We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Anyone know any credit cards that offer more than £10k limits?

Comments

-

But you say you’re paying off in full, so perhaps the purpose of the CC isn’t just the credit limit, as even if you put £1 on a CC you still get S.75 protection for the entire purchase.taconite2 said:

There are some months I'm spending more than £10k...holidays etcMrFrugalFever saidI’d be surprised if the dealer accepts much more than a few thousand on the CC, the transaction fees are up to 3% which is £300 at £10,000, payable by the dealer.

You already have a credit card that provides Section 75, why would you need another if this is the case and paying in full at end of the month. Your post makes no sense.

Is the purpose of requiring a larger limit to borrow more over a period of time or if to utilise certain benefits from the card such as Cashback or Avios points etc?If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing0 -

My Barclaycard has a £12k limit, although never used it much (or any other credit card for that matter).

It was stolen recently, but it ended up being quite a funny experience. After discovering it had gone, I checked my account apprehensively given the credit limit, and discovered there had indeed been a couple of payments - for £13.27 and £14.99! To bumble.com and gotinder.com, dodgy chat/escort sites I think. Thief with a conscience? Kid?0 -

BTW I did take out a Halifax Clarity card recently because I was going abroad, and this site recommended it due to its zero commission on overseas payments and ATM withdrawals (it was very useful). They gave me a £7k limit, which might be useful if you can split your payments between cards.0

-

Bumble is a legitimate dating site akin to match or similar, no idea about the other one though unless it's the payment site for the Tinder app. Probably just thief wanted to get contacts from behind the paywall and see if a low payment is not noticedmatth1j said:My Barclaycard has a £12k limit, although never used it much (or any other credit card for that matter).

It was stolen recently, but it ended up being quite a funny experience. After discovering it had gone, I checked my account apprehensively given the credit limit, and discovered there had indeed been a couple of payments - for £13.27 and £14.99! To bumble.com and gotinder.com, dodgy chat/escort sites I think. Thief with a conscience? Kid?0 -

Barclaycard didn't seem to notice, and they didn't tell me about it. The card was taken on Monday (morning I think) and I didn't realise it had gone until Tuesday afternoon when I got a (physical) letter from GWR telling me they'd got my wallet at Bristol lost property! (I had 2 wallets on me that day - long story. I got one back, but not the one with the Barclaycard in it.)Deleted_User said:

Probably just thief wanted to get contacts from behind the paywall and see if a low payment is not noticed0 -

I had a nationwide card with a limit with a 15k limit, must have changed the criteriataconite2 said:Currently with Nationwide on their old gold credit card and been using it for over 12 years always paid off in full every month. They've said the max limit is £10,000 not limited by my credit rating etc just a rule they have that's the maximum they offer any customers.

Fully realise now if I go with another provider I'll have to build up trust but does anyone know of providers have higher limits eventually? Subject to credit rating of course!

Ideally a reward credit card! Always good to make free money!

Barclaycard offered me £12500 as a starting limit0 -

My Amex limit has crept up to over £20k over the years. I once considered the Halifax Clarity CC and did the eligibility check on their website. I was pre-approved for the card and offered a £12k limit. Ultimately though I went with Barclaycard (despite their lower limit).0

-

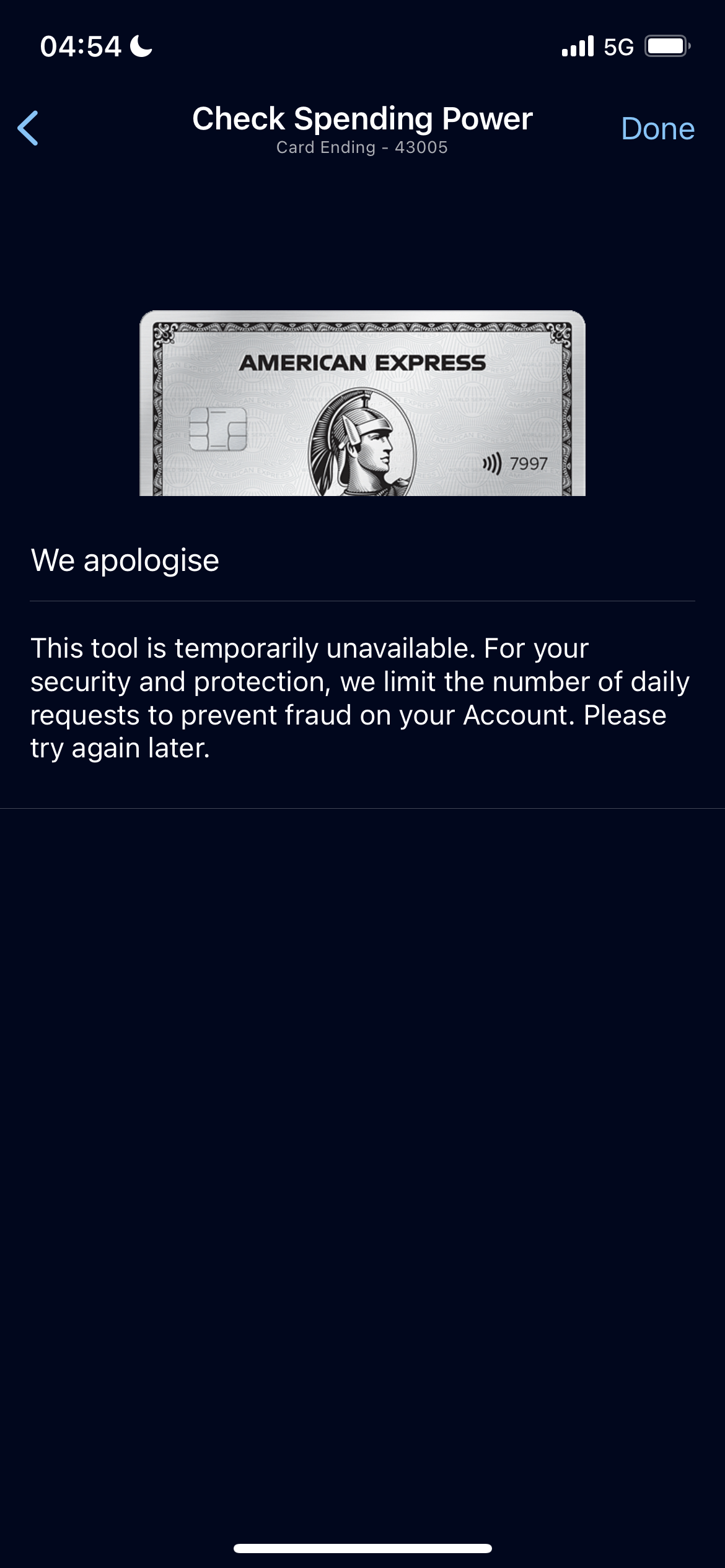

In theory the AMEX charge cards (platinum, green and basic) have no set limit. Although there is a calculator from Amex that will tell if a transaction will go through or decline. Testing different amounts to find the “credit limit” may result in the account being closed though.0

-

Why would Amex close your account for using a tool they provide on their website/app to determine your spending limit?maferit1909 said:In theory the AMEX charge cards (platinum, green and basic) have no set limit. Although there is a calculator from Amex that will tell if a transaction will go through or decline. Testing different amounts to find the “credit limit” may result in the account being closed though.

They let you check three different amounts a day and then give the following message if you try a fourth: 0

0 -

maferit1909 said:In theory the AMEX charge cards (platinum, green and basic) have no set limit. Although there is a calculator from Amex that will tell if a transaction will go through or decline. Testing different amounts to find the “credit limit” may result in the account being closed though.Explain your comment "may result in the account being closed though"Have you express knowledge of this ever happening or are you making a wild assumption that they would close the account for simply using a tool that Amex provide to see if you made a large purchase it would go through on a charge card that the person has?I've used this tool myself many times to check my spending power especially when i'm going to make a large purchase that falls outside my normal spending pattern, and Amex haven't written to me to say they are going to close my account.Personally sounds like you're making it up!!Time is a path from the past to the future and back again. The present is the crossroads of both. :cool:0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards