TigXC said:If your considering the Asda Credit Card and your a likely candidate to just pay the minimum payment (thus racking up hefty interest charges) you'll more than likely be accepted.However - have a good or very good credit rating with a 20% or less Credit Utilisation score - have a healthy income with good or great repayment history, own your own property outright with no mortgage and your 90%+ likely to be turned down.How might I know this .... well a group of us [8+ with 3 actual Asda colleges] sat down this afternoon to test out the JaJa application site and every application was turned down.I guess that old German saying of ''Ja Ja does not always mean yes. Yes?'' is very true.We're now in the process of having all our supplied details removed from their system and as for their buck passing to ''TransUnion''. That's a non starter as each member of our test group has a TransUnion checker account with each person having an above average rating and credit history. Some even going back 25+ years!Lastly with a max credit limit of £1200 ... really. For many that's not even a fortnights use!Can I recommend the Asda CC or JaJa Finance. In a word. NOThanks for posting that narrative.I don't know who you are or how reliable your information is, but what I will say is that your version of events does not surprise me in the least!0

-

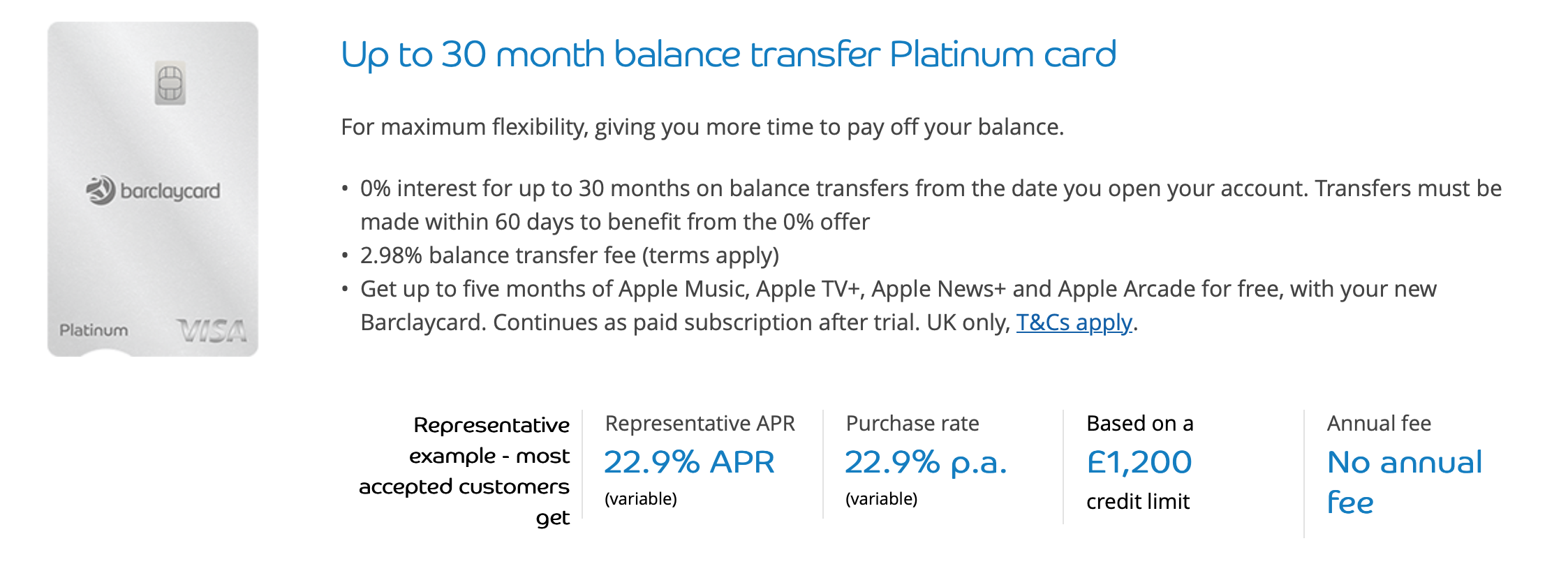

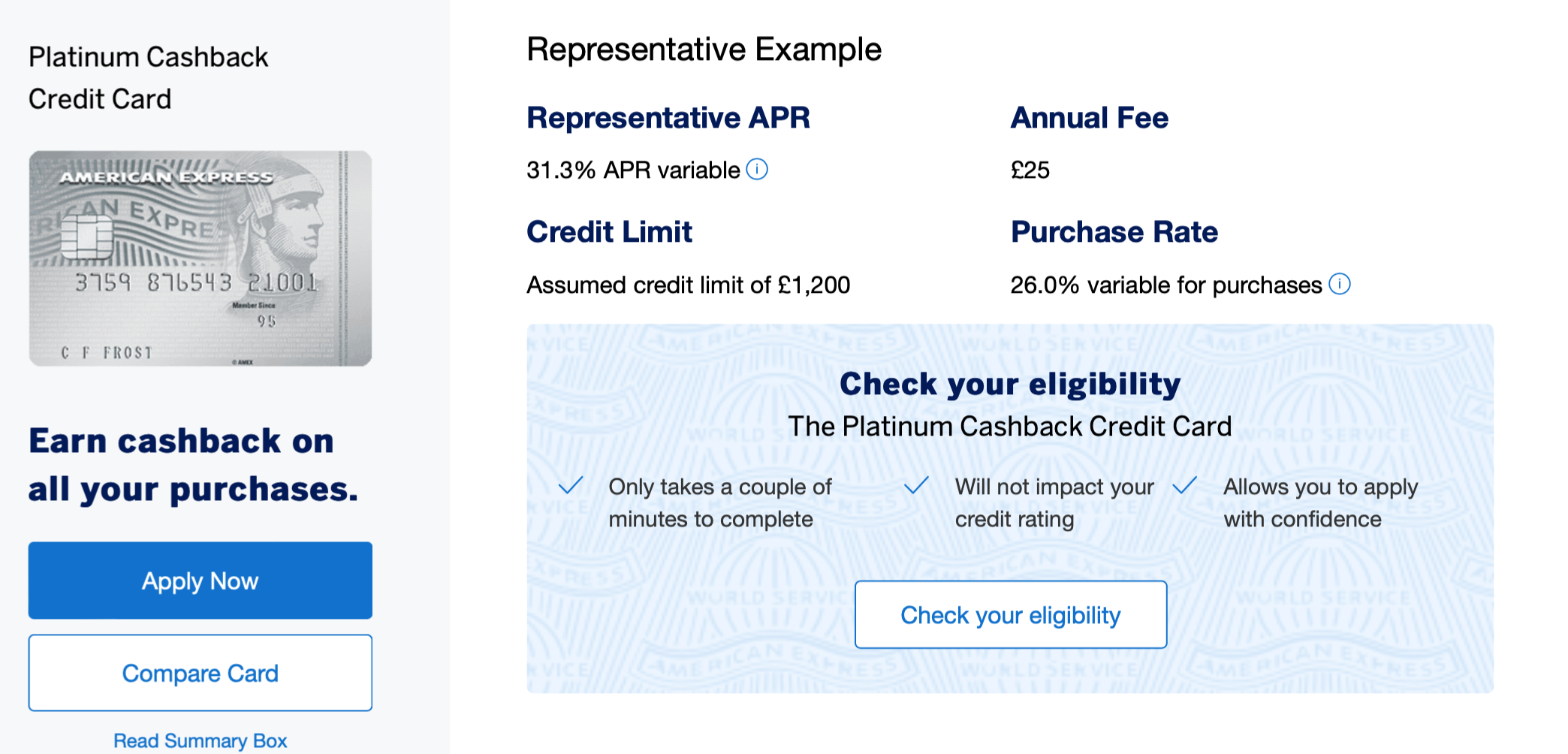

That isn't the max credit limit - that's the standard £1200 example limit that every provider of credit cards uses to demonstrate what they call a representative example of what your APR might be at a given credit limit. Credit limits are decided on a range of factors, and can be as low as several hundred or well into 5 figures.TigXC said:Lastly with a max credit limit of £1200 ... really. For many that's not even a fortnights use!

See below for two quick screen grabs of common credit cards:

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards