We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Fixed Interest Savings Discussion Area

Comments

-

Kent Reliance

Further to my post on the 19th Dec. I spoke to customer service on Dec 19th told them my online log in went to a page showing confirmation of application for1 Year fixed Issue 17 being complete and to wait to be sent details of how to fund account,

They requested an email and screen shot of this to be sent and that they would look into it for me. Said would refer it to IT as perhaps a glitch.

Today log in and states that have no account with them. Phone customer service and told yes application must have happened while product was been withdrawn and can do nothing about it. I state that I was sent a screen message that application was complete and to await details of how to fund, therefore the account should be honoured. Apparently no way to do this as everything automated and no manual intervention possible. Stated that I understood the product to be opened therefore they are rescinding on there last message to me and am very unhappy that their system is substandard. Never been accepted for product before and decision changed. Have experience of many banks, building societies. Stated wanted to make official complaint and see where that takes me. Tried to get me to open new product but I stated wanted to start complaint. Was a customer of theirs quite a while ago and no issues but feel being treated very badly0 -

Thursday was 18 Dec and product changed circa 5pm on 17th Dec so not certain what the issue is besides some frustration as 4.51% rate was no longer available when you tried to apply and encountered issuesashteadgirl said:Kent Reliance

Further to my post on the 19th Dec. I spoke to customer service on Dec 19th told them my online log in went to a page showing confirmation of application for1 Year fixed Issue 17 being complete and to wait to be sent details of how to fund account,

They requested an email and screen shot of this to be sent and that they would look into it for me. Said would refer it to IT as perhaps a glitch.

Today log in and states that have no account with them. Phone customer service and told yes application must have happened while product was been withdrawn and can do nothing about it. I state that I was sent a screen message that application was complete and to await details of how to fund, therefore the account should be honoured. Apparently no way to do this as everything automated and no manual intervention possible. Stated that I understood the product to be opened therefore they are rescinding on there last message to me and am very unhappy that their system is substandard. Never been accepted for product before and decision changed. Have experience of many banks, building societies. Stated wanted to make official complaint and see where that takes me. Tried to get me to open new product but I stated wanted to start complaint. Was a customer of theirs quite a while ago and no issues but feel being treated very badly

If you want 4.27% rate, re-apply or otherwise find a different product0 -

Do banks which offer fixed rate 'bonds' always ask the amount the customer plans to deposit on application? I've just applied for two fixed rate bonds, one with Chetwood Bank (with a 14 day window) and Habib Bank (with a 30 day window), yet I can't remember in either case entering a sum to be deposited with them. I can't understand how they can offer to save an undisclosed amount at a specified rate. The only thing they demand is a minimum amount within the period.0

-

If those rates were available from around the 11th, it's possible to have opened one or more, with different durations or interest annually / monthly or compound / pay-away, with 14 days to decide which options to fund.0

-

Some do some don't. Of those that do ask an amount to be deposited, some hold you to that and some don't.peter021072 said:Do banks which offer fixed rate 'bonds' always ask the amount the customer plans to deposit on application? I've just applied for two fixed rate bonds, one with Chetwood Bank (with a 14 day window) and Habib Bank (with a 30 day window), yet I can't remember in either case entering a sum to be deposited with them. I can't understand how they can offer to save an undisclosed amount at a specified rate. The only thing they demand is a minimum amount within the period.1 -

I imagine a few people will have funds maturing with Coventry on 2nd January (even though the Coventry fix states 31/12/2025 in the title), looking for options to reinvest into a new fix... the Vanquis options were feasible options with their 30-day window, but the Kent Reliance options were always going to be a long shot with their 14-day window and the BoE interest rate cut on Thursday 18 December...0

-

Sometimes, but barring any deposit time limits, any amount within the limits of the account is OK, why not?peter021072 said:Do banks which offer fixed rate 'bonds' always ask the amount the customer plans to deposit on application? I've just applied for two fixed rate bonds, one with Chetwood Bank (with a 14 day window) and Habib Bank (with a 30 day window), yet I can't remember in either case entering a sum to be deposited with them. I can't understand how they can offer to save an undisclosed amount at a specified rate. The only thing they demand is a minimum amount within the period.

check the details if they specify (some might say up to a million quid!) .The final amount can vary to what you originally declare and you can change your mind.1 -

Sorry I actually applied on the Wednesday afternoon just before 5pm that is why I am disgruntled. In my original post I said Thursday in error and my email and screen message are dated 17thMurielson said:

Thursday was 18 Dec and product changed circa 5pm on 17th Dec so not certain what the issue is besides some frustration as 4.51% rate was no longer available when you tried to apply and encountered issuesashteadgirl said:Kent Reliance

Further to my post on the 19th Dec. I spoke to customer service on Dec 19th told them my online log in went to a page showing confirmation of application for1 Year fixed Issue 17 being complete and to wait to be sent details of how to fund account,

They requested an email and screen shot of this to be sent and that they would look into it for me. Said would refer it to IT as perhaps a glitch.

Today log in and states that have no account with them. Phone customer service and told yes application must have happened while product was been withdrawn and can do nothing about it. I state that I was sent a screen message that application was complete and to await details of how to fund, therefore the account should be honoured. Apparently no way to do this as everything automated and no manual intervention possible. Stated that I understood the product to be opened therefore they are rescinding on there last message to me and am very unhappy that their system is substandard. Never been accepted for product before and decision changed. Have experience of many banks, building societies. Stated wanted to make official complaint and see where that takes me. Tried to get me to open new product but I stated wanted to start complaint. Was a customer of theirs quite a while ago and no issues but feel being treated very badly

If you want 4.27% rate, re-apply or otherwise find a different product1 -

And now the rate has gone down again KR 1 year FRB issue 19 - 4.11%.0

-

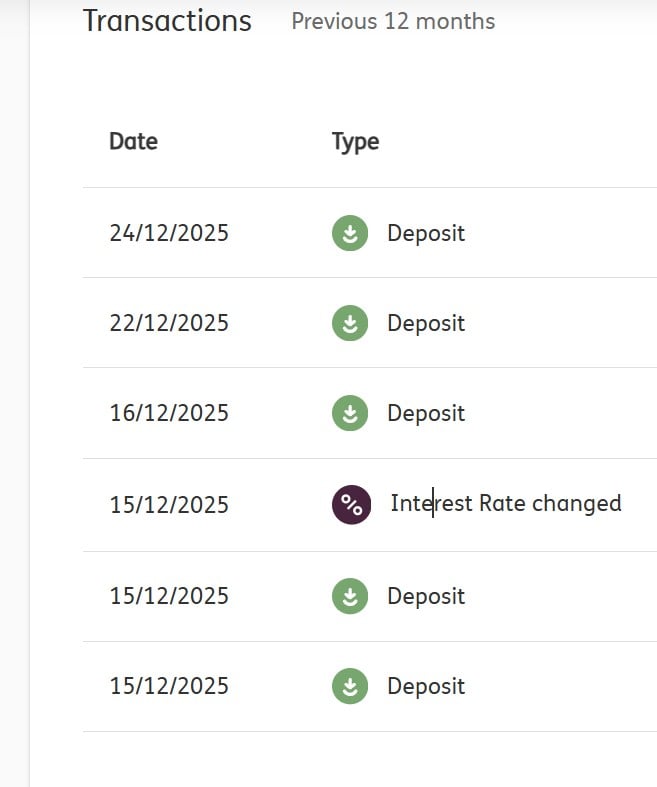

I'm on Issue 17 and completed my deposits within the 2 weeks allowed.DRS1 said:And now the rate has gone down again KR 1 year FRB issue 19 - 4.11%.

Not sure why it says rate changed on 15/12 (though product was withdrawn from general application at that point) as it is otherwise showing as the expected 4.51% at the time of opening.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards