We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Fixed Interest Savings Discussion Area

Comments

-

My money is tucked away elsewhere and doesn't drop-in until the 18th. I was trying to remain patient, but sadly it looks like I've missed out on the better odds. I thought I might just make it.

Plenty of 1yr fixes being scrapped even though they are still advertised on MF & MSE.

Vanquis/Ikano/Charter have all gone.

I'm thinking of applying for a 1yr (4.4) or (4.35) tomorrow and holding onto it for 14 days until I can deposit into it. I can't see it getting any better from here on and I don't want to lose the best of the rest.

(I'm looking for 1yr monthly pay-out)

Anybody with a crystal ball persuade me otherwise?1 -

I was hoping for 5% for the jump to a fix but that looks unlikely.

However the current rates give me more of a decent extra income for me because I am fortunate to have more than one large pot to split up - I really can't complain or be greedy.

Look at it this way if you fix for a year.

If rates have dropped by the time you renew you've done well.

If they have increased by that time you probably renew at a higher rate.

If they stay roughly the same, you haven't lost out much.

Also if inflation is lower in a years time (as expected), whatever you have is not eroded so much so lower rates work a bit harder.3 -

Anyone got their account user ID to log in yet?Bobblehat said:

As Rheumatoid saidPatr100 said:Rheumatoid said: ...... 4.84% for monthly paid away.

...... 4.84% for monthly paid away.

Ultra-quick to open as an existing customer. I needed the monthly interest as income too "How to access your account To access your account you'll need a User ID, which we’ll email to you. Once you’re logged in, you’ll be able to view your welcome documents in the secure messages of your online account which will include the General Savings Conditions along with a copy of the FSCS information leaflet."

"How to access your account To access your account you'll need a User ID, which we’ll email to you. Once you’re logged in, you’ll be able to view your welcome documents in the secure messages of your online account which will include the General Savings Conditions along with a copy of the FSCS information leaflet."

I haven't - only got the confirmation with the sortcode etc0 -

I was wondering if the Autumn statement on the 17th might influence anything more..... Probably not worth the risk holding on.Patr100 said:I was hoping for 5% for the jump to a fix but that looks unlikely.

However the current rates give me more of a decent extra income for me because I am fortunate to have more than one large pot to split up - I really can't complain or be greedy.

Look at it this way if you fix for a year.

If rates have dropped by the time you renew you've done well.

If they have increased by that time you probably renew at a higher rate.

If they stay roughly the same, you haven't lost out much.

Also if inflation is lower in a years time (as expected), whatever you have is not eroded so much so lower rates work a bit harder.0 -

I'm an existing customer so the new account showed up after logging out and back in again.Patr100 said:

Anyone got their account user ID to log in yet?Bobblehat said:

As Rheumatoid saidPatr100 said:Rheumatoid said: ...... 4.84% for monthly paid away.

...... 4.84% for monthly paid away.

Ultra-quick to open as an existing customer. I needed the monthly interest as income too "How to access your account To access your account you'll need a User ID, which we’ll email to you. Once you’re logged in, you’ll be able to view your welcome documents in the secure messages of your online account which will include the General Savings Conditions along with a copy of the FSCS information leaflet."

"How to access your account To access your account you'll need a User ID, which we’ll email to you. Once you’re logged in, you’ll be able to view your welcome documents in the secure messages of your online account which will include the General Savings Conditions along with a copy of the FSCS information leaflet."

I haven't - only got the confirmation with the sortcode etcCompiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

I still think retail rates have a bit to go up yet. Not much, but definitely up.Patr100 said:I was hoping for 5% for the jump to a fix but that looks unlikely.

UK inflation numbers are due next Wednesday. They're unlikely to show a surprise like the US, given our fuel and energy increases over the last 12 months.1 -

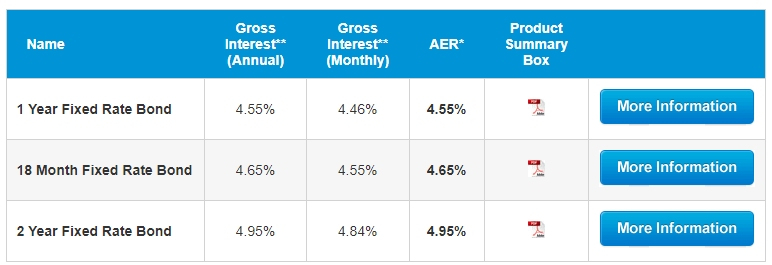

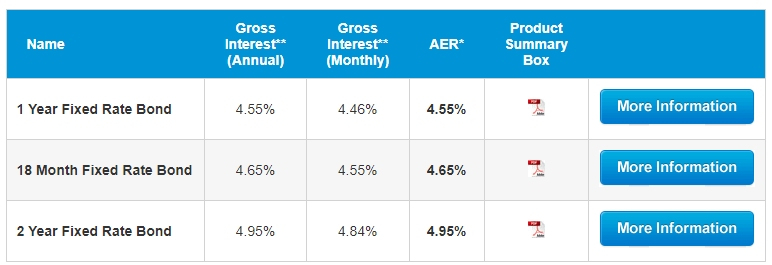

One thing to note about Charter Fixed rate(s) .... looking on the website I only see the 2 year fix. If I log in, and view "Open new account" ... I see this .....

Seems existing customers have more choice?Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

Timing of fixes is always quite tricky but on the other hand it's not a competition to get the perfect highest interest rate. Everyone's situation is different and for many it's just a way of fixing an amount of monthly income they're happy with - 5% for 2 or 3 years isnt near inflation but it might be comparable to dividend income for example.

Some will have been putting amounts into 1yr fixes as rates rise and may have done better than variables that way - current easy access rates arent that great at less that BoE base rate - and some might be wondering if fixes might not go much higher right now.1 -

With China starting to talk about deflation, and US inflation now on a sharp downward slope, it's surely only a matter of time before the same downtrends arrive in the UK and EU. We live in a globalised world.

Dyor, etc.0 -

When I go on the website it says that no more deposits can be made after the initial deposit, does that mean that I can’t put £1 in then the rest?Bobblehat said:One thing to note about Charter Fixed rate(s) .... looking on the website I only see the 2 year fix. If I log in, and view "Open new account" ... I see this .....

Seems existing customers have more choice?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards