We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Fixed Interest Savings Discussion Area

Comments

-

rothers said:

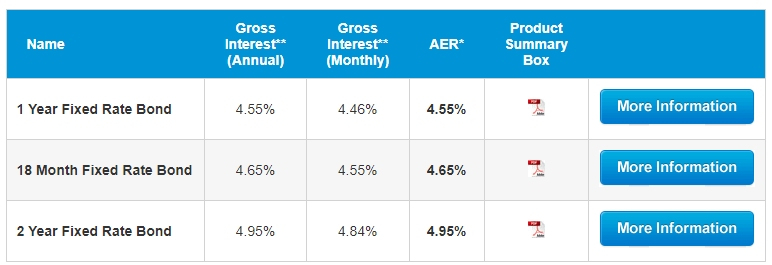

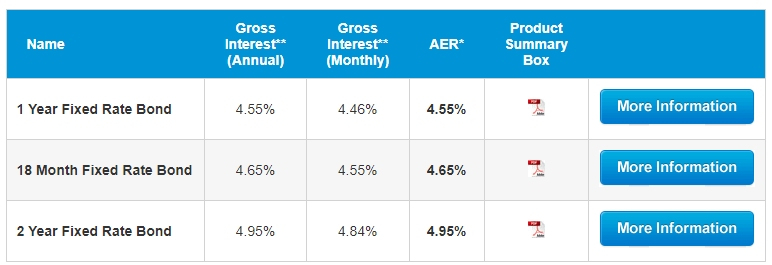

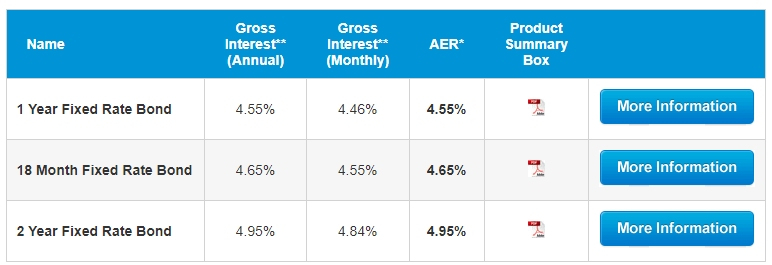

When I go on the website it says that no more deposits can be made after the initial deposit, does that mean that I can’t put £1 in then the rest?Bobblehat said:One thing to note about Charter Fixed rate(s) .... looking on the website I only see the 2 year fix. If I log in, and view "Open new account" ... I see this .....

Seems existing customers have more choice?Minimum deposit of £5,000, maximum account balance of £1,000,000. Once the Account is opened, and provided the product has not been closed to new deposits, you have a limited period in which you can make deposits into the Account. This is up to 14 days, beginning on the day you apply for your Fixed Rate Bond, after which you will be unable to make any other deposits into your Account.According to T & Cs you can make deposits (plural) for up to 14 days.

1 -

Nice one, thanks.Patr100 said:rothers said:

When I go on the website it says that no more deposits can be made after the initial deposit, does that mean that I can’t put £1 in then the rest?Bobblehat said:One thing to note about Charter Fixed rate(s) .... looking on the website I only see the 2 year fix. If I log in, and view "Open new account" ... I see this .....

Seems existing customers have more choice?Minimum deposit of £5,000, maximum account balance of £1,000,000. Once the Account is opened, and provided the product has not been closed to new deposits, you have a limited period in which you can make deposits into the Account. This is up to 14 days, beginning on the day you apply for your Fixed Rate Bond, after which you will be unable to make any other deposits into your Account.According to T & Cs you can make deposits (plural) for up to 14 days.

0 -

Note: They may well reject any first payment if it's under £5000 - I haven't had a chance to try a £1 test payment. If anyone has been able to - let us know.rothers said:

When I go on the website it says that no more deposits can be made after the initial deposit, does that mean that I can’t put £1 in then the rest?Bobblehat said:One thing to note about Charter Fixed rate(s) .... looking on the website I only see the 2 year fix. If I log in, and view "Open new account" ... I see this .....

Seems existing customers have more choice?The initial deposit will be rejected without interest if it doesn't meet the minimum balance requirements.0 -

Also:Patr100 said:According to T & Cs you can make deposits (plural) for up to 14 days.

"and provided the product has not been closed to new deposits"

So as soon as it's off the website, no more deposits, even if before 14 days are up.0 -

How long does it take get your User ID email from Charter Savings?

0 -

jak22 said:Timing of fixes is always quite tricky but on the other hand it's not a competition to get the perfect highest interest rate. Everyone's situation is different and for many it's just a way of fixing an amount of monthly income they're happy with - 5% for 2 or 3 years isnt near inflation but it might be comparable to dividend income for example.

Some will have been putting amounts into 1yr fixes as rates rise and may have done better than variables that way - current easy access rates arent that great at less that BoE base rate - and some might be wondering if fixes might not go much higher right now.

Assuming the BofE raises base rate by 0.5% in December, it's demoralising to think I'm locking away for 2 years at less than 1.5% above base rate, and that fixed rates are already being cut. Last week, the market expectation was that UK base rate would go to 5%, and based on that, I was hoping for at least 7% fixed rates next year, but that seems impossible now.

1 -

I am thinking I lock a third of our savings away now for a year, then wait until Jan/Feb to see what happens and if nothing drastic changes, lock another third away for a year. Last third will be easy access.Ted_E_Bear said:jak22 said:Timing of fixes is always quite tricky but on the other hand it's not a competition to get the perfect highest interest rate. Everyone's situation is different and for many it's just a way of fixing an amount of monthly income they're happy with - 5% for 2 or 3 years isnt near inflation but it might be comparable to dividend income for example.

Some will have been putting amounts into 1yr fixes as rates rise and may have done better than variables that way - current easy access rates arent that great at less that BoE base rate - and some might be wondering if fixes might not go much higher right now.

Assuming the BofE raises base rate by 0.5% in December, it's demoralising to think I'm locking away for 2 years at less than 1.5% above base rate, and that fixed rates are already being cut. Last week, the market expectation was that UK base rate would go to 5%, and based on that, I was hoping for at least 7% fixed rates next year, but that seems impossible now.1 -

If ,by consensus, we think interest rates are dropping long term, if you can do without your savings or at least a good proportion of them, why not lock in 5% now for 5yrs?Noneforit999 said:

I am thinking I lock a third of our savings away now for a year, then wait until Jan/Feb to see what happens and if nothing drastic changes, lock another third away for a year. Last third will be easy access.Ted_E_Bear said:jak22 said:Timing of fixes is always quite tricky but on the other hand it's not a competition to get the perfect highest interest rate. Everyone's situation is different and for many it's just a way of fixing an amount of monthly income they're happy with - 5% for 2 or 3 years isnt near inflation but it might be comparable to dividend income for example.

Some will have been putting amounts into 1yr fixes as rates rise and may have done better than variables that way - current easy access rates arent that great at less that BoE base rate - and some might be wondering if fixes might not go much higher right now.

Assuming the BofE raises base rate by 0.5% in December, it's demoralising to think I'm locking away for 2 years at less than 1.5% above base rate, and that fixed rates are already being cut. Last week, the market expectation was that UK base rate would go to 5%, and based on that, I was hoping for at least 7% fixed rates next year, but that seems impossible now.1 -

If you want certainty then lock for longer but 5 years is along time - anything could happen - perfect predictions are impossible.pedrodelgado said:

If ,by consensus, we think interest rates are dropping long term, if you can do without your savings or at least a good proportion of them, why not lock in 5% now for 5yrs?Noneforit999 said:

I am thinking I lock a third of our savings away now for a year, then wait until Jan/Feb to see what happens and if nothing drastic changes, lock another third away for a year. Last third will be easy access.Ted_E_Bear said:jak22 said:Timing of fixes is always quite tricky but on the other hand it's not a competition to get the perfect highest interest rate. Everyone's situation is different and for many it's just a way of fixing an amount of monthly income they're happy with - 5% for 2 or 3 years isnt near inflation but it might be comparable to dividend income for example.

Some will have been putting amounts into 1yr fixes as rates rise and may have done better than variables that way - current easy access rates arent that great at less that BoE base rate - and some might be wondering if fixes might not go much higher right now.

Assuming the BofE raises base rate by 0.5% in December, it's demoralising to think I'm locking away for 2 years at less than 1.5% above base rate, and that fixed rates are already being cut. Last week, the market expectation was that UK base rate would go to 5%, and based on that, I was hoping for at least 7% fixed rates next year, but that seems impossible now.

Think what the last 3 years have brought politically and economically!1 -

Ted_E_Bear said:How long does it take get your User ID email from Charter Savings?

Opened last night - got mine this morning - so same day or next day.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards