We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Chase 1.5% Easy Access

Comments

-

Credit card payments (debt payments) are on the cashback exclusions list https://www.chase.co.uk/gb/en/legal/Cashback-Exclusions/2

-

For those with large cash savings, remember that with increasing interest rates you may go over your personal savings allowance of £1000 interest for basic rate tax payers and £500 for higher rate tax payers for this tax year. Even with no other savings accounts, holding £85K in your Chace Savings account will mean you have to pay back 20% of the interest on £85000 - £66667 = £18333. The £18333 part will in effect earn 1.2%. To avoid this your spouse could open their own Chace Savings account and spread your savings.

0 -

Thanks. I’ve been thinking about this. Should we contact the tax office as I haven’t filled in a tax return for ages, or will it happen automatically?where_are_we said:For those with large cash savings, remember that with increasing interest rates you may go over your personal savings allowance of £1000 interest for basic rate tax payers and £500 for higher rate tax payers for this tax year. Even with no other savings accounts, holding £85K in your Chace Savings account will mean you have to pay back 20% of the interest on £85000 - £66667 = £18333. The £18333 part will in effect earn 1.2%. To avoid this your spouse could open their own Chace Savings account and spread your savings.0 -

Has anyone else had any problems setting up DD’s or using the debit card on their Chase account? My local council (Tunbridge Wells) will not set up a DD to pay my council tax as they claim their system says the account doesn’t support DD’s, no other companies have had that problem. As they couldn’t set up a DD I tried to pay for this month via the debit card and that was rejected as not being valid, I also had a similar problem with the debit card being rejected by Virgin Money which also said it was not a valid debit card.

0 -

agreed although with the caveat if you have no other income or a low income you get an extra £5000 interest allowance ie £6000 allowance in total. The £5000 starts tapering away after you reach £12500 incomewhere_are_we said:For those with large cash savings, remember that with increasing interest rates you may go over your personal savings allowance of £1000 interest for basic rate tax payers and £500 for higher rate tax payers for this tax year. Even with no other savings accounts, holding £85K in your Chace Savings account will mean you have to pay back 20% of the interest on £85000 - £66667 = £18333. The £18333 part will in effect earn 1.2%. To avoid this your spouse could open their own Chace Savings account and spread your savings.2 -

Olinda99 said:

Thanks for posting this, i did wonder, i am one of those goverments statistics - over 50 and economically inactive.

agreed although with the caveat if you have no other income or a low income you get an extra £5000 interest allowance ie £6000 allowance in total. The £5000 starts tapering away after you reach £12500 income

0 -

TisMeBill said:

Has anyone else had any problems setting up DD’s or using the debit card on their Chase account? My local council (Tunbridge Wells) will not set up a DD to pay my council tax as they claim their system says the account doesn’t support DD’s, no other companies have had that problem. As they couldn’t set up a DD I tried to pay for this month via the debit card and that was rejected as not being valid, I also had a similar problem with the debit card being rejected by Virgin Money which also said it was not a valid debit card.

not using Chase for direct debits, but used the card for the first time today in-person in Sainsburys and worked without issue... I suppose you have activated the card via the app?are you trying to set up the DD on their current account or the savings account ? sounds like the council's card payment system may be a little outdated to me.0 -

https://www.gov.uk/apply-tax-free-interest-on-savingsjaypers said:

Thanks. I’ve been thinking about this. Should we contact the tax office as I haven’t filled in a tax return for ages, or will it happen automatically?where_are_we said:For those with large cash savings, remember that with increasing interest rates you may go over your personal savings allowance of £1000 interest for basic rate tax payers and £500 for higher rate tax payers for this tax year. Even with no other savings accounts, holding £85K in your Chace Savings account will mean you have to pay back 20% of the interest on £85000 - £66667 = £18333. The £18333 part will in effect earn 1.2%. To avoid this your spouse could open their own Chace Savings account and spread your savings.

"If you’re employed or get a pension, HMRC will change your tax code so you pay the tax automatically. To decide your tax code, HMRC will estimate how much interest you’ll get in the current year by looking at how much you got the previous year.If you complete a Self Assessment tax return, report any interest earned on savings there.

You need to register for Self Assessment if your income from savings and investments is over £10,000. Check if you need to send a tax return if you’re not sure.

If you’re not employed, do not get a pension or do not complete Self Assessment, your bank or building society will tell HMRC how much interest you received at the end of the year. HMRC will tell you if you need to pay tax and how to pay it."

1 -

If you are on PAYE then they can collect the tax by adjusting your tax code. You can either notify them online of the expected interest, or wait and they'll collect it automatically in the next tax year.jaypers said:

Thanks. I’ve been thinking about this. Should we contact the tax office as I haven’t filled in a tax return for ages, or will it happen automatically?where_are_we said:For those with large cash savings, remember that with increasing interest rates you may go over your personal savings allowance of £1000 interest for basic rate tax payers and £500 for higher rate tax payers for this tax year. Even with no other savings accounts, holding £85K in your Chace Savings account will mean you have to pay back 20% of the interest on £85000 - £66667 = £18333. The £18333 part will in effect earn 1.2%. To avoid this your spouse could open their own Chace Savings account and spread your savings.

0 -

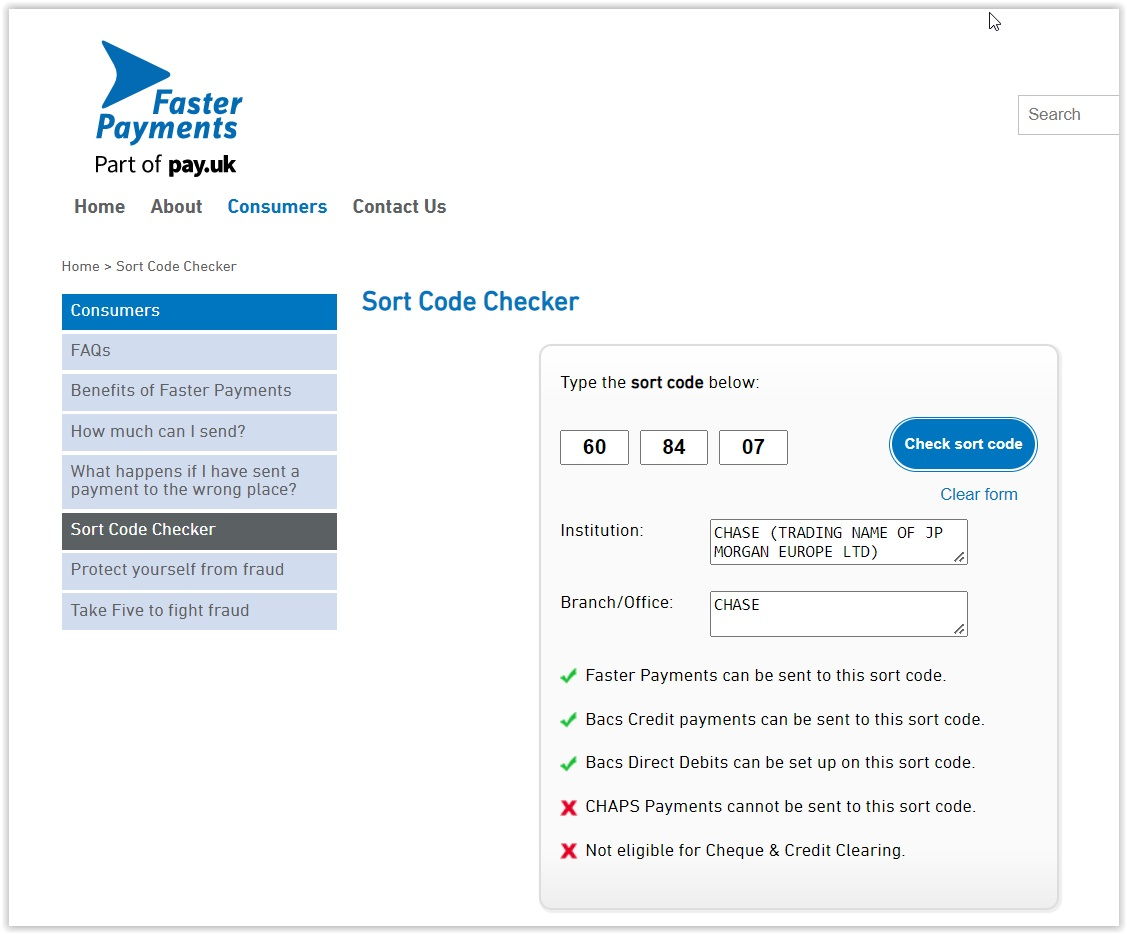

Your council is behind the times regarding the DDs. Assuming your sort code is 60-84-07, you can point them at this:TisMeBill said:Has anyone else had any problems setting up DD’s or using the debit card on their Chase account? My local council (Tunbridge Wells) will not set up a DD to pay my council tax as they claim their system says the account doesn’t support DD’s, no other companies have had that problem. As they couldn’t set up a DD I tried to pay for this month via the debit card and that was rejected as not being valid, I also had a similar problem with the debit card being rejected by Virgin Money which also said it was not a valid debit card.

Regarding the Chase debit card: for reasons I don't understand, some organisations check that the debit card was issued in the UK. Although the Chase debit card has been issued by the UK, it's been reported that the card actually uses a card number range allocated to WestPac in Australia. I don't know whether this is the reason for your council's rejection of your Chase card, but hopefully you have a second current account which doesn't come with these sorts of issues.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards